Summary:

- I have raised my price target for Alphabet Inc. to $302 per share, reflecting a 69% upside potential from its current level.

- Alphabet’s Q3 2024 performance was robust, with a 15% revenue increase driven by Google Cloud and AI-powered services, despite challenges in Search and YouTube.

- Google faces significant regulatory scrutiny and competition in the search market, but its AI and cloud investments are key growth drivers.

- “Other Bets” like Waymo and Wing add long-term value despite current losses, showcasing Alphabet’s innovation and operational efficiency.

SpVVK

Overview

In my previous article about Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) (NEOE:GOOG:CA), I set a price target of $210 per share. Since then, the stock price has remained flat, with Standard & Poor’s growing 12.7%. The main reason for this gap is that in July, the court ruled that Google used illegal tactics to keep its search engine monopoly, joining several other cases.

Considering those events but appreciating the efforts of the company to lead the AI market more clearly than in my previous article, I raise the target price to $302 per share, a 69% premium over its current stock price.

3Q 2024 financial performance

Alphabet Inc. reported robust Q3 2024 performance, with revenue up 15% year-over-year to $88.3 billion, driven by strength with a 35% rise in Google Cloud revenue. The growth in Google Services, including Search, YouTube Ads, and subscriptions, was supported by strategic investments in AI and product expansion. However, growth has decreased in Search and YouTube, a concern for me. Total Search ad sales were $65.9 billion in the third quarter, an increase of 10.4% from the same period a year earlier. That compares with 11.1% growth in the second quarter.

The company’s operating income grew by 34%, and its margin improved to 32%, with net income reaching $26.3 billion. These gains reflect strong topline growth, disciplined cost management, and efficiency gains. “Other Bets” like Waymo and Wing made progress, but still reported a $1.1 billion loss.

Alphabet invested $13 billion in CAPEX for infrastructure and expects similar spending in Q4. The company also returned $15.3 billion in share repurchases and $2.5 billion in dividends.

Search Business

One of the key points I consider relevant to analyze about Google is the search market. Google’s dominance in the $300 billion search ad market is under pressure, with its U.S. market share set to drop below 50% next year (Figure 1), a significant shift after years of leading the industry. Rising competition from Amazon (expected to grow to 22.3% share), emerging AI start-ups indicates that Google’s once-dominant position is being eroded by new, innovative players capturing search budgets.

TikTok’s new search ad targeting and Perplexity’s AI-generated ads are gaining advertiser attention, particularly among younger demographics, posing real risks to Google’s core revenue. Losing one percentage point of market share means almost losing $1 billion. Meanwhile, Microsoft Bing is also making strides in the AI ad space, which could further challenge Google’s hold on this market, but as I analyzed in a previous article about Microsoft, it hasn’t been relevant so far.

As a consequence of those difficulties, Google recently changed its leadership, putting long-time executive Nick Fox in charge of the company’s main money-making areas, like search, ads, and maps.

After those challenges, I believe Google will maintain its position, maybe losing some more market share, but not more than 2-3 percentage points. Google’s efforts to integrate ads into AI-generated summaries reflect its resilience and adaptability, two characteristics I value in the company.

Circle to Search, AI Overviews, and Lens illustrate its innovation capacity. Management says that AI Overviews get high satisfaction scores, which is increasing engagement. They also mentioned that AI Overviews are “making money at rates similar to traditional ads, with opportunities to better monetize new areas of search.”

YouTube

YouTube made $8.9 billion in ad sales from July to September, 12.2% higher than last year. This was slightly less than the 13% growth in the previous quarter. The reason is that Shein and Temu (Figure 2), two of Google’s top advertisers, spent less on U.S. ads from July to September this year compared to the same time last year.

Temu’s aggressive ad spending has significantly impacted growth in ad expenses across major platforms like Google and Meta. In 2023, Temu became one of Google’s top five advertisers, joining other fast-growing e-commerce players like Shein. This increased competition has driven up digital ad prices, which benefits Google by helping to rebound from the prior advertising slowdown.

This headwind is compensated by YouTube Shorts’ good performance, a direct competitor to Meta and TikTok. YouTube Shorts keeps growing fast, with more than 70 billion views daily. The difference in ad earnings between Shorts and regular YouTube videos is shrinking, especially in the U.S.

Other Bets

After several years of efforts to make Waymo a reality, I think it is already getting traction. Waymo is valued at more than $45 billion in the latest round of funding. Waymo is now managing almost 150,000 paid driverless car trips in California (Figure 3). It operates around 300 vehicles in San Francisco and 400 in other locations.

Waymo’s rollout in Phoenix, San Francisco, and Los Angeles, as well as partnerships with Uber in Atlanta and Austin, are solidifying its position in taxi-autonomous driving well ahead of Tesla (TSLA).

Figure 3

The drone delivery unit of Google’s parent Alphabet, Wing, is another promising bet that would pay off in the long term, my investment approach. The operation is getting 100,000 customer deliveries. It started in Logan (Australia) and extended to New Orleans, Manchester, England, and Florence, Italy.

