Summary:

- Alphabet Inc. is set to report Q3 results with analysts expecting an EPS growth of 36% and revenue growth of 10% on a YoY basis.

- Google Cloud Platform has been flying under the radar with all the focus on advertising and AI.

- GOOG stock is the best YTD performer among mega-cap tech stocks and heads into Q3 with stronger expectations than Q2.

- Judge this company and its stock over the long term as its ecosystem is built to survive and thrive.

400tmax

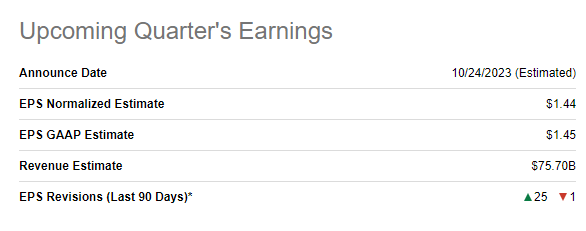

Alphabet Inc. (NASDAQ:GOOG) (GOOGL) is expected to report results for its Q3 that ended September 30th, 2023, post-market on Tuesday, October 24th. Analysts expect Alphabet to report an EPS of $1.45 on revenue of $75.70 billion. Should Alphabet meet these numbers, that would represent an EPS growth of 36% and revenue growth of nearly 10% on a YoY basis. That sounds impressive for a trillion-dollar company, despite the fact that Q3 2022 was one of the largest profit drops reported by Alphabet in its history.

GOOG Q3 Preview (Seekingalpha.com)

My last coverage on Alphabet was ahead of its Q2 earnings. I had rated the stock a “Buy” at that time, citing undervaluation heading into the Q2 report. Since then, the stock has gone up nearly 13%, handily outperforming the S&P 500’s -4.73% in the same time period. With that background out of the way, let’s preview Alphabet’s Q3 without any further ado.

Uptick In Expectations

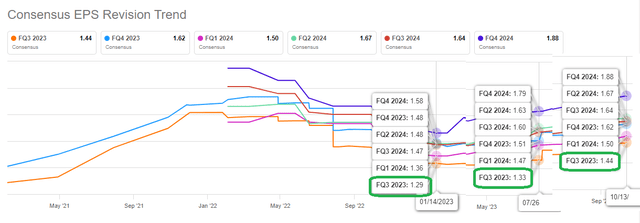

One of the biggest things Alphabet had in its favor heading into Q2 was the stock’s under-valuation and relatively lower expectations. This time around, Alphabet’s stock is heading into Q3 earnings in an upbeat mood. Backed by the strong Q2 report and Q3 guidance, EPS expectations have gone up from $1.29 at the beginning of the year to $1.44 now. More to the point, it was at $1.33 at the time of its Q2 report and has since jumped 8% to reach $1.44.

GOOG Q3 EPS Trend (Seekingalpha.com)

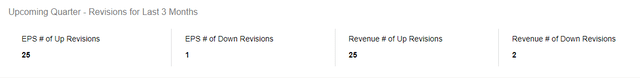

25 out of 26 EPS revisions have been to the upside and 25 out of 27 revenue revisions have been to the upside as well. Once again, this is in contrast to Q2 where only 19 out of the 27 revenue revisions were to the upside.

GOOG Q3 Revisions Count (Seekingalpha.com)

Overall, the set-up for Q3 is beginning to look vastly different from that of Q2 as analysts seem to be expecting more heading into Q3. Perhaps the stock may be a little ahead of itself? Let’s wait and see.

