Summary:

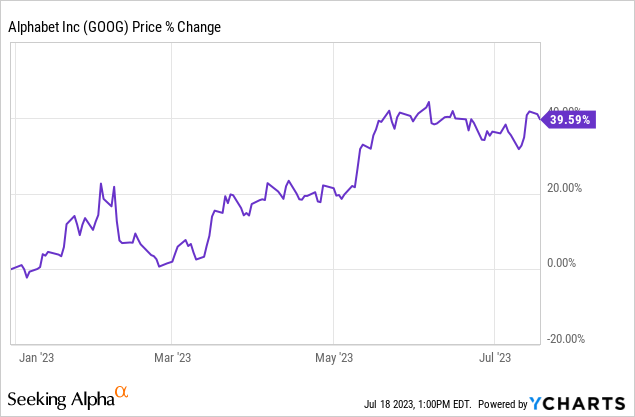

- Alphabet could be set to crush earnings expectations for its Q2 2023 report due to a stabilization of its advertising segment and favorable AI trends.

- The EPS revision trend is very positive. Easing inflation could drive a recovery in the digital ad market.

- Google likely had a strong FCF quarter and a free cash flow margin of ~20%.

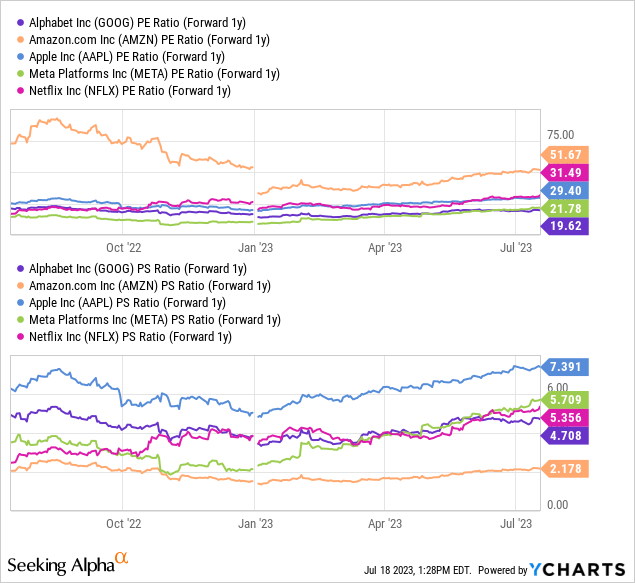

- Google’s shares are currently one of the cheapest in the group of FAANG stocks, with a P/E ratio of 20x and a price-to-revenue ratio of 4.7x.

JHVEPhoto

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) is set to release earnings next week, on July 25, 2023 and I believe the technology company could be set for a major earnings surprise. The EPS revision trend already indicates that analysts expect a decent Q2 report and the technology company could see an acceleration of its revenues quarter over quarter due to a recovery in the advertising business as well as favorable AI trends in the industry (which bodes well for Google’s Cloud business). With Google potentially also making new announcements about AI Bard possibilities in the coming week, I believe shares of Google have a very attractive risk profile ahead of the Q2 earnings release.

My expectations for Q2’23: looking for a continual revenue re-acceleration

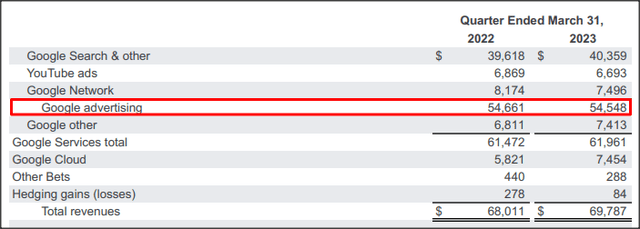

Like many other technology and advertising-focused companies, Google has suffered in the last year from a slowdown in the digital advertising market. As a result, Google’s advertising revenues fell 3.6% in Q4’22, but successively stabilized in Q1’23, suggesting that the worst is already behind the advertising market. For the second-quarter, I expect either flat or slightly growing core Google advertising revenues as the digital advertising market looks poised for a rebound.

For one thing, Meta Platforms (META) is seeing very favorable EPS revision activity, indicating that the market expects a strong recovery in the company’s core digital marketing business for Q2’23… a trend that Google would also benefit from. Meta Platforms achieves 98% of its revenues from advertising and its upside/downside EPS estimate revision ratio is 6:1.

