Summary:

- Google stock has crumbled amidst the tech crash.

- This isn’t an unprofitable cash-guzzling company – Google continues to generate cash and repurchase stock.

- Google has $112 billion of net cash – making up a sizable portion of the market cap.

- Google Cloud and Other Bets have a sizable value yet detract from earnings – the stock is much cheaper than it looks.

Prykhodov

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) is a surprising victim of the tech stock crash. While GOOGL is indeed a tech stock, one could be forgiven for thinking that the secular growth story, high profit margins, and $116 billion of cash would have lent the stock price some support. None of those came to the rescue as the stock sank after third quarter earnings. While the market continues to focus on near term growth and profit challenges, I instead am looking ahead for a recovery in both growth rates and operating leverage. This is a name which has historically aggressively invested in long term growth and I expect the fruits of those investments to show themselves even in a tough macro environment. With the stock trading at compelling valuations, this is one of my higher conviction ideas in the market today.

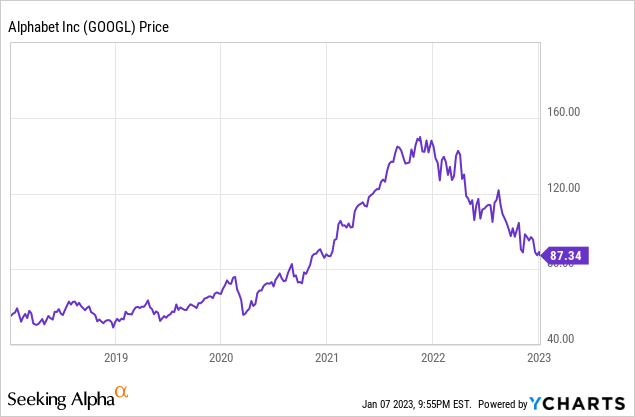

GOOGL Stock Price

GOOGL stock is down 40% from recent highs. If GOOGL was previously considered a “safe” stock to own in the tech sector, that notion has been seriously challenged.

I last covered the stock in September where I rated it a strong buy on account of the hidden value of Google Cloud. The stock has since dipped 18%, making the stock curiously undervalued in spite of high quality characteristics.

GOOGL Stock Key Metrics

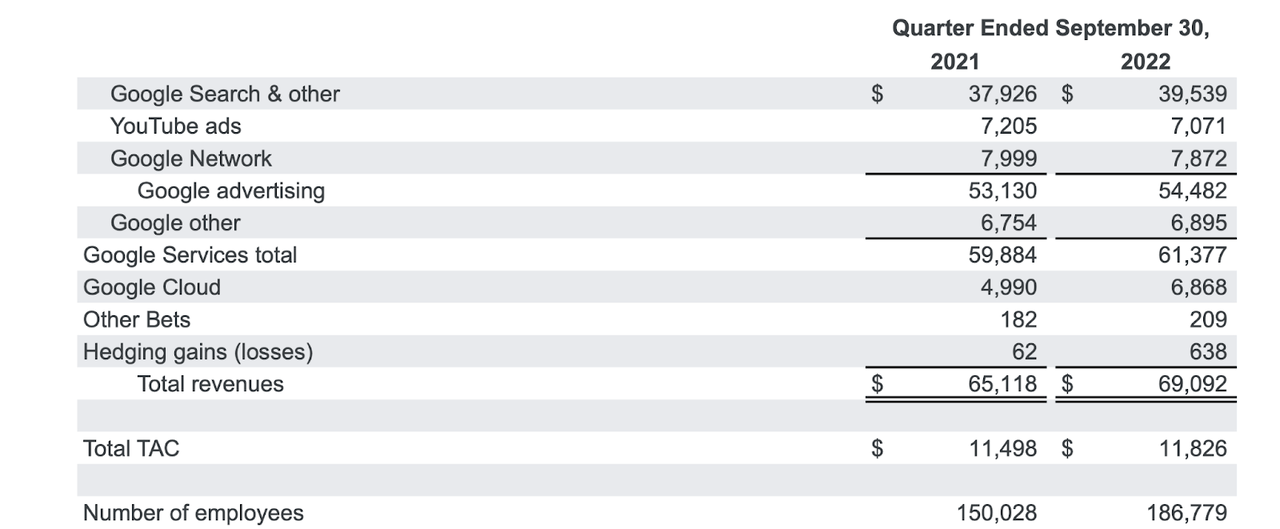

After growing revenues by 41% in the third quarter of 2021, GOOGL reported just 6% top-line growth though on a constant currency basis growth was better at 11%. The headline numbers may show a 24% decline in EPS, but we should adjust for non-cash unrealized investment gains and losses. After that adjustment, earnings stayed steady year over year at $1.24 per share.