Both units and others are dragging value with a $1.1 billion loss, but for me, it is an optionality, a characteristic I value in a company. This optionality is related to the core business as it deals with autonomous driving that is related to AI and operating systems (Android).

Cost Management

The company is efficiently reorganizing itself around AI efforts. That has two dimensions. First, the whole company aligns with AI efforts, simplifying the company.

Secondly, Google is using AI to reduce costs. According to management in the last earnings call: “AI generates more than a quarter of all new code at Google, then reviewed and accepted by engineers.” Besides, it allows Gemini teams to be more productive in improving the AI model, and this improved model makes the team even more productive, reinforcing a positive loop with great efficiency. Even Google was one of the first companies to design its proprietary AI chips, what they call TPUs, which let them save money with respect to 100% of Nvidia’s GPUs.

Those improvements are reflected in the income statement. Gross margins improved from 56.7% in 3Q 2023 to 58.7% in Q3 2024, and operating income improved from 27.8% to 32.3% in the same period.

Antitrust Allegations

Google is facing multiple allegations that are pressuring its business practices. A federal judge recently ruled that Google used illegal tactics to keep its search engine monopoly, revealing that Google paid Apple $20 billion in 2022 to stay the default on Apple devices.

There are other cases pressuring Google. The EU is investigating Google’s app store practices again, adding to Google’s regulatory pressure. The company also faces an antitrust trial in September for allegedly monopolizing digital ad technology, with the Justice Department accusing Google of manipulating ad auctions and forcing clients to use its products. In addition, Google is awaiting a California court’s decision on changes to its app store business after losing a case with Epic Games, which it plans to appeal.

These are headwinds that harm Google in several ways. There are so many cases that the main risk is management’s attention dispersion. Microsoft has recognized that when they lost the Justice Department’s landmark antitrust case in 1998, they lost the mobile operating system battle against Google’s Android. The AI battle is what is at stake this time.

Allegations of a search engine monopoly could be substantial. If 63% of US searches are mobile and the iPhone market share in the U.S. is 55%, 34% of Google’s business could disappear. It sounds astonishing, but Google is going to appeal, and its final resolution will take years.

Valuation

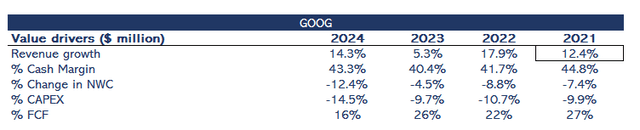

Figure 4 shows the company’s value drivers, considering a year as the last four quarters to capture the latest information. Regarding margins, I utilize a measure I call Cash Margin, which involves adjusting net income for non-cash items such as amortization and depreciation, stock-based compensation, and deferred income tax.

I estimate Google’s efforts on AI will enhance its services and grow its revenue by 14% per year over ten years. In this assumption, I consider that the business will increase its revenue while the base grows; that is, the growth is exponential. Just to give the context, that is an aggressive assumption.

I could model the antitrust allegation that it is suffering, as I described in the last section. As I have outlined, the impact could be high in the long term. I don’t consider it in my model because Waymo and Wing’s optionalities offset the judicial effects. I don’t model both due to their high uncertainty and long-term nature, and they are opposite in impact.

I conservatively project cash margins at 43% during the ten-year range of my model. I consider it conservative because, as I have outlined, AI productivity improvements coupled with the company’s cost discipline will reduce costs. One of the main advantages of AI is coding.

CAPEX investments will remain at their current high levels of 15% until 2029 and then be reduced to 8%. Technology and scale will reduce pressure on investment. Energy sources and GPU prices will decrease over the years.

Cash flows will be discounted at an 8.2% WACC because the beta is 1.03. The risk-free rate is 3.8%. The company’s leverage is 6% of total capital. Perpetual growth rate is set at 3%.

As shown in Figure 5, my value estimate is $302 per share, an 69% premium over its current stock price. My implied multiple Price to Free Cash Flow is 66, which means that I will keep growing the multiple to a level not seen in the last ten years (Figure 6). My valuation supports the core idea that Google will be one of the leaders in the AI market and that this market will generate added value.

Conclusion

Alphabet Inc. faces significant challenges with rising regulatory scrutiny and growing competition in its search and advertising business. Despite these headwinds, the company’s efforts in artificial intelligence and cloud services are drivers for future growth. Recent financial performance was solid. Revenue growth was 15% year-over-year due to Google Cloud and AI-powered services. Margins have improved, and the company keeps investing in data centers to support AI expansion.

Considering the resilience shown in Q3 2024 and the efforts to lead the AI market, I have revised my price target for Alphabet from $210 to $302 per share, reflecting a 69% upside potential from its current level. This target is based on Alphabet’s ongoing innovation, strong operational efficiency, and the optionality provided by its “Other Bets” ventures, which add long-term value despite current losses.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in GOOG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.