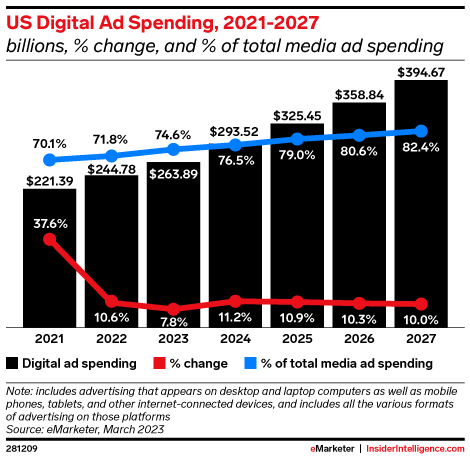

Secondly, the outlook for digital advertising spending in FY 2023 also remains overall supportive of my optimistic outlook that the market is set for a recovery. Insider Intelligence projects that U.S. digital ad spending will increase from $244.78B in FY 2022 to $263.89B in FY 2023, implying 8% year over year growth. In the last year, high inflation has weighed on the advertising sector and marketers have reduced their budgets as a result. However, inflation may no longer be a strong reason for advertisers to scale back their advertising campaigns as inflation slowed to just 3% in June, thereby removing a factor of uncertainty that has previously weighed on the digital ad spending.

Insider Intelligence’s projections for FY 2024 indicate even stronger growth (11% Y/Y) and imply that advertisers are funneling a larger share of their advertising budgets (77% as opposed to 75%) to digital marketing companies, a trend that would obviously benefit Google.

Source: Insider Intelligence

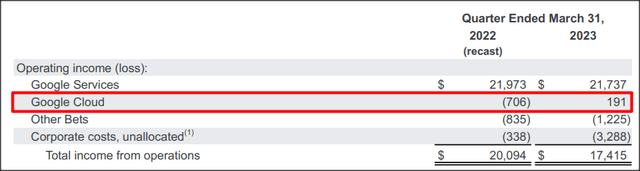

Cloud surprise potential for Q2

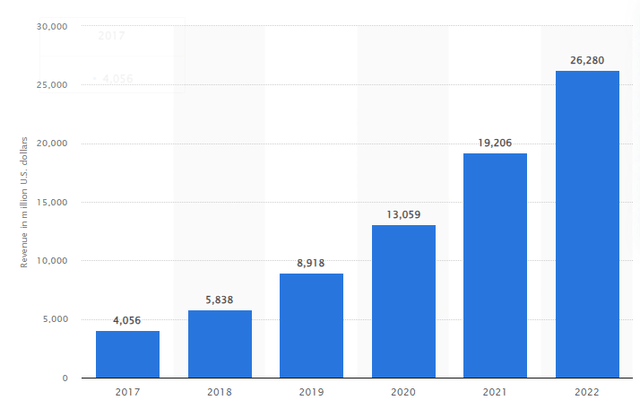

Google’s Cloud business is by far the fastest-growing segment for the technology company and the business has consistently seen double-digit top line growth in recent quarters. Google’s Cloud revenues have been in a long term upswing due to a growing number of workloads shifting to the Cloud, a trend that accelerated during the pandemic. In the last quarter, Google Cloud delivered revenues of $7.4B, showing 28% Y/Y growth.

Google Cloud achieved its first quarter of profitability (on an operating income basis) in Q1’23… which is an achievement that Google likely expanded on in Q2’23. With demand for Cloud-supported AI solutions potentially delivering a boost to Google’s Cloud growth in the second-quarter, I would not be surprised to see growing segment profitability in Q2’23.

AI is emerging as a potent growth catalyst for Cloud companies and Google is making heavy investments in this area. Google launched its ChatGPT rival Bard recently and Google could make new announcements about new monetization paths that adds new fantasy to the shares. Microsoft, as an example, heavily integrates ChatGPT into its Cloud offerings and just announced it is starting a subscription model for its AI-supported Microsoft Office package, 365 Copilot. Microsoft just made a new all-time high because of this announcement.

