Summary:

- Google’s Q3 performance showcases strong growth with double-digit revenue expansion and a significant 42% increase in earnings. The market reacted with a selloff.

- Concerns about the growth of Google Cloud are overblown, as growth in this segment is still solid. Future AI projects will likely boost Cloud performance.

- Google’s strong results in its core search business and its diversification efforts, such as the success of its Pixel phones, make it a robust mega-cap stock.

- Google offers a promising investment opportunity with a history of growth, faster earnings expansion than most mega-cap peers, and lower valuation multiples, making it one of the most attractive mega-cap stocks.

400tmax

In the realm of mega-cap investments, Google’s parent company, Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL), stands out as the most compelling choice at the moment, especially in the wake of a recent selloff triggered by its Q3 earnings report.

Despite some concerns surrounding its cloud-related performance, Google presents an array of appealing opportunities. With strong revenue growth and accelerated earnings expansion due to effective cost management, the company displays notable financial strength. Remarkably, despite its solid performance, Google boasts the lowest valuation multiples among most mega-cap stocks, all while expanding and diversifying its business and standing on the verge of substantial AI-driven prospects. Therefore, Google’s combination of attractive valuation, strong growth, and profitability metrics positions it as one of the best mega-cap investments available in the market.

Q3 earnings: double-digit revenue growth and strong earnings expansion

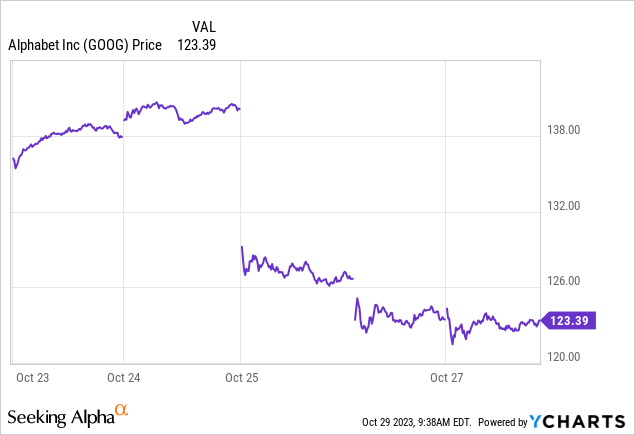

On October 24, Google reported its Q3 earnings, beating on revenue and EPS. The company reported $76.8 billion in revenue, with 11% year-over-year growth, and $1.55 in GAAP EPS. Despite its solid performance, the stock experienced a more than 10% drop in the next three trading sessions, resulting in a notable loss of approximately $200 billion in market capitalization.

A closer examination of the financial figures might leave some investors puzzled as to the reasons behind this substantial decline. In the third quarter, Google exhibited noteworthy performance across all but one revenue segments (Google Network, the smallest category by revenue, dropped by 2.7%), each experiencing double-digit revenue growth:

- Google Search and other revenue demonstrated an 11.4% increase, reaching a total of $44.03 billion.

- YouTube ads revenue saw a solid 12.4% growth, amounting to $7.95 billion.

- Google’s other revenue category experienced remarkable growth of 21%, reaching $8.34 billion.

- The Google Cloud division recorded an impressive sales increase of 22.6%, reaching $8.41 billion.

In addition to revenue growth, Google’s financial strength was further underscored by its net income margin. This margin expanded from 20% in the third quarter of 2022 to nearly 26% in the same period of 2023, culminating in a remarkable 42% increase in net income. Notably, this stands in contrast to the 27% net income growth reported by Microsoft (MSFT), a tech giant that experienced a significantly more favorable market response to its earnings. These financial dynamics render Google an intriguing investment prospect, particularly in the aftermath of its stock price decline.

Concerns around Cloud growth are overblown

One key factor cited as a catalyst for Google’s recent stock drop is the slowing growth of its cloud segment. The third quarter of 2023 saw Google Cloud’s growth rate dip to 22.6%, following a consistent performance of 28% growth in the first two quarters of the year.

However, from my experience working in data analytics, this deceleration could be attributed to a different narrative: existing customers, who have become accustomed to the platform’s efficiency, are likely optimizing costs amid economic uncertainty. Google Cloud still stands out as a solid platform, scalable for modern data and AI platforms, and user-friendly, based on my firsthand experience with the platform as a data analyst. These characteristics set Google Cloud on a promising trajectory, potentially mitigating concerns about slowing growth.

