Summary:

- Alphabet Inc./Google’s AI investments are taking off, as evidenced by its stellar Q3 2024 double beat.

- Google Cloud outperformance was the spotlight, with substantial sequential operating margin expansion and growth acceleration underpinned by robust AI contributions.

- Better-than-expected ad revenue growth despite a tough PY comp also mitigates the core native search business’ exposure to risks of AI disruption.

- The latest results continue to reinforce Google’s positioning as a key enabler and beneficiary of the ongoing AI transformation. But a further re-rate would likely require new catalysts, such as Google’s impending foray in reasoning AI, which remains underappreciated at current levels.

JHVEPhoto

Many investors may remember Alphabet Inc. aka Google (NASDAQ:GOOG, NASDAQ:GOOGL) CEO Sundar Pichai’s infamous response to an analyst question about the ROI structure for its elevated AI spending outlook during the Q2 earnings call:

I think the one way I think about it is when we go through a curve like this, the risk of under-investing is dramatically greater than the risk of over-investing for us here, even in scenarios where if it turns out that we are over investing.

Source: Google 2Q24 Earnings Call Transcript.

The vague response was a costly one for Google investors. It had essentially kicked off concerns about risks of over investing in AI across hyperscalers, which led to a subsequent selloff at Google that failed to recover through the quarter.

But Google’s latest Q3 earnings outperformance represents a 360 from previous fears unleashed by Pichai’s uncertain commentary over the ongoing AI transformation’s ROI formula. The company reported better than expected ad revenue growth across both its core Search and YouTube platforms, as well as strong AI revenue contributions in Google Cloud. This has contributed to a stark shift in investors’ previously skeptical view on the industry’s elevated AI spending environment, which is evident in the Google stock’s post-earnings recovery.

Specifically, Google’s core Search advertising business continues to demonstrate sequential strength, alongside y/y acceleration which outperformed management’s previous warnings of a tough PY comp. Meanwhile, YouTube continues to deliver a narrowing ad monetization gap in Shorts, alongside broad-based digital ad revenue share gains thanks to the platform’s sustained leadership in CTV view times.

More importantly, Google’s core ad sales growth continues to reflect robust adoption of its expanding suite of generative AI tools aimed at delivering incremental performance and efficiency gains critical to advertisers. AI returns were also evident in Google Cloud growth, with record-setting revenues and substantial margin expansion from the segment during Q3.

Taken together, Google continues to demonstrate its competitive advantage as a key enabler and beneficiary of AI advancements going forward. However, we expect the stock to stay trading range bound over the near-term, as its gradual appreciation remains primarily dependent on the continued monetization of existing AI developments. A further re-rate from current levels would require new AI developments, in our opinion, including Google innovations in reasoning AI.

Growth Cannibalization Assuaged in Core Ad Sales

Google advertising revenue accelerated from a year ago, despite management’s warnings of a tough PY comp that consisted of strong APAC-based retailer momentum, which has moderated in the current year. The company’s core search advertising business grew its Q3 revenue by 12% y/y to $49.4 billion, assuaging investors’ previous concerns of AI cannibalization. Meanwhile, YouTube advertising strength also persisted with Q3 revenue expanding 12% y/y to $8.9 billion, highlighting a robust monetization ramp for Shorts.

The latest results from Google’s core advertising business continues to corroborate additive growth enabled by AI integration. Specifically, the ongoing development of new AI tools aiding content creators, advertisers, and day-to-day end-users of Search are generating substantial economic gains, reinforcing a virtuous cycle for Google’s business model. This continues to be a key competitive advantage for Google, as it furthers its capture of shifting advertising budgets from linear TV to digital platforms.

Search

The broad-based rollout of AI Overviews (“AIO”) since May across more than 100 regions, and its strong adoption evidenced through the 1+ billion MAUs, has likely been additive to the native search business. This is corroborated by the search unit’s accelerating ad revenue growth in Q3, highlighting Google’s prudent navigation through earlier investors’ concerns about potential AI disruption. The unit’s margins have also been preserved through Google’s diligent investments in “hardware, engineering and technical breakthroughs”. These have helped to bring down costs of facilitating the imminent shift to AI responses on search queries by more than 90% over the last 18 months.

As discussed in our previous coverage on the stock, Google’s search-native generative AI tool deployed through AIO is critical to reinforcing the engine’s relevance going forward. More importantly, the feature is expected to drive additive growth for Google’s search advertising business by better capitalizing on queries with commercial intent.

We believe AIO represents a platform where Google can further integrate its growing slate of AI tools. This offers potential in unlocking an expanded monetization roadmap to mitigate against the maturing addressable market in Google’s native search engine.

