Summary:

- Alphabet Inc./Google provided an excellent earnings report, but the stock fell after the better-than-expected announcement.

- Google demonstrated robust top and bottom-line growth, with substantial momentum in AI and in other segments.

- Alphabet is cheap, has substantial growth and profitability prospects, and trades at a relatively low P/E ratio.

- Price projections and other factors suggest Alphabet can move much higher.

BlackJack3D/E+ via Getty Images

The last time we discussed Alphabet Inc. aka “Google” (NASDAQ:GOOG, NASDAQ:GOOGL), the stock was around its recent lows at $150, where I called it a compelling buy. More recently, Google announced an excellent earnings report for Q3 2024.

Alphabet delivered $88.27 billion in revenues, crushing the estimates by over $2 billion and registering an impressive 15% YoY growth rate. In addition, Alphabet announced strong EPS figures of $2.12, substantially more robust than the $1.85 consensus estimate. Google’s EPS result was impressive, illustrating a 37% YoY EPS increase and a solid 15% outperformance rate over the consensus estimate.

Alphabet reported an extremely robust quarter. Additionally, many of Google’s secondary businesses in AI, FSD, and other segments continue advancing, with particular progress in its Waymo (robotaxi) space. Google’s stock is inexpensive, below 20 times forward earnings, and could expand considerably as EPS and other financial metrics increase in future years.

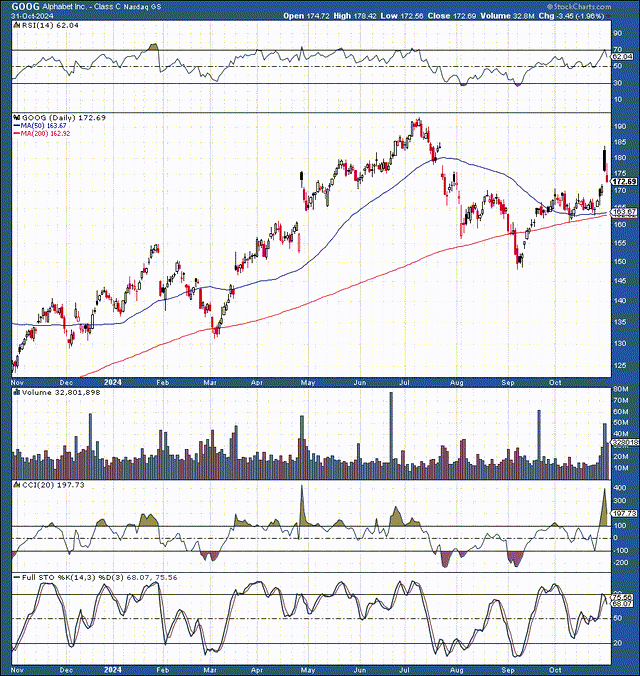

Technically — Google Is Very Bullish Now

Alphabet went through a significant correction recently, setting it up very well to move higher into year-end. Google dropped from its peak at around $193 in early July to a low of around $148 in early September. This selloff knocked the air out of Google, prompting its stock to decline by a whopping 23%. This dynamic created an excellent buying opportunity in the $150-160 range.

Now, we see a bullish inverse head and shoulders forming, implying that Google could have a considerable rally ahead. Furthermore, we recently saw Alphabet’s stock pullback post earnings, closing the minor gap at around $172, creating another buying opportunity here.

Alphabet’s Excellent Earnings Results

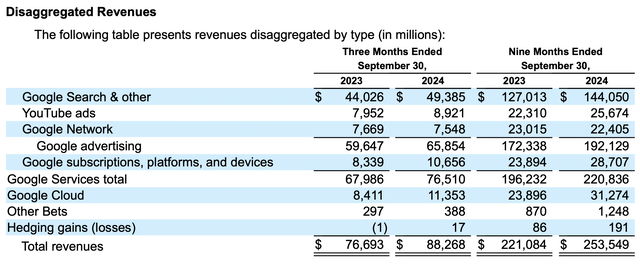

Google’s earnings were impressive, especially its cloud segment growth. Its cloud sales increased by 35% to $11.4 billion YoY. Total operating income increased by 34% YoY. However, Google illustrated its dominant market position across various segments.

YouTube ad revenue was $8.92B (12% YoY growth). In Google search/other, Alphabet’s core business reported sales of about $49.38B, a 12% YoY increase. Google’s subscription, services, and devices business grew at about 28% YoY to roughly $10.65B. This constructive growth dynamic suggests that Alphabet’s solid performance should continue, and more growth is ahead.

Analysts Upgrade Google

Google’s solid earnings announcement and its “AI prowess” have prompted analysts to reiterate or raise their price target estimates. After the recent report, Needham reiterated its buy rating and a $210 price target. Citi reaffirmed a buy rating and a $216 price target. Evercore ISI and Morgan Stanley have the equivalent of buy ratings and $205 targets. Wedbush raised its price target to $210, and Jefferies reiterated its buy rating and street-high target of $235 for Google stock.

Google’s average 12-month price target estimate is around $204, roughly 18% above its current price. Higher-end estimates ranged to $225, and Jefferies’ $235 target implies Google could appreciate by about 30-37% in the next year. Moreover, Google is around $172, close to its lowest price target estimates. This factor suggests that the downside risk could be minimal, providing investors with an excellent risk/reward opportunity.

