Summary:

- Alphabet Inc., a.k.a. Google earnings call highlighted new AI features like Overviews, Circle to Search, and Lens, defending Alphabet’s market dominance.

- Alphabet is investing heavily into AI capabilities and competitive edge, with $13 billion in quarterly CapEx.

- From YouTube’s expanding subscription model to Waymo’s autonomous ride services, Alphabet is broadening its revenue streams.

- Its valuation is relatively modest compared to other big tech peers.

LaylaBird/E+ via Getty Images

Alphabet Inc., a.k.a. Google (NASDAQ:GOOG), (NASDAQ:GOOGL), has always been the one big tech firm that I liked. Its search business is one of the most competitively advantaged growth businesses out there. With the emergence of large language models, or LLMs, and the clear usefulness of AI to get answers to your questions, there’s a new credible threat.

In the past, bears have argued the shift to mobile search or voice-based search could disrupt Alphabet’s dominance. Reviewing the latest earnings call, I’m primarily interested in any color on plans to defend its moat in search. The second most important piece to me is how Alphabet can leverage AI combined with the existing touching points with consumers (and the data this yields) to create new major services (i.e., growth). I’m also quite interested in the developments around the DOJ case. The call didn’t provide any fresh food for thought, so I’ve left it out of this note. This issue isn’t dissuading me from investing in Alphabet, but it is another key issue that needs to be monitored.

Let’s start with a quote about search being defended (emphasis mine):

…In search, recent advancements, including AI Overviews, Circle to Search and new features in Lens are transforming the user experience, expanding what people can search for and how they search for it. This leads to users coming to search more often for more of their information needs, driving additional search queries.

AI Overviews is a natural and very useful way to enhance Google search and stay competitive with various AI tools that answer questions. Google is probably as successful as it is because of its commitment to a very clean interface. Overviews are putting that simplicity at risk, but that’s likely worth it. Per the call (emphasis mine):

Just this week, AI Overview started rolling out to more than 100 new countries and territories. It will now reach more than 1 billion users on a monthly basis. We are seeing strong engagement, which is increasing overall search usage and user satisfaction. People are asking longer and more complex questions and exploring a wider range of websites.

There is still a long way to go. AI Overview actually hasn’t been rolled out in Europe, for example. But its use and usefulness is very encouraging. It also illustrates how Google can effectively fight off the competition from the LLM’s. With a search interface that integrates AI capabilities but ultimately should also allow access to Google Cloud (think of Google Docs/Google Sheets) its competitive position could improve. Alphabet’s competitive position should be quite difficult to match for anyone except the Microsoft Corporation (MSFT) – OpenAI combo.

Search is also increasingly made useful by unlocking it through other interfaces like “Circle to search” and “Lens.” I expect Alphabet will continue to make more types of data easier to search with even fewer restrictions on the input. A universal type assistant is one on the major projects the company wants to launch next year.

With all the data Alphabet, can access AND its large network of advertisers, it seems highly likely to me that it will be able to continue to deliver a search/AI interface that’s very cost-competitive. The company can likely deliver search/AI results at a lower cost while offering advertisers higher returns on ad spend. My general take of the evolving landscape is that Microsoft is getting closer in search, but Alphabet has an opportunity to be more competitive in the cloud.

In the short term, the AI race requires massive investments. Alphabet is throwing $13 billion at “technical infrastructure” for the quarter. That’s mostly servers, data centers and networking equipment. For next year, the CFO believes the number will be even higher. As part of trying to gain/maintain a competitive advantage, Alphabet developed its own dedicated AI chip; Trillium. AI workloads are notoriously power-hungry, and these chips help to gain a cost advantage. Even if other companies can run LLM’s models and do a search, doing it at the same cost is another matter.

The call also provided quite a bit of color on growth initiatives at Alphabet. Overall, I got the impression there was quite a bit of urgency felt around AI. Perhaps best exemplified by moving the Gemini app team to Google DeepMind (emphasis mine):

To support our investments across these three pillars, we are organizing the company to operate with speed and agility. We recently moved the Gemini app team to Google DeepMind to speed up the deployment of new models and streamline post-training work. This follows other structural changes that have unified teams in research, machine learning infrastructure and our developer teams, as well as our security efforts and our platforms and devices team. This is all helping us move faster.

Notebook LM is one example of a new service that was launched. Something like Notebook LM isn’t a huge growth driver by itself for Alphabet, but it is an example of building an interface that enables Google’s existing technology within a niche.