The strategy is consistent with Google’s deployment of Lens within its app to generate both traditional and AIO responses to image-based queries. The feature has garnered over 20 billion visual queries per month, with 25% of them stemming from commercial intent. This compares to an average 10% of commercial intent in all search queries based on current industry estimates. The substantial rise in potential conversion for ads in AI-enhanced placements is expected to reinforce Google’s share of increasing digital ad dollars in the industry, as secular declines continue in traditional linear formats. This is consistent with management’s observations that early integration of ads on AIO continues to be “performing well.”

The strategy is further corroborated by Google’s slate of expanding AI-enabled ad campaign creation and deployment tools behind the scenes. The integration of Gemini and other curated LLMs, such as Imagen 3 and Meridian, with Google’s Performance Max (“PMax”) and Demand Gen ad tools continues to unlock substantial performance and efficiency gains for advertisers. By streamlining the process of creating campaign assets with text-to-image generative capabilities enabled by Imagen 3, and automating the optimized deployment process with Demand Gen, advertisers have experienced as much as 15x higher conversion and 50% better cost per action (“CPA”). Meanwhile, improved measurement capabilities through Meridian have also helped advertisers better optimize their spending and returns formula.

Taken together, the combination of AI-enhanced monetization through innovations in user-facing platforms, as well as behind-the-scenes content creation tools continues to reinforce overall demand for Google advertising. This accordingly reinforces the financial capability at Google to further its developments on this front, thus generating a virtuous flywheel for the business’ long-term growth trajectory. The strategy also mitigates Google’s exposure to risks of growth and margin cannibalization from the advent of generative AI tools, as its native search engine continues to evolve profitably in the transformation.

YouTube

We believe YouTube continues to represent an area of emerging growth for Google’s core advertising business. AI enhancements curated for the video streaming platform further mitigates Google’s exposure from risks of obsolescence, in our opinion.

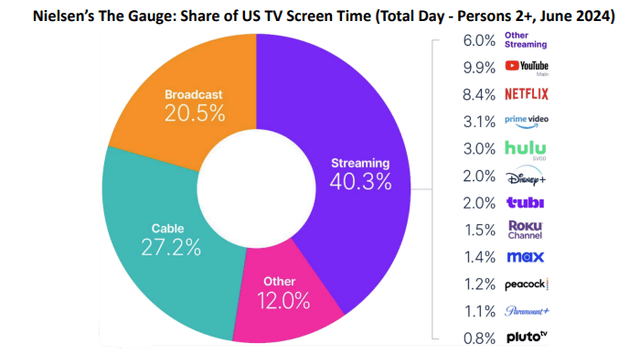

Recall that content is key for YouTube – the more eyeballs capture, the greater the ability for Google in capturing ad dollars and monetizing the platform. And YouTube continues to be successful on this front, as evidenced in its continued leadership in the share of U.S. TV screen time.

And the advent of generative AI has only bolstered YouTube’s content strategy, in our opinion. For creators, Google has not only been deepening its investments into revenue sharing incentives to encourage content creation on YouTube, but it has also honed in on curated AI tools to assist in content creation. This has accordingly generated another virtuous cycle of success for YouTube – the more content created, the greater the user engagement needed to facilitate ad demand, which then generates ad revenue sharing to further encourage uploads from content creators.

Specifically, on the incentives front, YouTube currently has one of the most enticing revenue sharing programs for content creators. The recently revamped YouTube Partner Program includes revenue sharing on ads distributed through Shorts, as well as revenue sharing on music rights. This has accordingly incentivized the continued build-out of YouTube’s Shorts content slate in recent quarters. More than 70% of content uploads to YouTube are now Shorts, with matching growth in this video segment’s viewership. This has accordingly encouraged greater ad placements in Shorts, which is evidenced in the format’s rapidly narrowing monetization gap from YouTube videos in recent quarters.

More importantly, Google has also been deepening its foray in AI-enabled video generation tools to further fuel the content creation economy on YouTube. During its latest Made on YouTube keynote, Google announced “Veo” – its curated model for AI-generated Shorts. Veo will complement “Dream Screen” – the AI-enabled background generation tool announced last year – to help content creators generate high resolution short-form videos with wide-ranging cinematic effects and visual styles. Not only does this enable greater productivity gains for existing creators, but the new feature will also improve video production accessibility for more people and expand YouTube’s content slate, critical for its business.

Massive Revenue Share Gain Prospects for Google Cloud

Google Cloud was the showstopper during the company’s Q3 earnings update. It was a blowout quarter for the segment, with Google Cloud revenue growing 35% y/y to $11.4 billion. Google Cloud Platform (“GCP”) continues to be the segment’s primary growth driver, with accelerating demand for its AI offerings across compute, model development, and end-market application deployment. The segment’s outperformance was further complemented by continued strength in Google Workspace uptake, which was evidenced in the offering’s increased average revenue per seat observed in Q3.

