Summary:

- Down 25% in the past one year, GOOG’s valuation is now compelling with both its P/E and EV/EBITDA looking attractive.

- The company has remained remarkably resilient and continues to grow its top line and profitability despite weak ad spending in 2022.

- Although ChatGPT has raised the competitive bar, fears of the threat that it poses to GOOG’s search business are unfounded in my view.

- GOOG has been steadily growing R&D spending, including in areas like AI, without taking on debt, sacrificing margins, or issuing new shares.

- The stock is an obvious buy at current levels that will likely reward investors who take advantage of the share price and accumulate.

LICreate/iStock Unreleased via Getty Images

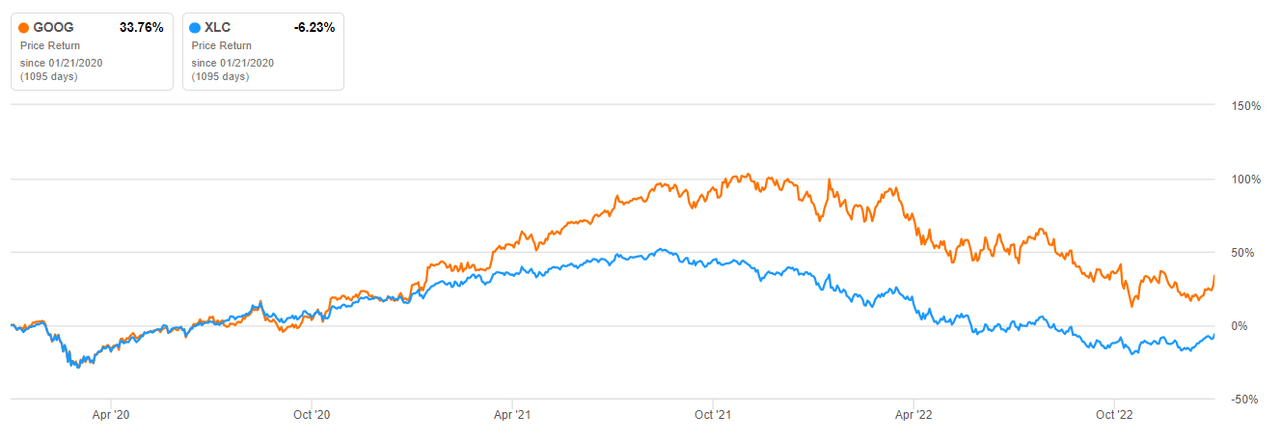

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) has fallen by more than 25% in the past 1 year. It has nonetheless performed marginally better than the broader communication services sector as represented by the Communication Services Select Sector SPDR Fund (XLC), which is down around 28% in the past year. GOOG’s outperformance relative to the sector is even more pronounced when you look at the 3 year chart.

GOOG vs XLC in past 3 years (Seeking Alpha)

While past performance is no guarantee of future results, GOOG is evidently a stock to consider if you’re looking to invest in the communications services sector. Like many names in the tech heavy Nasdaq (NDAQ), GOOG has declined in the past year as a result of the impact of rising interest rates on markets in general and tech stocks in particular. Thanks to this fall, which is largely unrelated to the company’s fundamentals, GOOG currently has one of the most compelling risk reward ratios among mega-cap stocks and is a strong buy in my opinion.

Remarkable resilience

The best time to go long on a stock is not when markets are hitting new highs and the economic outlook is optimistic but when the opposite is happening. In the past year, markets have slipped into bear territory and economic conditions have weakened, prompting fears of a recession. This has provided the perfect backdrop to identify resilient companies that can continue moving in a positive overall direction despite transitory economic and market headwinds. GOOG in my view fits this profile.

The economic weakness in the past year has had a direct impact on GOOG’s revenue growth as the company derives more than 80% of its revenues from online advertising. Marketing budgets are usually the first to be placed on the chopping block in difficult economic times and 2022 was no exception. Tellingly, Google’s advertising revenues were $54.48 billion in Q3 ’22, compared with $53.13 billion in Q3’21 but came in below analysts’ expectations. Analysts on average expected revenues to be $70.58 billion, according to Refinitiv data cited by Reuters.

