Summary:

- GOOG has more than 100% growth potential by 2029 based on regression analysis.

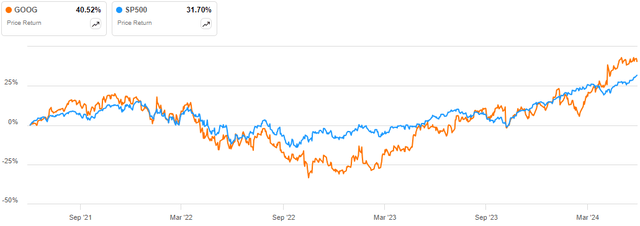

- Alphabet Inc. stock has outperformed the S&P 500 by 9% in the last three years, with a 41% increase.

- I have a bullish outlook on GOOG due to innovations, diversification, and favorable market trends in AI, cloud computing, and digital advertising.

- Technical analysis shows GOOG in a bullish trend with strong resistance to price declines, making it undervalued and a buy.

vzphotos

Investment Thesis

Alphabet Inc.(NASDAQ:GOOG) stock has soared by about 41% over the last three years, outperforming the S&P 500 by about 9%.

I am bullish on this stock and I believe that it will sustain its upward trajectory eventually due to its innovations and diversification, which will serve as a major growth catalyst. The favorable market trends in AI and cloud computing backed by the growth in digital advertising also give my bullish stance traction. From a technical perspective and based on regression analysis, GOOG has a bullish outlook; consequently, I rate the stock a buy.

Brief Company Overview

GOOG is an American multinational conglomerate whose headquarters are in California. The company arose through the restructuring of Google in October 2015, and it serves as the parent company to Google and several former Google subsidiaries. It is recognized as one of the largest tech companies by revenue with trailing revenue of $318.15 billion, and it is the 4th most valuable company globally with a market cap of $2.17 trillion.

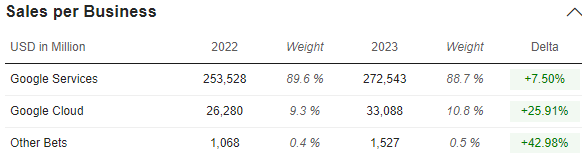

It has a diverse portfolio comprising various sectors such as artificial intelligence, auto cars, and the healthcare sectors among others. Its subsidiaries include notable names like Google Fiber, Calico, and Labs among others. It offers diverse products and services such as ads, chrome, YouTube, etc. The company operates through three major segments whose revenue contribution is shown below.

Market Screener

Technical Take

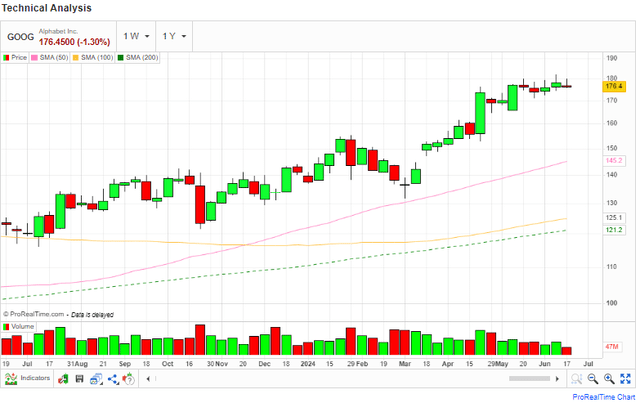

First off, let’s evaluate the price movement to evaluate the trend and using technical indicators project the possible future movement. To begin with, GOOG is currently in a dominant ascending channel, which is a bullish pattern characterized by higher highs and higher lows. Currently, the stock is forming a higher high at the upper trend line of the channel, where I expect the price to decline slightly to about $160 to form another higher high before shooting in the same sequence.

While it’s clear this stock is in a bullish trend, it is essential to assess how strong this trend is. I will use technical indicators to assess the strength. First off, the price is above the 50-day, 100-day, and 200-day moving averages indicating that this stock is in a bullish trajectory in the short, medium, and long terms. Notably, the 50-day and 100-day MAs exhibited the golden crossover, which is an indication of a sustainable long-term trend implying that the price is likely to keep soaring.