Google Cloud also expanded its operating margin by an eye-watering six percentage points sequentially to 17% in Q3. This continues to highlight substantial margin accretion in the increasing mix shift towards AI-related revenue contributions.

As discussed in a previous coverage, Google Cloud remains a key beneficiary of enterprise cloud spend optimization and multi-cloud adoption trends. And we believe Google Cloud’s increasing diversification strategy represents a key competitive advantage against its leading rivals Microsoft Azure (MSFT) and Amazon Web Services (AMZN) amid enterprise spending optimization trends.

On the hardware front, Google was one of the first to hone in on in-house developed processors to complement merchant GPUs offered by chipmakers like Nvidia (NVDA) and AMD (AMD). Its sixth generation Trillium TPU incorporates high bandwidth memory (“HBM”), making it a competitive choice against popular next-generation accelerators like Nvidia’s H200. Trillium instances also boast competitive cost efficiencies – it can deliver almost 5x better peak compute performance per chip, while enabling substantial energy efficiency of more than 67% when compared to instances run on its predecessor.

By offering a diverse portfolio of instances runs on in-house developed silicon and merchant accelerators, Google Cloud can better penetrate enterprise end-market opportunities. For instance, Midjourney currently trains on Google TPUs, and serves its workloads on Nvidia GPUs – both on Google Cloud. The example exhibits how Google’s diversified infrastructure not only improves its reach into a wider range of enterprise users with different cost and performance needs. Its diverse portfolio also attracts demand by helping end users better optimize their workloads.

In addition to diversification in infrastructure and hardware, Google Cloud is also expanding its model capabilities to better address different end-user needs in the ongoing AI transformation. As discussed in a previous coverage, Google’s strategic deployment of its proprietary Gemini model via different sizes curated for specific use cases is a prime example of diversification to help end-users better optimize their workloads. This has also optimized Google’s penetration into AI use cases across all platforms and industries, which is corroborated by the cloud unit’s impressive outperformance in recent quarters. Paired with other popular industry models offered through Vertex AI, and Google’s multimodal analytical capabilities through BigQuery, the Cloud unit’s diverse set of AI offerings is effectively deepening its reach into the AI-expanded cloud TAM.

Google Cloud’s diversification strategy also appeals greatly to the underserved cohort of small enterprises, which are typically more price sensitive. This is consistent with GCP’s reputation as the leading secondary public cloud vendor, with enterprise customers citing the platform’s diverse offering portfolio as a key plus. We believe Google Cloud’s diversification strategy serves as a competitive advantage in encouraging greater migration to the cloud as well – especially among smaller enterprises. This will accordingly reinforce Google Cloud’s capture of emerging IT spending intentions in the longer-term, and effectively narrow its revenue share gap from rivals Azure and AWS further.

Fundamental Considerations

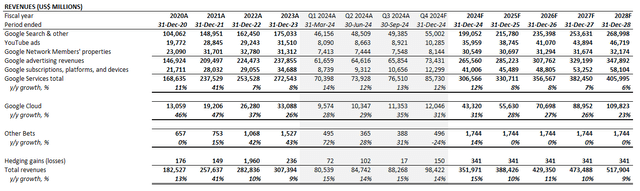

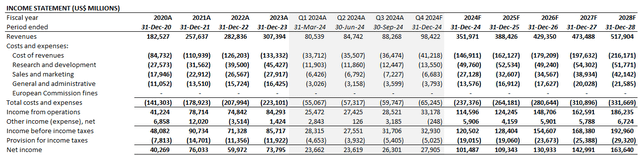

Adjusting our previous forecast for Google’s actual Q3 performance and outlook, we expect the company to grow revenue by 15% y/y to $352.0 billion this year. This remains largely unchanged from our previous estimates since April.

Google Search and YouTube will continue to benefit from secular tailwinds in digital advertising, especially given the two platforms’ industry-leading reach and engagement rates. This demand will be furthered by incremental efficiency gains unlocked to advertisers through Google’s proprietary AI tools for content and campaign asset creation. Meanwhile, Google Cloud will remain the key growth driver ahead, as the unit’s diverse offerings portfolio across infrastructure, research and foundation models, and end-user applications continue to expand and ramp.

The increasing mix shift towards Google Cloud revenue, driven primarily by AI contributions, will likely unlock sustained margin accretion over the longer-term as well. Admittedly, Google Cloud operating margins continue to trail those of Google Services’ significantly. But the accelerating scale of Google Cloud deployments enabled by secular AI transformation trends will underpin the company’s sustained long-term trajectory of profitable growth. This is already evident in the substantial sequential operating margin expansion observed at Google Cloud during Q3, despite the unit still being in the early stages of AI monetization.

