Summary:

- Buyback and cost reduction will increase EPS even if revenues struggle to grow.

- The Google Cloud segment is beginning to have a positive impact on operating income.

- The hype toward ChatGPT has not prevented the Google Search segment from continuing to grow.

400tmax

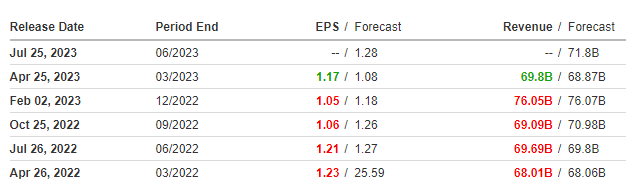

Far from an all-time high by 30% and after a series of quarters that missed analysts’ estimates, Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) this time managed to beat expectations.

- EPS was $1.17 against estimates of $1.08.

- Revenues were $69.80 billion against estimates of $68.87 billion.

Investing.com

Comment on Q1 2023

What I consider the most important aspects of this quarterly report are mainly three:

- Revenue resilience

- Re-engineering of costs

- Share repurchase

I will now show you in detail what I am talking about.

Revenue resilience

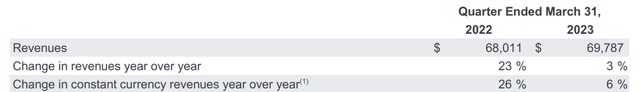

There has been no shortage of doubts about Alphabet’s revenue growth in recent months, as the current macroeconomic environment certainly does not favor more advertising spending by companies. Regardless, the company still managed to post quarterly revenue growth of 3% YoY or 6% in constant currency.

Certainly, it is not the growth rate that Alphabet has accustomed us to in recent years, but considering the current economic environment and that it is certainly not easy to grow that much when revenues reach $69.78 billion per quarter, it is not bad at all. There are size limits that necessarily have to be factored in.

In any case, Alphabet continues to grow albeit slowly.

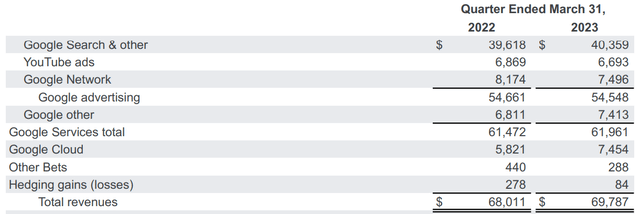

Google Search remained a gold mine and generated $741 million more revenue than in Q1 2022, chasing away all the criticism suffered in recent months related to its uselessness in front of ChatGPT. This is clearly not the case and the numbers prove it.

The Google Cloud segment continues major growth and generated $1.63 billion more than in Q1 2022. It is evident that this segment is the most attractive one in terms of growth rates, which is why the company is putting a lot of focus on it. Since it is a business that needs capital to build infrastructure and takes advantage of economies of scale, it will take time before it can make a major impact on net income as well. In any case, the news is that it has finally generated positive operating income.

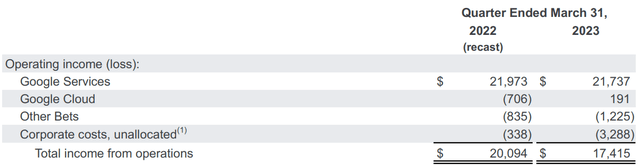

Unlike Q1 2022 where it had generated a loss of $706 million, in Q1 2023 its operating income was $191 million. This is an important result, as the cloud segment has generated major losses in recent years that have also negatively affected margins. In 2021 the operating loss was $2.28 billion and in 2022 $1.92 billion.

Overall, despite the improvement in the cloud segment, operating income was still lower than in Q1 2022. The reason is attributed to unallocated corporate costs that include charges related to employee severance and reduced office space. This is the subject of the next section.

Re-engineering of costs

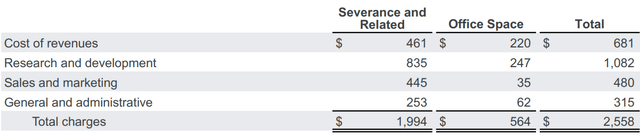

As anticipated, Alphabet is going through a cost revision phase. When revenues are struggling to increase, the only way to increase net income is to reduce unnecessary costs, and this is what is happening. Lately, this has been a common practice adopted by big tech, particularly Meta.

In any case, reducing workforce and office space comes at a cost, $1.99 billion and $564 million, respectively, for a total of $2.55 billion. While for layoffs the company has announced that it expects most of the costs to have been met, for office space reduction there may be additional charges in the future based on the company’s real estate needs.

I personally appreciate this choice by the company, as at this stage where there is little room for growth I think it makes sense to focus on streamlining the cost structure. It will be the net profit that will benefit.

Share repurchase

Alphabet’s Board of Directors has authorized the company to repurchase its Class A and Class C shares for up to $70 billion. In my opinion, a buyback of this magnitude could prove to be a smart choice for two reasons:

The first is that by reducing outstanding shares, EPS would increase assuming the same amount of earnings produced. The buyback, combined with the cost reduction could increase EPS by a lot without even needing major revenue growth. In such a difficult phase as the current one, seeing a company increasing EPS is a sign of strong resilience.

The second is that the price per share is currently quite cheap; therefore, the company could buy back a substantial amount of its own shares. In addition, Alphabet has $115.10 billion in cash, cash equivalents, and marketable securities; therefore, this is a financially sustainable operation. Not to mention the huge amount of free cash flow that is continuously generated: in Q1 2023 it was $17.22 billion.

Conclusion

Overall, I appreciate how the company is handling a not easy situation where revenues are no longer growing like previous years. In any case, by reducing costs and buying back own shares I expect EPS to be resilient even in a recession, which makes Alphabet a valid defensive choice for the portfolio. Also, with the Google Cloud segment now profitable, the company no longer has to sustain significant losses that previously worsened profit margins.

Personally, I value this company a lot, I have invested in it, and I am considering increasing my position. The criticism received in recent months and the hype toward ChatGPT have not even touched this behemoth that continues to grow in spite of everything.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not a financial advice, just my opinion.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.