Summary:

- Google’s dividend announcement provided a modest boost to my passive income and underscores its commitment to returning capital to shareholders.

- The company crushed the analyst consensus for both revenue and diluted EPS during the first quarter.

- Google is a free cash flow machine with an immense net cash position.

- Shares of the tech giant could be priced 9% below fair value.

- Google could deliver cumulative total returns of nearly 35% by the end of 2026.

An ATM dispenses $100 U.S. banknotes. selensergen

I love owning businesses that prioritize their shareholders. This probably means slightly different things from one person to another.

As a dividend growth-oriented investor, here’s what it means to me: A company that can balance investing for future growth with sending value back to its shareholders. This can be done via share repurchases and/or dividend payments.

Until recently, Alphabet (referred to as Google hereafter) (NASDAQ:GOOGL)(NASDAQ:GOOG) leaned entirely on the former. However, a swelling cash balance and robust free cash flow led Google to initiate a $0.20 quarterly dividend per share on April 25.

This move alone was a nearly 0.4% bump in my portfolio’s total net annual forward dividend income. That’s because, aside from Broadcom’s (AVGO) 5% weighting, Google’s 2.8% weighting now makes it my second-highest weighted dividend payer. Overall, the tech giant is my third-biggest holding, behind Amazon’s (AMZN) 2.9% weighting.

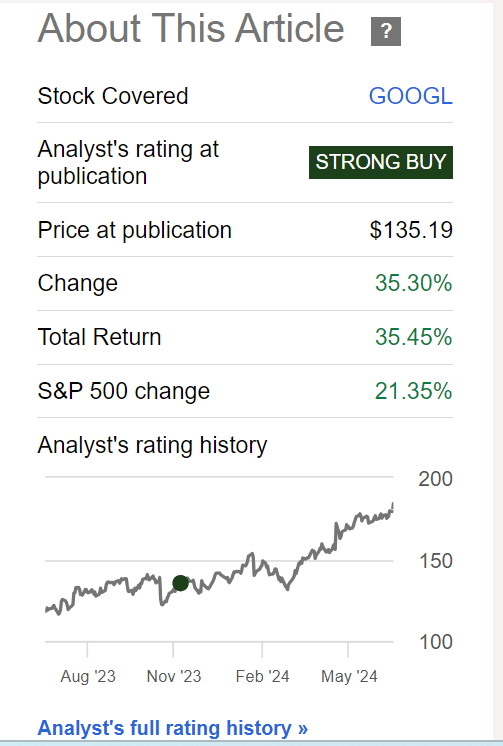

Seeking Alpha

Since I initiated coverage with a strong buy rating last November, Google has topped the 21% returns of the S&P 500 index (SP500) by nearly 14 points.

This short-term outperformance makes sense as the historical data from Hartford Funds (specifically Figure 7) backs up long-term outperformance as well: Dividend growers and initiators have beaten an equal-weighted S&P 500 index by almost 250 basis points annually from 1973 to 2023. For perspective, that’s more than a 3X difference in ending investment amounts between dividend growers and initiators and an equal-weighted S&P 500 index.

At the time when I rated Google’s shares a strong buy, I appreciated the company’s dominant plurality share of the digital advertising market. It was more than the next 10 competitors combined. I was also impressed by the sizable net cash position. Relative to my fair value estimate, shares were also almost 20% undervalued at the time.

Now, I think after the sharp rally in the last six months, shares fall short of a strong buy. However, first-quarter results are more than enough to update my coverage with a buy rating. For one, Google blessed shareholders with its 13th double-beat in the last 20 quarters. The momentum throughout its businesses should further allow vigorous future growth. Google’s newly initiated dividend is handily covered by earnings and free cash flow. Lastly, my upward revision to fair value means shares are still discounted.

A Robust First Quarter And More Growth Ahead

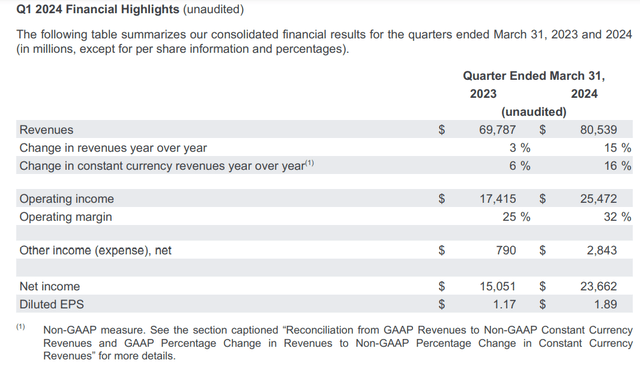

Google Q1 2024 Earnings Press Release

Just as high-quality businesses regularly do, Google delivered the first-quarter results that analysts and shareholders were expecting and then some. The company’s total revenue surged 15.4% higher year-over-year to $80.5 billion during the quarter. For perspective, that was $1.8 billion ahead of Seeking Alpha’s analyst consensus for the quarter.

Strength throughout most of the business was what contributed to this vigorous topline growth.

