Summary:

- Google should not just focus on advertising, but also increasingly pursue commission-based revenue through third-party retail integrations.

- There is no guarantee that Google’s ad solutions will be the best way to reach consumers in the era of generative AI.

- Google will need to prove that it can grow top line revenue faster than compute costs for its new AI-powered solutions.

Justin Sullivan

It has been over eight months since ChatGPT launched and set off the generative AI race. In a previous article, we discussed the threat that the generative AI revolution poses to Google’s core advertising revenue. Google (NASDAQ:GOOG) (NASDAQ:GOOGL)has since offered more insight into how they expect to evolve their advertising strategies for their own AI-powered conversational search services; Bard and Search Generative Experience [SGE]. This new form of search undoubtedly gives rise to new opportunities, but also creates new risks for the tech giant. Nexus Research maintains a ‘hold’ rating on the stock.

Previously we discussed how the rise of conversational search advances users’ ability to ask chatbots a string of questions in a more natural way, which improves Google’s ability to better understand user queries through conversation. This certainly enables Google to better grasp user intent, consequently bolstering its potential for targeted advertising. Nevertheless, Google is challenged with needing to strike the right balance between offering the most useful answers upfront to users’ queries, and showing ads of the highest-bidding advertisers that is relevant to those queries.

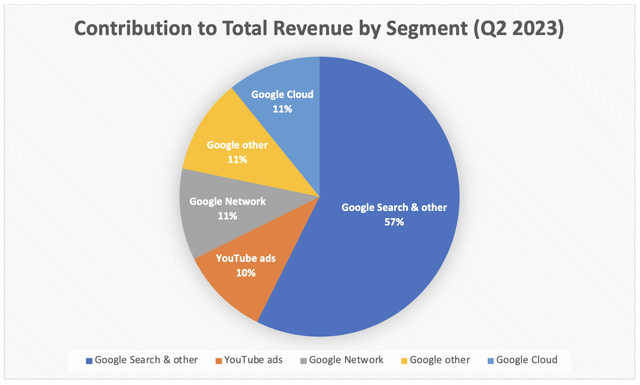

Google Search & Other makes up the lion’s share of the tech giant’s total revenue; 57% in Q2 2023, hence it is imperative for the tech giant to innovate the right advertising solutions adept for the era of generative AI in order to sustain its primary source of revenue.

Data source: company filings

There are two main types of searches that Google serves, commercial searches (where users are looking to buy goods and services) and informational queries (whereby users seek to learn something). Let us focus on the commercial aspect as this is a key driver of advertising revenue.

Google’s opportunities through conversational search

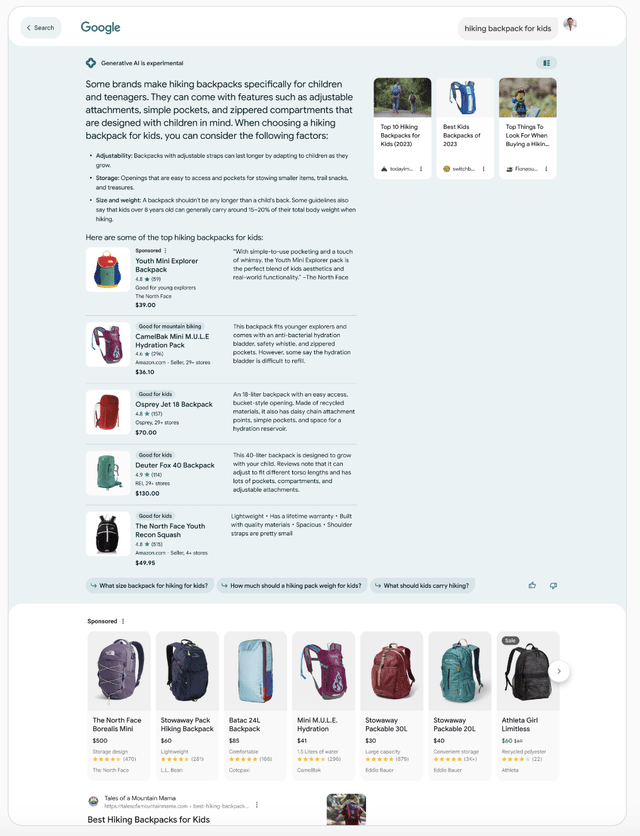

While advertising in the context of natural conversations with chatbots is a challenge, it is not necessarily impossible. Google will essentially need to get creative with how it finds a middle ground between ‘listing’ and ‘recommending’ products and services based on users’ queries. Google will want to keep its answers generic to a certain extent and avoid giving users exactly what they are looking for in an upfront manner, in order to be able to list various products/ services from advertisers with the supposed intention of giving users a range of choices. Google gave us a glimpse of how they are considering showing such “Sponsored” products/ services above and below the AI-generated answers, at the company’s I/O developer event in May 2023.