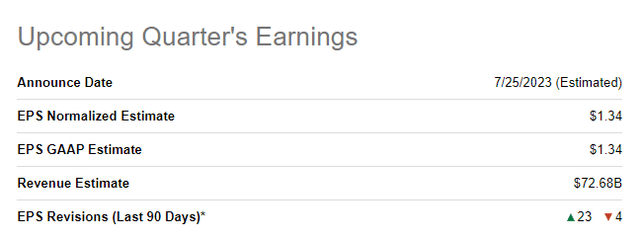

Favorable upside/downside EPS revision ratio ahead of Google’s Q2 earnings

Analysts currently expect Google to report $1.34 per-share in adjusted EPS for the second-quarter, implying 11% year over year growth. Spurred by Google’s ability to turn its top line growth around in the previous quarter, revenue estimates for Google have trended upward in the last 90 days: 23 upside EPS revisions compare to just four downside EPS revisions for Google’s upcoming second-quarter earnings sheet.

Google’s free cash flow, expectations for Q2

Google generated $17.2B in free cash flow in Q1’23 and an average of $15.5B in the last four quarters. Google achieves strong free cash flow chiefly from its advertising business and despite a down-turn in the industry in the second half of FY 2022, the firm managed to deliver free cash flow margins of around 22% (on average). Google’s free cash flow in the last four quarters generally fell into a range of $12.6-17.7B and while the second-quarter is typically not the strongest quarter for advertising companies, I do expect Google could report $14-15B in free cash flow Q2’23. Based off of current revenue expectations ($72.68B) for Q2, Google could report, at mid-point, a FCF margin of 20%… which would be only slightly below the 1-year average FCF margin.

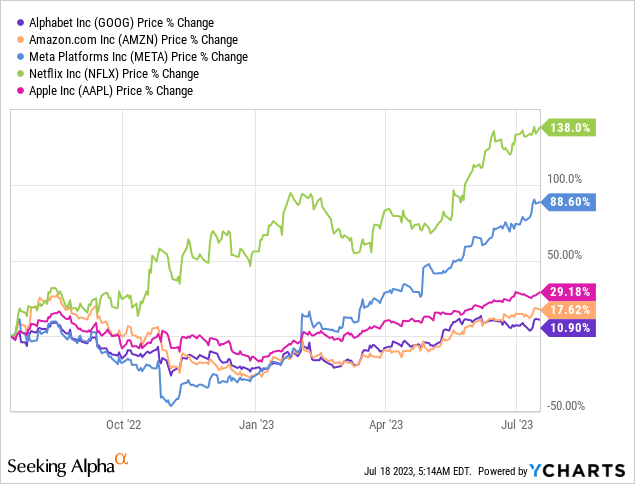

Google is lagging other FAANG stock, valuation has potential to reset after Q2

Ahead of Q2, Google is one of the cheapest FAANG stocks that investors can buy. Google has widely underperformed other FAANG companies despite offering some of the most diversified businesses (advertising, Cloud) and second-strongest free cash flow, after Apple (AAPL).

Shares of Google are currently valued at a price-to-earnings ratio of 20X and a price-to-revenue ratio of 4.7X which makes Google the cheapest FAANG stock based off of earnings and the second-cheapest based on revenues.

Considering that Google generated approximately $15.5B a quarter in free cash flow in the last four quarters and announced a $70B stock buyback in order to distribute this free cash flow, I believe Google remains the most promising FAANG stock ahead of the Q2 earnings release.

Risks with Google

The three biggest risks I see for Google are a deceleration of its top line, a slowdown in the Cloud business, which is currently the company’s growth engine, and an unexpected drop-off in free cash flow… all of which I consider to be unlikely. What would get me to change my opinion on Google is if the company saw a material deterioration in its advertising business in Q2.

Closing thoughts

Google has been a laggard in the FAANG group of stocks in the last year, but I believe Google has a strong chance to beat Q2 earnings expectations for the upcoming second-quarter due to a re-acceleration of its top line, driven by a rebound in the advertising business. Google already saw a re-acceleration of its top line growth in the previous quarter and the EPS revision trend is also very positive, suggesting that analysts also expect that the worst is behind Google. A stabilization of advertising revenues combined with continual double-digit top line growth in the Cloud business could translate into a better than expected earnings report for Google next week.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.