Summary:

- Alphabet Inc., aka Google, beats earnings expectations, generating $76.7 billion in sales and $21.3 billion in operating profits.

- Google’s advertising business drives strong revenue growth, with a notable 11% increase.

- The Cloud division slightly missed revenue forecasts, but the overall fundamental framework suggests a strong capital distribution outlook.

- Google now has a strong capital distribution outlook, underscoring the company’s value as an attractive investment.

- I do strongly recommend investors to “Buy” Google stock on this dip.

400tmax

Heading into Alphabet Inc.’s (NASDAQ:GOOG, NASDAQ:GOOGL) aka Google’s Q3 2023 report, I argued Google stock might pop on stronger than expected earnings. While the second leg of my argument was correct, namely that Google would beat the consensus, my assessment of how the stock would respond to the beat was very wrong — Google did not pop, but instead slumped. On this discrepancy, I am once again reminded that fundamental analysis in stocks must not be set equal to momentum/ sentiment predictions. And it is nice to get this reminder once in a while, easing intellectual arrogance.

That said, the focus of my analysis continues to be on fundamentals. And while I am taking a break from predicting share price action, especially for Google, I will nevertheless not let pass by the necessity to comment on Google’s earnings. In this post-earnings update note, I give my take on the insights revealed through Google’s Q3 earnings.

Google Beats On Earnings

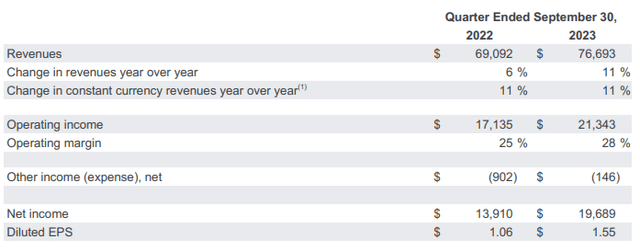

Overall, as a conglomerate, Google delivered very strong Q3 2023 earnings, beating consensus estimates on both the top line and earnings. During the period spanning June through end of September, the Search giant generated $76.7 billion in sales, achieving a robust double-digit YoY growth of about 11%, and beating analysts’ projections by close to $950 million according to estimates collected by Refinitiv.

On profitability, Google operating margin expanded 300 basis points, to 28%. In dollar numbers, this means $21.3 billion in profits, up close to 25% YoY compared to the same period one year prior. Accounting for non-operating expenses of $146 million, and $1.5 billion of income taxes, Google’s net income came in at $19.7 billion, or $1.55/ share, up more than 40% year-over-year and comfortably beating consensus with a 10% margin.

Strength in Search …

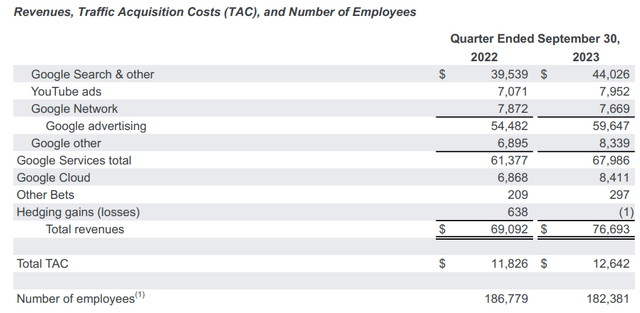

Google’s advertising business, which accounts for about 90% of the conglomerate’s total dollar-sales volume, was doing all the lifting in bringing the company to a consensus beat. As argued for in my earnings preview, Google was able to strongly capitalize in a broader rebound in the global advertising environment. During the Q3 period, Google’s ad business managed to score a strong 11% growth in revenue. Within that context, the performance was powered by strength performance in both Search and YouTube. Specifically YouTube performed above expectations, with the network’s ads revenue seeing a 12% YoY growth boost. During the analyst call, Ruth Porat commented (emphasis mine):

… yes, there was a stabilization in spending by advertisers. We’re really pleased about that. We’re particularly pleased about the ongoing performance in the Living Room and on Shorts. And as I said, that’s both watch time growth and monetization I’d say the other thing benefiting YouTube is the retail strength we talked about with Search, retail strength in APAC in both Search and YouTube, and that really began in the second quarter, continued in the third quarter, but that was another contributor. So quite a number of things going on.

Digging into the numbers, I would also like to point out that there was a nice pump in “Google other” revenue, from $6.9 billion in Q3 2022 to $8.3 billion in Q3 2023. This increase can be attributed primarily to the expansion in subscribers on NFL Sunday Ticket earnings. I see this growth trend continuing into Q4.