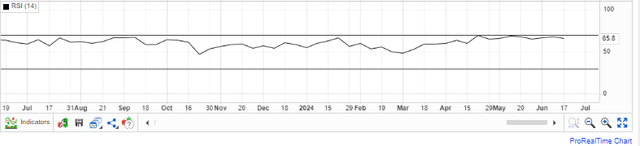

Further, the RSI oscillator is currently at 65 meaning that this stock is not yet in the oversold region above 70 and therefore there is room to grow.

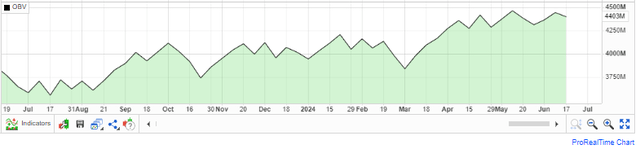

Additionally, its on-balance volume is rising, indicating an increasing cumulative trading volume for GOOG implying an increasing demand for the stock and hence a sustainable bullish trajectory.

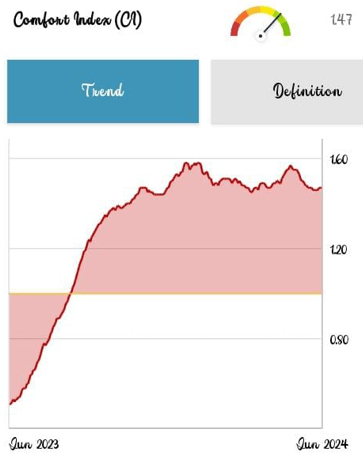

Above all, GOOG has a comfort index of 1.47 which has been increasing over the last year. This shows that the stock has a high ability to resist severe and lengthy price declines. The CI measures a stock’s resistance to downturns. It is measured on a scale of 0-2, and a value of 1 and above implies that the stock is resistant to downturns. I believe this is a good measure because it shows GOOG’s resilience amid the inflationary pressure.

Vector Vest

Based on this technical point of view, Alphabet is in a solid upward trajectory with a strong resistance to price declines, meaning that its bullish trend is likely to continue in the long as shown by the golden crossover.

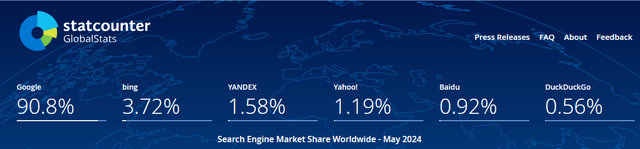

Market Position: Dominant In Search Engine Market

Although GOOG is more than just a search engine, it’s majorly known for its dominance and solid market presence in the search engine market, accounting for more than 90% of the market share.

It owns the most popular search engine globally, and it is a source of about 70% of global enquiries. It receives more than 1 billion hits monthly, signifying its high customer traffic. There are several reasons for this dominance, some of which I will discuss in this article. The first one is improved user experience. GOOG has focused on providing its users with a better experience rather than just monetization of search. Its algorithm accounts for multiple factors such as page quality and relevance, something which improved upon competitor models like Yahoo.

An example of improved page quality and relevance in Google, Alphabet’s search engine, compared to Yahoo is the adoption of the PageRank algorithm. It evaluates the quality and quantity of links pointing to a page to determine its importance. This is part of the company’s complex systems that analyze various factors like keyword relevance, user engagements, and backlink quality. With this innovation, when one searches for a term on Google, it ranks the results not just by the presence of keywords but also by contextual relevance based on link structure prioritizing links from reputable sources, which more often leads to more accurate and useful results. On the contrary, Yahoo considers factors like website authority and user engagement. Consequently, Google’s emphasis on backlinks and off-page optimization with its continuous updates to the algorithm makes it unique and stands out from the competition, delivering a more refined and relevant user experience.

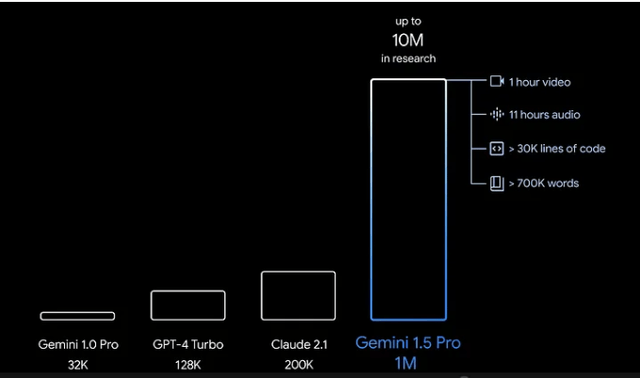

The other major reason is its innovation. On the innovation front, GOOG has been very innovative, and in the wake of the AI wave, it has several innovations that have adopted AI. For this analysis, I will discuss one of its recent innovations as an example. In February this year, the company introduced the Gemini 1.5 Pro. Of these models, the most outstanding one is the Gemini 1.5 pro, which has unique capabilities compared to existing models.

