Summary:

- With tech and IT obliterated and energy gravitated, we are in a tech anti-bubble.

- Google stock remains the cheapest name in my beaten-down 4.

- With the S&P 500 forming its first Golden Cross since the downturn in stocks, it may be a while before we get deals like this again.

Alex Wong/Getty Images News

The anti-bubble quartet

In previous articles addressing the “anti-bubble” framework used by Nick Sleep and Qais Zakaria in the Nomad Letters, this is something I have used as a foundation for happy value hunting. Whilst energy was down in 2020-21, tech was soaring. Now the tables have turned and we should turn to tech to hunt. While energy is certainly not a bubble based on current fundamentals, the underlying cyclical commodity from which they profit may have hit a peak. On the other hand, digital advertising and e-commerce are seeing a downturn leading to a sell-off in my favorite tech names.

The quartet includes Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) (“Google”), Amazon (AMZN), Meta Platforms (META), and Microsoft Corporation (MSFT). I would throw Apple Inc. (AAPL) in there as well, but that chart is still defying gravity. All of these companies are the cream of the crop when we look back at what management has demonstrated in the allocation of capital. This is easily seen through the lens of ROIC and high-profit margins; when a segment of the market gets hit, I don’t have to look far. Give me the best-managed companies at a fair discount to the historical averages. Although META stock has fallen out of my top-end price range of $146, Google is still squarely in it. Alphabet Inc. stock is a buy. Although I’m no chartist, the Golden Cross for the S&P 500 (SP500) is forming, and all boats may be lifted for some time. I hope my chance to accumulate lasts a little longer.

Alphabet’s story ’til now

Alphabet Inc., like Meta, derives a lion’s share of its earnings from digital ad revenue. It is my opinion, that until some amazing VC comes up with an acceptable way to put a chip in our heads and beam ads directly to us, digital advertising will continue to grow. Yes, we should expect a pullback in all company marketing expenses when the economy slows, but when it snaps back, look out. Google and Meta will be on a hiring spree again once that fulcrum hits.

Top line numbers for Alphabet Inc. are still growing on a TTM basis while the bottom line is slowing. Non-GAAP earnings are still growing as well on the other hand. Google’s digital advertising businesses have become so dominant and effective that they are now being sued by the U.S. Government to break up their monopoly. While this is a risk, it is also a reaffirmation that Alphabet has the crème de la crème digital ad portfolio. When the government calls you out, you know you’ve made it!

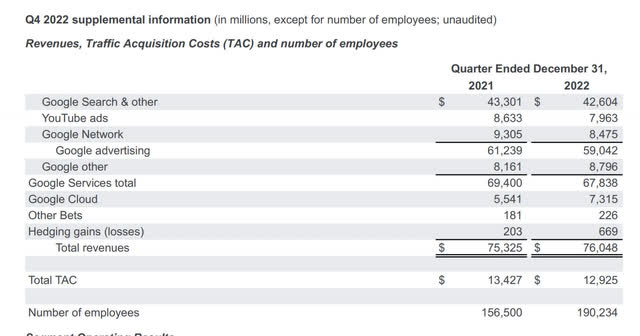

Hot off the presses, you can also find the Q4 2022 Alphabet top-line numbers above. Total revenues came in slightly ahead of 2021, with ad revenue down a couple of billion dollars and cloud services up a couple of billion to offset that decline. All in all, Google revenue is flat, with the most positive item being the growth in cloud services revenue up 32% yoy. Even with the news of layoffs at Alphabet, they still ended 2022 with 33,734 more employees than in 2021.

Management effectiveness

Warren Buffett has said on more than one occasion that effective management, creates value with their retained earnings:

“For every dollar retained, make sure the company has created at least one dollar of market value.”

In the case of Alphabet Inc., it has one similarity to Berkshire Hathaway (BRK.B, BRK.A) in that returns to the investor are through retained earnings and the growth of their holdings and businesses. Neither pays a dividend, so we have to trust them with their capital allocation decisions. Very few stocks without a dividend are even worth buying. This, like Berkshire, is one of them.

Market cap to retained earnings ratio

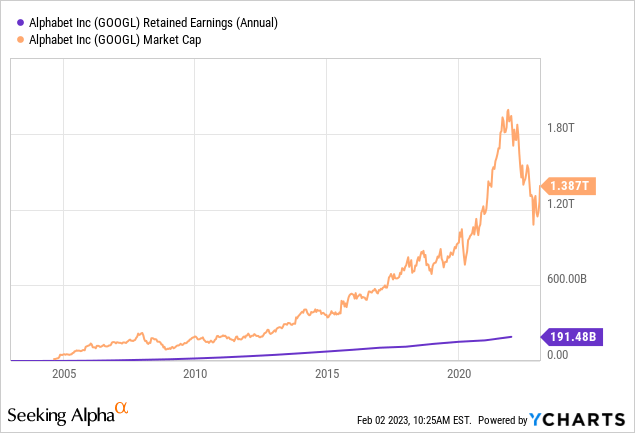

Charting out the ratio between market value and retained earnings is rather easy. Since retained earnings is a cumulative number on the balance sheet, the most recent TTM number will be your total retained earnings number. Even with the drop, if we look at Alphabet’s cumulative retained earnings of $191.48 Billion and a market cap of $1.387 trillion, we get a market cap to retained earnings ratio of 7.26. In other words, over time Alphabet’s management has created $7.26 of market value for every dollar of retained earnings.

