Summary:

- Google delivered strong Q2 results, with a 5% YoY growth in search and 28% YoY growth in Google Cloud.

- The company’s focus on cost control, investments in AI, and rebounding advertising business contribute to a rich operating profit.

- Google’s AI opportunities are expanding across products, customers, and functionalities, positioning the company at the center of the next-generation tech ecosystem.

- Post Q2 2023 reporting, I update my EPS expectations for Google through 2025; and I now calculate a fair implied target price of $169.31/ share.

Ingus Kruklitis

Google (NASDAQ:GOOG) (NASDAQ:GOOGL) delivered an impressive Q2 report: In the July quarter, Google achieved a ~5% YoY growth in search, while Google Cloud’s growth was reported at 28% YoY — resulting in a ~1.9 billion topline beat. And while Google’s business is moving onwards, the stock is trending upwards: In the 3 trading days following the earnings announcement, Google shares drifted ~10% higher.

I see more upside ahead. Reflecting on Google’s latest earnings report, along with the company’s (i) focus on cost control (ii) investments in AI and, (iii) rebounding advertising business, I raise my EPS projections for Google through 2025. As a result of these revisions, I now calculate a fair implied target price of $169.31 per share.

Strong Q2 Beats Expectations

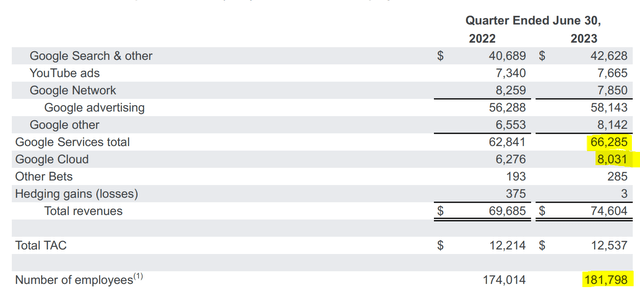

On Wednesday 26th after market close, Google opened its books for the Q2 2023 reporting period, beating analyst consensus estimates with regards to both revenue and earnings. During the period from April to end of June, the world’s leading Search & Information Indexing business generated about $74.6 billion of revenues, up from $69.7 billion for the same period one year earlier (7% YoY growth, 9% excl. FX headwinds), and significantly above the $72.75 billion estimated by consensus at midpoint (~$1.85 billion top line beat).

With regards to profitability, Google’s operating income came in at $21.8 billion, increasing close to 29% YoY vs. the same period in 2022; Google’s post-tax net income came in at around $18.4 billion ($1.44 share), up approximately 19% YoY, and beating analysts’ estimates by close to ~$1.3 billion.

Google closed Q2 with $118.3 billion of cash and short term investments, as compared to Q2 operating cash flow of about $28.7 billion and share repurchases of $14.97 billion.

Notably, Google’s earnings beat for the July period was carried by all of the group’s major business segments: The search business rebounded nicely vs. Q2 2022, materializing a 5% YoY growth, while YouTube achieved a 4% YoY growth. In more detail, search trends remained robust, despite the ChatGPT concerns. And YouTube now boasts close to 2 billion users, up from 1.5 billion a year ago. Subscription revenue also displayed strength, supported by the popularity of YouTube Music Premium and YouTube TV. Overall, the advertising business accumulated $66.3 billion of revenues, and $23.5 billion of operating income (the lion share, of course).

Google’s cloud business, meanwhile, remains an attractive growth engine with 28% YoY topline expansion, bringing 3-month revenues for the segment to $8 billion, and operating profits to $0.4 billion. Now, with Q2 being the second consecutive quarter of Cloud business profitability, it is suggested that Cloud has started to be long-term earnings accretive.

Google is currently pushing some small-scale restructuring to drive up operating profitability. In that context, it is worth noting that Q2 2023 results include approximately $2.0 billion of charges related to reductions in workforce (e.g., severance costs), as well as $633 of expenses due to office space optimization efforts. Accordingly, it is implied that without the non-recurring expense accounting, Google’s profitability for the Q2 period would have been ~12% higher.

As a final comment on Q2 metrics, however, I would like to point out that Google’s net headcount is still growing, despite extensive management commentary relating to workforce reduction programs. Unfortunately, I do not have a good explanation for this observation/ discrepancy; but, it is comforting to note that the company’s headcount is growing below revenue and profit growth.

More Visibility On AI

As expected, much of Google’s Q2 2023 conference call with analysts centered around growth and business opportunities relating to AI – with “AI” being mentioned an astonishing 96 times. Based on management commentary, it is quite evident that Google’s AI opportunities come with both breadth and depth across products and functionalities, as well as consumers and enterprises. Several key events and developments are worth mentioning: First, in late April, Google made the decision to consolidated Google Research (specifically, the Brain team) and DeepMind, which will likely fast-track the exploration and development of various AI tools and products. Second, Google Cloud has reportedly seen strong demand for AI adoption: The count of total AI customers jumped fifteenfold from April to June; and approximately 70% of GenAI unicorns are now using Google Cloud services, positioning Google in the center of the next-generation tech ecosystem. Third, Google continues to leverage AI technology to improve customer ROI on ad spend, strengthening the economic fundamentals and competitive positioning of Google’s most important profit center.

Valuation Update: Raise TP

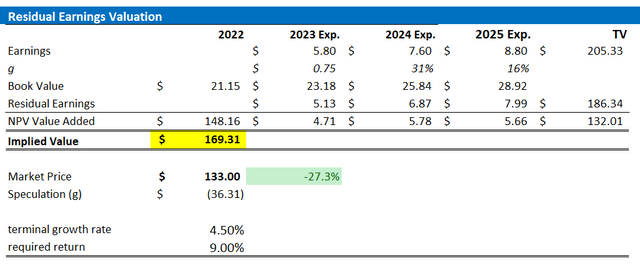

Reflecting on Google’s better than expected Q2 2023 performance, I update my EPS expectations for Google through 2025: I now estimate 2023 EPS to be around $5.8, as compared to $5.4 prior, reflecting the ads business rebound. Similarity, I raise my EPS expectations for 2024 and 2025, to $7.6 and $8.8 respectively.

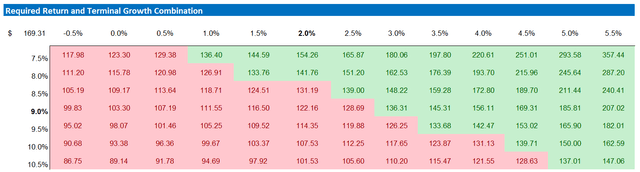

I continue to anchor on a 4.5% terminal growth rate (1-2 percentage point higher than estimated nominal global GDP growth, mostly due to new AI business), as well as on a 9% cost of equity.

Given the EPS upgrades as highlighted below, I now calculate a fair implied share price for Google equal to $169.31/ share, estimating approximately 27% upside.

Company Financials; Author’s EPS Estimates; Author’s Calculation

Below also the updated sensitivity table

Company Financials; Author’s EPS Estimates; Author’s Calculation

Conclusion

Google delivered strong Q2 results, with a 5% YoY growth in search and 28% YoY growth in Google Cloud. On the bottom line, the company’s focus on cost control, investments in AI, and rebounding advertising business contribute to strong operating income growth of 19% YoY.

Looking beyond Q2, Google’s AI opportunities are expanding across products, customers, and functionalities, positioning the company at the center of the next-generation tech ecosystem.

Post Q2 2023 reporting, I update my EPS expectations for Google through 2025; and I now calculate a fair implied target price of $169.31/ share. I reiterate a ‘Buy’ rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

not financial advise

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.