Summary:

- Alphabet Inc./Google just released its second quarter earnings and beat on revenue as well as EPS.

- Going into the release, expectations were muted, with analysts expecting $1.85 in EPS, which would have been a 2.1% quarter over quarter (Q/Q) decline.

- Actual results were $1.89 per share, unchanged Q/Q and up 28% year over year (Y/Y).

- In this article, I explain why I remain bullish on Google stock after its second quarter earnings release.

Google”s New York City Headquarters In Manhattan Michael M. Santiago/Getty Images News

Alphabet Inc. (NASDAQ:GOOG), better known as “Google,” just released its second quarter earnings. The results ahead what analysts were expecting. Revenue came in at $84.7 billion, up 15%, a beat, while earnings per share (“EPS”) came in at $1.89, up 28%, also a beat.

Before its second quarter earnings release, Google stock had been getting bid up in the markets. It made a very sharp rise on Monday, when it gained more than 2% at market open. By mid-Day on Tuesday, the stock was up 0.52% from Monday’s close.

Evidently, investors were feeling optimistic about Google’s Q2 earnings release before it came out. Judging by the after-hours (“AH”) action, they weren’t disappointed. Shortly after Google’s earnings release came out, the stock rose 1.4% AH. Commentary on X suggested that investors were impressed with the release.

The second quarter release had many valuable operational highlights. The company’s Cloud segment again grew by high percentages. Subscription review (largely YouTube premium) increased. The number of employees fell by 1.2%. Overall, these developments provided hope that Google’s best days lie ahead of it.

When I last covered Google, I rated the stock a “strong buy” because of the improvements the company had been making in generative AI. At the time, many investors still thought that Google was at risk of losing market share to ChatGPT, and that its search monopoly was in danger. Today, such thoughts are not as common as they were when I addressed them. Indeed, the recent earnings release, with its strong growth, confirms what I wrote about Google having a wide economic moat. For this reason and others I’ll outline below, I re-iterate my bullish rating on GOOG stock.

Earnings Recap

Google delivered solid numbers in its second quarter earnings release. The highlight metrics included:

-

Revenue: $84.7B, up 15% (BEAT).

-

Net income: $23.6B, up 28% (BEAT).

-

Diluted earnings per share (“EPS”): 1.89, up 28% (BEAT).

-

Cash from operations: $26.6B, down 7%.

-

Search ad revenue: $48.5B, up 13.8%.

-

YouTube revenue: $8.6B, up 13%.

-

Google Cloud revenue: $10.347B, up 28.8%.

-

179,000 employees, down 1.2%.

These numbers broadly beat analyst estimates, showing that Google remains a strong player in big tech.

Particularly encouraging was the high revenue growth observed in the Cloud Computing segment. Not only was the growth high, but the segment was again EBIT profitable. This was a very encouraging result. For a long time, many investors doubted whether Google Cloud could ever become profitable, now the question is whether the segment can achieve a double-digit margin on a full-year basis. Judging by the second quarter earnings release, Google is already part of the way there.

Google AI Overviews: Cost or Opportunity?

