Summary:

- Strong Q2 results for GOOG stock were met with a sizable market correction.

- The price dip, combined with the improving fundamentals, offers an excellent entry point.

- Key return drivers include growth in its cloud service, margin expansion potential, and integration of AI into its vast product lineup.

Kenneth Cheung/iStock Unreleased via Getty Images

GOOG stock: Strong Q2 results met stock price dip

I last analyzed Google’s stock (NASDAQ:GOOG, NASDAQ:GOOGL), aka Alphabet Inc., with a strong buy rating earlier in the month. As you can see from the screenshot below, the article is titled “Google’s Accelerated Path To $3 Trillion Market Cap.” In that article, I projected,

GOOG to reach a $3 trillion market cap in about three years based on the market’s EPS growth. I then argued why I think the timeframe could be even sooner. The double-compounding mechanism – profit growth plus a shrinking share base due to aggressive buybacks – could push Google stock to $3T market cap much sooner.

Seeking Alpha

That article is thus more oriented toward the midterm, with a focus on GOOG’s capital allocation. Since then, the company has reported its 2024 Q2 earnings. Overall, I think the company has delivered another strong quarter (more on this in the next section). However, the stock price suffered a sizable correction, as you can see from the next chart after the report. To wit, its price dropped to $175 as of this writing, translating into a correction of around 10% off the peak level before the earnings report.

Given the new development described in the ER and the sizable price correction, this article will provide an updated assessment of the stock. In contrast to my previous article, this assessment will be more oriented toward the near term given the ongoing catalysts outlined in the ER. You will see why I think the price dip offers an excellent entry point for GOOG.

Seeking Alpha

GOOG stock: Q2 recap and operating margin in focus

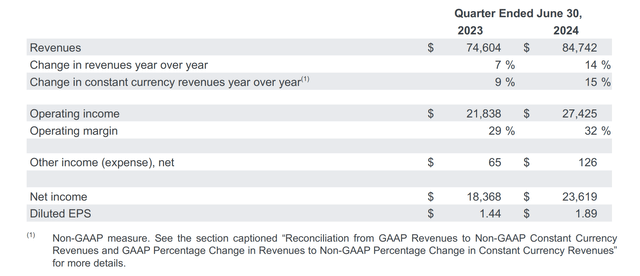

As aforementioned, the company delivered another strong quarter. It beat consensus expectations on both earnings and revenue. To wit, total revenue reached $84.7 billion in Q2 2024, translating into a YOY growth rate of 15% in constant currency. Net income grew to $23.6 billion, a 29% YOY growth. Finally, EPS grew even more, from $1.44 last year to $1.89, translating into a growth of 31% due to the share repurchases over the past year.

Google Q2 ER

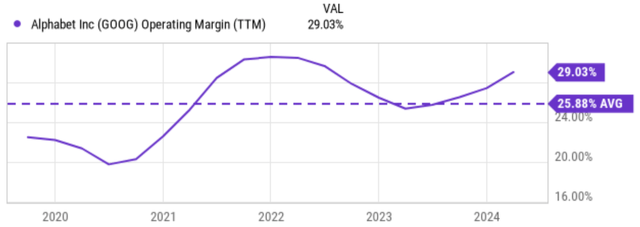

Note that net income growth outpaced revenue growth rate by a good gap, which means the margin has expanded substantially. Indeed, the company’s operating margin dialed in at 32% in the past quarter as seen, a whole 300 basis point expansion compared to a year ago.

Broadening the context a bit wider, the next chart shows its operating margin in the past five years. As seen, the current margin of 32% is not only far better than the five-year average of 25.88% but also near the peak level in at least five years. In my view, the key drivers are its cloud services and cost control efforts. As its President and Chief Investment Officer Ruth Porat commented (the emphases were added by me):

We delivered revenues of $85 billion, up 14% year on-year driven by Search as well as Cloud, which for the first time exceeded $10 billion in quarterly revenues and $1 billion in operating profit. As we invest to support our highest growth opportunities, we remain committed to creating investment capacity with our ongoing work to durably re-engineer our cost base.

Seeking Alpha

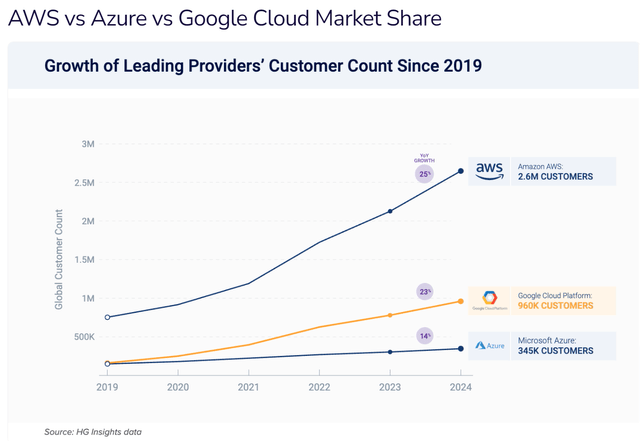

Google cloud certainly reached a milestone with $1 billion quarterly operating profit. Looking ahead, I see a robust growth curve due to a few key differentiating factors. While AWS currently is the market leader and Azure boasts vast service portfolios, Google Cloud Platform (“GCP”) stands out in at least two ways. First, GCP offers superior price-to-performance in my view. Their infrastructure, built on Google’s own network, often delivers faster data transfer and lower latency at competitive rates. As its CEO Sundar Pichai pointed out in his comment, GOOG’s “longstanding infrastructure leadership and in-house research teams” are two key strengths, and I could not agree more. Second, GCP also excels in a multitude of AI and machine learning tasks. Google’s expertise in these areas translates to powerful tools and services (like TensorFlow) that make GCP a compelling choice for businesses looking to leverage big data and artificial intelligence for innovation.

