Summary:

- Alphabet’s vertically integrated search model and extensive network create significant entry barriers, making it difficult for AI-powered search engines like SearchGPT to disrupt Google Search.

- Despite Microsoft’s AI-powered Bing, its market share growth has been minimal, reinforcing the strength and dominance of Google Search.

- AI-powered search engines are not new; Alphabet’s AI Overviews already offer similar functionalities, making the impact of new AI entrants limited.

- I reiterate a ‘Buy’ rating for Alphabet with a fair value of $215 per share, expecting 14% revenue growth driven by Google Cloud and Search.

da-kuk

The arrival of SearchGPT has raised many concerns about Alphabet (NASDAQ:GOOGL)’s online search business. I previously discussed the potential impact of AI on Alphabet’s search business in the risk section of my article published in July 2024. I think these AI-powered search engines, including SearchGPT, will complement Google Search in the near future and the financial impact will be quite limited. I reiterate a ‘Buy’ rating with a fair value of $215 per share.

I don’t think AI-powered search technology will disrupt Google Search for the following reasons:

Reason #1: Vertical Integration Creates Unique Online Search Model

Alphabet controls more than 90% of the global search market and operates a vertically integrated business model for Google Search. To become a successful search engine, it needs to create an integrated business that effectively connects advertisers with information seekers. Over the past decades, Alphabet has created a massive network of end-users, via their Android smartphones, third-party partnerships, YouTube, and other platforms. Many devices choose Google Search as the default search engine, giving Alphabet access to a huge number of customer base.

On the other hand, Alphabet has established a strong Ads trading platform for advertisers, allowing these merchants to purchase advertisements, manage marketing campaigns, perform data analytics and performance reviews, and conduct customized or targeted marketing by leveraging Alphabet’s massive data sources.

As a result, the online search ecosystem is a highly complex, vertically integrated business model. I don’t think OpenAI can easily disrupt Google Search by just relying on an AI-powered search engine without access to these additional resources.

Reason #2: Bing Search Engine Has Not Gained Big Share Since AI Introduction

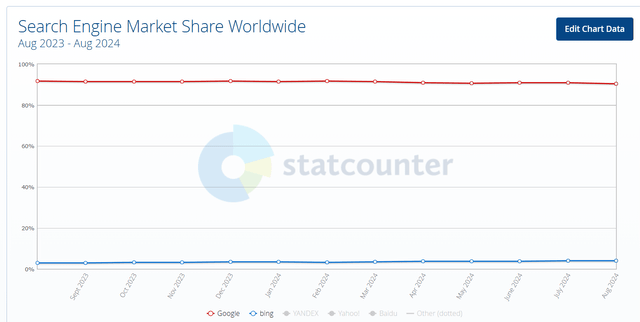

According to StatCounter report, Bing search engine’s market share only increased from 3.03% in August 2023 to 3.91% in August 2024, as depicted in the chart below.

In February 2023, Microsoft (MSFT) introduced their new AI-powered Bing search engine and Edge browser, partnering with OpenAI. Notably, the revamped search engine applies AI to the core search algorithm. However, based on the data above, Microsoft has not gained too much market share following their AI launch. It demonstrates that it is unlikely to disrupt Google Search without a powerful vertical integrated network connecting both advertisers and end-users.

Reason #3: AI-Powered Search Engine is Not Something New

Before the arrival of SearchGPT, there are several AI-powered search engines available in the market, such as Perplexity, Arc Search, etc. These AI-powered search engines can engage in conversations with end-users and provide search summaries instead of just links on a page.

As an example, when I used Perplexity to search for “How to subscribe stock investment research?”, the platform provided a quick summary of major popular services for equity research. The search engine summarizes the contents from these websites and presents to me. While I acknowledge it is convenient to review the summary, the information might not be comprehensive or accurate. As a user, I prefer visiting the websites of these service providers to review their fees and services in detail.

In addition, Alphabet also introduced AI Overviews, which provides AI-organized search result page. As such, the search summary is becoming somewhat of a commodity.

Outlook and Valuation

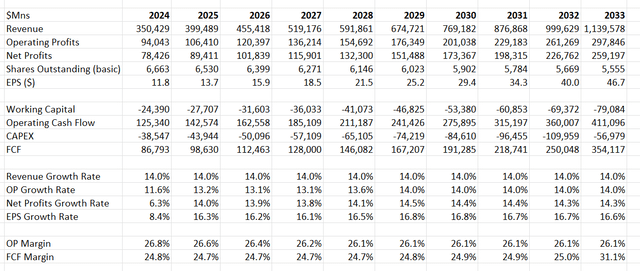

As discussed in my previous article, Google Cloud led the growth in Q2 FY24, growing by 28.8% year-over-year. With the rapid growth in cloud computing and AI, I anticipate Google Cloud will sustain double-digit revenue growth in the near future. For the near-term growth, I am making the following assumptions:

- Google Search: in my previous article, I projected Google Search would grow by 14% in the near future. Considering that OpenAI has nearly 200 million weekly active users, I anticipate SearchGPT will attract some online search traffic. As analyzed previously, I don’t expect Google search will be disrupted by SearchGPT. I anticipate Google Search will grow by 12% in the near future, assuming a 2% impact from AI-powered search engines.

- I continue to forecast Google Cloud will grow by 25%, driven by ongoing digitalization and AI workloads.

- For the subscription and services, I anticipate the segment will grow by 10%, which is consistent with their growth trend.

As such, I project Alphabet will grow their revenue by 14% in the near future. As Alphabet increased their CAPEX spending over the past few years, the company is going to face higher amortization and depreciation costs. I project their operating margin will decline by 10-20bps, the same assumption in my previous DCF model.

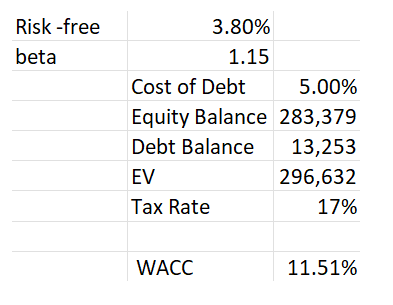

I revised WACC to 11.5%, reflecting a lower risk-free rate and lower cost of debts as the Fed cuts the interest rate.

Alphabet DCF Model- WACC

With these assumptions, the DCF can be summarized as follows:

Discounting all the free cash flow, the fair value is calculated to be $215 per share, according to my DCF model.

Key Risks

Microsoft could potentially integrate SearchGPT to their Bing and Edge browser in the future. As Microsoft has a significant market share in the desktop market, the integration of search engine with SearchGPT might help the company gain more share in the global search market.

In addition, a federal judge ruled that Alphabet has violated US antitrust law with its search business. According to the judge’s opinion, Google is a monopolist in search and has violated Section 2 of the Sherman Act. These legal battles will create some headline risks for Alphabet in the near term, in my view.

Conclusion

In short, I don’t anticipate these AI-powered search engines will disrupt Google Search in the near future. Alphabet owns tremendous advantages in their online search business, and I expect the company’s entry barriers will be difficult to overcome. I reiterate a ‘Buy’ rating with a fair value of $215 per share.

Analyst???s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.