Summary:

- Google is scheduled to announce its September quarter earnings on October 29th, after the market closes, and I am bullish heading into the announcement.

- Analysts are forecasting revenue of about $86.2 billion and operating profits of $27.4 billion, reflecting YoY growth of 12% and 14%, respectively.

- Given a highly supportive macro environment for advertising, I believe analyst estimates are reasonable.

- Google search engine gained market share in Q3, while YouTube growth outperformed growth for competitor platforms Instagram, Facebook, and TikTok.

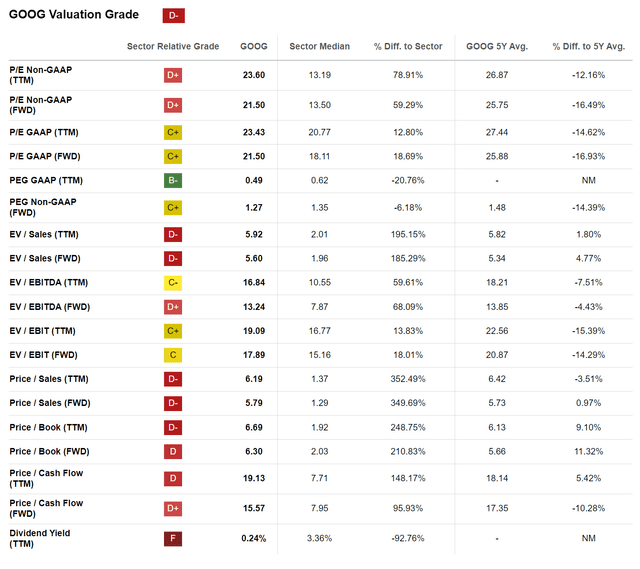

- In terms of valuation, Google stock appears attractively priced, trading around 17x EV/EBIT for 2025 estimates. Buy.

undefined

Google (NASDAQ:GOOGL) (NASDAQ:GOOG) (NEOE:GOOG:CA) is set to release its earnings for the September quarter on October 29th, after market close. Analysts expect around $86.2 billion in revenue and $27.4 billion in operating profits up 12% and 14% YoY, respectively. Looking at the broader macro backdrop, which is supportive for the advertising momentum, I believe analyst estimates are reasonable, and I expect Google to meet projections. Meanwhile, investor fears relating to Google’s loss of its search monopoly continue to look grossly exaggerated. In Q3, the Google search engine gained market share and ChatGPT visits amounted only to a fraction of Google search visits (indeed, less than 5%). On valuation, Google stock looks trading cheap, with shares priced at approximately 17x EV/EBIT for 2025 EBIT. And accordingly, in my view, I like the risk/ reward set-up of holding Google shares heading into the reporting season. I reiterate “Buy” rating.

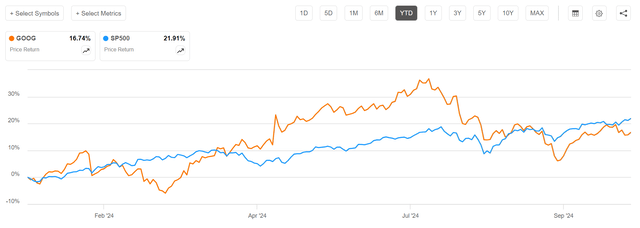

For context, Google’s stock has under-performed the broader market this year. Year-to-date, GOOGL shares have risen by about 17, while the S&P 500 (SP500) has increased by roughly 22%.

Strong Advertising Backdrop Supports Commercial Strength

With Generating about 78% of its revenues from advertising, it is important to highlight that the overall macro backdrop for advertising in Q3 has been stable, supporting Google’s momentum through Q3. In fact, UBS research noted (emphasis mine):

Budget growth accelerates throughout 3Q24: Despite a slower start, ad budgets accelerated in Aug into Sep citing uplift from political, brand advertising recovery, and improved consumer sentiment; and while most verticals ramped through 3Q24, we note particular strength in auto and CPG. Meta/Instagram and Google/YouTube both benefited from political spend and optimization/efficiencies unlock from automation and a greater share of budgets moving through Performance Max and Advantage+. (Source: UBS research note dated 7th October: 3Q24 Online Advertising Preview – Rising Tide Lifts All Boats on the 2024 Outlook)

I’m also optimistic based on positive feedback from industry channel checks: After discussions with six market participants who manage annual advertising budgets ranging from $200 thousand to $10 million, I calculate that overall ad spend in Q3 2024 could increase by approximately 12-13% YoY (budget-weighted growth derived from channel checks). This would position Google’s advertising revenue at around $66-67 billion for the September quarter, vs. $64.6 reported in Q2.