Beat or Miss? Early Signs of Trend Reversal

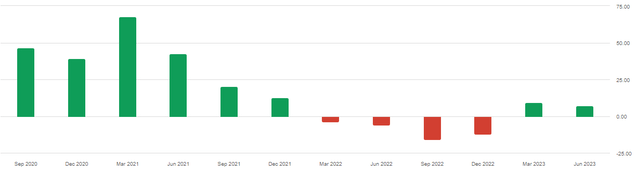

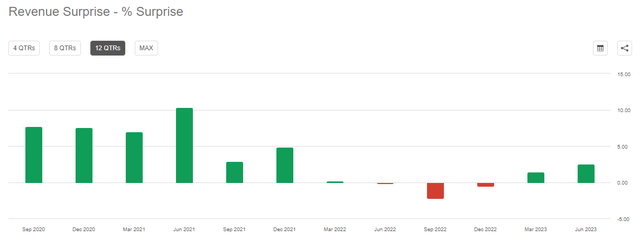

In the last 12 quarters, Alphabet has beaten EPS estimates 8 times and revenue estimates 9 times. Those numbers were the same during the Q2 preview. But more importantly, Alphabet has now reported two consecutive EPS beats after missing estimates 4 consecutive quarters in 2022.

In the Q2 preview, I had predicted that the company would beat slightly on revenue and that the EPS beat/miss would come down to the company’s operating discipline (AKA expenses). That turned out to be true as revenue beat by a small margin (2.54%) but EPS beat by a slightly bigger number (7%) due to overall operating margin going up YoY from 28% to 29%. I predict a slight beat on both revenue and EPS once again, but unlike last time, I believe the stock’s pre-earnings run-up may require more than a small beat to justify any further run-up in stock price.

GOOG EPS Surprise (Seekingalpha.com) GOOG Revenue Surprise (Seekingalpha.com)

Advertising and AI – Still The Two Main Stories But Something Is Peeking Through The Cloud

