Summary:

- Many people believe that Microsoft is the winner of generative AI.

- However, this is not the case.

- In recent months, there have been a number of developments that have challenged Microsoft’s position as the leader in this space.

Filmstax/iStock via Getty Images

The Ambiguous Strategic Relationship between Microsoft and OpenAI

The relationship between Microsoft (MSFT) and OpenAI is becoming intricate. According to an article cited from The Information, an internal Microsoft document instructed Azure salespeople to inform customers that Microsoft can provide more services compared to OpenAI. On the other hand, OpenAI has implemented defensive measures such as delaying access to Microsoft’s product APIs and delaying the provision of the latest models.

The news uncovers that their collaboration is more complex than initially perceived. While Microsoft provides financial and computational support to OpenAI for research and development, and OpenAI’s advanced AI technologies enhance Microsoft’s software products, there are underlying conflicts of interest between the two.

Both Microsoft and OpenAI offer similar technical services to business customers, resulting in direct competition. Looking ahead, OpenAI’s continuous advancements, particularly with ChatGPT, have the potential to reshape the consumer application ecosystem, which could significantly impact Microsoft.

Resolving these conflicts requires compromises from both parties to find a mutually beneficial solution. Microsoft, being a business entity, is not inclined to act as a mere stepping stone for OpenAI’s success. Although OpenAI received over $10 billion in funding from Microsoft, it remains an independent entity and is unwilling to be relegated to a supporting role.

According to an article, OpenAI’s ownership structure includes Microsoft and venture capitalists (VCs), each holding 49%, while the OpenAI Fund has 2%. Profit distribution follows this process: Early investors, including Khosla Ventures, and the Reid Hoffman Foundation, will receive the initial return on investment. Then, Microsoft will receive 75% of profits until it recoups its $13 billion investment. Once recouped, Microsoft and the VCs will share 49% of profits ($92 billion for Microsoft and $150 billion for the VCs). After all amounts are repaid, OpenAI will regain full ownership and control.

In our opinion, this arrangement raises concerns for the long-term collaboration between Microsoft and OpenAI, as it sets the stage for an unpredictable future.

Microsoft’s OpenAI Partnership Falls Short

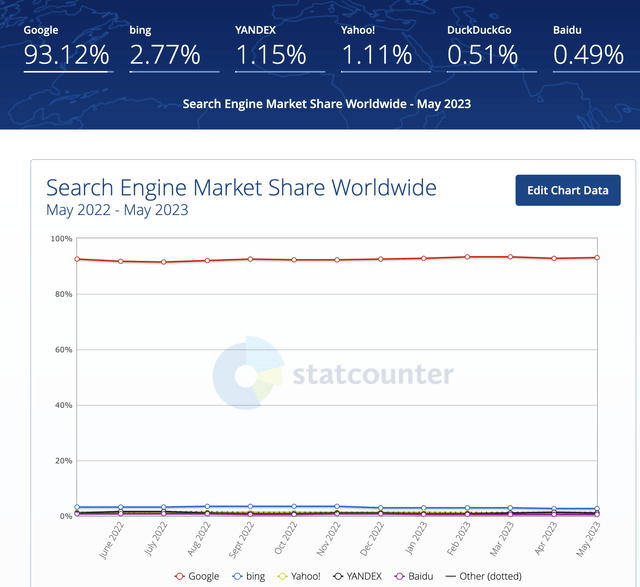

The AI trend has been booming since ChatGPT was launched in November 2022. Microsoft partnered with OpenAI to integrate ChatGPT into its Bing search engine in an attempt to boost its market share. However, Google’s Chrome web browser has maintained a stable market share despite the AI boom, while Bing’s market share remains below 3%.

