Summary:

- Alphabet Inc. aka Google just reported Q3 earnings, delivering great results in Search, Cloud, and YouTube.

- YouTube is of particular interest to us given the potential for significant monetization growth in coming years.

- YouTube could be worth — conservatively — $750 billion+ by 2027, which could add 20% or more to GOOG’s market cap in just a few short years.

- In combination with GOOG’s other surging businesses, we think shares look like a ‘Buy.’

10’000 Hours/DigitalVision via Getty Images

We’ve said it before, and we’ll say it again: YouTube has been the clear winner of the streaming wars.

While other companies like Disney (DIS), Netflix (NFLX), and Warner Brothers (WBD) have been at each other’s throats trying to compete for subscription content revenues, Google’s YouTube has been growing users, revenue, and monetization rates at an alarming pace for the better part of the last two decades.

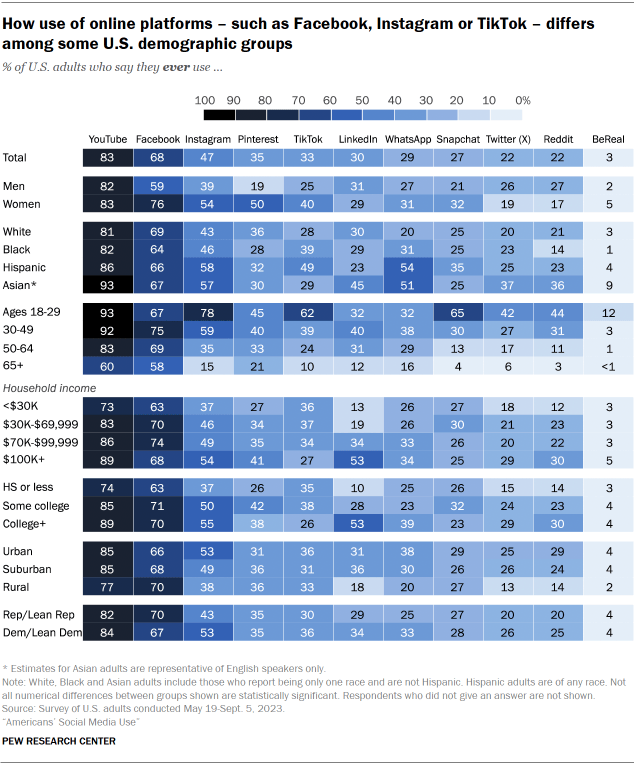

YouTube has grown so much that now, when it comes to popular online properties in the US, the platform ranks as basically the number one option for all demographics:

Pew Research

Whether you’re trying to capture eyeballs of men, women, the young, the old, the rich, the poor, or any demographic in between, YouTube is the place to be.

Last night, Alphabet Inc. aka Google (NASDAQ:GOOG, NASDAQ:GOOGL), YouTube’s parent company, reported Q3 earnings. The results were strong, and the stock advanced roughly 6% on the print.

Many have been quick to mention strong growth reported in Search and Cloud, and if you’d like to read more about those successes, many other authors have already written about those topics here.

In this article, we wanted to spend more time looking at YouTube. While the segment only produces somewhere around 15% of GOOG’s revenue, operating margins are high (and expanding), which makes us think that with continued growth, the segment could start contributing meaningfully to GOOG’s bottom line in coming years.

Today, we’ll explore YouTube’s potential, explain why we think YouTube is on a path of substantial continued growth, and model out what the segment could be worth, within GOOG’s umbrella, in the coming years.

Sound good? Let’s dive in.

GOOG’s Q3 Results

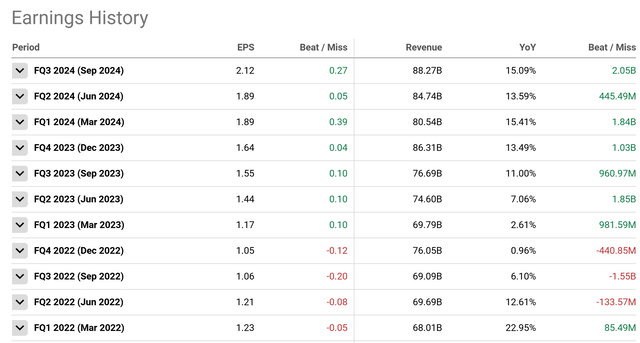

As we just mentioned, GOOG recently reported earnings, which came in above expectations.

