Summary:

- Google reported strong Q3’23 results, beating analyst revenue estimates by nearly $1 billion.

- Google Cloud grew by 22% to $8.4 billion, but investors focused on the small miss in this segment rather than the big beats in other categories.

- The stock is cheap at ~13.5x EPS targets and a relative bargain to other tech giants.

winyuu/iStock via Getty Images

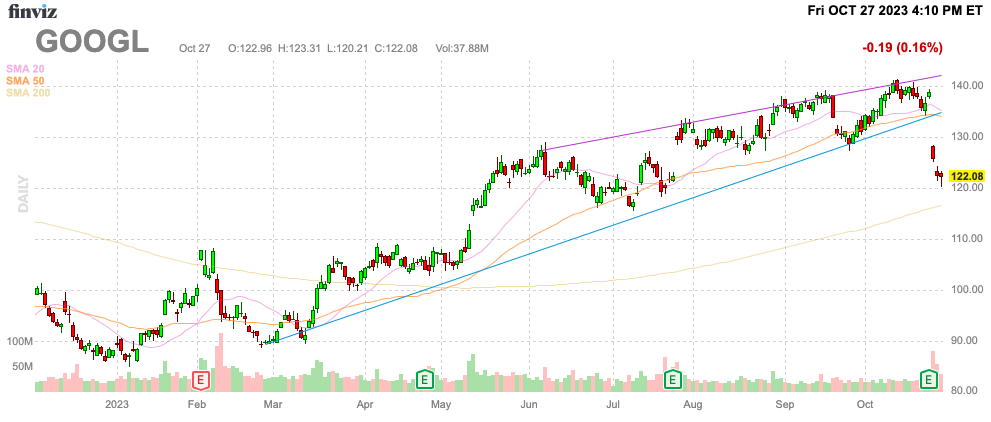

After reporting a generally strong quarter, Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL), aka Google, has seen the stock collapse. The AI-powered Search giant disappointed the market with weakness in the Cloud sector, yet the results weren’t so spooky. My investment thesis is ultra Bullish with Google trading down nearly $20 from the recent highs that weren’t even above the 2021 highs, unlike other mega tech stocks.

Source: Finviz

Great Quarter

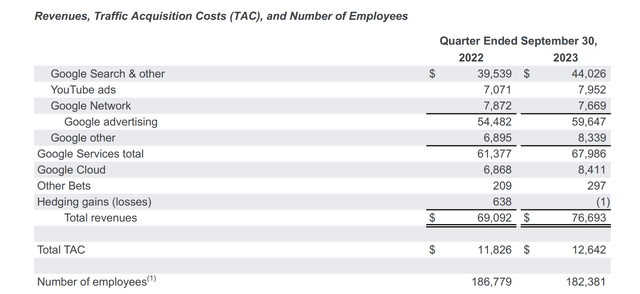

As the dust settles from the Q3’23 earnings carnage, investors need to go back and remember Google easily beat analyst estimates. The tech giant reported revenues of $76.8 billion, nearly $1 billion above analyst estimates.

Google grew total revenue in the quarter by 11% and Google Cloud soared over 22% to $8.4 billion. The far more important Google Search business grew by a strong 11% and grew to $44.0 billion.

Source: Google Q3’23 earnings release

Google Cloud has the highest growth rates of any business unit, but the Cloud business is only the same size as YouTube ads and Google Other. The whole company produced $76.7 billion in sales during Q3 while Google Cloud hardly accounted for 10% of sales and the growth rate was only targeted slightly above the 22% rate. The big question is why investors were so focused on the small miss while ignoring the big beats in other categories.

