Summary:

- Google and Fastly announced a partnership.

- Most investors probably thought it was more important to Fastly.

- It’s actually much more important to Google.

400tmax

On March 15, 2023 Google (NASDAQ:GOOG) (NASDAQ:GOOGL) partnered with Fastly (FSLY) on a product that is likely more critical to Google’s future than Fastly.

Let me explain.

Online ads were the Wild West for a while. You could visit an e-commerce website, put an item in your shopping cart, leave the site, and then see ads for that item for weeks show up in any app or browser you used.

At some point people either got annoyed or thought this was an invasion of privacy. Apple (AAPL) made the most significant changes to online targeting of ads when the company rolled out iOS 15 in 2021.

If you’ve ever seen this pop up on your Apple device, it’s in response to the targeted ads that built businesses like Meta (META) and Google. Essentially the more people that click “Ask App Not to Track” the less advertisers know what you like, where you shop, and what type of ads to serve you.

It had devastating effects on Meta in particular. In some ways, it was the catalyst to get Mark Zuckerberg to change the company’s name (and long term focus) to the “metaverse”.

It’s had slightly less impact on Google as a larger number of ads Google serves are intent driven by a query into a search box, rather than a re-targeting of something Google knows you have interest in. Not to mention Google more or less controls the Android operating system, is the default search engine on Apple devices, and owns the Chrome web browser. Meta isn’t afforded those luxuries.

That being said, Google’s been far more cautious rolling out ad privacy changes. The company has delayed phasing out “cookies” from its Chrome browser numerous times. That’s because Google makes nearly all its revenue from advertising, whereas Apple could be far more blunt with its approach.

But Google knows it’s got to do more. There’s some competitive pressure with Apple vs Android, but more importantly laws have been passed in the EU that essentially force Google to make surfing the web and seeing targeted ads more difficult.

Enter FLEDGE

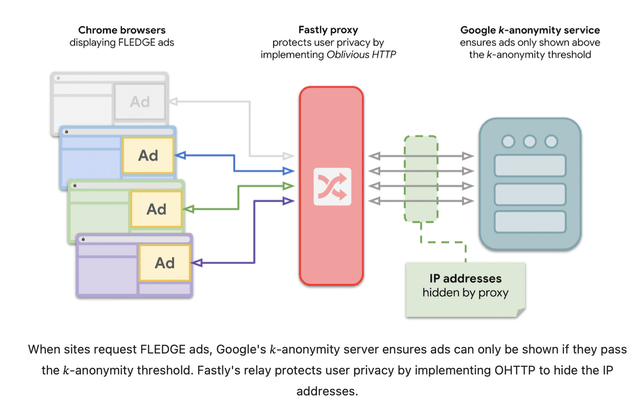

It’s largely irrelevant to investors how Google is going to work around privacy laws but still show ads that generally target users’ interest, but if you want to read how it will work you can find the details here.

The most important takeaway is the fact this will maintain a relatively effective way for advertisers to show ads to the users that are most likely to click and convert on the ad. While it won’t be a cross-platform solution – as it’s rolling out on Chrome and eventually Android, it will be an acceptable solution to most online marketers.

From an investment perspective, Fastly will sit between the user and the ad-server ensuring that advertisers don’t get data that is essentially illegal to collect in some parts of the world.

In my opinion, it sets the stage for Google to buy Fastly outright at some point because if Google decides to use this solution to show targeted ads on Chrome and Android, it’s one of the most important products in the entire company.

I wrote about this back in August of last year, specifically calling out Google as a potential buyer of Fastly as Google has a long track record of buying “internet plumbing” companies like Fastly.

Given the fact mega-cap tech is largely shut out of doing transformative acquisitions based on the climate in Washington DC (on both sides of the aisle), a deal for Fastly could likely sail through without much work from the legal team.

For Fastly, it likely means a floor underneath the share price, but does cap the upside to what Google would want to pay.

For Google the stakes are even higher. Its online ad business has stalled with just 5.7% growth projected this year. Reaccelerate revenues at Google, and the 18.5x forward earnings multiple could expand back into the 30’s.

Sure, there’s going to be lots of noise about AI, chatbots and integrating that into Google’s products, but the bread and butter ad business is going to keep paying the bills. If Google can successfully allow online advertisers to target users and Fastly sits in the middle – Google will want to own that end-to-end. I’ve been a buyer of Google stock since the drop into the $90’s and will consider adding Fastly as a way to capture upside without having to sell Google.

Disclosure: I/we have a beneficial long position in the shares of GOOGL, APPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.