Summary:

- The search segment remains strong as the business continues to evolve by including more AI elements.

- Combined advertising and subscription revenue for YouTube from the last 4 quarters was more than $50 billion.

- The Google Cloud operating margin went from 3% in 3Q23 all the way up to 17% for 3Q24.

TARIK KIZILKAYA

Introduction

Per my October 1 article, Google’s (NASDAQ:GOOG) (NASDAQ:GOOGL) Waymo is leading the U.S. robotaxi race. Google’s overall 3Q24 operating income and revenue numbers have come out since then and they look better than ever. The 3Q24 call was the first one with the new CFO, Anat Ashkenazi. My thesis is that Google’s increases from the last 4 years have been amazing and they are on track to continue.

Operating Income And Revenue

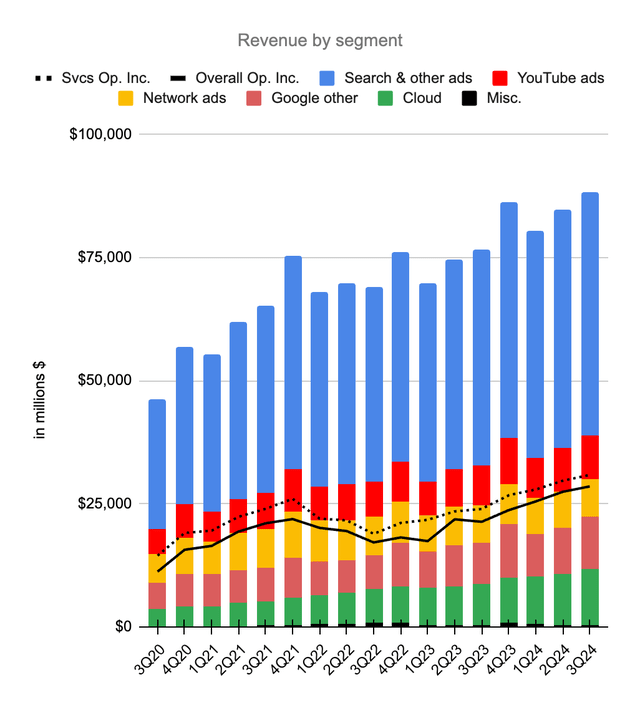

Google’s operating income growth from the last four years has been prodigious and their revenue growth has been impressive as well:

Operating income and revenue (Author’s spreadsheet)

Looking at the last four years and pulling numbers from the 3Q20 10-Q and the 3Q24 release, overall quarterly operating income went up 154% from $11,213 million in 3Q20 to $28,521 million in 3Q24. This was on revenue growth of 91% from $46,173 million in 3Q20 to $88,268 million in 3Q24. One of the reasons we’re poised for continued growth in the years ahead is because Google Cloud has gone from hurting overall operating income to boosting overall operating income. Back in 3Q20, Google Cloud was a drag on overall operating income because the segment had operating losses of $1,208 million. In this last 3Q24 period, the segment contributed $1,947 million in operating income.

Search

Years ago people said Amazon’s Alexa would replace Google search because people could just ask Alexa for diapers or other items without using a search engine. More recently people said ChatGPT would replace Google search. Neither happened in a meaningful way. Google now shows Gemini AI Overview results along with legacy search results and we see them here with advertisers such as Home Depot (HD):

In the 3Q24 call, CEO Sundar Pichai talked about the way the cost of AI Overviews has come down over the last 18 months and I expect cost reductions to continue (emphasis added):

We are also doing important work inside our data centers to drive efficiencies while making significant hardware and model improvements. For example, we shared that since we first began testing AI Overviews, we have lowered machine cost per query significantly. In 18 months, we reduced cost by more than 90% for these queries through hardware, engineering and technical breakthroughs while doubling the size of our custom Gemini model.

Senior VP Philipp Schindler was also excited about the search business in the 3Q24 call, saying AI will revolutionize things (emphasis added):

We’re now seeing that people find ads directly within AI Overviews helpful because they can quickly connect with relevant businesses, products and services to take the next step at the exact moment they need. As I’ve said before, we believe AI will revolutionize every part of the marketing value chain.

