Summary:

- The loss of the antitrust trial with Epic Games is unlikely to materially impact profits.

- Alphabet has shown resilient revenue and earnings growth, but the rise of generative AI raises concerns about the long-term viability of the search business.

- The market has overlooked strong results from the cloud division, likely due to slower growth rates compared to Microsoft.

- Waymo is ramping up and is worth far more than the negative value often ascribed due to Other Bets losses.

- The stock looks exceedingly cheap on a sum of the parts basis.

Justin Sullivan

Alphabet (NASDAQ:GOOGL) has once again proven the attractiveness of its underlying businesses, showing resilient revenue and earnings growth in spite of the tough macro environment. What is the problem then? The rise of generative AI has thrown into question the long term profitability of revenues from the search business. Even as the company shows resilient results and a material recovery in growth rates, investors may be hesitant to give the company due credit for the impressive results. Moreover, the company’s cloud division is seeing slower growth rates than Microsoft (MSFT) in spite of operating from a lower revenue base. Investors may be interpreting these results to suggest that MSFT is taking market share, perhaps due to its close relationship with OpenAI. I reiterate my strong buy rating as Wall Street remains too pessimistic on the quality of this wonderful business – the stock is exceedingly cheap when valued on a sum-of-the-parts basis. GOOGL is one of my top picks for the upcoming year.

GOOGL Stock Price

GOOGL has shown impressive fundamental results highlighted by resilient top-line growth and generous margin expansion. The stock remains well off lows of the past year, but the valuation is arguably too conservative given the quality here.

I last covered GOOGL in September where I rated the stock a strong buy on account of the increasingly shareholder friendly outlook. It might not be easy to stay the course amidst recent price weakness, but GOOGL remains a compelling “fat pitch” investment opportunity.

GOOGL Stock Key Metrics

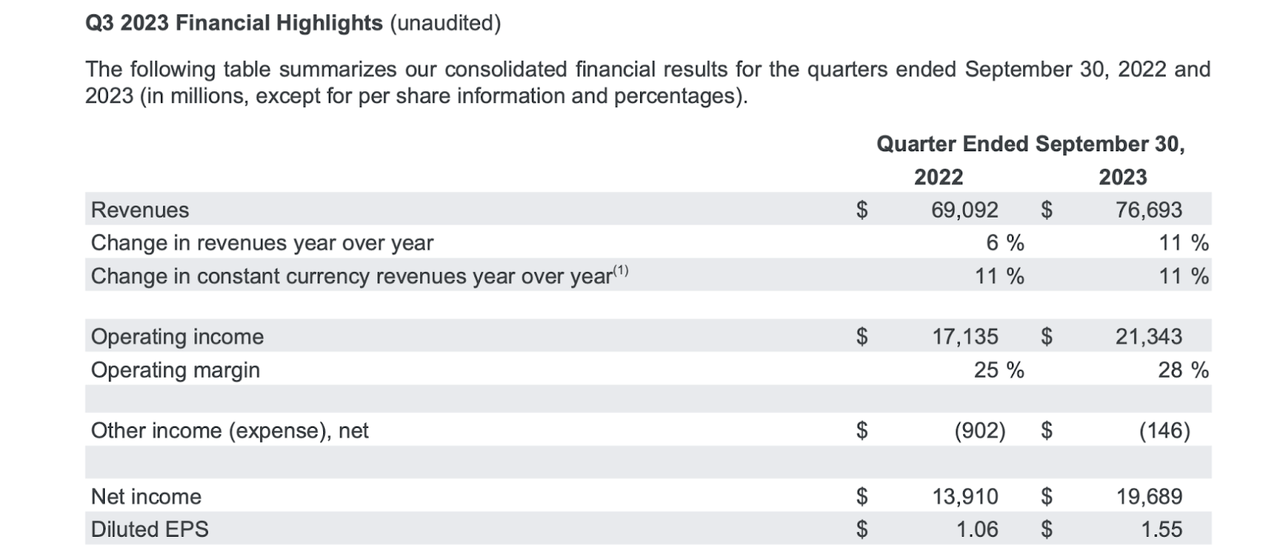

In its most recent quarter, GOOGL delivered solid 11% YoY revenue growth to $76.7 billion, with its operating margin expanding 300 bps to 28%.

Diluted EPS grew 46% YoY to $1.55, but that includes non-cash gains and losses from its balance sheet. Excluding these items, diluted EPS grew 30.6% YoY to $1.62.