Google Search & other revenue climbed by 14.4% over the year-ago period to $46.2 billion in the first quarter. According to the company, this was a combination of paid clicks growth and cost-per-click growth. The former grew by 5% due to the secular trends of user adoption growth and rising mobile device usage globally. The latter increased by 8% as advertising spending grew and ad formats and delivery were further optimized for efficiency.

YouTube ads revenue rose by 20.9% year-over-year to $8.1 billion during the first quarter. Just like for Google Search, higher advertising spend was a major contributor to this topline growth. Per Chief Business Officer Philipp Schindler’s opening remarks during the Q1 2024 Earnings Call, YouTube has been the leader in U.S. streaming watch time for the last 12-plus months.

Combine that with continued improvements in Shorts monetization and this is what was behind these excellent results. In the U.S., the monetization rate of Shorts compared to in-stream viewing has more than doubled in the last 12 months and improved by 10 points sequentially in the first quarter.

Google Network revenue retreated by 1.1% over the year-ago period to $7.4 billion for the first quarter. This was fueled by a decrease in AdSense revenue during the quarter.

Google’s subscription, platforms, and devices revenue made its way 17.9% higher year-over-year to $8.7 billion during the first quarter. This was made possible by subscription services like Google One and YouTube Music Premium, each topping 100 million paid subscribers globally in the first quarter.

Finally, Google Cloud revenue leaped 28.4% higher over the year-ago period to $9.6 billion for the first quarter. Growth in the Google Cloud Platform and Google Workspace offerings were the elements that powered this topline growth for the company.

Moving down the income statement, Google’s diluted EPS soared 61.5% year-over-year to $1.89 during the first quarter. For context, this was $0.38 better than the Seeking Alpha consensus.

A renewed focus on operating efficiency was at the heart of this improved profitability. A 5.1% reduction in employee headcount kept total expenses growth (+5.1%) in check versus revenue growth in the first quarter. This led to a 780 basis point expansion in Google’s net profit margin to 29.4% during the quarter. Along with a 2.3% reduction in the outstanding diluted share count to 12.5 billion shares, this is how diluted EPS growth greatly outpaced revenue growth for the quarter.

Looking ahead, Google has its share of growth catalysts to sustain comfortably double-digit annual diluted EPS growth.

In Cloud, CEO Sundar Pichai noted in his opening remarks during the Q1 2024 Earnings Call that the company has announced more than 1,000 new products and features in recent months. This innovation is resonating with customers of all types. Pichai indicated that more than 60% of funded Gen AI startups and almost 90% of Gen AI unicorns are Google Cloud customers. More established businesses like PayPal are also choosing Google’s infrastructure to meet their needs.

Discover Financial (DFS) has started to deploy Gen AI-driven tools, which are delivering faster resolution times to customers.

Finally, Google rolled Gemini into Performance Max in February. According to Schindler, advertisers using the P-Max asset generation are 63% more likely to publish a campaign with good or excellent ad strength. Those same customers have seen 6% more conversions on average.

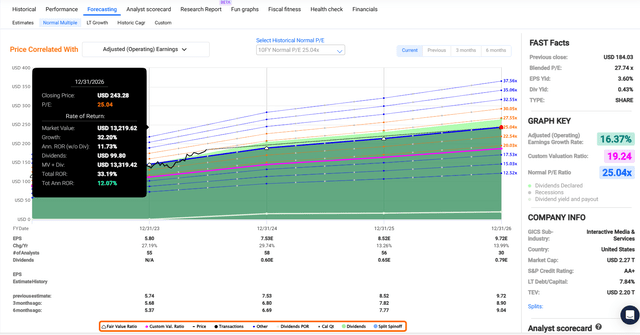

So, Google’s continual improvements in conversions should keep leading to paid clicks and cost-per-click growth. That’s why for 2024, the FAST Graphs analyst consensus projects that diluted EPS will be boosted by 29.7% to $7.53.

In 2025, the analyst consensus is for another 13.3% growth in diluted EPS to $8.52. For 2026, the FAST Graphs analyst consensus is for diluted EPS to increase by 14% to $9.72.

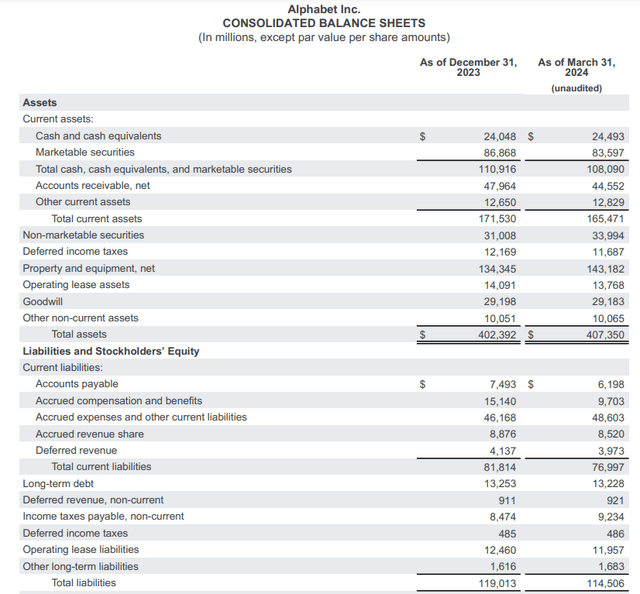

Google Q1 2024 Earnings Press Release

If Google’s exceptional business performance and growth prospects weren’t enough, its financial positioning puts it over the top. As of March 31, the company had $94.9 billion in net cash and cash equivalents/marketable securities.