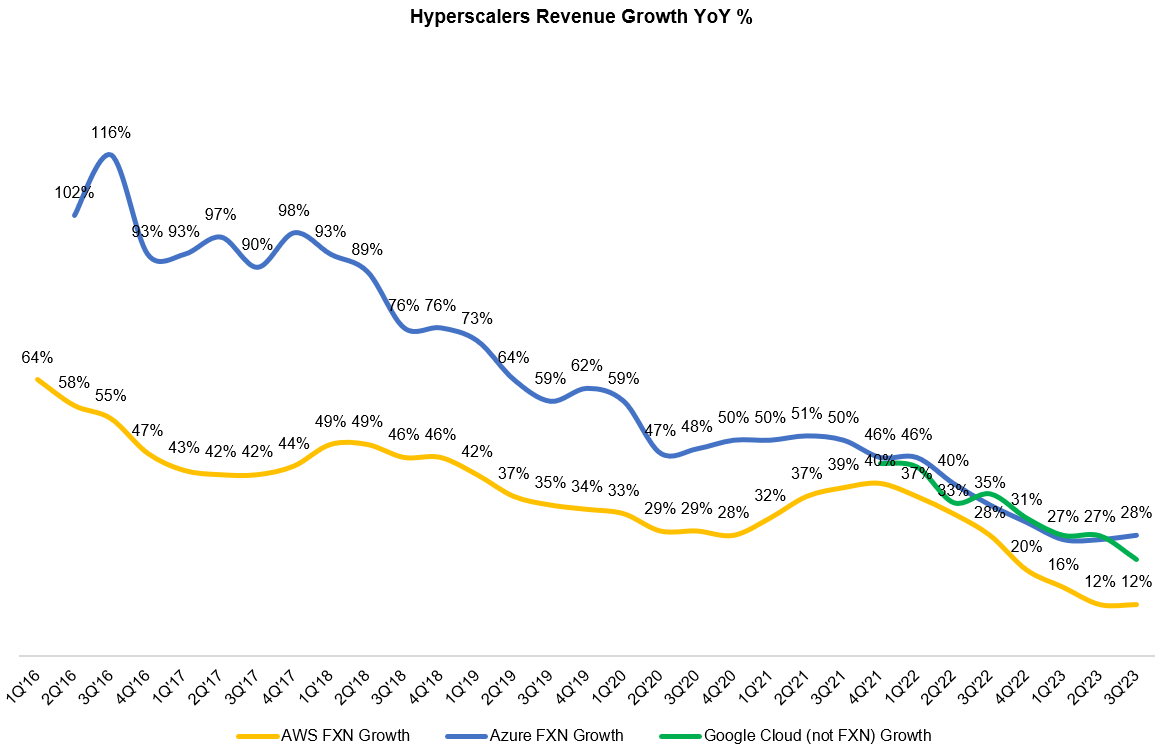

Compared to other Could services, Google’s growth rates definitely took a tick down while others saw an uptick in growth. Microsoft (MSFT) Azure saw growth tip back up to 28% while Amazon (AMZN) remained stuck at only 12% growth.

Source: Mostly Borrowed Ideas Twitter/X

Part of the issue is likely the focus on growth rates. Google Cloud only generated $8.0 billion in prior quarter revenues, so the segment did grow $0.4 billion sequentially. The division saw rather strong growth back in Q3’22 with sales jumping from just $6.3 billion in Q2 to $6.9 billion sequentially in Q3.

Google has discussed some customers optimizing spend in order to reduce costs. The key here is that as these customers reset, they’ll be in a strong position to maintain spending levels allowing Google Cloud to push into surging AI demand.

On the Q3’23 earnings call, CEO Sundar Pichai discussed how AI Cloud demand is up dramatically:

On Cloud, maybe what I would say is, overall, we had definitely started seeing customers looking to optimize spend. We leaned into it to help customers given some of the challenges they were facing. And so that was a factor. But we are definitely seeing a lot of interest in AI. There are many, many projects underway now, just on Vertex alone, the number of projects grew over 7x.

Focus Beyond Cloud

The tech giant doesn’t appear to have any major issue in Cloud and AI demand will ultimately lead the business to higher levels as the murky economic climate improves over time. Analysts like Monness, Crespi, Hardt took the opposite view and cut targets, which just doesn’t add up.

Google remains more focused on Search and YouTube via both ads and subscription services. Google Cloud just can’t move the needle enough to hit the 2024 EPS targets by $0.74 to fall to $6.21.

A prime example is how current growth rates in Search and YouTube limit the need for significant growth from Cloud in order to hit financial targets. Analysts predict Q3’24 revenues of $85.2 billion for 11% growth. Google only needs the non-Cloud business to grow at a 10% clip to contribute $6.8 billion of the $8.5 billion in sales growth YoY.

Cloud only needs 20% growth for the tech giant to meet analyst targets, but the business would only contribute $1.7 billion worth of revenue growth for the September quarter. The bigger key to maintaining double-digit sales growth in 2024 is the Search and YouTube business due to the much larger scale.

Cloud is definitely a key focus of the business for the future, but the market is placing too much focus on short-term numbers. The stock only has an enterprise value of $1.4 trillion now and Google has already delivered nearly $83 billion in operating cash flows with over $30 billion in Q3 alone.

After the recent collapse, the stock remains exceptionally cheap with Google only trading at ~13x operating cash flows for 2023 alone. The company is on pace for 2024 EPS of close to $7 and stock-based compensation of ~$24 billion contributes another $1.50+ in non-GAAP EPS.

Google only trades at ~13.5x non-GAAP EPS targets, yet the market is stressing out on a few basis points of growth in one of the smaller divisions of the business. As a relative comparison, Microsoft only grew total sales at a slightly faster clip of 13%, yet the stock trades at 29x FY24 EPS targets.

Takeaway

The key investor takeaway is that the market got too spooked by a sharp dip in the Cloud business. Google saw the key Search business return to solid growth in a sign generative AI chat isn’t impacting the business as feared while the company works to implement its own AI technologies like Bard.

Investors should absolutely use this sudden weakness in Google as an opportunity to own a premier company poised to play a significant role in AI now trading at a major discount.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.