Statcounter

ChatGPT Growth Stalls among Individuals

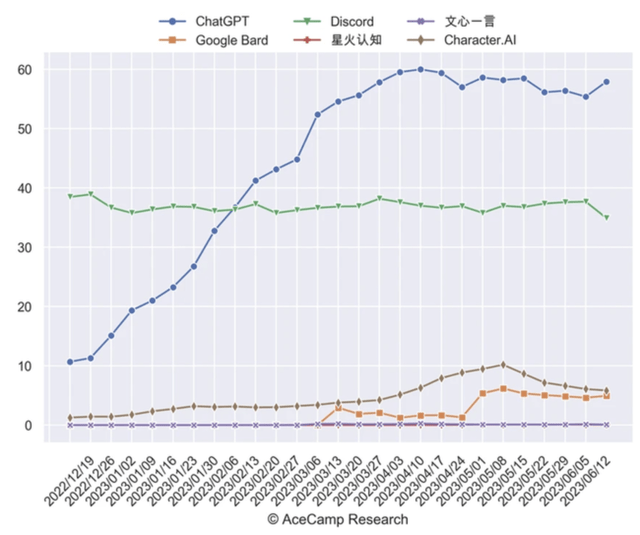

ChatGPT witnessed impressive traffic growth in the early months, with monthly rates of 131.6% in January, 62.5% in February, and 55.8% in March. However, growth slowed notably from April (12.6%) to May (2.8%). By June 20th, traffic had dropped around 38% compared to May. Without significant stimuli by June 30th, June’s growth rate is likely to decline. AceCamp data reveals that most AI chatbots, including ChatGPT, have experienced user number stagnation, and some even show a downward trend.

AceCamp

According to a survey conducted by Checkr, a significant 85% of employed Americans have utilized AI tools for their work tasks. This high adoption rate within the workforce indicates a considerable acceptance of AI tools and potentially suggests a stabilization in the growth of the user base.

Generative AI may not have a moat

One potential explanation for the stagnant growth of ChatGPT is its lack of a moat to fend off competition.

An internal Google (GOOGL) document was leaked, revealing a statement from Google staff that both Google and OpenAI lack a competitive advantage. We find this statement compelling and will support the argument with the following explanation:

To illustrate our point, we use Grammarly as an example. Grammarly, a spell-checking and grammar-correction typing assistant, reached a valuation of $13 billion in a late 2021 funding round. However, the rise of generative AI such as ChatGPT overshadowed Grammarly.

We hold the opinion that Grammarly’s limited functionality and its easily replicable interface are the primary reasons for its vulnerability to being replaced by generative AI models. The emergence of generative AI has not only impacted Grammarly but has also given rise to design platforms like Midjourney and DALL-E, which pose threats to companies like Adobe (ADBE).

Adobe possesses numerous creative tools like Photoshop, Illustrator, Creative Cloud, After Effects, and InDesign, which have powerful functionalities that generative AI tools cannot compete with. Considering the ease of replicating generative AI interfaces, Adobe embraced the strategy of incorporating AI assistants into their products as a defense mechanism against competition.

Adobe introduced “Firefly”, an AI-assisted creative tool integrated with Google’s AI chatbot, Bard. It also focuses on assisting creators rather than “replacing” them and prioritizes protecting creators’ rights.

In less than three months, Adobe has transformed from a possible “AI victim” to an “AI winner” at an astounding rate.

Early in June, the company introduced a paid B2B version of Firefly, demonstrating the high demand for the products. Adobe reported impressive Q2 2023 revenue of $4.82 billion, surpassing expectations, and has raised its full-year revenue and profit outlook, citing the positive impact of AI on its business. Additionally, Adobe’s decision to increase the price of Acrobat Pro, its PDF reader software, by 40% suggests that more Adobe products will incorporate AI and potentially undergo price adjustments.

Google came out strong

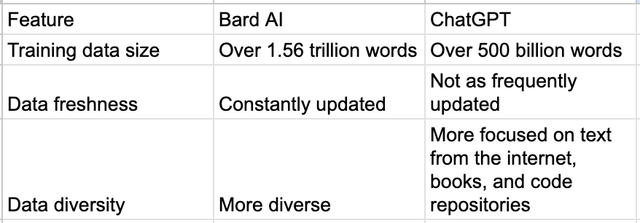

Google introduced Bard on February 6, 2023. Bard AI and ChatGPT were trained with data sizes of over 1.56 trillion and 500 billion words, respectively. Bard has a number of data advantages over ChatGPT. Bard’s training data is larger, fresher, and more diverse. This means that, in the long term, Bard can be better at understanding and responding to natural language, and it can also be better at researching and summarizing information. Our tests indicate that Bard reacts much faster than ChatGPT as well.