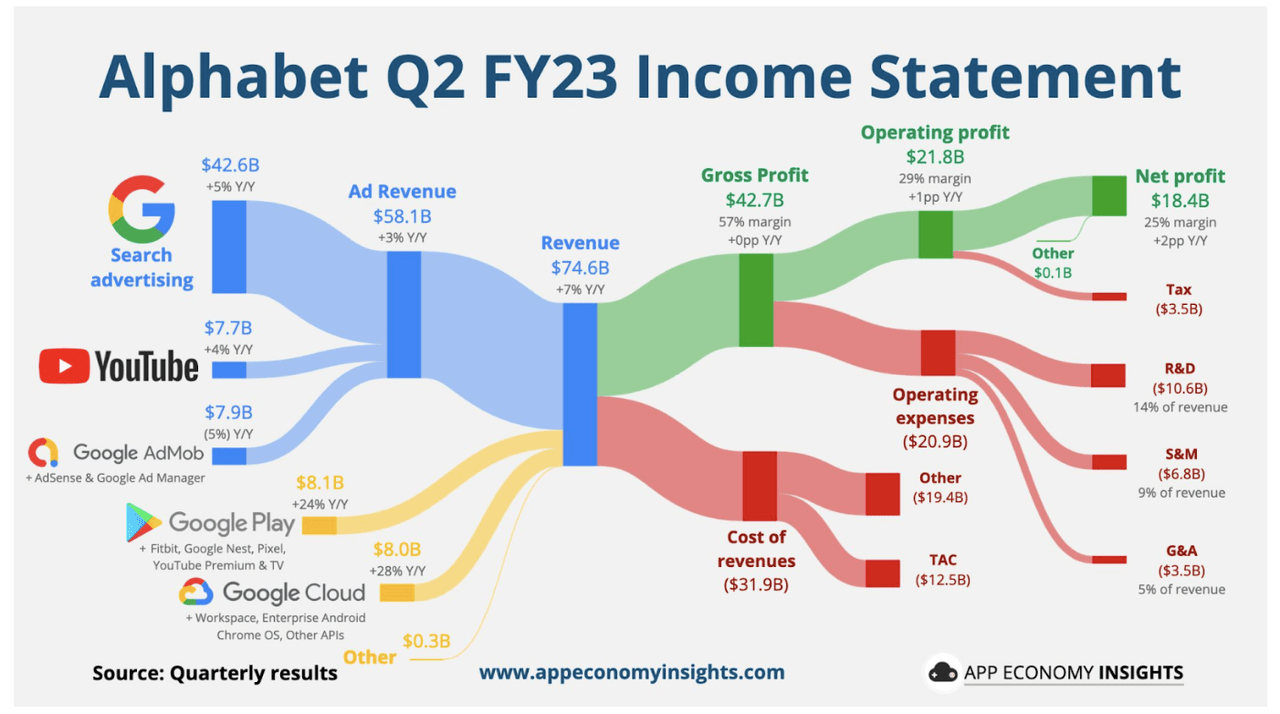

In my Q2 preview, I had written that Advertising and AI were likely to be the top two stories in that quarter. Advertising revenue came in at $58.1 billion, up 3.30% from 2022’s Q2. In addition, the company also reported that AI focus was going on at full speed with teams being refocused on the efforts.

- For Q3, advertising will still be the core moneymaker obviously, and I conservatively predict a similar 3% to 4% growth YoY, bringing Q3 2023’s advertising revenue between $56.1 billion and $56.7 billion. That’s still more than 75% of the total revenue expected at $75 billion and likely why the company finally moved aggressively on its AI efforts.

- In the Q2 report, CEO Sundar Pichai focused on the company’s headcount and reprioritization:

“To take advantage of AI, Alphabet has been “sharpening our focus as a company, investing responsibly with great discipline and finding areas where we can operate more cost-effectively,” Pichai said. That includes headcount reductions and relocating teams, including aligning Waze ad sales with the existing business, and combining engineering efforts across core infrastructure and cloud: “Overall, we are actively moving people to higher-priority activities within the company.“

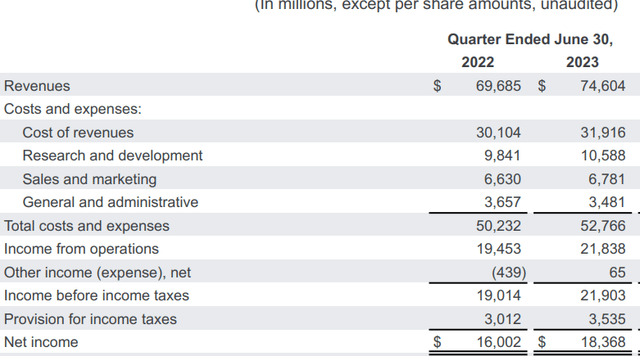

But, if you are looking for a reduction in total expenses in Q3, I think you’d be disappointed. Despite the constant chatter about reducing headcount and refocusing on critical items, Alphabet reported a 4.50% YoY jump in total employees in Q2 2023 and a 5% jump in total expenses YoY. I am a believer in “watch what they do and not what they say” and will be closely monitoring the costs and expenses section when the Q3 report comes out.

Alphabet Expenses (Alphabet Investor Relations)

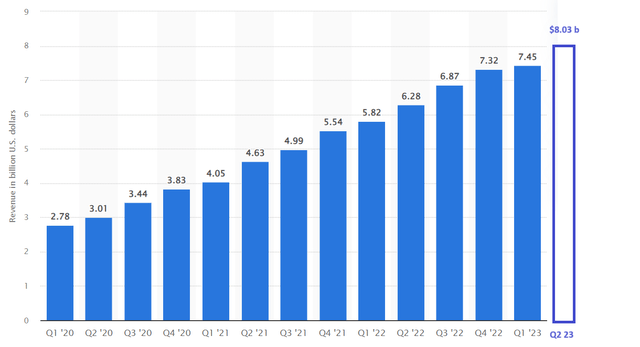

- Ironically, Google’s cloud has stayed above the clouds for a while now but has chalked up an impressive streak of quarterly revenue growth dating back to at least Q1 2020. Now, peeking through the cloud, Google Cloud Platform [GCP] reported its 2nd consecutive profitable quarter on the back of a record $8.03 billion revenue in Q2 2023. I expect both the revenue and profit streaks to continue for GCP in Q3 given the company’s expanding infrastructure around the world with 39 Google Cloud regions.

