Summary:

- The implications of generative AI on Google have taken center stage in discussions around the view of the stock.

- Amid all the AI hype, I think Google Cloud is passing by unnoticed as it carries a shower of positive surprises.

- Management’s commentary has shifted from an investment-heavy focus to one of profitability and this is backed by strong improvements in Google Cloud’s incremental EBIT margins.

- Broad-based price hikes in Google Workspace and Google Cloud Platform are strong catalysts for Google Cloud margins.

- Wall St consensus does not seem to be baking in these margin tailwinds as they are forecasting worse profitability going ahead. Therein lies my variant perception and the potential for alpha.

Look up at the cloud

georgeclerk/iStock via Getty Images

Introduction

Developments in generative AI technologies and its implications for Google (NASDAQ:GOOG) (NASDAQ:GOOGL) and it’s market leading search engine (89% market share) have taken the center stage in discussions around the stock. No doubt, these factors will determine the fate of Google. However, I am wary of making bold predictions of the ultimate winner(s) of the new search function market share leaders. I am skeptical about first-mover advantages other authors have discussed as internet history shows that many initial leaders often do not end up as the ultimate stable market share incumbent leaders. For example, before Google, search engine market share was dominated by names that would be unrecognizable and unknown, especially to the younger generations: Alta Vista, Excite, Lycos, etc. In these hard to predict situations, I defer to the wisdom of the crowds principle; the consensus view is likely to be an accurate view.

I think alpha-generating insights often come from recognizing things that are less obvious. In the case of Google, I think this applies to its cloud business. I suspect positive surprises vs consensus on Google Cloud’s path to profitability:

Financials of Google Cloud

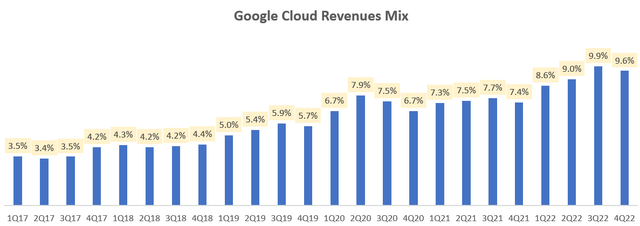

Google Cloud’s contribution to overall company revenues has increased over the last few years from 3.5% to 9.6%:

Google Cloud Revenues Mix (Company Filings, Author’s Analysis)

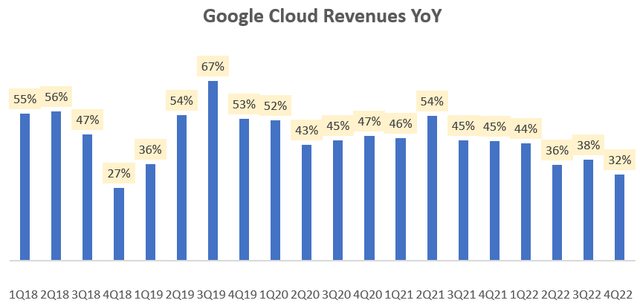

This contribution is expected to increase as the segment is still growing at more than 30% YoY; much faster than the company average growth rates, despite the recent slowdown in cloud spending:

Google Cloud Revenues YoY (Company Filings, Author’s Analysis)

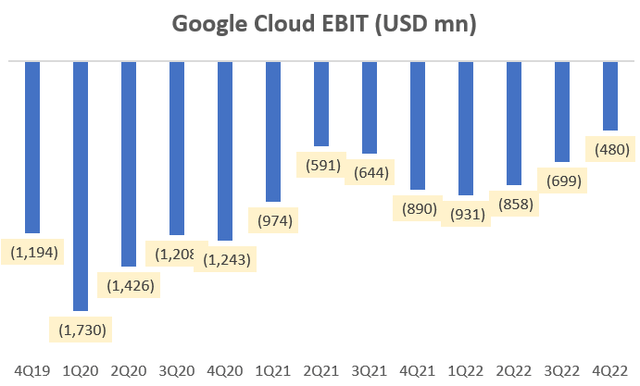

However, these operations are loss-making:

Google Cloud EBIT (Company Filings, Author’s Analysis)

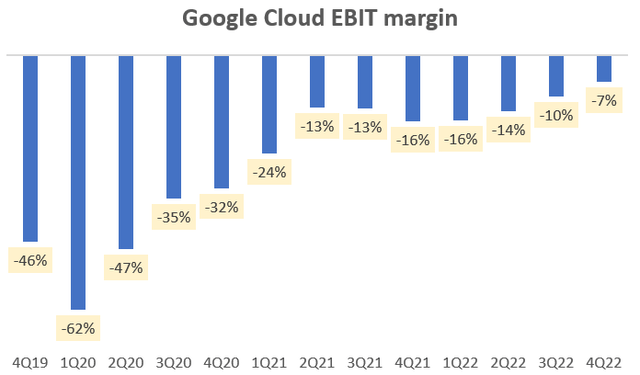

EBIT margins are improving but are still negative:

Google Cloud EBIT Margin (Company Filings, Author’s Analysis)

Profitability is back in focus

In the Q4 FY22 earnings call, management noted that:

Cloud remains very focused on its path to profitability.