It isn’t just a matter of increasing revenue by getting more searches. Senior VP Schindler explains in the 3Q24 call how Google increases revenue from the same number of searches as they use AI to make the advertising process more efficient:

Let’s start with creative. Advertisers now use our Gemini-powered tools to build and test a larger variety of relevant creatives at scale. Audi used our AI tools to generate multiple video image and text assets in different links and orientations out of existing long-form videos. It then fed the newly generated creatives into demand gen to drive reach, traffic and booking to their driving experience. The campaign increased website visits by 80% and increased clicks by 2.7 times, delivering a lift in their sales. Last week, we updated image generation at Google Ads with our most advanced text-to-image model, Imagine 3, which we tuned using ads performance data from multiple industries to help customers produce high-quality imagery for their campaigns. Advertisers can now create even higher-performing assets for PMax, Demand Gen app and Display campaigns.

AI also helps advertisers with measurement and Senior VP Schindler talked about the ways Google’s Meridian tool is being rolled out:

This quarter, we extended availability of our open source marketing mix model, Meridian to more customers, helping to scale measurement of cross-channel budgets to drive better business outcomes.

Later in the 3Q24 call, Morgan Stanley (MS) Analyst Brian Nowak asked about AI search products. CEO Pachai mentioned Circle to Search along with AI Overviews which has gone out to more than a billion users (emphasis added):

Look, it’s been an extraordinary year of innovation. I mentioned in my remarks about Circle to Search Lens now with video search approaching over 20 billion queries a month and obviously, AI Overviews. And with each of these changes, we are definitely expanding what’s possible in search. And it’s been really heartening to see users adapt. They understand they can ask more queries. They come back more often. And so – and we have seen growth there.

YouTube

CEO Sundar Pichai praised YouTube in the 3Q24 call, saying combined ad and subscription revenue from the last four quarters exceeded $50 billion for the first time. Trailing twelve months (“TTM”) YouTube ad revenue was $34.9 billion or $25,674 million + $31,510 million – $22,310 million. This means TTM YouTube subscription revenue was at least $15.1 billion! For comparison, Netflix (NFLX) had TTM revenue of $37.6 billion or $8,833 million + $9,370 million + $9,559 million + $9,825 million per their 3Q24 letter.

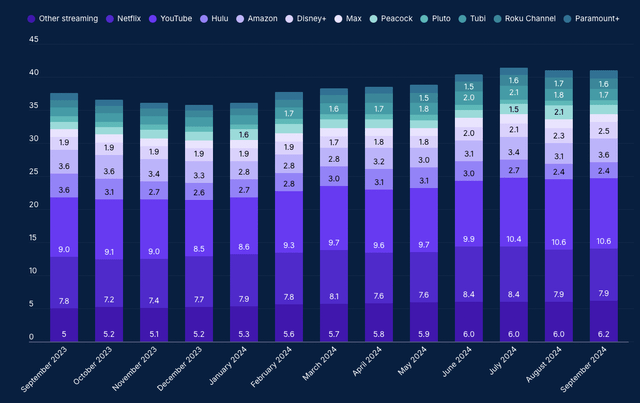

Per Nielsen’s The Gauge, streaming in the US went from 37.5% of TV time in September 2023 up to 41% in September 2024. YouTube increased from 9% of TV time up to 10.6% during this time:

YouTube US share (Nielsen’s The Gauge)

Like Netflix, YouTube will continue growing as users switch away from linear tv. Also, YouTube will increase revenue per viewer as their AI efforts improve the efficiency of advertising. This means YouTube operating income and revenue should continue growing in the years ahead.

Cloud

In many ways Google Cloud has been the most impressive segment in recent years. I don’t think AWS (AMZN) and Azure (MSFT) have a history of hubris but they are absolutely paying attention to Google Cloud now. Again, four years ago in 3Q20, Google Cloud had operating losses of $1,208 million on revenue of $3,444 million. In 3Q24, Google Cloud had operating income of $1,947 million for a 17% margin on revenue of $11,353 million. This was also a huge YoY improvement as operating income grew 632% from $266 million and revenue grew 35% from $8,411 million. Just a year ago the 3Q23 operating margin was a mere 3%. CFO Ashkenazi said the following about the Google Cloud margin in the 3Q24 call (emphasis added):

The operating margin expansion was driven by strong revenue performance across cloud AI products, core GCP and Workspace, as well as ongoing efficiency initiatives.

