Summary:

- Google is in the middle of a reorientation and is set to take significant one-off cash adjustments for the quarter due to laying off 12,000 personnel.

- It has also pivoted its accounting model, compressing operating margins for its core business while increasing them for Google Cloud.

- Consensus has become starkly negative against the firm, with EPS estimates down 41% from their highs.

- The essence of this upcoming earnings report appears to be that Google is undergoing short-term pain for long-term gain.

Alena Kravchenko

Overview

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) is slated to release earnings for Q1 2023 this upcoming Tuesday, April 25th. Given all of the recent news around the company it is fair to say that this will be a highly watched earnings report. Furthermore, there are several unique factors that are playing into this current earnings report, including the recent accounting changes and write offs being made by Google. This article will review what investors should expect, comment on consensus, and highlight the themes and undercurrents that would have had an impact on the company over the past quarter.

Cost Reductions and Expense Reallocations

Google, like most of the tech sector, has been cutting costs. This is to say that it has been laying people off. The results of this will be apparent in this upcoming earnings report and are going to take the form of a one-time cash expense charge as well as a reduction in full-time headcount. As noted by SA, the company expects to take a $1.9-2.3B severance charge in relation to this initiative. If we take the midpoint of this figure and peg it at $2.1B, this will come out to a 9.3% one-time cost increase on last quarter’s operating expenses of $22.55B.

Alphabet has also made material changes to its stock-based compensation plan for employees. The company will now be granting restricted stock units in March of every year rather than January. Since this still falls within Q1 of each year, it is more an employee retention tactic than a true expense redistribution; employees that haven’t yet vested shares for a year are significantly less likely to leave. It is nonetheless forecast to reduce ongoing Q1 stock-based compensation expenses somewhat by management.

Google has also shifted its overall depreciation schedule, indicating a marginally longer lifespan for its server farms and networking equipment. This is expected to take the form of $3.4B reduction in depreciation expense for fiscal year 2023. Dividing that by four, we have a decrease of $850M in expenses per quarter.

Segment Reallocation and Google Cloud

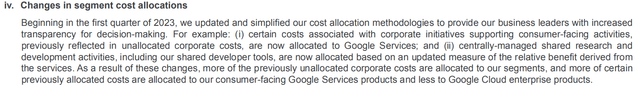

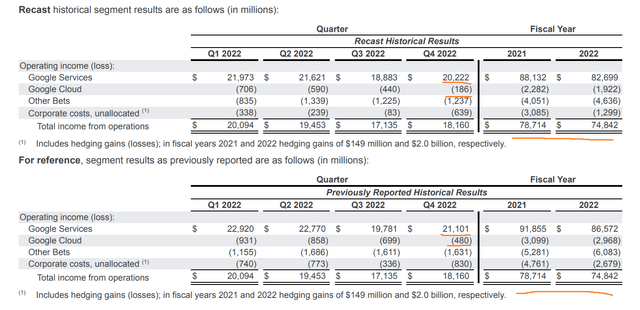

Another change for this upcoming quarter and beyond is in how Google will be allocating expenses across its operating segments. The goal is to more closely tailor computing/R&D spend to revenue generation. While this change maintains the same consolidated bottom line figure for Google’s previous financial results, it does result in two significant changes to the overall figures:

- Lower operating income/operating margin for the Google Services division

- Increase operating income/operating margin for the Google Cloud division

Under the new expense allocation plan we can see that Google Services (search/advertising) is eating more costs than before while Google Cloud is sustaining less. This has resulted in a Google Cloud division that is significantly closer to breakeven. While the previous expense distribution plan saw Google Cloud operate at a $480M loss for Q4 2022, the new plan saw it only generate a $186M loss.

What I want to stress here is that investors should not read too far into these figures; the bottom line is exactly what it was before. Even though Google Services will now have a lower operating margin, the facts on the ground haven’t changed. Additionally, Google Cloud becoming profitable one or two quarters earlier than also doesn’t change the facts on the ground. While I’m sure that this is a good shift for Google leadership to more closely track spend, it is just window dressing for investors as firm-wide figures are not changing.

Revenue Headwinds

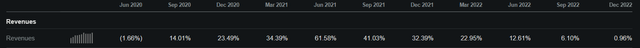

Google’s top line is expected to continue facing pressure from the deteriorating macroeconomic environment as well as ongoing pressures on digital advertising spend. This is readily apparent from the company’s revenue numbers, which showed that YoY growth for Q4 2022 was the worst since Q2 2020.

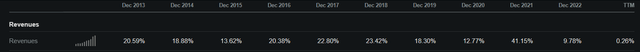

The yearly number is even more illustrative, indicating that the past year was the worst in a decade for Google as to revenue growth.

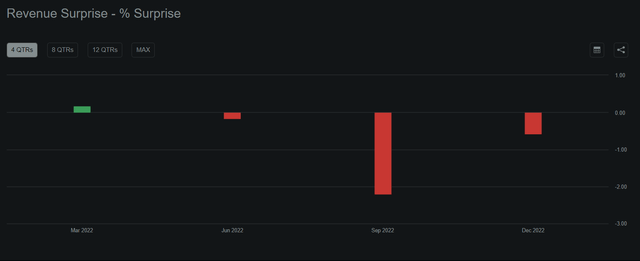

Consensus has Google growing revenues at 1.14% YoY, which I think is a fair estimation. However, I also wouldn’t be too surprised to see this dip closer to 0% or even negative. We can note that Google has surprised to the downside on revenue 3 quarters out of the last 4.

Consensus

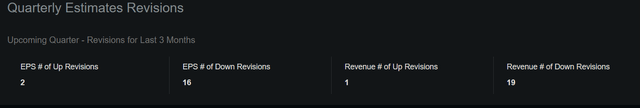

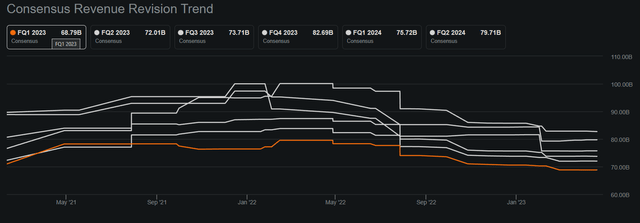

Consensus is already quite negative for Alphabet, with a steady drumbeat of downward revisions.

Overall EPS estimates have come down 41.1% from their high.

With the macro difficulties as well as the one-off adjustments, I don’t see this as misplaced and would not personally bet against consensus this time around.

Conclusion

Google is at an inflection point and this quarter’s results are set to reflect that. The company is in the middle of reorienting itself for the new economic reality in which we now find ourselves. The added expenses of this adjustment, along with ongoing weakness in the digital advertising space, should make for a relatively rough quarter.

Given the numerous adjustments around bottom-line figures, I will personally be more focused on top-line figures. Additionally, it will be interesting to see if Google Cloud is able to break through and earn a profit this quarter.

As mentioned, the main take away here is that investors shouldn’t read too far into operating margin changes across Google’s divisions. Furthermore investors should also not read too far into what it is expected to be a weak quarter. These changes are short-term pain for long-term gain; Google’s headcount reductions will allow to post much better profitability figures throughout the upcoming year.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.