Summary:

- Alphabet Inc./Google introduced its new quantum computing chip, Willow, earlier this month, highlighting a step in the right direction but far from its destination: a market-ready product.

- Quantum computing continues to generate too many errors to be useful today or even in a year, and hence, excitement over its commercial viability, in our opinion, is premature.

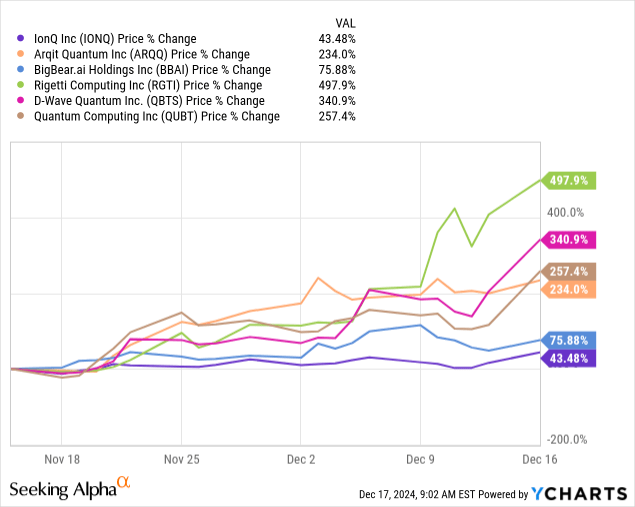

- Quantum computing stocks such as IONQ, ARQQ, BBAI, RGTI, QBTS, and QUBT are skyrocketing on the one-month chart, offering windows to play on the hype, but we expect their outperformance to moderate once reality meets expectations.

- There’s still a major lack of knowledge about what quantum computing is; while many are busy drinking the Kool-Aid (i.e., pushing the bullish take), we’re sharing our contrarian one.

da-kuk/E+ via Getty Images

Earlier this month, Alphabet Inc. aka Google (NASDAQ:GOOG), (NASDAQ:GOOGL) introduced the world to Willow, its latest quantum computing chip in a ten-year-long journey. Everyone and their grandmother expect quantum computing to be the next big thing, and while we agree, considering the potential large-scale computer capable of complex, error-corrected computations, we think the word to focus on here is “potential.”

Quantum computing is not a reality today, and our belief is that it is unlikely to be one next year, either. The reason is simple: quantum computing is not applicable today because it generates too many errors. The new Willow Chip, Google’s most recent step towards commercializing quantum computing, is just that, a step. Google themselves said on December 9th that:

Our new chip demonstrates error correction and performance that paves the way to a useful, large-scale quantum computer.

We count ourselves impressed with the progress made and its potential for scalable quantum systems down the road.

Still, we think there is a long way to go, and the Willow chip is still generating errors that make it not useful today, although impressive in theory. There is also a fundamental lack of real understanding of what quantum computing is and plenty of claims/promises around its future that are challenging to make from our current standpoint in December 2024. This is without mentioning that there are no supercomputers to commercialize this yet.

The world we live in today uses different combos of 0s and 1s; that’s how classical computing works. Transistors work in Morse code, like DNA, to create different combinations. What quantum computing does depends on cubics, so it allows not only for different combos of 1s and 0s but also for the range that sits between the two, i.e., 0.0001, 0.0002, etc. The seemingly infinite new combinations it allows make quantum computing the fastest option for productivity and problem-solving, but one that we still have yet to perfect. This is despite what the Quantum Corporation (QMCO), Rigetti Computing, Inc. (RGTI), D-Wave Quantum Inc. (QBTS), and IonQ, Inc. (IONQ) stock price movements reflect.

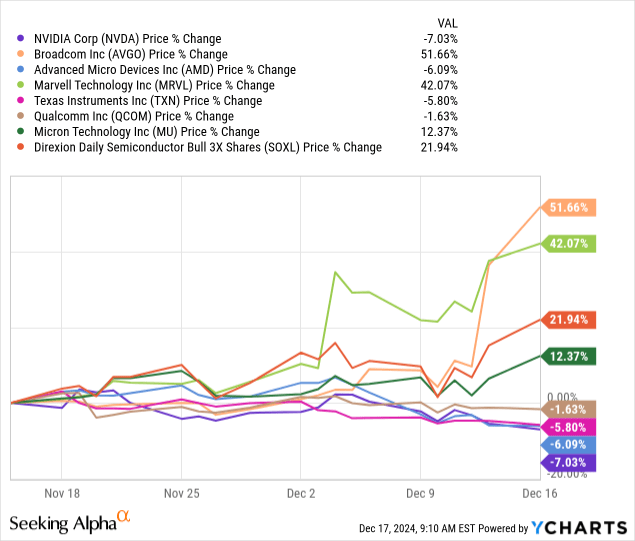

The truth is if the quantum computing moment was here, then semis would have been crashing. This is because it would mean Intel Corporation (INTC), Advanced Micro Devices, Inc. (AMD), Dell Technologies Inc. (DELL), and even NVIDIA Corporation (NVDA) are old news and need to catch up, and that hasn’t been the case since Google announced its Willow Chip. Direxion Daily Semiconductor Bull 3X Shares ETF (SOXL), a triple leverage ETF concentrated portfolio of around 30 largest US-listed semiconductor companies, was up around 7% on Friday and another ~6% on Monday. So, our belief is that, yes, quantum computing is the future, and estimates coming out placing its CAGR at 32.7% by 2029 to hit $5.3B could hold weight. However, we don’t think anyone has enough visibility as of today to produce an accurate outlook.

YCharts

Longer-term ways to play on quantum computing still exist more or less, and that would be through companies like Google or Amazon, who are effectively trying to create a market-ready product and have the capital to spend on it. Exposure to these names would translate to longer-term exposure to the tailwinds of quantum computing. Aside from that, we think that hype is what is driving up the quantum chip peer group, as shown below, and we don’t see a favorable risk reward there. We think there is a high risk once the market expectations meet reality in terms of what quantum computing means for the average Joe today or even your businesses and healthcare: not much. And we understand the market is forward-looking, we seek to remind investors that the market almost always over-trades.

YCharts

Our takeaway — We think quantum computing will happen, but we think anyone sticking a timeline to it is out of line; we expect years before we see a solution that can be commercialized, i.e., brought to market.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Tired of losing money? Our Tech Contrarians team of Wall Street analysts sifts through the noise in the tech industry and captures outperformers through a coveted research process. We let the work speak for itself here.