Mlyearning, inverse

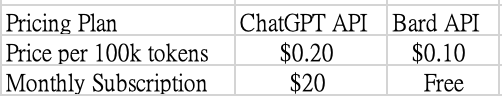

Recognizing their delayed entry, Google understands the need to regain ground by focusing on enterprise clients. Their offering comes with competitive pricing. Individual users can access Bard entirely free of charge, in contrast to ChatGPT’s $20 monthly subscription. Moreover, for enterprise users, Bard charges only half the price compared to ChatGPT. This strategy aims to attract businesses and establish a foothold in the market.

Google, OpenAI

To differentiate itself from competitors, OpenAI launched an AI marketplace, but it faces challenges gaining traction. Some popular plugins on the marketplace, like Bing Search for web browsing and VoxScript for YouTube video summarization, seem overshadowed by Google’s Bard. Bard includes most of ChatGPT’s plugin functions by default, while ChatGPT requires a subscription to ChatGPT 4 for plugin activation. In fact, during a recent event, OpenAI’s founder, Altman, openly acknowledged the lack of product-market fit for ChatGPT plugins.

Moreover, Google enjoys a stronger advantage in plugin functionality due to its dominant share in the Chrome browser market and a robust extension marketplace.

In our opinion, the $10 billion investment from Microsoft may not be sufficient to attract developers to join OpenAI’s app platform because Google already has a strong developer community supporting its Chrome extensions.

Consequently, Bard is more likely to succeed in the enterprise market due to its easy adoption, competitive pricing, product quality, and strong community.

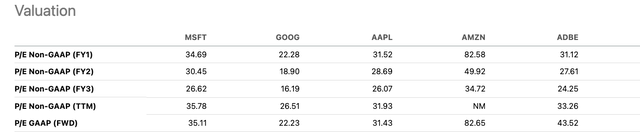

Valuation

Google’s stock is currently trading at a forward P/E ratio of 26x, which is lower than that of its competitors. Microsoft, Apple (AAPL), and Adobe trade at multiples of 35x, 31x, and 33x, respectively.

Seeking Alpha

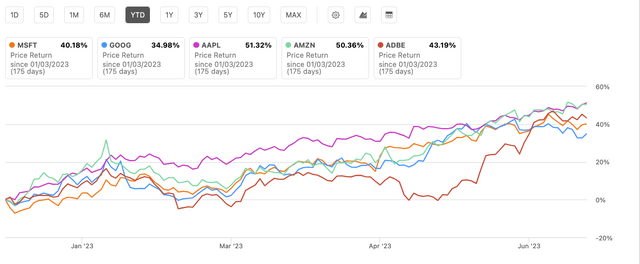

Furthermore, Google’s stock performance has lagged behind its tech peers.

Seeking Alpha

Both the valuation multiples and stock performance suggest that the market has a relatively pessimistic view of Google compared to its industry peers.

Summary

The valuation of tech equities is high overall. However, if investors are looking for exposure to the generative AI theme, we prefer investing in Google over Microsoft.

The rationale for this recommendation is as follows:

-

Competitive Advantage: Google’s AI chatbot, Bard, has a competitive edge over OpenAI’s ChatGPT. Bard has been trained with a larger, fresher, and more diverse dataset, making it more efficient at understanding and responding to natural language. Our tests indicate that Bard reacts much faster than ChatGPT.

-

Pricing Strategy: Google’s pricing strategy for Bard is more attractive than ChatGPT’s. Individual users can access Bard free of charge, while enterprise users are charged half the price compared to ChatGPT. This strategy is likely to attract more users and establish a stronger foothold in the market in the long run.

-

Strong Developer Community: Google has a robust developer community supporting its Chrome extensions. This gives Google an advantage in plugin functionality and makes it more likely to succeed in the enterprise market.

-

Valuation: Google’s stock is currently trading at a forward P/E ratio of 26x, which is lower than its competitors, including Microsoft, Apple, and Adobe. This suggests that Google’s stock is undervalued compared to its peers.

-

Stock Performance: Google’s stock performance has lagged behind its tech peers, indicating potential for growth.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.