When we compare Google’s cloud performance to industry giants like Microsoft and Amazon (AMZN), it becomes clear that the concerns over its growth are somewhat overblown. Hence, Amazon Web Services (AWS), one of the dominant players in the cloud services arena, managed only a 12% growth rate in the quarter. Microsoft’s Azure revenue did increase by a more substantial 28% in constant currency, but this was a significant decrease from 35% growth in the same quarter last year. Besides, the total Intelligent Cloud revenue went up by only 19%.

What further supports the potential resilience and growth prospects of Google Cloud is its existing client base. According to Sundar Pichai, a substantial 60% of the top 1000 companies still rely on Google Cloud, indicating the platform’s stability and trustworthiness within the corporate world. Moreover, the cloud segment’s influence extends beyond established enterprises. A significant portion of generative AI startups also prefers Google Cloud as their foundation, setting the stage for impressive future growth in this innovative and rapidly expanding industry.

Next, Google Cloud. We see continued growth with Q3 revenue of $8.4 billion, up 22%. Today, more than 60% of the world’s 1,000 largest companies are Google Cloud customers. At Cloud Next, we showcased amazing innovations across our entire portfolio of infrastructure, data and AI, workspace collaboration, and cybersecurity solutions. We offer advanced AI-optimized infrastructure to train and serve models at scale. And today, more than half of all funded Generative AI startups are Google Cloud customers. This includes AI21 Labs, Contextual, Elemental Cognition, Rytr, and more.

Finally, Google’s upcoming Gemini AI project is set to enhance the attractiveness of Google Cloud for AI opportunities even more. Gemini AI’s capabilities and the resources it can draw upon are expected to propel Google Cloud into a more competitive and innovative position in the AI sector. As AI continues to shape the future of technology, Google’s cloud segment is well-positioned to capture a substantial share of this rapidly growing market.

Google search endures, diversification adds strength

Despite concerns about the slowdown in advertising revenue and the rise of AI-driven language models like ChatGPT, the latest reality check suggests that these worries about Google Search might be premature. During the quarter, Google’s search and other advertising revenues increased by a solid 11%, signaling the resilience of this core revenue stream. Additionally, Google has taken proactive steps to secure its foothold in the evolving landscape of AI and search. The company has been rolling out initiatives like the Search Generative Experience with models such as Bard, which ensures that users continue to rely on Google Search for their information and query needs in the age of AI.

Moreover, sentiment analysis reveals that ChatGPT, while promising in many respects, still lags behind traditional search engines when it comes to browsing the internet and finding specific information efficiently. This observation underscores the enduring relevance of search engines like Google and emphasizes that the shift toward AI-driven alternatives might not happen as swiftly as some have predicted. With a combination of steady advertising revenues, strategic AI integrations, and user sentiment favoring traditional search, Google’s position in the digital landscape remains robust, making it unlikely that ChatGPT will fully replace the company’s core search services in the near future.

Additionally, in a strategy reminiscent of Apple’s (AAPL) approach to diversification and integration, Google has been making notable steps in expanding its product and service offerings. The recent success of Google’s Pixel phones is an example to this diversification. With positive feedback from consumers and year-over-year growth in sales, these devices are establishing a firm presence in the competitive smartphone market. Google’s integrated approach further boosts its appeal, with services like Google Assistant with Bard, equipped with AI features, becoming more seamlessly interwoven in its Pixel phones, which also use Google’s Tensor chips. This cohesive approach enhances the overall user experience and should strengthen brand loyalty, akin to the Apple ecosystem.

From Q3 earnings call:

We unveiled our new products this month. We introduced our new Pixel 8, Pixel 8 Pro, and Pixel Watch 2 to very positive consumer feedback and reviews. Pixel is the fastest growing smartphone brand in our top markets and the only one that grew in units sold year-over-year. Our portfolio of Pixel products are brought to life, thanks to our combination of foundational technologies, AI, Android, and Google Tensor.

Furthermore, while Google continues to witness substantial growth in its other major service domains, like YouTube and Cloud, the integration of these services across a multitude of devices, including smartphones and smart home products, underscores Google’s commitment to diversification, providing a wide set of user-oriented services and bolstering its reputation as a multifaceted technology giant.