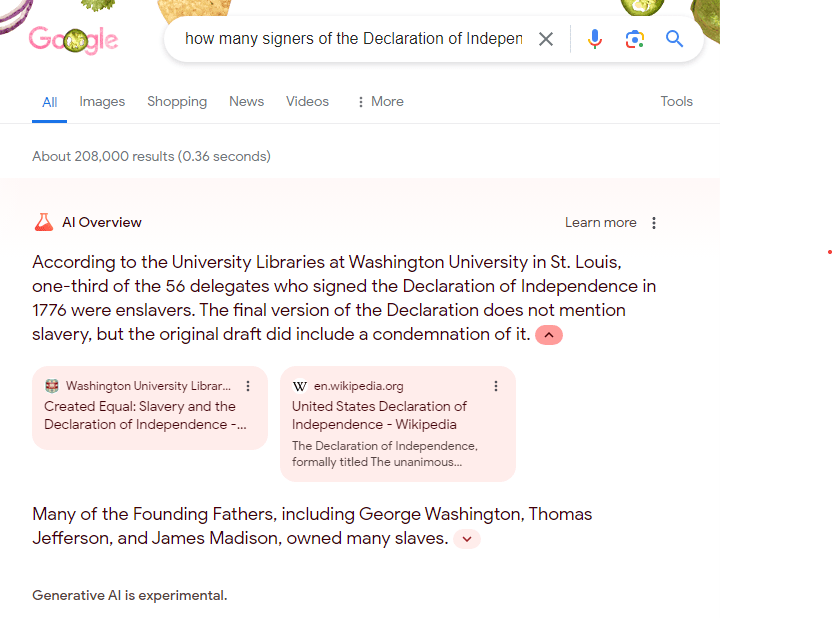

One topic I covered extensively in previous Google articles was the company’s application of generative AI. An example of this was in my most recent article, where I mentioned that the company had been receiving good reviews for its then-new AI overviews. If you haven’t seen them yet, they are the little generated texts that have been appearing at the top of Google search results for a few months now. These were received much better than Google’s Gemini ChatBot, but some analysts thought that they would reduce Search revenue because they crowded out screen real estate traditionally used to show ads. I took the opposite view, arguing that Search overviews could eventually be used to run ads themselves.

Google AI overviews (Ars technica)

With Google’s earnings release out, we can deliver a preliminary verdict:

AI overviews are not killing Google’s search revenue. To the contrary, they may be helping it! As we saw in the second quarter earnings release, Google Search revenue maintains its positive growth rate to this day. In fact, search revenue is growing by double digits! And moreover, Google has many other profitable and growing businesses (YouTube, the Cloud, etc.) that provide hope that the future will be even better than today.

Valuation

Having looked at Google’s second quarter earnings release, we can now do a preliminary valuation of Google stock. Since a new earnings release just came out, the relevant multiples need to be updated for the new information. Below, you will find Google’s three prior quarters’ earnings metrics courtesy of Seeking Alpha Quant, along with the second quarter’s numbers straight from the horse’s mouth (i.e., the second quarter earnings release).

|

Second quarter |

First quarter |

Fourth quarter |

Third quarter |

TOTALS |

|

|

Revenue |

$84.7B |

$80.5B |

$86.3B |

$76.6B |

$318.1B |

|

Diluted EPS |

$1.89 |

$1.89 |

$1.64 |

$1.55 |

$6.97 |

|

Book value |

$300.7B |

N/A |

N/A |

N/A |

$300.7B |

|

Operating cash |

$26.6B |

$28.8B |

$18.9B |

$30.6B |

$104.9B |

|

Free cash flow |

$13.4B |

$12.3B |

$7.8B |

$16.4B |

$49.9B |

Before going any further, I should give a few notes on the table above:

-

I did not “total” book value because it is a metric that doesn’t “accumulate” over time. The second quarter book value is simply the most recent book value figure, incorporating everything that happened leading up to it.

-

The most recent quarter’s share count of 12.38 billion can be used to calculate revenue, operating cash flow and free cash flow on a per-share basis.

Using the information in point two above, we can create a second table that includes full year per-share amounts as well as the multiples these produce.

|

PER SHARE METRIC |

MULTIPLE | ||

|

Revenue |

$26.5024233 |

Price/sales |

6.92766839 |

|

Diluted EPS |

$6.97 |

P/E |

26.34 |

|

Book value |

$24.29 |

P/book |

7.56 |

|

Operating cash |

$8.47 |

p/cashflow |

21.67 |

|

Free cash flow |

$4.03 |

p/fcf |

45.55 |

These remain among the lowest multiples you’ll see anywhere in big tech today. For comparison, the NASDAQ-100 index (home to many of Google’s peers) trades at 32 times earnings. The price/free cash flow multiple might look high but remember that Q4 saw a temporary decline in FCF brought on by a one-time increase in capital expenditure related to Google’s new AI investments. Over time, that multiple should smooth out.

The Big Risk to Watch Out For

On the whole, Google’s second quarter earnings were satisfactory. All the headline metrics increased on a year-over-year basis, and beat expectations. It was more than what investors wanted.

However, there is still a risk factor that investors ought to keep their eyes on:

Legal risk.

Google is currently being sued by the Department of Justice (DoJ) for paying other companies like Apple (AAPL) to make Google Search the default search on their platforms. Google spends $20 billion on this every year. The lawsuit could come with financial penalties, and would presumably make Google Search no longer the default search on Apple devices. The potential for a multi-dollar penalty is a serious risk, but it’s less clear that the cancellation of the Apple deal would be a real loss. At $20 billion per year, it costs a significant percentage of Google’s entire annual profit.

The Bottom Line

The bottom line on Google is that it’s ultra-profitable, it’s growing, and its search dominance isn’t going anywhere. As the company’s second quarter earnings release showed, it’s still one of the undisputed Kings of big tech. For my money, it’s a strong buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.