Valuation – Best Among The Big Boys

Heading into Q2 earnings, Alphabet’s stock was:

- the cheapest among mega-cap tech stocks.

- cheap on its own relative to its growth prospects and,

- weakest performer among the mega-cap tech stocks YTD (then).

Things are a little different heading into Q3.

- Alphabet is still the cheapest with a forward multiple of 24.50 compared to Apple Inc. (AAPL) at 29.4, Microsoft Corporation (MSFT) at 29.7, and Amazon.com, Inc. (AMZN) at 60. However, Alphabet’s case for undervaluation shrunk as the difference (in forward multiple) between Alphabet and the 2nd cheapest in the group (Apple) was 10 back then and is just 5 now.

- Alphabet’s valuation on a stand-alone basis has become attractive as the expected earnings growth rate has gone up from 16% to 18.40%. That gives the stock a Price-Earnings/Growth [PEG] of 1.33 heading into Q3 report as opposed to 1.4 heading into Q2 report.

- Alphabet stock is no longer the weakest performer YTD among the mega-cap stocks. In fact, the stock is now the best performer in this group as it is up nearly 55% YTD compared to Microsoft at 37%, Apple at 43%, and Amazon at 51%.

It is now safe to say the relative under-valuation story heading into Q2 has turned into a fairly to perhaps a smidgen over-valued story.

Technical Strength – Sitting On A Solid Base

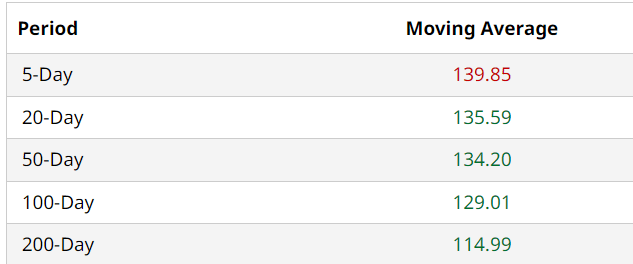

GOOG stock has gotten pretty strong technically since the Q2 preview as we head into the Q3 report. For example, the 200-Day moving average has moved up from $104 to $115. That the stock is trading well above the 100-Day and 200-Day moving averages is generally good news. But please be aware that in case the Q3 report (or Q4 guidance) turns out bad and the market continues its recent wobble, the stock has a way to fall before finding support.

GOOG Stock Moving Avg (Barchart.com)

The stock’s Relative Strength Index (“RSI”) has gone up from 49 during my last article to 68 now. But this is good for the stock from a technical perspective as it shows strength and accumulation with enough room left before getting overbought.

GOOG RSI (Seekingalpha.com)

Conclusion

I expect Alphabet to report a strong Q3 with a beat on both EPS and revenue but unlike with Q2 report, I don’t believe the stock will move much higher after the Q3 report as it is arguably fairly valued heading into the report with higher expectations.

However, a curveball to finish the article. Despite my cautious tone throughout the article, I am sticking with my “Buy” rating as I’d like Alphabet (and myself) to be judged on long-term performance and not quarterly. With an ecosystem that is, in my opinion, behind only the likes of Apple, Microsoft, and Amazon, Alphabet has a lot in its favor as it can cross-sell and cross-offer its platforms like few others can do. For example, in the Q2 report, CEO Pichai talked about how its AI approach makes innovation easier for its users by offering GCP infrastructure. Let’s not even get into how Alphabet can (and does) leverage its dominance in search to enhance its fortunes across the board.

So, what’s your take on Alphabet’s upcoming Q3 and its future in general? Please leave your comments below.

Alphabet Ecosystem (linkedin.com)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, AMZN, GOOG, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.