2022 Q3 Press Release

GOOGL saw YouTube ad revenue decline year over year but still reported strong 37.6% growth in Google Cloud. Operating income declined in spite of revenue growth due to continued investment in growth, as headcount grew 24.5% YOY and 7.4% sequentially (the numbers in the following snapshot are shown in millions except for number of employees).

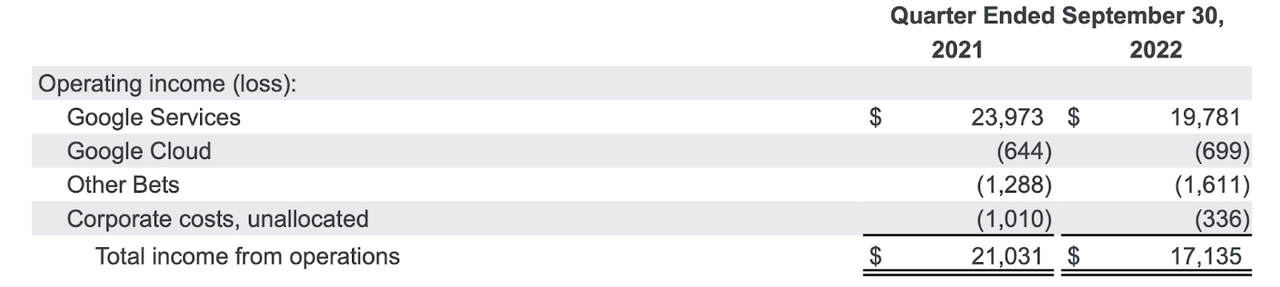

2022 Q3 Press Release

While Google Cloud saw only a mild increase in operating losses, both Google Services and Other Bets saw some margin contraction.

2022 Q3 Press Release

GOOGL ended the quarter with $116.3 billion of cash versus $14.7 billion of debt. The company continued to show strong commitment to returning cash to shareholders, generating $16.1 billion of free cash flow versus $12.6 billion of share repurchases.

On the conference call, management noted that they were “realigning resources to invest in [their] biggest growth opportunities,” shifting away from “lower priority efforts to fuel higher growth priorities.” Management guided for lower headcount additions in the fourth quarter in the third quarter. Judging by the market’s reaction to the report, one could conclude that Wall Street was hoping for more drastic cost cuts instead of moderating expense growth.

Management expects the fourth quarter to see an even larger headwind from foreign exchange, which only compounds the near term headwinds from the tough macro-environment and tough prior year comparables.

Is GOOGL Stock A Buy, Sell, or Hold?

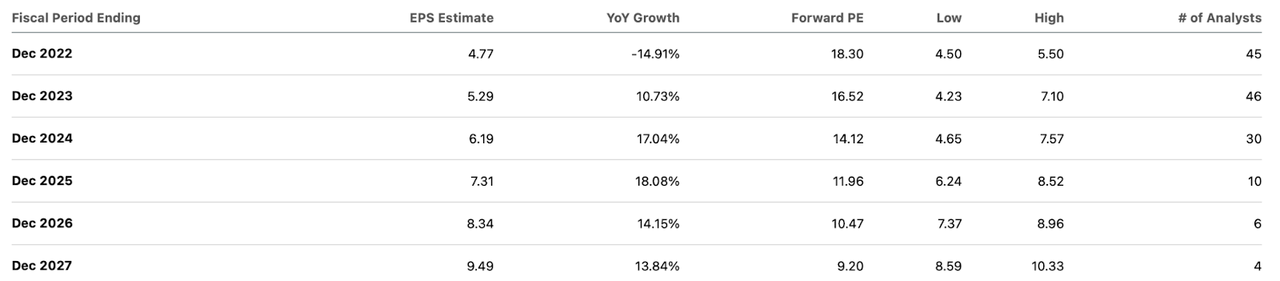

At recent prices, GOOGL was trading at just 18x earnings. I’ll show why the stock is even cheaper than that in just a moment, but even at that multiple the stock looks too cheap in light of consensus expectations for sustained double-digit earnings growth.