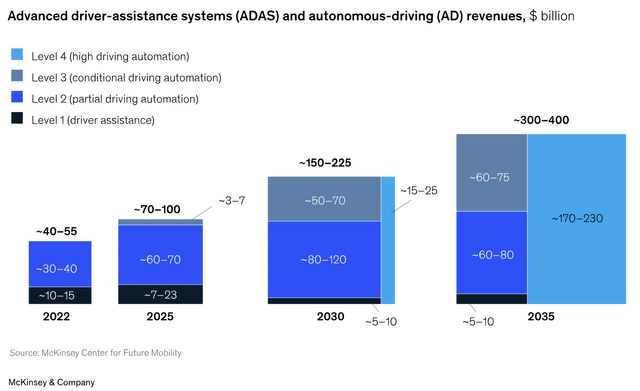

Waymo Making Advancements

Waymo now provides over 150,000 paid trips and drives over one million fully autonomous miles weekly. “The future is here, it’s growing, and it’s taking riders safely to their destinations every day,” Google says. It’s remarkable how much Google has achieved with Waymo, and we’re likely only scratching the surface here, as the future of taxis and driving will likely become increasingly autonomous.

The autonomous vehicle market/full self-driving “FSD” will likely become enormous in the next 5–10 years. Projections indicate that by 2030, the FSD market may be worth about $200B annually and could become a $300-400B market by 2035.

Waymo is a leader in this lucrative space and is one of the most advanced and best-positioned enterprises. It was recently valued at over $45B in a funding round. However, Waymo may be worth far more than the funding round implies here.

A Morgan Stanley report valued Waymo at $175B, substantially more than many estimates. The FSD market may be considerably undervalued here, providing another excellent opportunity for Alphabet to capitalize on in future years.

Buy Alphabet While It Is Still Cheap

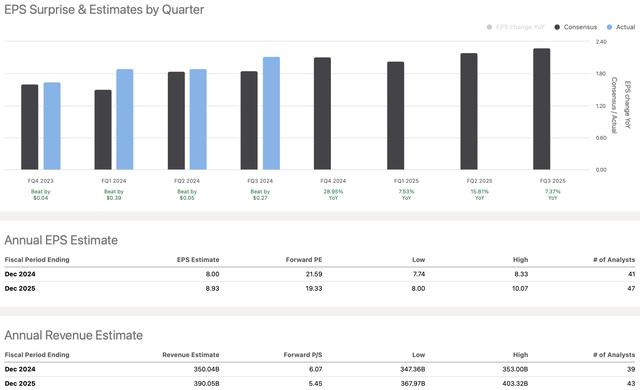

EPS vs. estimates (seekingalpha.com)

Google’s consensus EPS estimate is for roughly $9 in EPS next year. However, looking back on Google’s TTM EPS, we see that Google has outperformed the consensus estimate by 11%, delivering $7.54 instead of the anticipated $6.79 figure. Therefore, there is a high probability that Google can continue outperforming the forecast.

While 2025’s consensus EPS estimate is around $9, Alphabet could deliver earnings toward the high end of the estimate range of approximately $10, about in line with the continuation of around a 10% EPS outperformance rate.

$10 in EPS next year illustrates that Google may be trading at only about a 17 forward P/E multiple, relatively cheap for a dominant, diversified, market-leading company in the tech space with enormous growth and profitability potential.

Where Google’s stock may be in the future

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $351 | $396 | $444 | $485 | $533 | $588 | $630 |

| Revenue growth | 14% | 13% | 12% | 10% | 9% | 9% | 8% |

| EPS | $8.20 | $9.85 | $11 | $13 | $16 | $19 | $23 |

| EPS growth | 38% | 20% | 12% | 18% | 23% | 19% | 21% |

| Forward P/E | 20 | 22 | 23 | 25 | 24 | 23 | 22 |

| Stock price | $197 | $242 | $300 | $400 | $456 | $529 | $570 |

Source: The Financial Prophet.

Google’s sales and EPS growth should continue advancing as Alphabet’s core business and secondary segments are set for more growth in future years. Moreover, a more accessible monetary environment and improved global growth should help Google’s stock appreciate. Alphabet could provide substantial EPS growth. Moreover, its multiple could expand as the company moves forward. Thus, we could see Alphabet’s depressed P/E multiple grow to about 20-25 or higher. Due to this bullish dynamic, Google could reach $400-500 or higher by 2028-2030 or sooner.

Risks To Google

Google faces challenges despite my bullish assessment. Alphabet has increased competition in search, AI, cloud, and other segments. The competition is especially fierce in the search and the AI arena. Microsoft’s Bing is a threat to Google, as it has acquired more market share and has an advantage with OpenAI’s ChatGPT. Google must close its AI gap with Microsoft to prevent giving up more market share in search and other crucial segments. Google must also continue innovating to stay ahead of the curve and keep investors happy. Investors should consider these and other risks before investing in Google.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return) and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Join The Financial Prophet And Become A Better Investor!

Join The Financial Prophet And Become A Better Investor!

Don’t Hesitate! Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!