Summary:

- Google is aware of the threat posed by Bing and other AI competitors, prompting the company to develop a new search engine powered by AI technology.

- Alphabet strategically focuses on integrating AI throughout its offerings, with plans to incorporate generative AI tools into a search through initiatives like Bard.

- Google’s I/O event highlighted the scale advantage of the company, with five “mega-apps” and the Android OS, each boasting over 2 billion users.

- Vertical integration was a key focus of Google’s I/O event, with generative AI being integrated into various apps to boost productivity and user engagement.

Justin Sullivan/Getty Images News

Introduction

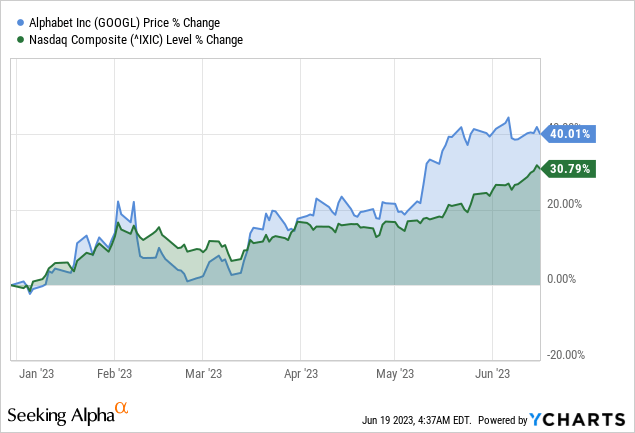

Recent developments in the tech industry have highlighted the growing competition between major search engines and artificial intelligence (AI) players. Alphabet Inc. (NASDAQ:GOOGL) (NASDAQ:GOOG), a long-standing dominant force in the search engine arena, faces a significant challenge from competitors like Bing and other AI technologies.

However, third-party estimates indicate that Google’s market share has remained unchanged since Microsoft Corporation’s (MSFT) updated Bing debut. Similarly, the stock price of Alphabet has outperformed Nasdaq Composite Index, and its current momentum is expected to persist for the foreseeable future.

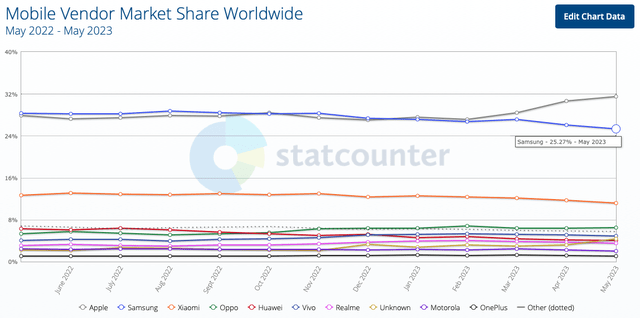

Samsung Is Not Going Anywhere Anytime Soon

Earlier in April, a New York Times article reported that Samsung was considering replacing Google with Bing Search on its smartphones. This news rightfully spooked investors, and NYT reported that executives at Google are in a “panic.” This seems plausible given the 20-year monopoly Search enjoyed until last November, the stickiness of the Android partnerships over that time (often a result of Google paying for default distribution), and the shifting tides in Search since ChatGPT was launched.

Samsung currently holds a significant portion of the smartphone market, accounting for 27% (excluding China) and 60% of Android’s market share, particularly in the high-end segment. Samsung controls around 25%-26% of the smartphone market share (with a high share in South Korea). This market share figure represents a decent proxy for digital ad coverage for Samsung in the US, UK, and Western Europe, Google’s major ad markets.

However, last month WSJ reported that Samsung Electronics has no plans to replace Google as the default search engine on its smartphones with Microsoft Bing in the near future. It would be speculative whether Samsung was considering switching to Microsoft as it may be could also be a move to gain leverage back from Google; the relationship between Samsung and Google has been hot and cold for several years.

A press report in 2020 from Reuters noted that Google was offering Samsung better economics to curtail Samsung’s efforts to build out its app store and assistant. More recently, in 2021, the State Attorneys General’s lawsuit argues that Google has been employing anti-competitive terms in tying its app store to distribution agreements with Android OEMs (similar to what played out in 2018 in the EU).

Laser-focus On AI

According to a New York Times article, Google faces a genuine challenge from competitors like Bing and other AI technologies. In response, Google is aggressively developing a brand-new search engine that utilizes AI technology. Additionally, Google is enhancing its current search engine by incorporating AI features. The upcoming search engine aims to provide users with a highly personalized experience, striving to anticipate their needs. I remain in the bull camp on Google as the NYT article also mentioned a plethora of possible new AI products coming from Google, which should help steer the narrative back a bit.

During the recent conference call, Alphabet emphasized its strategic focus on integrating AI throughout its various offerings. With its partnership with OpenAI, Microsoft has started challenging Google’s dominant search monopoly by incorporating generative AI tools into Bing. In response, Alphabet launched Bard as a rival to OpenAI’s ChatGPT in March and plans to integrate generative AI tools into Search further.

However, Google is moving cautiously, considering the potential impact on Search and the risk of negative user experiences. Meaningful changes in competitive positions may take time, but the near-term costs associated with AI, such as infrastructure upgrades, are expected to rise.

The conference call also highlighted the significance of AI across Alphabet’s business divisions, including Search, YouTube, and Cloud. Google discussed the development of new AI products and enhancements, such as search bots similar to ChatGPT, AI-powered cybersecurity offerings, and tools to automate manual tasks for creative purposes. Performance Max, an AI-enhanced feature benefiting advertisers, was cited as an example of how AI can improve efficiency and drive higher conversion rates.

