Summary:

- Google has a bright future ahead, as they continue using AI to increase revenue across their segments.

- After passing Netflix, YouTube is now the streaming leader for TV viewing in the US.

- After years of operating losses, the Google Cloud segment had operating profit of $1,716 million on revenue of $33,088 million in 2023.

400tmax

Introduction

Per my October article, Google (NASDAQ:GOOG) (NASDAQ:GOOGL) improved nicely for the first 9 months of 2023 compared to the first 9 months of 2022 despite disappointment in the cloud segment. Since that time, the 4Q23 cloud figures have been impressive, with operating income of $864 million on revenue of $9,192 million.

Google CEO Sundar Pichai and DeepMind CEO Demis Hassabis posted an introduction about Gemini on December 6. Pichai said Gemini is their most capable and general AI model yet. Hassabis said it was built from the ground up to be multimodal and noted it will soon be available in products like Search, Ads, Chrome and Duet AI.

My thesis is that Google looks good when viewed through a long-term lens.

The Numbers

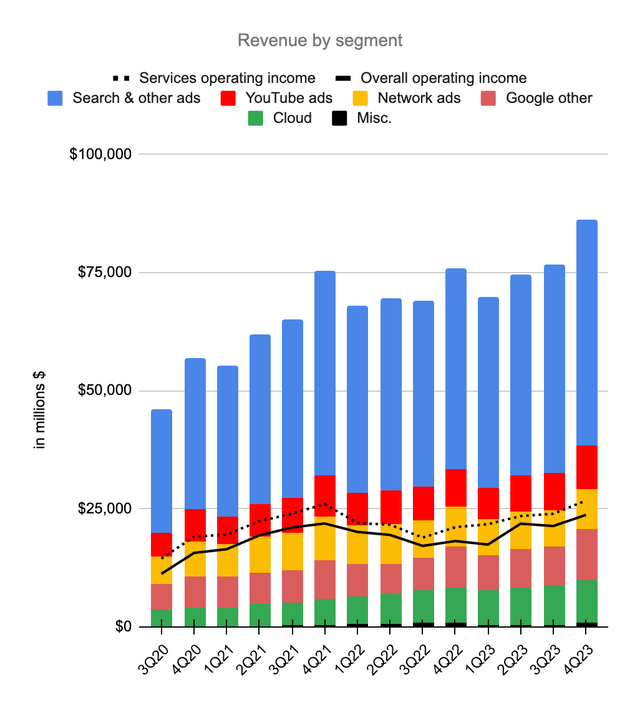

Per the 4Q23 release, segment revenue for Google continues to increase nicely over time:

Segment revenue (Author’s spreadsheet)

Search & Other

Per Exploding Topics, ChatGPT reached 1.6 billion monthly visits by March 2023. Many people thought AI tools like ChatGPT would crush Google’s search ad revenue. The segment did see revenue decline from $43,301 million in 4Q21 to $42,604 million in 4Q22. However, the segment did well in 4Q23 as revenue went up to $48,020 million. In the December 6 post mentioned earlier, DeepMind CEO Hassabis said Gemini AI is already being used to improve Search:

We’re already starting to experiment with Gemini in Search, where it’s making our Search Generative Experience (SGE) faster for users, with a 40% reduction in latency in English in the U.S., alongside improvements in quality.