It has an expanded context window to 1 million tokens, and there are plans to double it to 2 million tokens. The expanded context allows it to maintain context over longer conversations and understand more complex inquiries. It is also capable of processing complex inputs at ago such as more than 700, 000 words, one hour of video, 11 hours of audio, and over 30,000 lines of code. Again, it has a multimodal understanding which is absent in other models. Gemini 1.5 Pro is capable of processing and understanding various data types such as text, images, and audio, which enhances its ability to handle diverse inputs. Lastly, is its enhanced speed and efficiency. The product is designed to be more efficient both in computation and response time, making it suitable for real-time applications. To achieve this, the company has leveraged several technologies such as the MoE architecture, which is a specialized technique that allows the model to selectively leverage relevant components of its processing power rather than executing the entire model with each enquiry, thereby resulting in faster response time since the model can focus on specific expertise needed for a given task.

Given this background, it appears that this company’s market dominance is built on a strong foundation of enhanced customer satisfaction, or rather improved customer experience and innovation. The company’s ability to stay ahead of the competition in terms of innovation, in my view, gives the company a competitive edge and I believe this signifies the company’s commitment to offer its customers high-quality products before its competitors, something that will make its market dominance hard to break. Further, the company’s algorithms, especially those used by Google are highly complex and operate at a massive scale, which makes it hard for competitors to replicate, and it’s even harder given that they are continuously improved. This implies that GOOG is likely to keep its market dominance in the long run.

Growth Catalysts

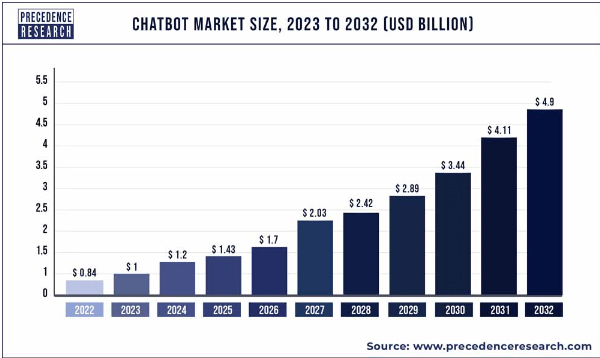

Besides its solid market presence, which on its own is a significant growth catalyst, GOOG has other strong tailwinds which, I believe, will stir up its growth trajectory. Among them is a favorable market trend. With the company’s massive investment in AI, it is very pleasing to see that it has a massive growth potential. With the launch of open AI ChatGPT, the demand for AI has been skyrocketing recently, and this leaves the Chatbot market with a massive upside potential. According to precedence research, the market is projected to grow from about $1 billion in 2023 to about $4.9 billion in 2032 translating to a CAGR of 19.29%.

Precedence Research

With this solid market growth potential, I am confident that GOOG is strategically positioned to leverage this opportunity given its Gemini technology, which is unique and superior features. Furthermore, the company’s strong financial position, which I will discuss in this analysis, offers them the ability to keep investing in innovation to stay ahead of the competition and leverage on the emerging opportunities better than its competitors.

