Summary:

- Alphabet stock is finally rising, but a frothy market is ignoring secular risks.

- GOOGL’s latest quarter showed 16% YoY revenue growth and a huge jump in cloud margins.

- The stock’s valuation at 22x earnings might already factor in competitive headwinds, but I foresee further pressure on search revenue growth.

- I prefer reallocating to stocks with better risk-reward profiles, like Meta Platforms, given the rising valuations and potential headwinds for GOOG.

Michael M. Santiago

Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) has been one of my oldest holdings. Amidst a frothy market, I note that I feel fortunate that GOOGL has not historically enjoyed the same froth as some tech peers, as such froth may have tempted me to sell off my position early. Yet now, even without that much froth, I am closing my position. While the company continues to offer many “ways to win,” Wall Street appears to be underestimating the threat to the core search business. With shares trading up recently in tandem with the rest of the sector, this looks like an opportune moment to reallocate towards names with more favorable risk reward profiles. I am downgrading GOOGL to a neutral rating to reflect the closing of my position.

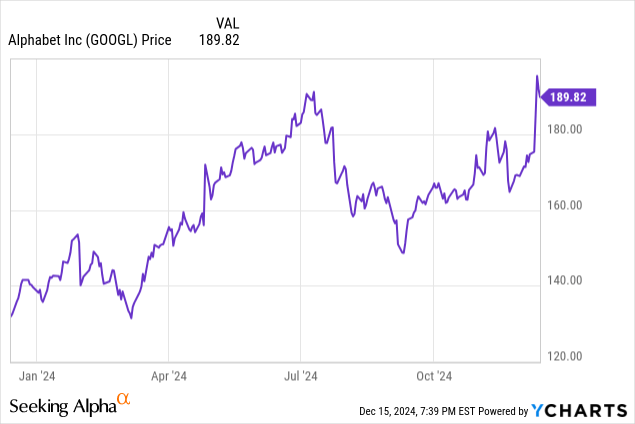

GOOGL Stock Price

I last covered GOOGL in September, where I reiterated my bullishness in spite of SearchGPT risks. The stock has performed strongly since then.

It is ironic that I am now closing my position not primarily due to valuation, but instead due to my changed opinion regarding competitive threats. What is the saying, “better lucky than right?”

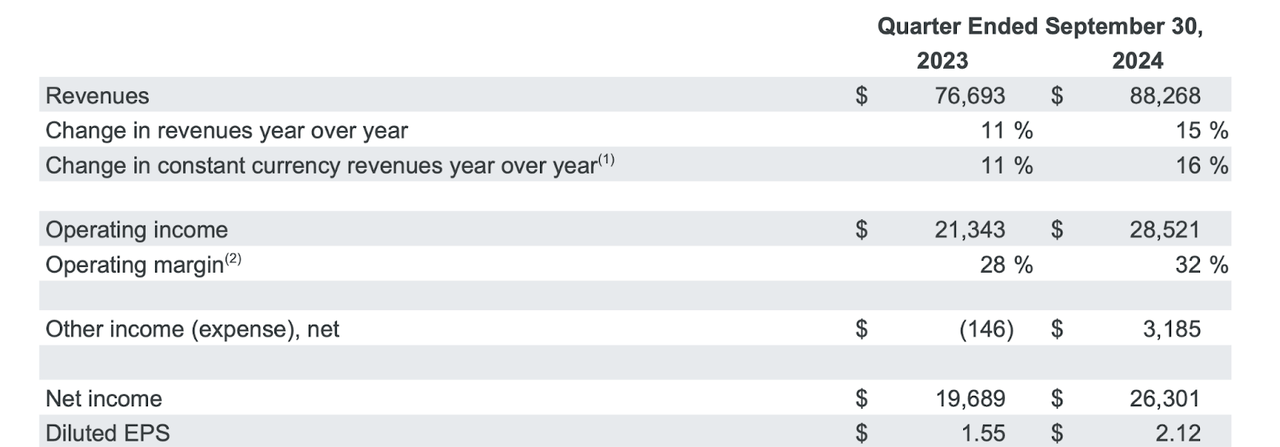

GOOGL Stock Key Metrics

In the most recent quarter, GOOGL delivered 16% YoY revenue growth alongside even faster growth in profits as operating margins expanded 400 bps.