Put another way, that’s approximately $7.57 in net cash and cash equivalents/marketable securities for each outstanding share. This equates to 4%+ of the current $184 share price (as of June 26, 2024).

That substantial net cash position explains why Google maintains an AA+ credit rating from S&P on a stable outlook. This is a feat matched by only Apple (AAPL) and bested by Johnson & Johnson (JNJ) and Microsoft (MSFT). So, Google arguably has one of the lowest risk balance sheets in the entire corporate world (unless otherwise sourced or hyperlinked, all details in this subhead were according to Google’s Q1 2024 Earnings Press Release and Google’s Q1 2024 10-Q Filing).

Fair Value Has Surpassed $200 A Share

Despite Google’s significant rally since I initiated coverage last November, I believe shares are still discounted. This is because the fundamentals of the business have gotten that much better in that time. For instance, the diluted EPS analyst estimates for 2024 and 2025 in my last article were just $6.69 and $7.79, respectively.

Couple that with my fair value estimates moving from 2023 and 2024 into 2024 and 2025 and my fair value estimate now tops $200 a share.

Google’s shares are trading at a current-year P/E ratio of 24.4. This is just below the 10-year average P/E ratio of 25 per FAST Graphs.

Moving forward, I think that a valuation multiple of 25 remains reasonable. That’s because the company’s three-year forward annual growth outlook of 16.4% is in line with the 10-year average of 18.2%.

The calendar year 2024 will be 50% complete in just a few days. So, that leaves 50% of 2024 and another 50% of 2025 remaining in the next 12 months. This is how I get a 12-month forward diluted EPS input of $8.03.

Applying a valuation multiple of 25, I arrive at a fair value of $201 a share. Compared to the $184 share price, that equates to a 9% discount to fair value. If Google reverted to my fair value multiple and matched the growth consensus, it could produce 33% cumulative total returns through 2026.

A Dividend Growth Juggernaut In The Making

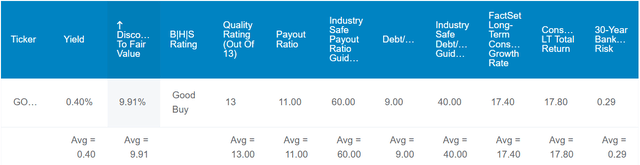

The Dividend Kings’ Zen Research Terminal

Google’s 0.4% dividend yield isn’t going to win any favor with investors seeking immediate income. Given that I’m 27 years old, though, this one is right up my alley.

That is because, had Google also paid its current dividend in Q1, the EPS payout ratio would have been 10.6% in 2024. This is far below the 60% EPS payout ratio that rating agencies desire from Google’s industry, per The Dividend Kings’ Zen Research Terminal.

From a free cash flow perspective, the company generated $16.8 billion in free cash flow during the first quarter. Against the $15.7 billion in share repurchases, that still left $1.1 billion in excess free cash flow.

Now, the quarterly dividend per share will consume approximately $2.5 billion each quarter. So, this is a free cash flow payout ratio of around 15%. These payout ratios and a nearly $100 billion net cash balance afford Google an enviable degree of flexibility to return capital to shareholders in the years to come (unless otherwise sourced, info was from Google’s Q1 2024 Earnings Press Release).

Google hasn’t yet announced any dividend hikes. But for these reasons, I expect annual dividend growth at least in the mid-to high-teens annually for the foreseeable future.

Risks To Consider

Google is in every conceivable way among the best businesses on the planet. It still has risks, though.

As a tech giant, the biggest risk is obsolescence-related. As a leader in huge and growing addressable markets, the company has a big bullseye on its back. Thus far, Google’s innovation has kept competitors at bay.

If the company can’t keep out-innovating its peers, it risks losing market share. That could materially impact the growth prospects.

Another risk to Google is the potential for data privacy laws to be enacted in key markets around the world. If this happened, it could diminish the value proposition offered by the company to its advertising customers. That could weigh on Google’s market share and future growth potential.

Just as I noted in my previous article, one other risk for the company is its revolutionary founders themselves. Measured by voting power, Larry Page and Sergey Brin are still the majority owners of the company. If there are any strategic missteps allowed by the visionaries, it could harm Google’s overall fundamental picture.

Summary: The Next Great Dividend Growth Stock Remains A Buy

Google is consistently increasing revenue, diluted EPS, and free cash flow. The balance sheet is an unquestionable fortress. Shares are also still modestly undervalued. Pair that with 30%+ cumulative total return potential through 2026 and that’s why I’m updating coverage with a buy rating.

Google is a company I’m glad to own as a next-generation dividend grower within my portfolio. My only regret is not buying more in the past 24 months. However, so long as the fundamentals hold up, I plan on further growing my weight in the coming months and years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, AVGO, AMZN, AAPL, JNJ, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.