Thanks to these unique strengths, GCP’s share of the cloud market has nearly doubled in the past six years (from about 6% 2017 to 11% in 2023) as you can see from the chart below, outpacing Azure by a good margin. In the meantime, I’m impressed by the company’s efforts to “re-engineer the cost base” and keep costs under control under elevated inflation pressure and labor rates.

With plenty of revenue drivers like GCP and effective cost control, I’m optimistic that the margin will keep expanding as elaborated on next.

HG Insights

GOOG stock: Growth outlook and valuation

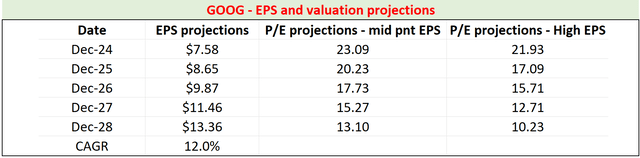

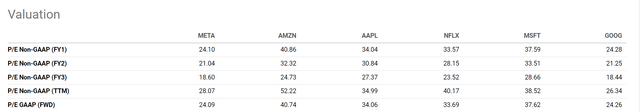

Looking ahead, the consensus EPS estimates do point to a robust growth rate for GOOG in the years to come. As seen, the estimates imply a growth rate of 12% CAGR for the next five years, translating into EPS (mid-point of the estimates) growth from $7.58 in 2024 to $13.36 in 2028. Such a growth curve implies an FY1 P/E of 23x, which would then shrink to 13.1x only in five years. Given variance in the estimates, the implied FWD P/E is even lower based on the high end of the EPS estimates as seen (only about 10x in five years).

Seeking Alpha

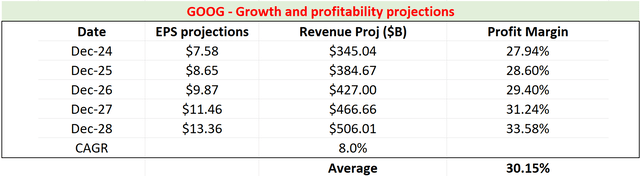

The consensus estimates also project its revenues to grow at a robust pace of 8% CAGR as seen in the next chart. The estimates point to a growth from $345B in 2024 to $506 in 2028. Again, note that the projected top-line growth rate is again noticeable lower than its bottom-line growth rate, indicating the market expectation for its margin to further expand. As an estimate, my following calculation shows the net profit margins implied by the above EPS and revenue consensus. In this estimate, I assume its number of shares to remain constant for the sake of simplicity. When share repurchases are considered, the margins will be slightly lower than what’s shown here, but the discrepancy should be small enough and won’t change the point I am making. As seen, this simply estimate shows consensus projections expect GOOG’s net profit margin to gradually expand from 27.94% in 2024 to 33.58% in the next five years. The average NPM expected in this period is about 30.15%.

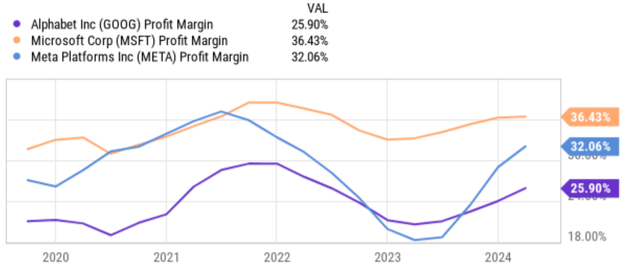

Author

Such an expansion is very plausible in my mind given the profit drivers, the cost control measures, its historical record, and also the margins of its close peers as you can see from the next chart below. GOOG’s NPM has fluctuated in the past and reached as high as 30% in 2021 as seen. Furthermore, similar businesses like Microsoft (MSFT) and Meta (META) have seen similar fluctuations in recent years. However, admittedly, MSFT has shown both a higher average margin and lower variance than GOOG in the past, which justifies its valuation premium. With the margin expansion projected above, I anticipate GOOG’s P/E multiple to expand and the valuation gap to narrow. Combined with the recent price dip, I expect a highly skewed return/risk profile.

Seeking Alpha

Seeking Alpha

Other risks and final thoughts

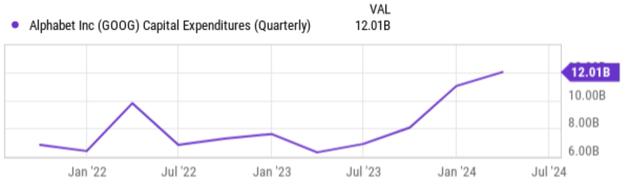

A top concern in my mind while reading the Q2 ER involves its increasing capital expenses. To keep growing its key segments, GOOG needs continued heavy investment in AI, Cloud, YouTube, etc. Such capex requirements have resulted in a rapid increase in capital expenses in recent years, as you can see from the next chart below. Currently, the quarterly capex hovers over $12 billion on a quarterly basis, the highest level since 2021.

All told, my conclusion is the positives far outweigh the negatives. Combined with the sizable price dip following the Q2 earnings, I see a very compelling entry point for GOOG here. To recap, the key catalysts in my mind for the near term include the growth in its cloud service, margin expansion potential, and also valuation discount relative to close peers (such as the FAAMNG group). For the longer term, I see equally strong catalysts too, thanks to its wide moat and enviable capital allocation flexibility (as detailed in my last article).

Seeking Alpha

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.