This could work similarly to how Amazon shows a ‘Products related to this item’ section below the product a user is looking at. While Google is admittedly still experimenting with ads in conversational search solutions, this strategy is indeed promising in terms of being able to sustain ad revenue. As per the example above, the tech giant has cleverly found a way to both answer the query in a useful manner, followed by a mixed list of sponsored products and relevant products. While Google is unlikely to make money if the user were to click on the non-sponsored products, this strategy at least opens the door to advertising revenue generation, and is much more assuring than the way Microsoft has been experimenting with Bing Chat ads. Hence, this advertising strategy enables investors to be more confident that Google will indeed be able to maintain its advertising proficiency in the era of generative AI.

In addition, remember that Google is a data collection juggernaut. Not only does it already hold years of Google Search history data for users, but it also has multiple sources of consumer activity data through its variety of apps and services such as Google Maps and YouTube. This data can indeed further feed into its targeted advertising strategy in conversational searches, augmenting the appeal of Google’s ad solutions, conducive to more advertising revenue for investors.

Furthermore, the conversational mode of search can also enable Google to advertise in more proactive ways, such as suggesting the next steps relating to their query (e.g. preparing for a holiday) or simply anticipating what they will need next. This opens the door to advertising other products or services that the user hasn’t even asked about yet. It would mitigate the risk of users going to another platform to look for other products/ services they will need, keeping them entangled within the Google ecosystem.

Now having considered how Google is adapting its advertising strategy for conversational search, Google’s revenue potential can extend beyond advertising in the era of generative AI.

Google’s third-party integrations

Considering the facilitation of commercial activities from a different perspective, with the shift towards conversational-style search activity, Google should not just focus on advertising, but also increasingly pursue commission-based revenue when their AI technology is able to facilitate sales for merchants. As users increasingly use Bard/ SGE for their daily activities, especially commercial activities, merchants will become increasingly enticed to list their products/ services on Google to reach its broad user base and avoid missing out on a promising new sales channel.

At the company’s I/O developer event, Google revealed third-party merchants including “Spotify, Walmart, Redfin, Uber Eats, TripAdvisor and ZipRecruiter” will be directly integrated with Google Bard. Note that Microsoft is taking a similar approach with Bing Chat.

As an example, users will be able to create a grocery shopping list with the help of Bard based on meal plans to be ordered from Walmart. Google has not revealed how it will exactly monetize these third-party integrations and subsequent sales activity, but it could indeed incur lucrative commission fees for the tech giant, akin to how Google earns commissions from sales through the Google Play store. In fact, Google already has third-party integrations with Google Assistant, its voice-controlled virtual assistant, including companies like Starbucks and Uber, which generates commission-based revenue.

Now in the era of generative AI, when users utilize these Bard plugins for diverse commercial activities, their unique preferences get stored on the platform. This enables Google to serve these users more easily in the future and also contributes to targeted advertising endeavors. As a result, Google will want to make sure that consumers commence such commercial activities through Bard/ SGE, as opposed to any competing platform. Doing so enhances the likelihood of users returning to repeat those transactions and similar affairs, as the software is already familiar with their inclinations, leading to a progressively smoother commerce experiences over time. This will ultimately culminate into an immensely powerful ecosystem, conducive to long-term recurring revenue growth for investors.

While competitors like Bing, as well as the rise of new AI-powered rivals, will also be striving to build their own commercial ecosystems, Google has several strengths to leverage, including the popularity of its wide range of additional apps/ services, like the aforementioned Google Maps.