YouTube Ads

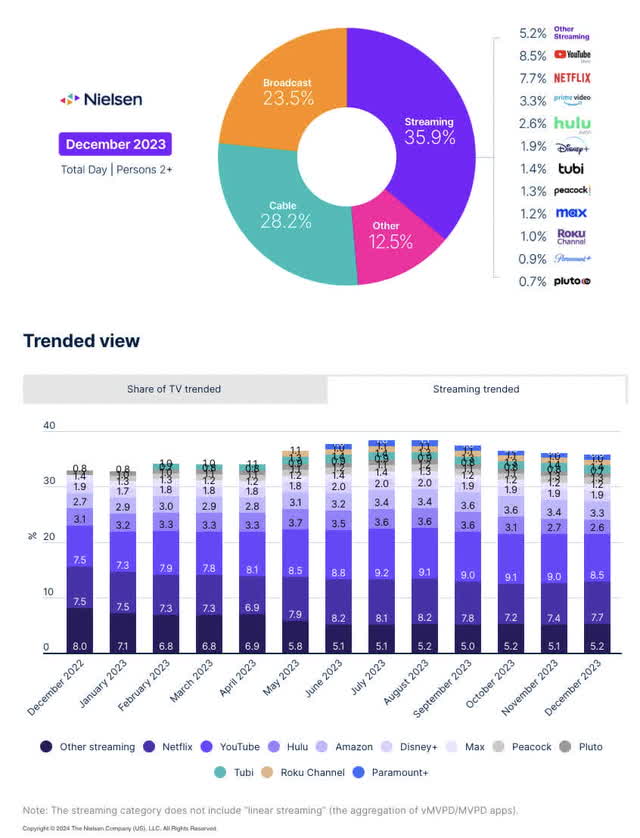

YouTube ad revenue increased 46% from $4,717 million in 4Q19 to $6,886 million in 4Q20. Since that time, revenue for the segment climbed to $9,200 million for 4Q23 which is a 3-year CAGR of more than 10%. Per Nielsen December Streaming Viewing report, the big streaming winners in the US are YouTube and Netflix (NFLX). They have 8.5% and 7.7% of TV viewing, respectively, which is a big part of the streaming total of 36%. YouTube is especially impressive as today’s 8.5% is much higher than their 7.5% from December 2022:

YouTube share (Nielsen December Streaming Viewing)

Like Netflix, YouTube has a tremendous path for growth outside the US. Relying on user-generated content from millions of creators around the world, YouTube is a different beast from the other streamers above. A January 25 daily update interview/podcast with Ben Thompson is noteworthy because Netflix co-CEO Greg Peters explains to him that YouTube has put things together well. YouTube takes user-generated content and makes it available in a fitting user experience. Using an ad-based business model, YouTube flourishes, and it has become the brand people seek for user-generated content (emphasis added):

YouTube is a different beast entirely, although I’ll note that it plays a different role in the consumer’s mind and I often think that there’s four things you got to put together and they all have to work together – it’s the content class and the content that works for certain members, it’s the actual user experience that’s right for that content to make that connection happen, it’s a business model that fits around it and is appropriate for that and maximizes the value of that, and it’s a brand which tells consumers around the world that that’s what you go do. YouTube has done that, and has done it incredibly well, but in a totally different space.

AI is unlocking creativity for YouTube creators. A September 2023 YouTube blog post talks about 5 new creator tools from the “Made On YouTube” event. Dream Screen is a generative AI tool that makes videos for YouTube Shorts based on a text prompt. An example is shown where the user types in “Panda drinking coffee” and then the AI generates videos. Per TechCrunch, YouTube shorts went from 50 billion daily views in January 2023 up to 70 billion in September 2023. YouTube Create is a new editing app for mobile creators. It includes thousands of royalty-free tracks, and one tap allows captions to be generated automatically. A feature is shown which lets creators remove unwanted background noise. AI Insights, Aloud and Assistive Search in Creator Music are additional tools for creators.

CBO Philipp Schindler noted in the 4Q23 call that YouTube is embracing AI in order to boost creativity and advertising. He focused on many of the Made on YouTube AI developments mentioned above (emphasis added):

AI has been a very critical piece of this already. You are obviously aware of the Made On YouTube announcement where we introduced a whole lot of new complementary creativity features on YouTube, including Dream Screen, for example, and a lot of other really interesting tools and thoughts. You can obviously imagine that we can take this more actively to the advertising world already. As you know, [AI] already continues to power a lot of our video ad solutions and measurement capabilities. It’s part of video rich campaigns.