Valuation Considerations

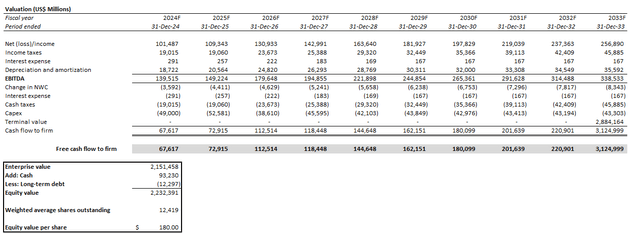

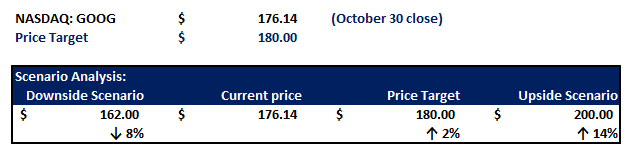

Our base case price target remains unchanged for Google at $180 apiece. Despite the company’s latest earnings outperformance, and our confidence in Google’s diversification strategy in monetizing emerging AI opportunities, we believe the materialization of new catalysts are needed to drive a further re-rate.

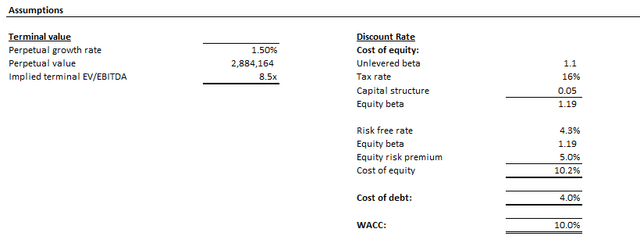

Author

The base case price is derived under the discounted cash flow approach, which considers projections in line with the fundamental analysis discussed in the earlier section. A 10% WACC is applied, alongside an estimated perpetual growth rate of 1.5% on terminal cash flows. The valuation assumptions applied are reflective of Google’s capital structure and risk profile, as well as its terminal steady-state growth trajectory, in our opinion.

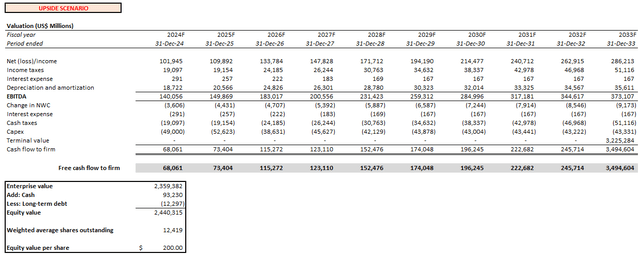

Upside Scenario with Reasoning AI

In the upside scenario, we believe Google can reach $200 apiece. The upside scenario valuation considers an upward re-rate to Google’s fundamental trajectory, which, we believe, will materialize should its diversification strategy observed in AI monetization continues to ramp with additional growth drivers. This includes the potential introduction of “reasoning capabilities” – even in public preview – to Google’s slate of proprietary foundation models, which would complement its competitive advantage in multi-modal capabilities.

Specifically, reasoning currently represents the next step in ongoing industry developments towards artificial general intelligence – the type of AI that would reach parity with human capabilities. The latest development in reasoning AI includes OpenAI’s introduction of its o1 model in September.

But substantial roadblocks remain in the development of reasoning AI capabilities. They include the high costs associated with reasoning AI models’ intensive compute needs, as well as limited access to relevant training data. And Google has the capabilities to address said roadblocks and carve out an edge on this front, given its years of leadership in AI research and the development of supporting hardware. Despite its historically conservative pace in rolling out innovations, Google is unlikely behind on its development of reasoning AI capabilities. This makes the emerging development a potential impending catalyst for jumpstarting the stock’s next leg of re-rate.

Conclusion

Admittedly, Google faces intensifying competition, with the advent of generative AI still presenting risks of disruption to its core native search business. Yet, the company’s continued AI leadership continues to demonstrate capabilities in not only mitigating the impact of said risks, but also unlocking incremental modernization opportunities in the digital transformation.

AI remains a critical lever for Google Cloud, especially, to gain market share and diminish the leadership gap long held by its rivals Microsoft Azure and AWS. It is also transforming its core digital advertising business for the better by furthering efficiencies in how content and campaign assets are created and deployed. Taken together, we believe Google remains a long-term AI beneficiary. However, unlocking the pent-up valuation gains attributable to Google’s AI prowess will likely require further materialization of its innovative pipeline associated with the nascent technology.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.