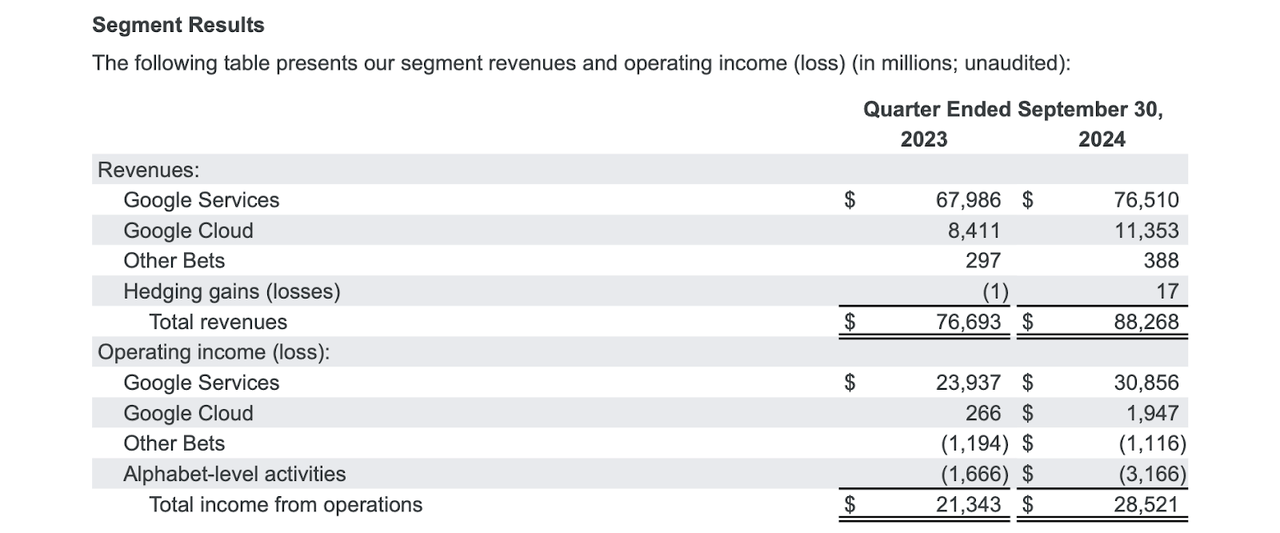

GOOGL saw cloud revenue growth accelerate to 35%, powered by increasing demand for generative AI products. Cloud operating margins expanded to 17%, up from just 3.2% in the prior year. The strong results in the cloud segment might help explain the stock’s recent strength, as the elevated margins may have highlighted the value in the segment.

GOOGL ended the quarter with $93 billion of cash and $36 billion of non-marketable securities, versus $12.3 billion of debt. The net cash balance sheet offers risk mitigating characteristics, as well as representing a potential long-term catalyst.

On the conference call, management called Waymo “a clear technical leader within the autonomous vehicle industry” with “more than 1 million fully autonomous miles and …over 150,000 paid rides” each week. However, while the stock price might imply otherwise, the company appears to be facing intense competitions in artificial intelligence, with management in my opinion failing to provide an adequate response to an analyst question regarding Gemini usage compared to the “250 million weekly active users” of ChatGPT.

Is GOOGL Stock A Buy, Sell, or Hold?

I am not so concerned with the potential for the DOJ to break up the company, nor am I too optimistic regarding the release of their quantum computing chip, which might not have a significant financial impact relative to the large revenue base.

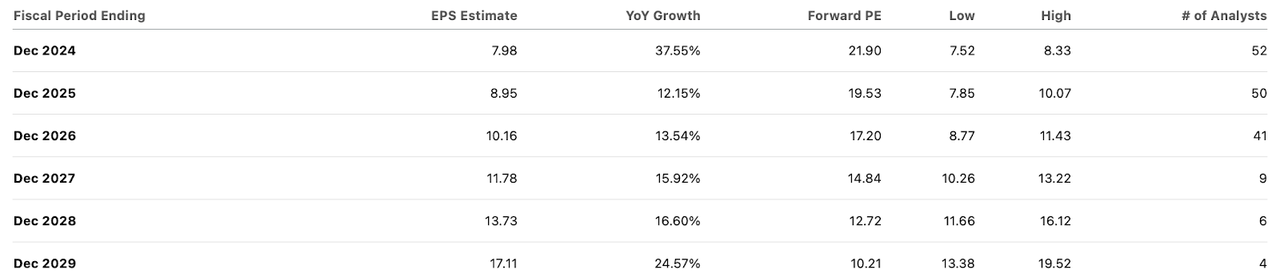

At first glance, GOOGL still looks reasonably priced, if not outright cheap.