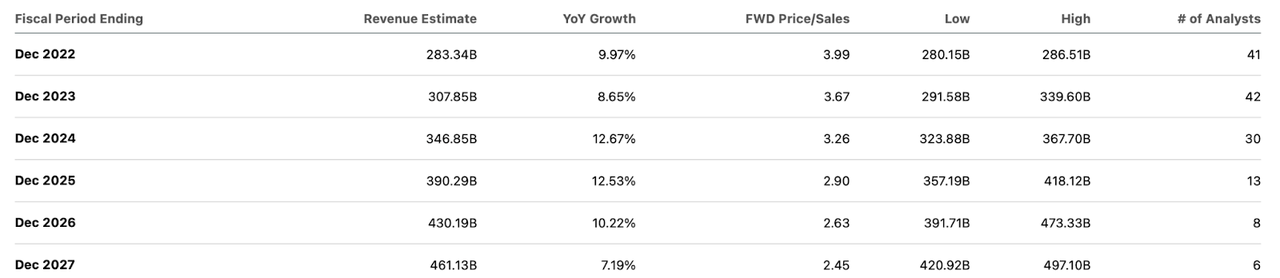

Seeking Alpha

Those earnings expectations also look too conservative considering that they are factoring in minimal operating leverage.

Seeking Alpha

Management acknowledged the challenging environment, noting that their approach to the current challenges is to “set up for the next decade of growth ahead.” On a side note, I think investors are under-estimating the positive long term effects from cost rationalization that is taking place at tech companies today.

In Google Cloud, management noted that they are seeing customers take longer to commit to deals as well as shorter terms or smaller deal sizes. Many investors may be dismayed by the lack of operating profits at Google Cloud – especially considering the robust margins posted at Amazon Web Services (AMZN) – but management has pointed out that while they are still “focused very much” on profitability and free cash flow there, they are prioritizing investment in the long-term opportunity.

As usual, GOOGL should be valued on a sum-of-the-parts basis. The stock trades at 18x earnings, but we should note that the $111.6 billion net cash position is worth $8.52 per share. Adjusting for net cash, shares trade for 16.5x earnings. But that earnings valuation implicitly assigns a negative valuation for the loss-producing Google Cloud and Other Bets divisions. To be conservative, we can assign a $0 value to Other Bets even though its long term value may be quite significant as it houses the self-driving unit Waymo among other things. I expect Google Cloud to generate 30% net margins over the long term. Assuming 30% growth and a 1.5x price to earnings growth ratio (‘PEG ratio’), I place fair value at 13.5x sales, or $373 billion. That equates to $28.50 per share. I expect Google Services (search, advertising, and YouTube) to grow at a 10% clip long term. Applying a 1.5x PEG ratio and assuming 40% long term net margins, I see it valued at 6x sales, or $1.48 trillion ($112.70 per share). Adding these together, we arrive at $150 per share in value. I expect GOOGL to far surpass that valuation, as a 2x to 2.5x PEG ratio looks more warranted in light of the attractive secular growth story and strong moats of the business.

What are key risks? GOOGL is already a very large business – it is possible that the law of large numbers eventually kicks in and Google Services growth does not return. I find that hard to believe, however, as this segment still benefits from the intersection of various secular tailwinds such as digital usage and digital transformation. While GOOGL is in control of its Android devices, it may face headwinds from Apple (AAPL) as AAPL moves forward with its advertising ambitions. A recently underappreciated risk may be that of regulatory action, as the company is constantly under government scrutiny for its monopolistic characteristics and use of data. I note that I am less concerned with near term macro risks as the company’s strong cash flow generation and balance sheet should help it weather the storm.

As discussed with Best of Breed Growth Stocks subscribers, I view a basket of beaten-down tech stocks as the best way to take advantage of the tech crash. I rate Google stock a strong buy as one of my higher conviction ideas.

Disclosure: I/we have a beneficial long position in the shares of GOOGL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long all positions in the Best of Breed Growth Stocks portfolio.

Growth stocks have crashed. The time to buy is when there is blood on the streets, when no one else wants to buy. I have provided for Best of Breed Growth Stocks subscribers part 2 of The Tech Stock Crash List, the list of names I am buying amidst the tech crash.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks today!