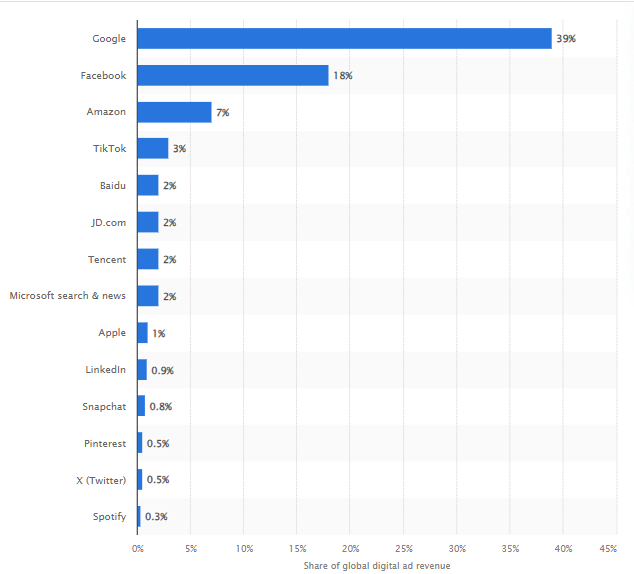

Further, the company will benefit from digital ads spending projected growth. Its digital ads business accounts for about 80% of its total revenue, and the company is a dominant figure in the digital ads business in terms of revenue. In 2023, it commanded about 39% of the market, being at the top spot according to Statista.

Statista

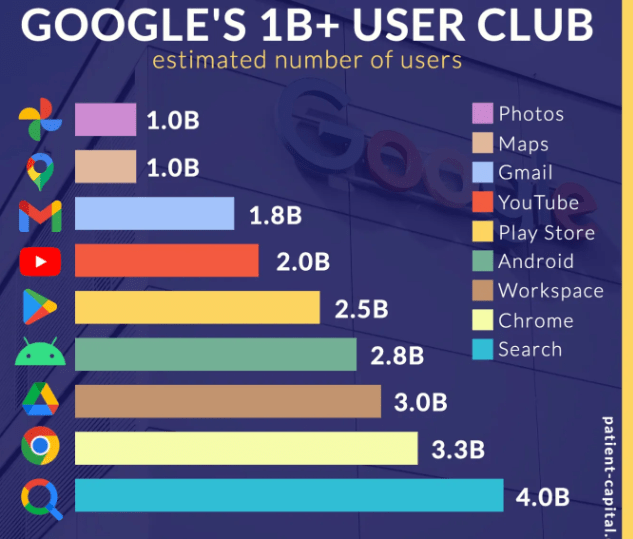

Its success in the ads business is majorly due to the popularity of its products and services, particularly in the search engine. It has nine products whose user base exceeds 1 billion, and this offers them a massive opportunity to advertise.

Patient Capital

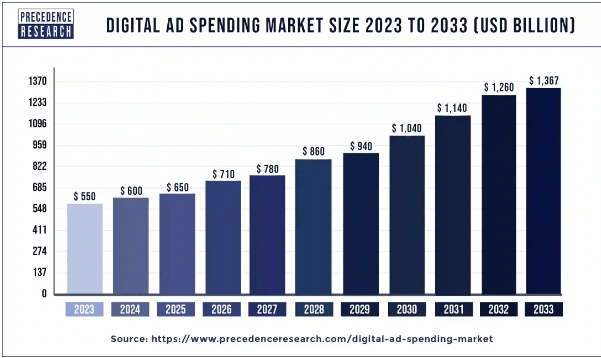

Given this background, GOOG is well positioned to leverage the projected digital ads spending growth. It is estimated that the ads spending will grow from $550 billion in 2023 to $1,367 billion in 2033, growing by a CAGR of 9.58%.

Precedence Research

Notably, GOOG has diversified beyond search with a range of products such as YouTube, Google Cloud, and Android. This diversity offers them a wide revenue stream and a competitive edge over rivals such as Meta, which relies primarily on social media for revenue. For this reason, I think the GOOG model is more resilient than its competitors.

Lastly, a key growth catalyst for this company is its solid financial position. GOOG has a strong balance sheet characterized by net cash of $79.62 billion. Further, in Q1 2024 its revenue grew by more than 15% YoY and its net income soared by about 57% YoY. I believe this solid performance is majorly due to its solid brand identity and market dominance, which saw its ads revenue grow by more than 13%. Most importantly, it has been consistently generating strong cash flows from operations and its trailing operating cash flow stands at $107 billion. Its net cash can cover its trailing CapEx of $37.97 billion more than 2x, and its operating cash flow can cover its CapEx by about 3x. With such a robust financial footing, GOOG enjoys a lot of financial flexibility, and they can invest in growth opportunities with ease and without seeking external financial footing. Above all, its solid financials allude to strong fundamentals, which could lead to bullish sentiments culminating in higher share prices.