– CEO Sundar Pichai

This commentary marks a change in priorities from 2 years ago when in the Q1 FY21 earnings call, the CEO signaled an investment-heavy phase:

…we will invest aggressively in products and go to market…

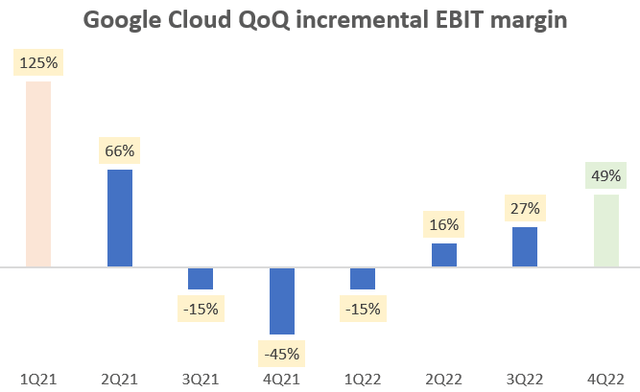

Importantly, these changing priorities are being seen in the numbers as well. After a drop in incremental EBIT margins during the growth-heavy investment phase, this figure is now trending back up at an accelerating pace; Q4 FY22 showed a sharp rebound to 49%:

Google Cloud QoQ Incremental EBIT Margin (Company Filings, Author’s Analysis)

Price hikes incoming

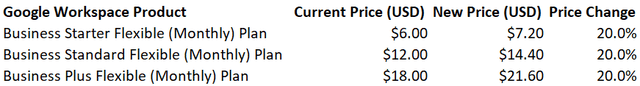

From April 1, 2023, the company will hike up prices in cloud storage in both components of Google Cloud; Google Cloud Platform [GCP] and Google Workspace:

Google Workspace Price Hikes (Company Website, Author’s Analysis)

Google Workspace’s Monthly plans are seeing a 20.0% price hike after April 1 2023.

Google Cloud Platform Price Hikes (Company Website, Author’s Analysis)

As seen in the table above, Google Cloud Platform is also seeing large increases especially in network egress costs.

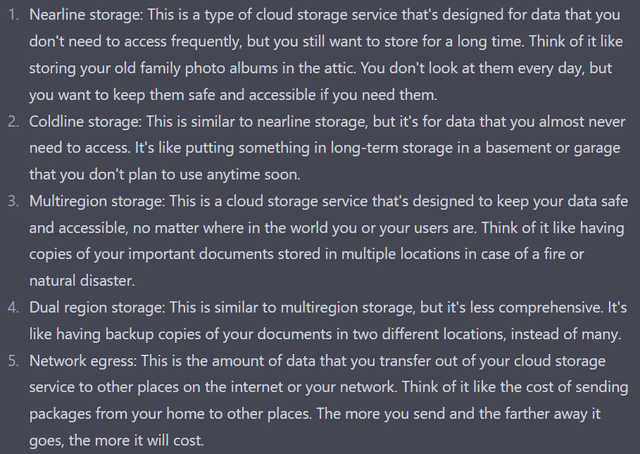

If you’re unfamiliar with these cloud terms, this snapshot explanation courtesy of ChatGPT should help:

Definition of Cloud Technical Terms (ChatGPT)

Overall, I believe these changes will accelerate Google Cloud’s path to profitability in the quarters ahead. And since cloud adoption is a powerful structural trend, I do not expect any material loss of customers or sharp falls in revenue growth as a result of this pricing strategy.

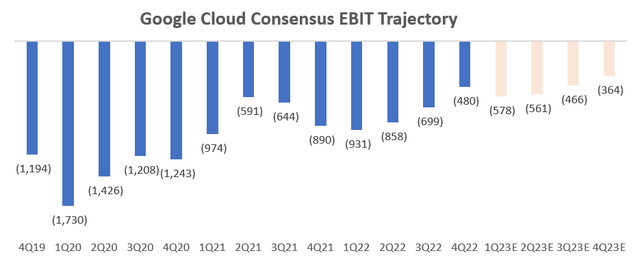

Consensus is not pricing in the margin tailwinds for Google Cloud

Google Cloud Consensus EBIT Trajectory (Company Website, Author’s Analysis)

The average of Bloomberg and Visible Alpha estimates on Google Cloud EBIT is forecasting further losses in EBIT in the next 2 quarters. Given management’s commentary and the aforementioned price hikes catalyst, I believe this is unlikely to occur. Hence, I anticipate upside surprise risks on this number.

What about the view ex of Google Cloud?

As mentioned in the introduction, for the other parts of Google, I am assuming the consensus view. Hence my variant perception is coming solely from my different take on Google Cloud’s margins.

Is such an assumption reasonable?

I would argue yes. This is because based on Capital IQ data, over the last 75 quarters since the current CFO Ruth Porat’s regime started in May 2015, the median of Google’s overall EBIT margin beats vs consensus has been only 1bp. The median of Google’s absolute EBIT margin surprise vs consensus has been 0%. So the stats show that generally, consensus is on the mark.

Hence, I find it perfectly acceptable to go with the consensus view, except for the Google Cloud margins piece, where I believe there are some real catalysts that may not be priced in. This leads to my overall positive bias on the stock.

Overall View

Stocks like Alphabet/Google move on variant perceptions vs consensus. As consensus estimates have on a 75-quarter median average been on the mark, my view is identical to the wisdom of the Wall St crowd. Except for one area where I believe there is upside risk; Google Cloud’s margins.

A change in tone in management commentary to favor profitability backed by rapidly improving incremental EBIT margin economics and the catalysts of broad price hikes all suggest an improvement in Google Cloud’s margins going forward. However, Wall St is not reflecting this in the numbers yet; rather, Google Cloud EBIT margins are forecasted to worsen over the next couple of quarters rather than improve. This leads to my variant perception view; ceteris paribus, Google Cloud’s margins and hence overall margins can positively surprise.

As a result, I am bullish on Google stock (GOOGL). As mentioned in a previous article, it has found a place in my portfolio.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.