Other important topics that were discussed on the call were 1) improving cloud margins. I got the notion it is reasonable to expect some modest further expansion there, although near term, the increased CapEx may be obscuring some of that expansion. 2) The autonomous business; Waymo is moving from test mode towards sustainable commercialization. Waymo is now driving 150,000 paid rides per week. Per CEO Sundar Pichai:

So for us, we are mainly focused on each city as we go, and the pace at which we can now do additional cities gets easier. So we are definitely accelerating that way. That’s why we – you’ve seen us move into L.A. We’re also striking partnerships in newer and unique ways. Hence, the Uber partnership and expansion to Austin and Atlanta. And we have more options where we are looking at the driven by Waymo model with other network partners, fleet managers, et cetera. So it’s an exciting moment, but we are still obviously being safety focused, but are looking to scale and test out a variety of models and which will help us plan ahead well for 2025 and beyond.

I’m quite excited about Waymo. Autonomous has been somewhat of a slog (read; slow progress and expensive) while being developed/tested. I still believe growth could be remarkable as long as there’s incredible attention being paid to safety. Partnership models can make a huge difference in terms of accelerating a rollout. There is a first mover and scale advantage as the costs of the required data collection and software development are spread across a wider base.

3) Finally, YouTube is a massive part of Alphabet, and it is an impressive, successful business within the conglomerate. YouTube generated over $50 billion in revenue for the quarter. YouTube continues innovating and improving its platform. Increasingly, it is possible to create very high-quality content and distribute it through its infrastructure. Personally, I view YouTube as a business that’s much better than Netflix, Inc. (NFLX), which is valued at some $330 billion.

The true power of YouTube will become more obvious if higher-value content moves there that can command a subscription fee. Creating content and asking for a subscription fee is one thing, other people creating content, and you still get a take is quite another. YouTube is now enabling creators to organize content through episodes/seasons, which is another step down this trajectory.

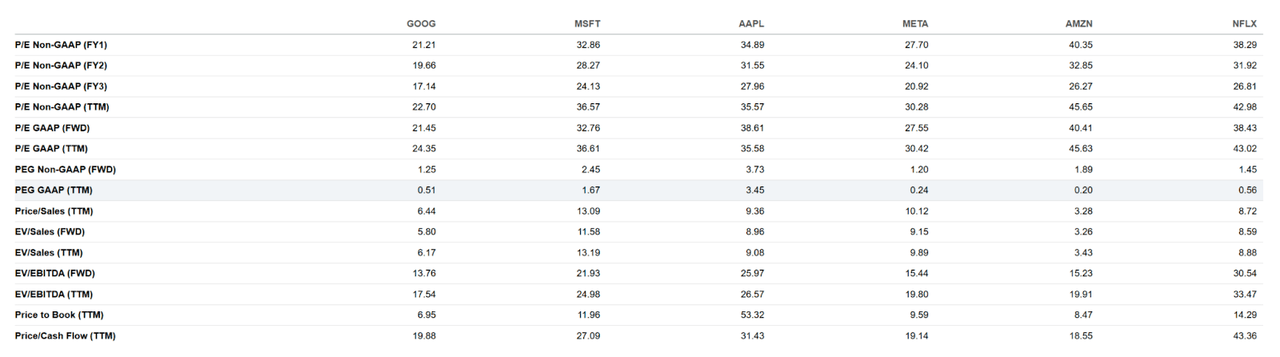

big tech valuations (seekingalpha.com)

Alphabet consists of a diverse set of businesses, and it isn’t exactly comparable to any company. In some respects, it is like Microsoft Corporation (MSFT), in others like Apple Inc. (AAPL) and its YouTube business could be compared to Meta Platforms, Inc. (META) or Netflix, Inc. (NFLX). Amazon.com, Inc.’s (AMZN) retail business is quite different, but it is a major competitor in the cloud. I’ve pulled up the valuations for these mega-cap tech companies, and Alphabet stands out in terms of valuation. With Alphabet, I like to look at P/E, Forward P/E, EV/Sales, EV/EBITDA and P/FCF. Generally, it is valued between ~30%-50% lower.

Alphabet’s core search business, with AI Overviews and other developments, is likely to stay competitive. There is a risk Microsoft will take share because of the emerging LLMs. Aggressive investment in infrastructure and specialized AI hardware (Trillium) helps to secure its cost base in search and cloud. YouTube is growing and continues to evolve. Higher-value content can be monetized more effectively. Waymo appears to have entered the commercialization phase. After lulling everyone to sleep throughout the testing phase, this segment could turn out to grow surprisingly fast going forward. Although there are threats, given the company’s valuation, Alphabet looks like a buy to me, especially relative to the other major tech companies.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.