Google Cloud

What a difference a year makes! Google Cloud had an operating loss of $1,922 million on revenue of $26,280 million in 2022. In 2023, the segment had operating profit of $1,716 million on revenue of $33,088 million. It took billions of dollars in operating losses over the years to get to this point and this is one of the reasons why I don’t see another hyperscale cloud company entering the picture in the near future to compete with the big-3 which are AWS (AMZN), Azure (MSFT) and Google Cloud. The Google Cloud segment had revenue of just $3,831 million in 4Q20 and this grew to $9,192 million by 4Q23 for a 3-year CAGR of nearly 34%. The revenue growth below for Google Cloud from 4Q19 to 4Q23 is substantial:

|

in millions $ |

||||||

|

Google Cloud Qtr End |

Google Cloud Operating Income |

Google Cloud Revenue |

AWS Qtr End |

AWS Operating Income |

AWS Revenue |

|

|

Dec 2019 |

$ (1,194) |

$2,614 |

Dec 2015 |

$580 |

$2,405 |

|

|

Mar 2020 |

$ (1,730) |

$2,777 |

Mar 2016 |

$604 |

$2,566 |

|

|

Jun 2020 |

$ (1,426) |

$3,007 |

Jun 2016 |

$718 |

$2,886 |

|

|

Sep 2020 |

$ (1,208) |

$3,444 |

Sep 2016 |

$861 |

$3,231 |

|

|

Dec 2020 |

$ (1,243) |

$3,831 |

Dec 2016 |

$926 |

$3,536 |

|

|

Mar 2021 |

$ (974) |

$4,047 |

Mar 2017 |

$890 |

$3,661 |

|

|

Jun 2021 |

$ (591) |

$4,628 |

Jun 2017 |

$916 |

$4,100 |

|

|

Sep 2021 |

$ (644) |

$4,990 |

Sep 2017 |

$1,171 |

$4,584 |

|

|

Dec 2021 |

$ (890) |

$5,541 |

Dec 2017 |

$1,354 |

$5,113 |

|

|

Mar 2022 |

$ (931) |

$5,821 |

Mar 2018 |

$1,400 |

$5,442 |

|

|

Jun 2022 |

$ (858) |

$6,276 |

Jun 2018 |

$1,642 |

$6,105 |

|

|

Sep 2022 |

$ (699) |

$6,868 |

Sep 2018 |

$2,077 |

$6,679 |

|

|

Dec 2022 |

$ (480) |

$7,315 |

Dec 2018 |

$2,177 |

$7,430 |

|

|

Mar 2023 |

$ 191 |

$7,454 |

Mar 2019 |

$2,223 |

$7,696 |

|

|

Jun 2023 |

$ 395 |

$8,031 |

Jun 2019 |

$2,121 |

$8,381 |

|

|

Sep 2023 |

$ 266 |

$8,411 |

Sep 2019 |

$2,261 |

$8,995 |

|

|

Dec 2023 |

$ 864 |

$9,192 |

Dec 2019 |

$2,596 |

$9,954 |

|

|

$ (11,152) |

$ 94,247 |

$ 24,517 |

$ 92,764 |

Per comments from Google Cloud CTO Will Grannis at the December 2023 Scotiabank Inaugural Global Technology Conference, Google’s BigQuery Omni tool helps customers across the other hyperscale cloud companies, AWS and Azure:

[In] 2020, we released a capability called BigQuery Omni. And BigQuery Omni allows – basically co-locates compute and binaries inside of other clouds like Amazon, Microsoft, and allows you to send a query across any cloud that you want without having to egress your data, and bring that back and bring only the results back. And you can imagine how important that is to companies who have data stores in multiple clouds. So now instead of having to deal with the cost of egress and these complex technical bits, we’ve solved this through a product we called BigQuery Omni. So that’s the next layer of stack, its kind platform layer.

CEO Sundar Pichai talks about Google’s Duet in the 4Q23 call, saying it benefits both Google Workspace and Google Cloud (emphasis added):

In Google Cloud Platform, Duet AI assists software developers and cybersecurity analysts. Duet AI for developers is the only GenAI offering to support the complete development and operations life cycle fine-tuned with the customer’s own core corpus and policies. It’s helping Wayfair, GE Appliances and Commerzbank write better software, faster with AI code completion, cogeneration and chat support. With Duet AI and security operations, we are helping cybersecurity teams at Fiserv, Spotify and Pfizer.