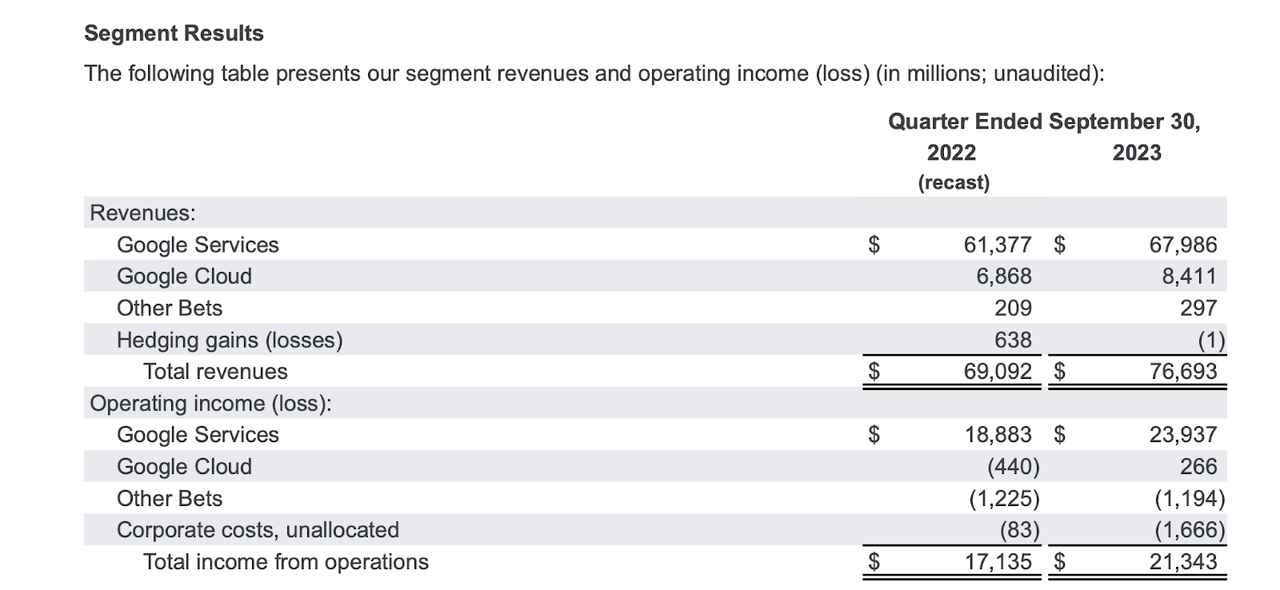

GOOGL saw strong 22% YoY growth from Google Cloud, but that strong result was overshadowed by the stronger results at MSFT. My view is that the current macro environment has significantly complicated the picture and investors should be careful to avoid assigning winners and losers based on quarterly performance alone. Google Cloud delivered yet another quarter of operating profitability, but again Wall Street appears to have overlooked the solid financial developments due to MSFT’s incredible results.

GOOGL previously disclosed that it would be allocating costs associated with Google Research and DeepMind out of Other Bets and into unallocated corporate costs beginning the second quarter of this year (due to the increasing importance of artificial intelligence to their business). That explains the steep jump in operating losses from unallocated corporate costs.

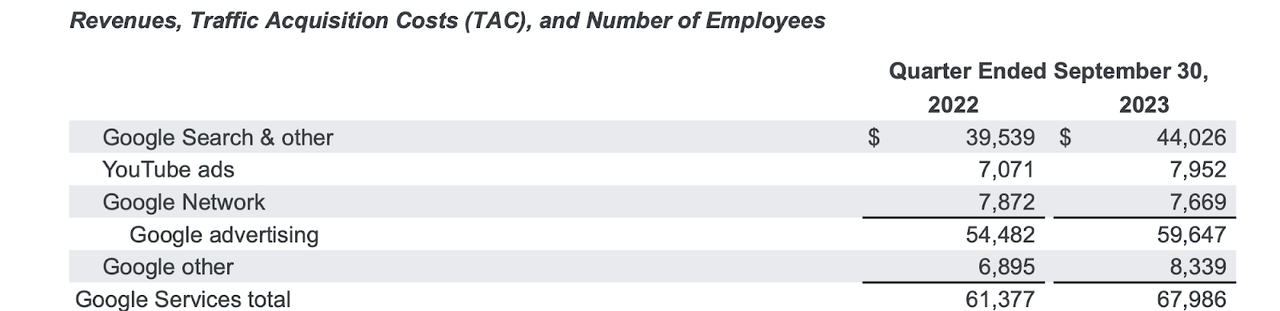

Within Google Services, GOOGL saw a recovery in growth rates at YouTube (that segment had seen growth decelerate meaningfully in the second quarter) and Google Search, despite all the fears of competition from Bing, managed to deliver 11% YoY growth.