Google is one of the lowest-valued mega-caps, not justified by its performance

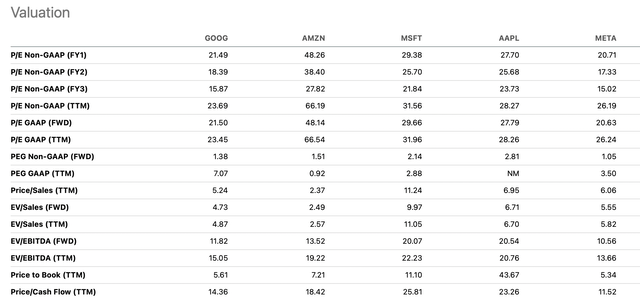

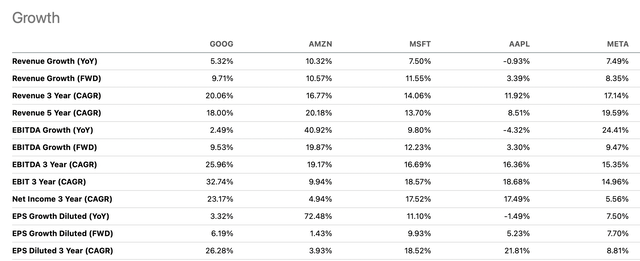

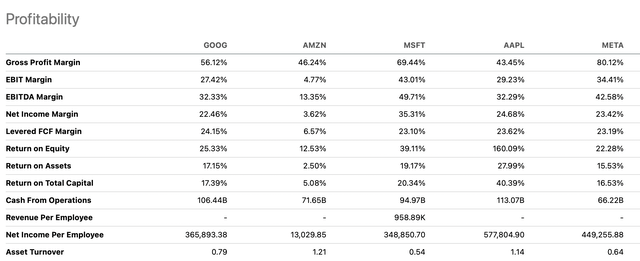

Google stands out among the mega-cap giants with its attractive valuation multiples. Its forward GAAP P/E ratio of 21.5 is notably lower than Amazon, Microsoft, and Apple, and only slightly higher than Meta (META). Additionally, its price-to-sales ratio is among the lowest, second only to Amazon, which is known for its slim margins.

Meanwhile, Google demonstrates impressive growth figures, making it one of the best choices in the market. With a 3-year revenue CAGR of 20%, solid forward revenue growth of almost 10%, and a higher EBITDA 3-year CAGR of 26%, it remains at the forefront of growth among its mega-cap peers.

In terms of profitability, Google maintains a robust net income margin comparable to Apple and Meta, although slightly lower than Microsoft. It boasts the best free cash flow margin at 24% and ranks among the top in cash generated from operations, only trailing Apple.

Risks

Investing in Google carries certain risks that investors should be mindful of. While the company is actively diversifying its revenue streams, a substantial portion of its earnings still relies heavily on advertising, particularly in the search segment. Any slowdown in this domain could have a significant impact on the company’s performance. Moreover, Google’s significant investments in AI, while promising, may take time to yield substantial returns. Additionally, the company has a history of discontinuing projects, even those with potential, such as Stadia. Finally, in the competitive cloud computing market, Google Cloud faces formidable rivals like AWS, Azure, Snowflake (SNOW), and Databricks, which may pose challenges to its scalability and market share.

Key takeaways

Google’s strong Q3 performance reflects robust growth, with the company returning to double-digit revenue expansion. Even more encouraging is the remarkable 42% increase in earnings. Google’s long-standing Google Search business exhibits consistent revenue growth, highlighting its capacity to endure in an ever-changing technological landscape. Yet, Google’s dedication to diversification holds promise for the company’s future, strengthening its capacity to adjust and foster innovation.

Despite concerns about slowing growth in Google Cloud, it remains a solid performer among its competitors, like Microsoft’s Cloud or Amazon Web Services. The incorporation of AI features, such as the upcoming Gemini project, is poised to give this segment a substantial boost in the future, suggesting that the concerns surrounding its performance may be overblown.

With a promising future, a solid track record of growth, and earnings expanding more rapidly than most mega-cap peers, Google presents a compelling investment opportunity. Surprisingly, Google’s valuation multiples are the lowest among the mega-cap stocks, indicating potential undervaluation. All these factors make Google one of the most attractive mega-cap stocks available in the market today, especially after the recent selloff, offering investors a blend of growth and value within the tech sector.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.