Despite missing analysts’ Q3 revenue estimates by more than $15 billion, GOOG has demonstrated remarkable resilience and is still a bigger, more profitable and more dominant company than it was 3-5 years ago. It is expected to rake in revenues of $283.32 billion in 2022 and $306.61 billion in 2023. In contrast, it booked revenues of $257.64 billion in 2021, $182.53 billion in 2020 and $161.85 billion in 2019, highlighting the remarkable resilience of the business which continues to move from strength to strength on a top line basis despite the slower ad spending in 2022.

GOOG’s management has also been executing exceptionally well, taking difficult decisions to protect margins and cash amid the strong multi-year growth in revenue. This includes slowing hiring and “right sizing”. The company expects to reduce its global workforce by 6% following the recent move to let go of 12,000 people. Lower costs should help shore up EPS, with the consensus estimate of $5.28 for 2023 representing a 11% jump from 2022’s estimate of $4.75. The company’s net income margin of 23.75% for the trailing twelve months is close to 200 basis points higher than the 5 year average of 21.80%, an impressive feat given the specter of rising inflation in the past year.

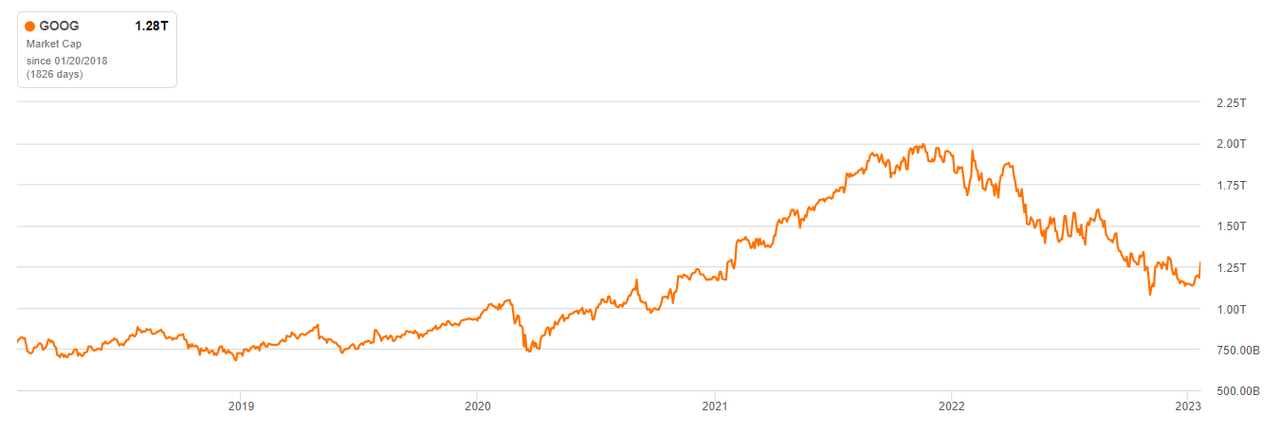

GOOG’s current market cap of $1.28 trillion represents a 40% discount from it’s all time high of around $2 trillion that it attained in Q4 2021. Its valuation as measured by P/E and EV/EBITDA has also declined over this period. It has a P/E (FWD) of 20x vs a 5 year average of 27x and an EV/EBITDA of 10x vs a 5 year average of 18x, showing that it is undervalued relative to historical multiples. The risk reward ratio therefore looks very compelling at current levels.

GOOG’s current market cap 40% off all time highs (Seeking Alpha)

ChatGPT a misunderstood opportunity

Looking to the future, I think it’s worth clarifying that ChatGPT — OpenAI’s sensational AI driven chatbot — is a misunderstood opportunity. It’s true that it has the potential to disrupt GOOG’s search business, which is its cash cow. This threat could further intensify if Microsoft (MSFT) successfully acquires a $10 billion stake in OpenAI as has been reported recently. The deal is part of a funding round with other investors involved that values OpenAI at $29 billion. There are even reports that GOOG is bringing back founders Larry Page and Sergey Brin to help fend off the ChatGPT threat, and that the company declared a so-called “code red” over ChatGPT.