Market Dominance Under Pressure? Don’t Think So

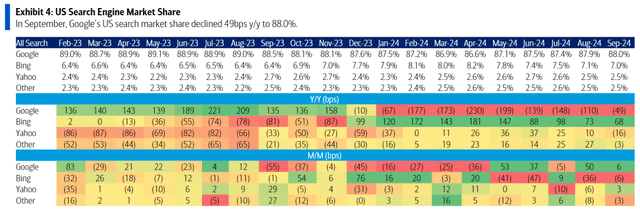

With the advent of GenAi, sentiment relating to Google’s search moat has been under pressure. However, approximately two years since the launch of ChatGPT, Google continues to defend its “monopoly” position in search. In September, according to Statcounter and data presented by BofA, Google’s US total search share across desktop, mobile, tablet, and console was up by 6 basis points MoM, while Bing dropped by 6 bps. Although Google’s market share declined YoY by 49 bps to 88.0%, the drop can be considered minimal. Moreover, Google’s market share has improved since August by about 110 bps. Most notably, as of September 30th, web visits to Google increased 1% MoM to 2.7 billion. ChatGPT saw a notable rise, up 20% MoM to 115 million visits, while Bing’s visits decreased by 3% to 58 million. This data highlights that ChatGPT usage (in terms of visits) is still only a fraction of Google usage, less than 5% (Source: BofA research note dated 7th October: Title: Alphabet: Search Wars: Google’s US search share up m/m; ChatGPT traffic gets o1 bump).

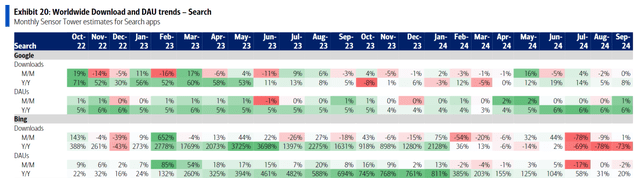

Strong momentum for the Google platform was also suggested by app data. According to Sensor Tower’s checks, and data presented by BofA, Google’s DAU trends have been solid in Q3, with QoQ growth estimated at about 1% and YoY growth estimated at about 6% (Source: BofA research note dated October 7th: Internet/e Commerce September app data: Mixed trends with Amazon DAU acceleration a bright spot).

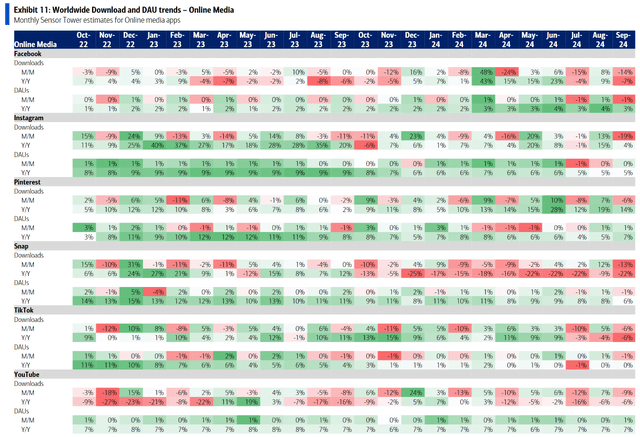

At the same time, DAU trends have been very strong for YouTube. Indeed, QoQ DAU growth for YouTube outpaced competitor platforms like Facebook, Instagram and TikTok. In July, August and September, YouTube’s MoM DAU growth was 0%, 0%, and 1%, respectively, vs. net negative growth for the 3 competitors mentioned.

Valuation: Cheapest Mag 7 Stock

Google stock is currently trading at 17x EV/EBIT for 2025 estimates. This, in my view, is cheap: Investors should consider that the EV/EBIT range for the Mag 7 stocks trends closer to 25x to >30x (Meta 23x, MSFT 25x, AAPL 28x, AMZN 33x, NVDA 40x, TSLA 93x). I have previously estimated Google’s fair implied value at approximately $201 per share. And heading into Q3, I continue to view this estimate as reasonable, based on enclosed assumptions:

I now anticipate Google’s earnings per share for FY 2024 to fall within the range of $7.0 to $7.4 (non-GAAP), with projections of reaching $8.5 in FY 2025 and $9.8 in FY 2026. Beyond FY 2026, I maintain a view of approximately 4.0% compound annual growth rate in earnings, about 200 basis points higher than estimated nominal GDP growth and likely conservative. At the same time, I lower my cost of equity assumption by 50 basis points, to 8.5%, mostly as a reflection of a more accommodating interest rate environment. With these updates, I now assess the fair value of Google stock at $201.

Investor Takeaway

Google is scheduled to announce its September quarter earnings on October 29th, after the market closes, and I am bullish heading into the announcement. Analysts are forecasting revenue of about $86.2 billion and operating profits of $27.4 billion, reflecting YoY growth of 12% and 14%, respectively. Given the supportive macro environment for advertising, I believe these estimates are reasonable. At the same time, concerns about Google losing its search dominance still seem overblown, as the company actually gained search market share in Q3, while ChatGPT visits remain under 5% of Google’s search traffic. In terms of valuation, Google stock appears attractively priced, trading around 17x EV/EBIT for 2025 estimates. With this favorable risk/reward profile heading into earnings, I maintain my “Buy” rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.