The way I read Google’s Q3 reporting and subsequent earnings call with analysts, there is good reason to expect that Google’s advertising powertrain will steam all through Q4, closing FY 2023 strong.

… Overshadowed By Weakness In Cloud

Google’s Cloud division was the main loser for the conglomerate in Q3. The Cloud business, which is considered a key growth driver, missed revenue forecasts, with the segment rising only 22% YoY vs. a forecasted range by analysts of 24-26%.

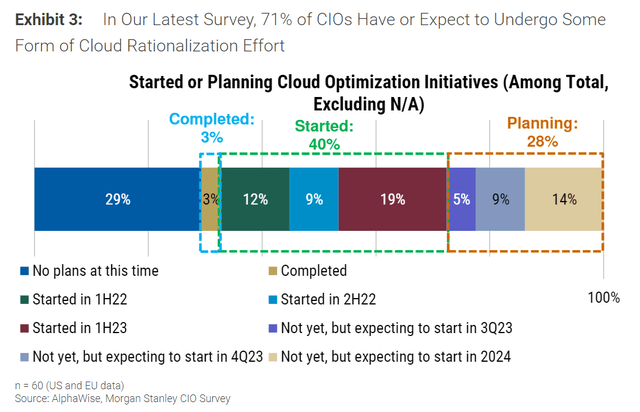

Now, there are quite a few considerations when thinking about this miss. First, I point out that Google does not provide guidance for the Cloud business, meaning the “miss” was self-inflicted by overly optimistic expectations. Secondly, although Google’s Cloud growth slowed down, at 22% it is still a major growth force for the company and top line expansion accretive on a group level. Third, the slowdown in Cloud computing should not come as a full surprise to investors. In fact, the industry’s challenges have been broadcasted quite extensively and loudly. The quarterly CIO survey conducted by Morgan Stanley, for context, has suggested that Cloud customers continue to promote cost optimization in their IT budgets, over growth investments. According to the survey, only 3% of respondents have completed said “optimization” projects as of October 2023. (Morgan Stanley Research: 1Q24 Preview – Mind the Ramp Please, dated October 17). It is suggested that once the broader Cloud environment becomes more bullish, Google Cloud growth may accelerate as well.

Lastly, I point out that Google’s Cloud business accounts for only about 10% of the company’s total revenues. And on an earnings perspective, Cloud is completely ignorable. Accordingly, punishing down the company’s stock post earnings due to a slowing Cloud business, while the main revenue and profit driver accelerates, is likely an overreaction.

Stay Focused On Fundamentals

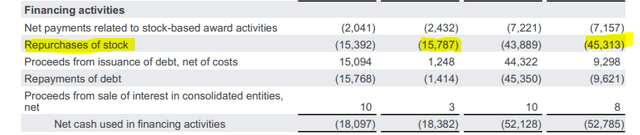

On group level, Google continues to show solid, double-digit growth and strong profitability. Moreover, the company needs relatively little investments to sustain the commercial momentum, as indicated by strong free cash flow. I point this out as an excellent combination of fundamentals, which is poised to set up Google investors for a windfall in capital distributions. For context, in Q3 2023, Google repurchased $15.8 billion worth of its own stock, an increase compared to the $15.4 billion repurchased on year prior. Benchmarking Google’s Q3 distributions to the company’s net earnings, I highlight a 80% earnings payout, on track to bring Google’s share repurchase yield for the FY 2023 to 3-4% of market capitalization.

While I didn’t want to give commentary on stock price action, I just want to flag that it is very hard for me to shift bearish on such a yield, complemented by double-digit top line growth.

Investor Takeaway

Contrary to what the selloff post earnings suggests, Google delivered robust results. The company’s performance for the September quarter exceeded expectations on both the top line and earnings, with the company accumulating $76.7 billion in sales, (+11% YoY) and $21.3 billion in operating profits (+25% YoY). The company’s net income of $19.7 billion, or $1.55 per share, outperformed consensus estimates by a comfortable 10% margin.

Google’s strong Q3 performance is primarily attributed to Google’s advertising business, with a notable 11% growth in revenue, bolstered by both Search and YouTube. While the Cloud division slightly missed revenue forecasts, its underlying growth and momentum remains solid. The overall fundamental framework for Google suggests a strong capital distribution outlook, underscoring the company’s value as an attractive investment. While I do not want to predict Google’s share price action, following my misstep pre-earnings, I do strongly recommend investors to “Buy” this dip in Google shares.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

not financial advise

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.