Valuation

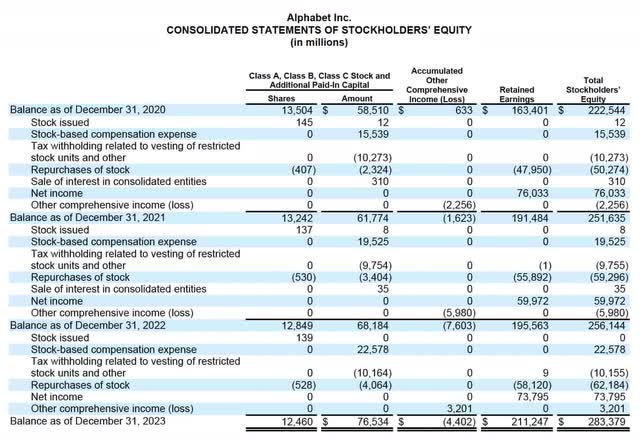

An important aspect of any company’s valuation is the way in which management allocates capital. Google’s management has used a significant amount of capital to buy back shares the last two years, and this has noticeably reduced the number of shares outstanding. The cash flow statement shows buybacks of $59,296 million in 2022 and $61,504 million in 2023. Looking at 10-K filings, there were 660,971,321 shares outstanding as of January 25, 2022. This was before the July 2022 20-for-one stock split, so the equivalent was 13,219 million shares outstanding. Due to buybacks which were partially offset by stock-based compensation (“SBC”), this fell to 12,807 million as of January 26, 2023 and 12,433 million as of January 23, 2024. In other words, the share count went down by 6% from January 2022 to January 2024 because of buybacks. The decrease in shares is even more impressive when we look at the December totals from 2020 to 2023 in the statement of equity. There were 13,504 million shares in December 2020 and this fell 7.7% to 12,460 million by December 2023 per the 2023 10-K:

Google repurchases (2023 10-K)

Per the 2023 10-K, Google Services has 2023 operating income of $95,858 million on revenue of $272,543 million. I think an operating income multiple of 18 to 20x is reasonable for this segment, implying a valuation range of $1,725 to $1,915 billion when rounding to the nearest $5 billion.

4Q23 Google Cloud operating income was $864 million on revenue of $9,192. The run rate for this revenue is $36,768 million. CFO Ruth Porat said the following about the segment in the 4Q23 call (emphasis added):

In terms of profitability, the improvement in 2023 reflects sustained focus across the team with the intent to maintain healthy profitability while we continue to invest to support long-term growth.

I’m optimistic Google can eventually get to an operating margin of 15 to 20% when it’s at a higher revenue level, and it’s not investing as much for growth. This implies a hypothetical operating income power of $5,515 million to $7,354. I think a multiple of 16 to 18x is in order, implying a segment valuation of $90 to $130 billion when rounding to the nearest $5 billion.

Here is my sum of the parts valuation:

$1,725 to $1,915 billion Google Services

$90 to $130 billion Google Cloud

$25 to $50 billion Other Bets

————————————-

$1,840 to $2,095 billion Total

Per the 2023 10-K, there were 5,893 million A shares and 869 million B shares as of January 23 for a consideration of 6,762 shares which we multiply by the January 31 GOOGL share price of $140.10 to get a partial market cap of $947.356 billion. There are also 5,671 million C shares which we multiply by the January 31 GOOG share price of $141.80 to get another partial market cap of $804.148 billion. Adding these together gives us an aggregate market cap of $1.752 trillion. The enterprise value is less than the market cap, seeing as there is $110.916 billion in cash and equivalents relative to long-term debt of just $13.253 billion.

The market cap is below my valuation range, so I think the stock is a buy for long-term investors.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, GOOGL, AMZN, MSFT, NFLX, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.