Regression Analysis: 2029 Price Target Projection

First off, I adopted a regression model to do this assessment because it is based on quantitative and fundamental inputs. Further, the model uses more independent variables that affect the stock price, and therefore it is comprehensive compared to a DCF model which purely relies on cash flows. Lastly, in the analysis, I have created a balanced approach by adopting both company-specific inputs and macroenvironment inputs, and thus the analysis is comprehensive.

In running this model, I used both micro and macro factors that can influence the stock performance to have a balanced fundamental-based model. For micro factors, I used the company’s EPS and revenue. For the macro factors, I used interest rate because it affects the cost of borrowing, which in turn affects returns on investment. Lastly, I used market growth because this is often a major growth catalyst. The model was run using data for the last 5 years to estimate the model, after which the future price of the stock was estimated using projected values. In my model, the assumptions were that there exists a linear relationship between the Y variable (Stock price) and the X variables (revenue, EPS, interest rate, and market growth), and that the residuals are independent of each other.

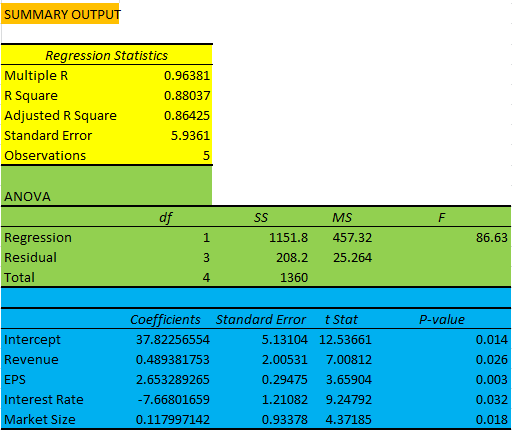

Using these inputs, the model was run at a 95% confidence interval, and below is the output.

Author

From these results, the model has an adjusted R square of 0.86425 meaning that it explains 86.42% of the variability in the dependent variable; therefore this is a good model for this evaluation since a high R square means that the model accounts for a greater percentage the variance in the Y variable. To justify the variables’ statistical significance, the t-stats being above 2 and the p-values being below the 0.05 confidence interval meaning all the X variables are statistically significant, and therefore they are valid predictors of the Y variable.

With this justification, the output has shown that revenue, EPS, and market growth have a positive coefficient, meaning that any incremental unit in these variables has a positive impact equivalent to their respective beta coefficients on the stock price. Conversely, interest rate has a negative coefficient, meaning that any incremental unit in interest rates hurts the stock performance. Given these results, the overall model is;

Y=Bo+B1X1+B2X2-B3X3+B4X4+e

Where;

Y is the stock price, B0 is the intercept, B1 is the coefficient of revenue, X1 is revenue, B2 is the beta coefficient for EPS, X2 is EPS, B3 is the beta coefficient for interest rate and X3 is interest rate, B4 is the beta coefficient of market growth and X4 is market growth.

Given this model, we can estimate the stock price as of 2029 by plugging the estimated values for revenue ($557.88 billion) and EPS ($17.71) from Seeking Alpha, the projected search market by Statista of 345 billion and the projected fed rate of about 2.90% according to S&P Global. Putting these values in the overall model equation above yields a price target of $377.28 marking a growth potential of 113.82% over the next 5 years.

Although this model is comprehensive in its approach, its major drawback is that it heavily relies on the future projecting of the independent variables, which may not always hold. However, the estimated price target would respond to the variations in the estimates. For instance, if the negatively impacting parameters go high, I expect the price to decrease in an equal measure and vice versa.

Risk

One major risk of investing in this company is the potential disruption of its core business by advancements in AI, mostly in the realm of search technology. Google is the dominant player in the internet search, but the emergence of AI-driven Chatbot like ChatGpt could significantly change the landscape. AI has gained popularity and this represents a shift in how users may seek information in the future, something which could see traditional search engines lose relevance. If this happens, GOOG will lose significant advertising revenue, which is a cornerstone of its business model.

Conclusion

In conclusion, GOOG is a good investment opportunity with a dominant market share and competitive advantage stemming from its innovation and financial strength. The company has a massive growth potential backed by solid market trends which bodes well for its growth trajectory. With this background, I rate this stock a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.