While ChatGPT raises the bar in terms of competition in search, it’s far-fetched to imagine that it will replace Google search. It can complement it, but not replace it. Moreover, what ChatGPT represents is not a direct competition to Google Search but the emergence of a new category in the search business. For dominant players, category growth is often a bullish sign as it is simply an opportunity to get a big piece of a big pie. GOOG can launch a similar product and outspend OpenAI to gain market share. It can also simply buyout another competitor.

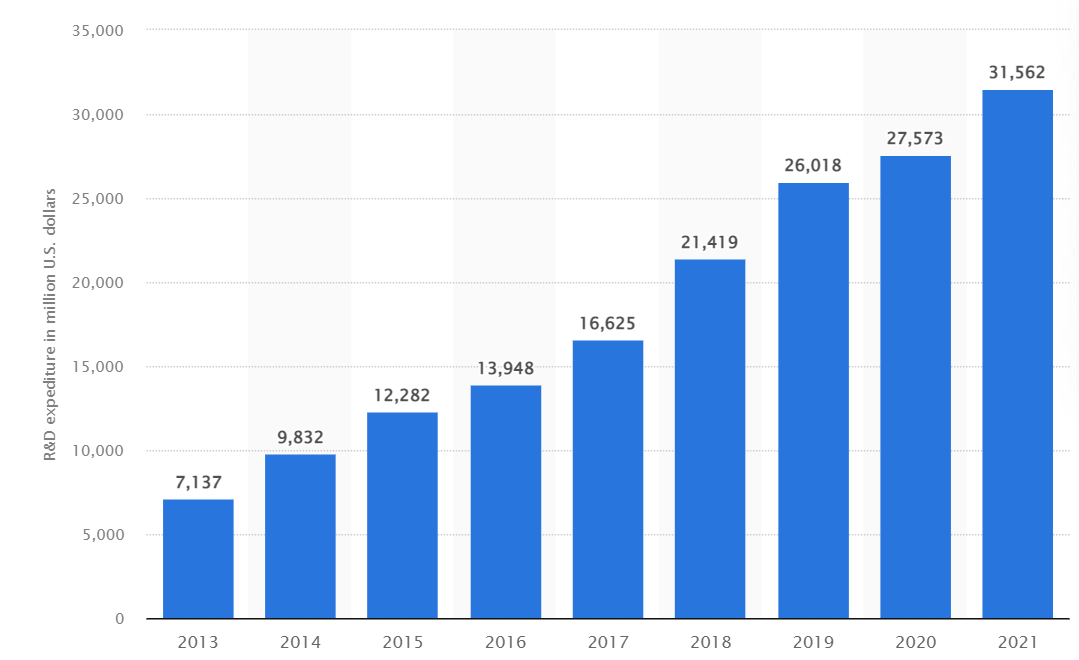

GOOG’s R&D Spend Growing Robustly (Statista)

GOOG has been steadily growing its R&D spending over the past decade and I would not be surprised if its response to OpenAI’s ChatGPT is more superior and popular.

The best part about GOOG’s growth efforts is that it is not taking on debt, issuing shares or sacrificing margins to innovate and grow. Despite its high R&D spend, it has total debt of $29.34 billion vs cash of $116.26 billion for the most recent quarter (it’s essentially debt free). GOOG has also been buying back its shares, with outstanding shares declining 7% from around 13.9 billion shares in 2018 to around 12.9 billion in the most recent quarter.

Obvious buy

The weakness in GOOG’s stock in 2022 was expected given the slowdown in ad spending, the dip in EPS (after a strong 2021), and the impact of rising interest rates on US equities. Thanks to the decline, GOOG’s valuation is now compelling while the underlying business looks set to continue growing robustly despite fears over emerging threats like ChatGPT. It is an obvious buy that could be highly rewarding for investors who have the patience to buy and hold.

Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.