The retained earnings value creation number is astounding. However, Alphabet, Amazon, Meta, and Microsoft also have a secret weapon, an expense called R&D. This is listed as an operating expense, but in essence, is also a part of retained earnings. They get to expense this item, and then you as the investor reap the fruits of the businesses that it spawns from the research and development. Mohnish Pabrai likes to use a framework addressing these companies as “spawners” – and I certainly concur with the analogy.

While much of the market value of Alphabet Inc., especially at its peak capitalization, was based on a bubble mentality, you still had the option of realizing a huge return if you chose to do so. Sometimes, promotion and product perception can add as much value as effective capital allocation. Tesla, Inc. (TSLA) is a good example of this.

ROIC

Including both the debt and equity of the business, ROIC (return on invested capital) is Joel Greenblatt’s favorite metric for effective management. According to my brokerage, Alphabet has a return on assets of 22.4%, a return on equity of 32%, and a return on invested capital ROIC of 28.94%. Throw in a gross profit margin of 56.9% and a net of 30% and you can see how Alphabet management has created so much value for its investors with their retained earnings, R&D investments, and acquisitions. This is blue-chip management team through and through.

Valuation

In my previous article on Alphabet Inc., I used a standard trailing PEG ratio incorporating GAAP earnings to create a price target. At the time, the existing data indicated a GAAP earnings growth rate of 22.74%. Therefore, I used 22.74 as the multiplier and the GAAP EPS as a multiplicand to get my low-end price target of around $96. We can see in the GAAP instance that growth for the TTM is trending lower than the previous year, but if we look at Non-GAAP EBITDA, Google is still growing.

The TTM EBITDA numbers for Google/Alphabet are at $93.733 Billion. With 13.242 Billion shares outstanding, that equates to $7.078 in EBITDA per share. The EBITDA CAGR, incorporating the TTM as our terminal value to end 2022, would equal a trailing 5-year growth rate of 17.8%. Using 17.8 as a multiple and $7.078 as our multiplicand, we get a price target of $120.89. This is getting toward our upper-end, but still within value parameters. In spawners with lots of R&D and tax benefits, the non-GAAP under-the-hood methods are my preferred method. Although growth has slowed a bit from my last article, where I pegged the upper-end based on EBIT growth at $143, the price still fits value within the reduced price target.

Balance sheet trends

The Alphabet balance sheet hasn’t changed much since my last article. Still loads of cash at $116 Billion, a debt-to-equity ratio of 11.57%, and a current ratio of 2.52 X. With this enormous cash balance, it certainly helps me sleep well at night knowing the Alphabet will never be in a cash crunch regardless of interest rates. How many stocks do you hold where you could say the same? Truth is, there are only a handful of stocks whose balance sheets I feel supremely confident in, and Google/Alphabet is one of the few.

Cash flow trends

With a TTM free cash flow (“FCF”) of just over $62.5 Billion, the rich get richer. With TTM EBITDA for Alphabet at $93.733 Billion, that’s an EBITDA to FCF conversion ratio of 66%. The CAGR in free cash flow from 2018 to TTM is over 22% per annum, more evidence that management is doing an amazing job to help us relax and hold with confidence.

Catalysts

TikTok ban. While ad revenue and earnings beating estimates are great, a banning of rival TikTok would be all too juicy for the market to digest. The issue is now getting bipartisan support on the Hill.

TikTok, owned by China’s ByteDance, should be removed from app stores run by Apple Inc and Alphabet’s Google because the short video social media app poses a risk to national security, Senator Michael Bennet, a Democrat on the intelligence committee, said in a letter dated Thursday.

An all-out ban of the TikTok app would leave Alphabet and Meta as the chief candidates to absorb the business that would be left in TikTok’s wake. Both have been optimizing their short video products to match. There should be enough business out there for both to have a nice lunch.

Risks

There is an anti-trust lawsuit to break up Google’s “monopoly” on digital advertising. Below is a summary of the lawsuit.

Filed in the U.S. District Court for the Eastern District of Virginia, the complaint alleges that Google monopolizes key digital advertising technologies, collectively referred to as the “ad tech stack,” that website publishers depend on to sell ads and that advertisers rely on to buy ads and reach potential customers. Website publishers use ad tech tools to generate advertising revenue that supports the creation and maintenance of a vibrant open web, providing the public with unprecedented access to ideas, artistic expression, information, goods, and services. Through this monopolization lawsuit, the Justice Department and state Attorneys General seek to restore competition in these important markets and obtain equitable and monetary relief on behalf of the American public.

What would a breakup of Alphabet look like? Nobody knows. A slew of spinoffs as from the old AT&T (T) (Baby Bells), maybe. Either way, the digital advertising businesses of Google/Alphabet are invaluable and would receive a much higher multiple to EBITDA than what we pay for Google stock currently in my opinion. Investors will be compensated one way or another. Plus adept lobbyists are certainly working while we speak with defense attorneys hand in hand. I’m not extremely worried, but the price could suffer from perception if action is taken and Google flat-out loses the suit.

Conclusion

Alphabet Inc. remains one of the best-managed businesses in the world. CEO Sundar Pichai has done wonders, maintaining high-profit margins and ROIC with a lot of sharks in the water.

I have moved my focus from energy to tech as my anti-bubble of choice. I do fear that the window may be closing without being able to accumulate enough, but there are certainly worse things in the world than that. I remain unconstrained in where I hunt, and adore value wherever it may be.

Google is my favorite anti-bubble stock because it has the strongest balance sheet of the bunch plus one of the more modest GAAP and Non-GAAP valuations. Not as cheap as it used to be, but I reiterate buy for GOOG with a PT of $120.

Disclosure: I/we have a beneficial long position in the shares of GOOGL, GOOG, AMZN, MSFT, META, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.