Summary:

- Google has underperformed due to market fears that the DoJ could succeed in breaking up its search and ad tech businesses.

- However, the worst-case scenario isn’t expected to be disastrous, suggesting the market has likely overplayed its pessimism.

- Google’s diversification with YouTube and Cloud has strengthened its competitive moat, potentially mitigating the regulatory headwinds.

- GOOGL’s forward PEG ratio has dropped into attractive zones, which doesn’t seem to do justice to its best-in-class profitability.

Justin Sullivan/Getty Images News

Google Underperforms As The Market Fears A Breakup

Alphabet (NASDAQ:GOOGL)(NASDAQ:GOOG) investors have had to endure a torrid Q3, as the stock of the search behemoth has underperformed the S&P 500 (SPX)(SPY) since topping in early July 2024. As a result, I assessed that the market has started to price in the uncertainties relating to the DoJ monopoly case that it lost recently. Although final remedies aren’t expected until August 2025, the market is likely assessing potentially adverse outcomes, as the DoJ is expected to unveil its proposed remedies over the next few months.

In my previous bullish GOOGL update, I urged members to buy into its pessimism. I also noted that Microsoft’s (MSFT) previous attempts to dislodge Google from its search dominance didn’t pan out. However, with the recent adverse ruling against Google in its search monopoly case, the market has likely reassessed the possible remedies that could hurt the clarity of its earnings outlook from 2025.

Wall Street indicates that the market has attempted to reflect execution risks relating to the potential loss of exclusive distribution deals with Google’s current partners. Accordingly, the $20B Apple (AAPL)-Google exclusive deal is at stake, bolstering the opportunities for Microsoft, as the Redmond-based company looks to unhinge Google’s entrenched dominance.

While nothing has been announced, GOOGL’s relative underperformance has demonstrated the market’s pessimism that the Mountain View-headquartered company would escape unscathed. While the legal process is expected to drag on for some time, the market’s concerns over a further breakup of Google’s search dominance aren’t misplaced.

Moreover, the second DoJ case against Google’s ad tech business has introduced more challenges for CEO Sundar Pichai and his team. The Trade Desk (TTD) CEO Jeff Green has stated clearly that Google hasn’t played fair in the digital advertising market for some time. The revelation that even Meta (META) found it challenging to untether Google’s ad tech dominance has added fuel to the fire. Green emphasized that Google has played the roles of “the prosecuting attorney, the defense attorney, and the judge and the jury” in its ad tech business. As a result, it has given Google an “unfair” advantage against its smaller ad tech peers. While the trial is ongoing, the market’s pessimism likely stemmed from Google’s previous loss as it failed to defend successfully against the search monopoly allegations.

Google Search Could Lose Market Share To Microsoft. So What?

Despite that, investors must ask whether the worst-case scenario of losing its exclusive search distribution deal could be disastrous. Although Google could surrender potentially significant search market share to its peers, Evercore analysts highlighted that the impact on its earnings per share would likely be in the “single-digit percentage range.” Investors must remember that Google wouldn’t need to pay the hefty $20B sum to Apple, potentially mitigating the earnings impact from the market share losses due to “lost search revenue.”

Despite that, Google has been diversifying its reliance on search advertising and ad tech. While YouTube’s growth has slowed, it has capitalized and scaled up to become one of the most essential and market-leading streaming platforms. With CTV expected to continue driving growth, YouTube’s dominance is expected to persist, notwithstanding the regulatory challenges it has experienced in its search and digital advertising businesses.

Moreover, Google Cloud has made significant progress in its cloud offerings. As one of the leading hyperscalers, Google Cloud faces intense competition from a resurgent Oracle (ORCL). Oracle’s rising competitiveness in building mega AI clusters in its partnership with Nvidia (NVDA) could unhinge Google’s fledgling momentum in the hyperscaler space.

Despite that, Google Cloud CEO Thomas Kurian underscores the flexibility of its accelerated computing architecture. Notably, Kurian telegraphed the platform offers customers choices in leveraging in-house TPUs or Nvidia’s AI chips, focusing on optimizing TCO and reliability. However, developer hesitation has also been noted in Google’s Gemini AI models, suggesting it remains behind the Microsoft-OpenAI partnership. With Microsoft expected to gain more share against Google in search advertising if the DoJ succeeds in its remedies against Google, it faces an increasingly critical pivot to delivering the goods in its cloud business. Moreover, Amazon Web Services (AMZN) has also upped the ante as AWS looks to bolster its competitiveness against its peers, capitalizing on its market-leading scale.

Is GOOGL Stock A Buy, Sell, Or Hold?

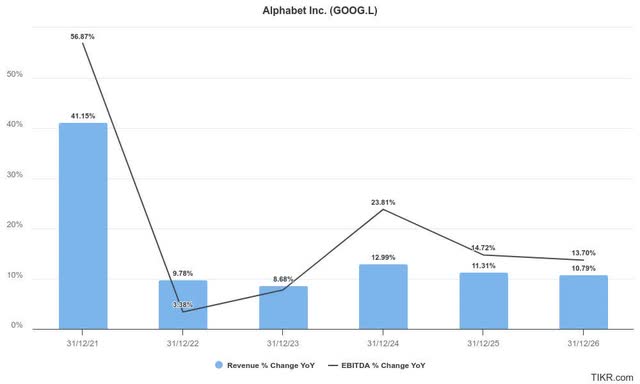

Accordingly, Google is still expected to notch double-digit revenue growth and adjusted EBITDA through 2026, highlighting GOOGL’s best-in-class profitability. Notwithstanding its recent underperformance, Wall Street has mostly lifted Google’s estimates, suggesting the market’s pessimism seems unwarranted.

Furthermore, GOOGL’s forward adjusted PEG ratio of 1.24 is slightly below its sector median of 1.29. For a fundamentally strong company like Google, it’s arguable to suggest it deserves to trade at a premium against its peers, given its robust business model.

Therefore, investors who have not added exposure aggressively can consider buying more shares to capitalize on the recent pullback.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, META, MSFT, NVDA, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!