GOOGL ended the quarter with $119.9 billion of cash and $30.9 billion of non-marketable securities versus $13.8 billion of debt. The increased net cash position reflects $10.5 billion in tax payments that were deferred until after the quarter (so investors should use $95.6 billion of net cash for modeling purposes).

GOOGL continued to be shareholder friendly, repurchasing $15.8 billion of stock as compared with $22.6 billion of free cash flow. I expect share repurchases to remain an important part of the story here given the low equity valuation and difficulties in making big acquisitions.

On the conference call, management noted that Shorts, their answer to TikTok, now averages over 70 billion daily views. It is remarkable to see how quickly GOOGL and Meta Platforms (META) have been able to address the competitive threat from TikTok, something that had previously plagued their stock prices in the last year.

While MSFT has received the bulk of attention for its generative AI prowess, I continue to be of the view that the market is underestimating the competitive abilities of GOOGL (and Amazon (AMZN) for that matter). Management noted that “more than 60% of the world’s 1,000 largest companies” and “more than half of all funded Generative AI startups” are Google Cloud customers.

Investors often ascribe zero or even negative value to the loss-generating Other Bets segment (I use zero in my models below) but there are some exciting developments coming from this segment. Management noted that their autonomous driving unit Waymo is ramping up in San Francisco with Austin being the next city to come online.

I suspect that investors have some concerns about management’s commentary regarding their commitment to profitable growth, as management appeared to avoid giving a clear promise for revenue growth to exceed expense growth in 2024. Investors may be concerned that the margin expansion seen in 2023 was a one-time thing, with GOOGL (and other tech teams) reverting to old patterns moving forward. It is interesting that the market can show great optimism for the long term future for generative AI, but at the same time expressing disdain for a ramp up in investments to support that future.

Is GOOGL Stock A Buy, Sell, or Hold?

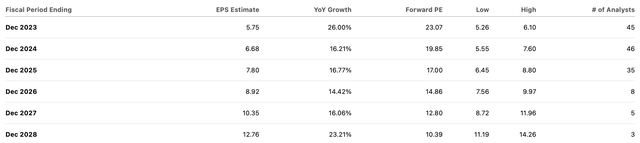

At recent prices, GOOGL trades at highly reasonable valuations.

Due to the losses from Other Bets and muted profitability from Google Cloud, the sticker P/E ratio is understating the value proposition.

The advertising business generated $90 billion in operating income over the trailing twelve months. Assuming a 21% tax rate and 23x earnings multiple, I value this segment at $129 per share. I previously modeled 25% growth for Google Cloud which I still find achievable, but will now use 20% for a more conservative estimate. Based on my projection of 40% long term net margins and a 1.5x price to earnings growth ratio (‘PEG ratio’), I value Google Cloud at $32 per share. The $95.6 billion in net cash is worth $7.50 per share. Assuming $0 in value for Other Bets, we arrive at a total of $169 per share in fair value, representing significant upside from current levels. This is a good moment to note that GOOGL cut “only” 6% of its workforce during the broader tech layoffs in early 2023. In contrast, I estimate that META laid off over 30% of its workforce throughout the year. GOOGL may have its own “year of efficiency” as a catalyst in the future.

What are the key risks? It is possible that newer generations begin using Bing search instead of Google search, perhaps due to better generative AI offerings or the potential risk that Apple (AAPL) switches to Bing as their default search engine. If this were to occur, then GOOGL would no longer benefit from secular tailwinds but instead would face secular headwinds and the risk of extinction. I can see online advertising tailwinds as helping to counteract these headwinds as well as contribution from YouTube, but a switch in search preferences is a challenge that the company – and investors – has not faced before. The tough macro environment may get worse, potentially derailing the recovering advertising growth rates. GOOGL has a strong balance sheet and lean cost structure, but results may be volatile in the near term. Regulatory risk remains important as well. GOOGL recently lost an antitrust case against Epic, which may threaten the 30% fees it charges in its Play Store. The direct impact from reducing Play Store fees might not be so large (estimated to be a maximum of 8% of profits in the link above) but that misses the point: regulatory uncertainty may act as a valuation overhang until there is a resolution, if ever. GOOGL may be able to take advantage of the lower valuations through share repurchases, but this can act as a lid on the potential upside.

I reiterate my strong buy rating for the stock, as its current valuation is not reflecting the strong secular growth tailwinds nor the pristine balance sheet.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, META, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.