One might argue that competitive headwinds are already priced in, with the stock trading at around 22x earnings. Indeed, I made the same argument in my prior coverage, noting that a 30% decline in search revenues might lead to a “44% decline in net income.” I considered that to be an arguably mild worst-case scenario. I now have a different opinion of the likelihood of this outcome, as I am growing increasingly of the view that competing search engines like SearchGPT or Perplexity are offering similar if not superior search experiences. I believe that the current competitive playing field for generative search is similar to the environment when “normal” search first emerged and GOOGL was competing with the likes of Yahoo, Ask Jeeves, Bing, and others. Despite many decades of search dominance, GOOGL is looking more like a struggling incumbent rather than the dominant market leader it is used to be. Of course, it must be acknowledged that existing users of Google Search might still exhibit switching costs. But I suspect that younger generations are already contemplating the question of which search engine to use, something that wouldn’t have been typically thought of just several years ago. I expect cracks to show first through decelerating top-line growth relative to online advertising peers. It seems official – just as Netflix (NFLX) disrupted cable and GOOGL disrupted printed advertising, GOOGL appears to be getting disrupted by generative search.

However, as previously noted, shares are by no means expensive, even factoring in my bearish outlook for search. Google Cloud still generates an insignificant contribution to annual profits, but the incessant margin expansion over the last many quarters suggests that this may change in the future. I peg fair value for the fast-growing segment at around 12x sales, implying $550 billion in value, or around $25 per share in value. Even after the recent run-up, this is still significant, but may be insufficient to offset pressures on the search business. I expect the earnings multiple to re-rate to the 15x to 18x earnings range over the coming years, which may make it difficult for the stock to outperform the broader market.

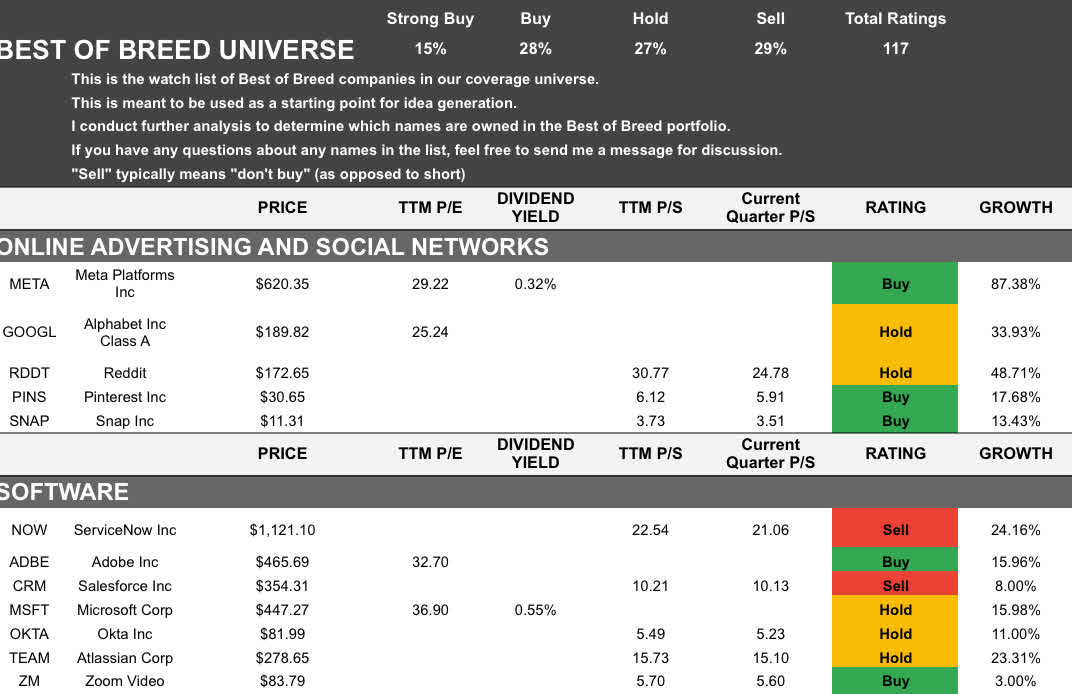

I prefer the more richly valued Meta Platforms (META) due to the fewer obvious headwinds, but it is more difficult to find compelling bargains nowadays. The market has surged such that over 50% of the growth stocks in my coverage at Best of Breed Growth Stocks are rated “hold” or “sell,” in sharp contrast to just a couple of years ago when over 80% were rated “buy” or “strong buy.”

Best of Breed Growth Stocks

GOOGL Stock Conclusion

As valuations keep rising, it might be tempting to just tolerate the headwinds facing GOOGL. However, I caution against increasing one’s risk tolerance, as the valuation landscape can change very rapidly – as witnesses as recently as during the 2022 crash in tech stocks. While competitive headwinds have not yet appeared in the company’s financials, I expect search revenue growth to decelerate meaningfully over the coming years, which in turn may lead to pressures on the valuation multiple. I am downgrading the stock to a neutral rating as I am closing my position.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service "Best of Breed Growth Stocks"

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!