As customers keep finding more use for Google Cloud, segment revenue scales up and segment operating margins improve. In the 3Q24 call, CEO Pichai explained how customers are using Google Cloud products in five different ways. The types of anecdotes he cites should soon be repeated with other customers as growth continues. First is the AI infrastructure where Google offers both their own TPUs and Nvidia’s (NVDA) GPUs. Second is Vertex, Google Cloud’s enterprise AI platform. Snap (SNAP) saw over 2.5 times as much engagement using Gemeni’s multimodal capabilities. The third way customers are using Google Cloud products is with Google’s data platform, BigQuery. Multimodal data analysis takes place regardless of storage location with ultra-low latency access to Google’s Gemeni. Lloyd’s of London syndicate, Hiscox, has used this setup to reduce the time it takes to code complex risks from days to minutes. The fourth way is with cybersecurity solutions powered by AI. The fifth way is with the new customer engagement suite. Volkswagen of America uses this suite to power their new myVW Virtual Assistant.

During the 3Q24 call, JPMorgan (JPM) Analyst Doug Anmuth asked about infrastructure advantages and capex efficiencies arising from Google using their own TPU hardware for AI. CEO Pichai has always been bullish on Google’s TPUs and he responded by saying they are on the sixth generation on the TPU front. CFO Ashkenazi chimed in as well and then CEO Pichai added thoughts on flash pricing:

The one other thing I would add on the – Doug, on your first part of the question on the TPUs is if you look at the flash pricing we have been able to deliver externally, I think – and how much more attractive it is compared to other models of that capability, I think probably that gives a good sense of the efficiencies we can generate from our architecture.

Evercore (EVR) Analyst Mark Mahaney asked about the cloud margin expansion and CFO Ashkenazi answered as follows (emphasis added):

The first is scale. Obviously, as we scale the business, we have more opportunity for margin expansion. But the second, and shouldn’t be underestimated is the work the team has done to drive efficiencies across the cloud business, and we’re seeing those come through, whether it’s through headcount management or facilities management, other process efficiencies. We’re seeing that go to the bottom line and driving the results you’re seeing this quarter.

There is more room for margin expansion and revenue growth in this segment as we make comparisons with Google Cloud’s bigger cousin, AWS. Looking at the Amazon 3Q24 results, AWS had operating income of $10,447 million for a 38% margin on revenue of $27,452 million. Additionally, AWS had YoY revenue growth of 19.1% from the 3Q23 figure of $23,059 million. In some ways the hyperscale cloud business reminds me of the early days at Netflix (NFLX). Cash investments in original content heavily exceeded amortization and depreciation for Netflix but we trusted management and they were right about the investments being smart. Management at hyperscale cloud companies tells us cash spending on AI is a good investment and I think they are right but we won’t know for sure until the business is more mature.

Waymo

Waymo has been busy this year as they scale up the number of weekly robotaxi rides for paying customers in the US:

|

Period |

Weekly Rides |

|

May |

50,000 |

|

Aug |

100,000 |

|

Oct |

150,000 |

I know of no other company offering a significant number of driverless rides to paying customers in the US at this time.

In the 3Q24 call, CEO Pichai said Waymo has multiple paths to market (emphasis added):

Waymo is now a clear technical leader within the autonomous vehicle industry and creating a growing commercial opportunity. Over the years, Waymo has been infusing cutting-edge AI into its work.

In the 3Q24 call, Goldman Sachs (GS) Analyst Eric Sheridan asked about key learnings as Waymo has rolled out to additional cities. CEO Pichai answered by talking about options with the“driven by Waymo” model (emphasis added):

We’re also striking partnerships in newer and unique ways. Hence, the Uber partnership and expansion to Austin and Atlanta. And we have more options where we are looking at the driven by Waymo model with other network partners, fleet managers, et cetera.

Waymo’s October 30 blog post says they have been at the forefront of AI and ML in autonomous driving for over 15 years and it links to a research paper on End-to-End Multimodal Model for Autonomous Driving (“EMMA”). This part got me thinking about other uses for Waymo’s AI such as robotics:

The significance of this research extends beyond autonomous vehicles. By applying cutting-edge AI technologies to real-world tasks, we are expanding AI’s capabilities in complex, dynamic environments. This progress could lead to AI assisting in other critical areas requiring rapid, informed decision-making based on multiple inputs in unpredictable situations.

Valuation

It isn’t just a matter of operating income and revenue increasing the last 4 years. Capital has been returned to shareholders in the form of buybacks. The 3Q20 10-Q shows 300,643,829 A shares plus 45,915,231 B shares plus 329,867,212 C shares for a pre-split total of 676,426,272 shares. There was a 20:1 split in 2022 so this was the equivalent of 13,529 million shares. The 3Q24 10-Q shows we now have 9.5% fewer shares as today’s total is just 12,241 million shares.