This is seen as just the beginning of the potential performance gains advertisers can achieve through AI. Additionally, Alphabet announced the merger of DeepMind and the Brain Team, its two AI research groups, shifting associated costs from Google Services to corporate expenses.

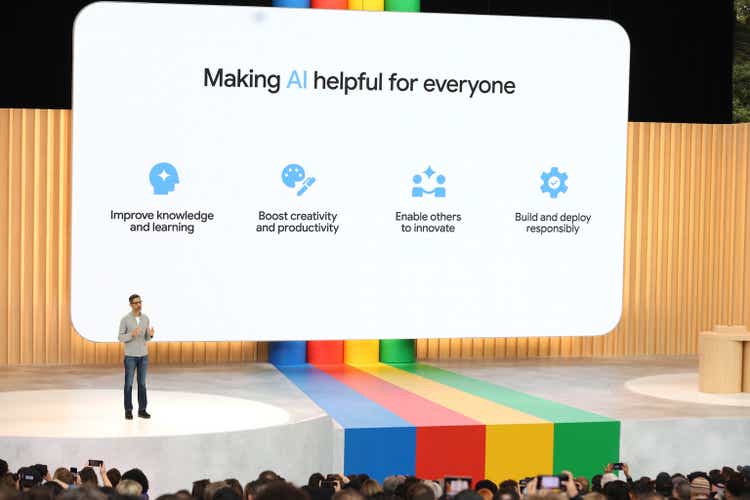

Leveraging GAI

During the I/O keynote presentation, Google showcased significant progress in leveraging Generative AI (GAI) to transform Search and other products. This signals Google’s intent to regain control of the narrative around GAI, which Microsoft has recently dominated.

While not all of Google’s product improvements are groundbreaking or immediately available, they demonstrate the company’s accelerated pace of innovation in deploying GAI-driven products for users and businesses. With 15 products boasting over 500 million users and 6 surpassing 2 billion users, Google’s initiatives are expected to have broad adoption beyond core Search, extending to platforms like Gmail, Maps, Photos, and more.

Google officially introduced PaLM 2, its current Large Language Model (LLM), which operates in different versions (e.g., Gecko for mobile) and powers over 25 products and features. Google’s early GAI search platform, Bard, has fully transitioned to running on PaLM 2 and is now available in 180 countries. Notably, Google showcased examples of the new search results page featuring an AI-powered snapshot that integrates key elements of the existing search experience, including Shopping graph results, advertisements, and links to merchant websites.

theguardian.com

Expanding The Availability Of Bard Globally

I perceive Google’s initial launch of Bard in February as rushed and insufficient in addressing concerns surrounding ChatGPT and Generative AI. However, the recent announcements regarding Bard demonstrated a more deliberate and refined approach by management. The company successfully showcased Bard’s potential with Google’s latest technology, product lineup, and partner ecosystem.

Google has now fully transitioned Bard to PaLM 2, its advanced LLM, and made it available in over 180 countries in English, with Japanese and Korean added, and plans to include 40 more languages. Additionally, Google introduced export options and announced partnerships, such as integrating Bard with Adobe Firefly. Most significantly, they integrated existing Google products like Lens, Docs, Drive, Gmail, Maps, and more with Bard, highlighting their synergies.

Alphabet’s Google I/O 2023 Event

One of the first and most important takeaways for investors from I/O is the sheer scale advantage that Google has over many other companies in consumer internet. The company has disclosed various data points over the years at I/O, but this year was another definitive flex.

The company stated that the five “mega-apps”, Search, Gmail, Play, Chrome, and YouTube, and the overall Android OS (#6) are all north of 2B users today. Alphabet exhibited several features across its core search, Gmail, and Workspace suite at Google I/O that may boost efforts to reduce disruption from GAI in Search.

A foldable phone could strengthen its Android ecosystem for deploying LLM on-edge devices. Cloud is positioned to benefit from demand for AI-based copilots and assistants for workloads. Vertical integration was a major focus of this year’s Google I/O event. Alphabet emphasized a rollout of generative AI features across the company’s core search page, Gmail, photos, and Workspace apps.

This could enhance user engagement across its family of apps, even as users find that the metadata and contextual awareness boost their productivity. The management highlighted six apps, with more than 2 billion users, that offer scale in terms of user data and distribution for using generative AI.

Search Poised To See More Change

Many user-interface changes to Google’s core search page are likely, as it integrates generative AI and large LLMs to offset ChatGPT. The introduction of a follow-up button aims to drive the conversational aspect within the Search. Though search volume could be pressured in the near term, the follow-up button might boost engagement and let the company exhibit sponsored ads and clickable links. Using contextual models to drive search experience may lead users to spend more time on its page since personalization will likely improve over time.

Takeaway

In conclusion, Google is aware of the evolving landscape of search engines and the increasing influence of AI technologies. The company proactively responds to the competition by developing a new search engine and integrating AI across its various products and services.

Google’s focus on vertical integration and deploying GAI tools demonstrates its commitment to improving user engagement and productivity. While meaningful changes in the competitive landscape may take time, Google’s efforts to leverage AI technology position it to regain control of the narrative and maintain its position as a leader in the industry. Finally, the advancements showcased at the I/O event highlight Google’s accelerated pace of innovation and its commitment to delivering highly personalized and efficient experiences to its vast user base.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.