On top of that, Google also possesses the most popular mobile operating system worldwide, Android OS, boasting a market share of 70.79% in Q2 2023. People are increasingly engaging in commercial activities through mobile devices. Google leverages the prominence of Android OS in mobile devices by pre-installing its apps, and will undoubtedly take a similar approach to deeply-imbedding Bard/ SGE into people’s daily lives too. This can give it an edge over rising competitors, barring impediments from potential antitrust litigations.

Google’s Compute costs and profitability

While the opportunities presented by the new conversational search services are lucrative, in terms of both advertising and commission-based revenue prospects, keep in mind that the underlying computing costs to deliver human-like answers in Bard/SGE will indeed be much higher than the traditional search engine results.

The cost of compute amid the generative AI transformation is something Google executives have touched upon frequently on earnings calls. In the April 2023 earnings call, CEO Sundar Pichai mentioned:

“On the cost side, we have always – costs of compute has always been a consideration for us. And if anything, I think it’s something we have developed extensive experience over many, many years. And so for us, it’s a nature of habit to constantly drive efficiencies in hardware, software and models across our fleet. And so this is not new. If anything, the sharper the technology curve is, we get excited by it because I think we have built world-class capabilities in taking that and then driving down cost sequentially and then deploying it at scale across the world.”

And CFO Ruth Porat had acknowledged in January 2023:

“It is more compute-intensive, but also opens up many more services and products for our users, for creators, for advertisers…

we are focused on durable improvements to our expense base… they take longer to implement, execute. They’re in process now, and they continue to build on themselves and continue to provide added upside as we go through time, which is why I indicated you would see more of an impact on 2024 than in 2023.”

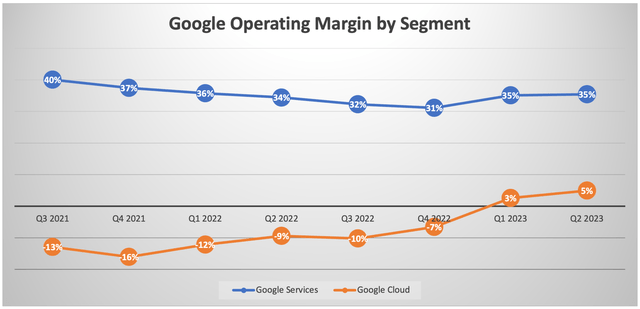

Given Google’s experience, scale and expertise in serving Search answers for decades, the tech giant should indeed be able to increasingly drive cost efficiencies for their various generative AI applications, and thereby support its operating profit margins. In Q2 2023, the Google Services segment (majority of which is Google Search advertising revenue) delivered an operating margin of 35%.

Data source: company filings

While operating margin bounced back this year, it follows several consecutive quarters of declining profitability. The company does not break down its profitability for Google Search individually, but if Google wants continue expanding its profit margins, it will need to prove that it can successfully grow top-line revenue, through effective ad solutions and potential sales commissions through third-party integrations, at a faster pace than the underlying compute costs.

More problems for Google

New era, new competitors: For years, Google has enjoyed incredible monopolistic power, with over 90% market share of the Search engine market. While this is alluring from an investment standpoint, it also means that Google has a lot to lose in this new era. As generative AI revolutionizes the digital economy, it will undoubtedly give rise to new apps and platforms offering innovative services that may once have been unimaginable. Subsequently, these new apps could potentially also offer more potent advertising solutions.

While the glimpse Google has given us into its new ad solutions is encouraging for it to be able to sustain advertising revenue generation, we don’t know yet how it will compare with ad solutions from other new-age platforms. There is indeed the risk that such new apps and platforms could better attract users and offer more appealing advertising avenues. Hence, the advertising market could indeed become increasingly fragmented as advertisers have a lot more choice going forward. Potential signs of Google losing market share could indeed undermine the valuation multiple investors are willing to pay for the stock.

Antitrust issues: Google has a long history of exploiting its platform dominance and power, such as in the form of favoring its own search vertical while suppressing competing businesses (a prominent example would be Yelp). Now with the evolution towards conversational search services, Google could potentially engage in such unethical business practices in more powerful manners as it is in full control over its chatbots’ recommendation systems.

As a result, this could lead to ongoing antitrust litigations that lead to costly fines and the divergence of resources away from innovation that is imperative to stay ahead in the intensifying AI race.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.