One obvious risk for today’s valuation is the regulation landscape. If parts of Google are forced to be split off then I’m optimistic it will be similar to what happened with AT&T (T) back in the day when the sum of the parts was still valuable.

Much of Google’s valuation depends on the world consistently investing in AI. The dot com bubble burst in 2000 when internet investing paused and I’m optimistic AI investing will be smoother. Critics say AI hasn’t really led to anything substantial but CEO Pichai mentioned the Nobel Prize in the 3Q24 call (emphasis added):

Turning to research. Our team at Google DeepMind continues to drive our leadership. Let me take a moment to congratulate Demis Hassabis and John Jumper on winning the Nobel Prize in chemistry for their work on AlphaFold. This is an extraordinary achievement and underscores the incredible talent we have and how critical our world-leading research is to the modern AI revolution and to our future progress. Also, congratulations to Jeff Vinton, who spent over a decade here on winning the Nobel Prize in physics.

One area of concern with valuation is the way overall free cash flow (“FCF”) lags accrual earnings. CFO Ashkenazi said the following about FCF in the 3Q24 call:

We delivered free cash flow of $17.6 billion for the third quarter and $55.8 billion for the trailing 12 months. Year-on-year free cash flow was negatively impacted by the following items. In 2023, we deferred cash tax payments from the second and third quarter to the fourth quarter. And in Q3 2024, we made a $3 billion cash payment related to the 2017 EC shopping fine. We ended the quarter with $93 billion in cash and marketable securities.

The above TTM FCF of $55.8 billion compares to TTM net income of $94.3 billion or $73,582 million + $73,795 million – $53,108 million. TTM operating income was $105.1 billion or $81,418 million + $84,293 million – $60,596 million. The main reason FCF lags net income is because capex exceeds the sum of depreciation and amortization. I’m optimistic that much of the capex is for growth as opposed to maintaining the same units. Railroads always have capex in excess of depreciation and we’re headed for disappointment if the cloud business turns out to be the same way.

Looking at the services group on the 3Q24 10-Q and the 2023 10-K, we have TTM operating income of $115.2 billion or $88,427 million + $95,858 million – $69,128 million and this came from services revenue of $297,147 million or $220,836 million + $272,543 million – $196,232 million. I think most of the Alphabet-level operating losses should be assigned to the services group. This TTM figure came to $(10.8) billion or $(7,758) million + $(9,186) million – $(6,152) million. If we adjust TTM operating income for the services group by subtracting the $10.8 billion from Alphabet-level operating losses then the adjusted operating income figure is $104.4 billion

In the past I’ve used a multiple of 18 to 20x for the services group but now I’m more optimistic given the growth we’ve seen the last 4 years such that I now use a multiple of 19 to 21x for the adjusted operating income of $104.4 billion. This gives us a range of $1,985 to $2,190 billion when rounding to the nearest $5 billion.

Google Cloud had record 3Q24 operating income of $1,947 million for a new margin high of 17% on revenue of $11,353 million. In the past I thought Google Cloud was worth 18 to 20x operating income but I am more bullish now given the way the operating margin has improved without sacrificing growth. I believe the cloud business is worth 20 to 22x the annualized operating income of $7,788 million for a range of $155 to $170 billion when rounding to the nearest $5 billion.

Waymo is the U.S. robotaxi leader by a wide margin and this is one of the reasons why I think the Other Bets segment is worth $50 to $75 billion.

My sum of the parts valuation is as follows:

$1,895 to $2,190 billion Google Services

$155 to $170 billion Google Cloud

$50 to $75 billion Other Bets

————————

$2,100 to $2,435 billion total

The 3Q24 10-Q shows October 22 share counts of 5,843 million A shares plus 864 million B shares for a consideration of 6,707 million. We multiply this by the November 1 GOOGL share price of $171.29 to get a market cap sub total of $1,148,842 million. We also have 5,534 million C shares which we multiply by the November 1 GOOG share price of $172.65 to get another sub total of $955,445 million. Adding the sub totals, the market cap is $2,104 billion. The market cap is at the bottom of my valuation range and I think the stock is a buy for long-term investors who will hold it for at least 3 years.

Forward-looking investors should keep tabs on the evolution of how people get information as AI becomes a bigger part of our world. Additionally, investors should pay attention to ongoing regulatory developments.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, GOOGL, AAPL, AMZN, MSFT, NFLX, NVDA, TSLA, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.