On the top line, GOOG reported revenues of $88.2 billion, YoY growth of roughly 15%. This result represents a re-acceleration of GOOG’s top-line sales, which is a significantly positive data point for investors:

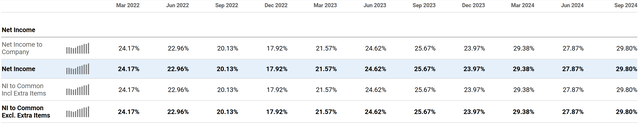

On the bottom line, GOOG reported $26.3 billion in net income, which represents net margins of roughly 29.8%. This, too, represents a significant YoY margin expansion of more than 400 basis points:

When you combine these results with GOOG’s ongoing share buyback program, the company reported $2.12 in EPS, which was a $0.27 beat vs. analyst expectations. Not bad!

As we alluded to, investors were primarily excited about growth in Cloud and Search, which were both strong.

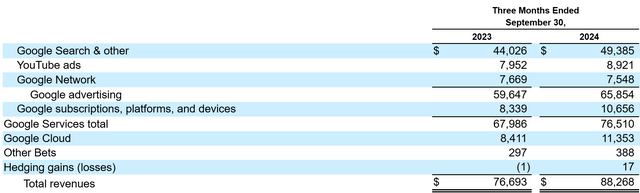

On the cloud front, management reported sales growth of roughly 35% YoY, which is substantial, and Search grew by 4.3 billion YoY, representing roughly 9.5% growth. Both of these are impressive in their own right, but the growth of YouTube is what has our attention.

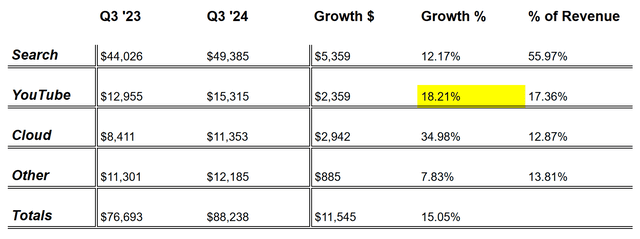

On a sales basis, GOOG reported roughly 13% YoY growth in YouTube ads, and ~28% growth in “Google Subscriptions, Platforms, and Devices,” most of which are YouTube subscription revenues:

Thus, if you add it all up, here’s what GOOG’s main segments look like, cleaned up for readability:

Some of these numbers are estimates, given that GOOG doesn’t break down the financials this way, but this schedule gives a clearer picture of each segment going forward.

YouTube’s Prospects

So – why are we interested in YouTube?

In short, we like YouTube for one key reason – subscription monetization. This unlocks the possibility of margin expansion and revenue growth, with very little in the way of incremental cost. Looking out a few years, this combination could drastically boost the value of YouTube as a unit within GOOG.

Off the bat, YouTube delivers great gross and operating margins. Sure, the cost of content and infrastructure is relatively high on a gross margin basis (and was estimated to be around 38% in 2022), but past that, other G&A costs are quite low. Headcount is an insignificant cost, and there aren’t a lot of other associated costs with running the platform aside from content and infrastructure.

Based on Q3 figures, we’d estimate that YouTube currently has around ~35% operating margins. While this is a bit lower than Search, investors still keep one dollar out of every three earned in revenue. Not bad.

The key here is the ability for YouTube to boost margins further with its YouTube premium product. Currently, this service is an add-on for YouTube, which adds utility by removing ads, improving the viewing experience, and including a number of other quality-of-life upgrades.

Other tech companies, like Apple (AAPL) and Spotify (SPOT), offer subscription products across various media – news, fitness, audio, podcasts, premium TV, and more.

YouTube Premium “does it all,” and is GOOG’s “one-stop shop” for content of all types. Want to follow breaking news? YouTube has you covered. Workouts? YouTube. New Music? YouTube. Audio and Video podcasts? YouTube. Entertainment you can’t find elsewhere by niche creators? YouTube.

This makes YouTube Premium an excellent value-for-money, and the only “cost” of serving it is the lost ad revenue on a per-user basis. Given that RPU is significantly boosted on conversion, YouTube Premium is incredibly accretive to GOOG on both the margin side and the revenue side.

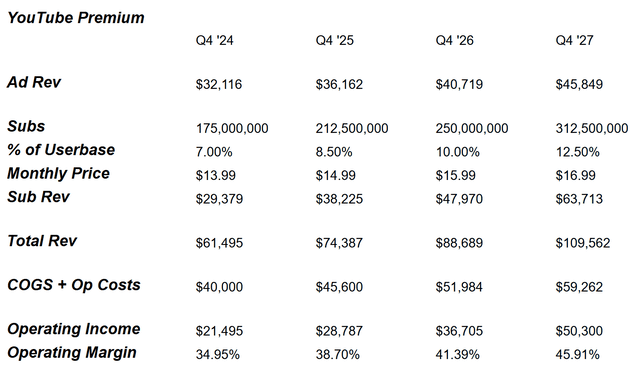

Here’s where we see YouTube headed over the coming years:

Currently, we think YouTube will end FY ’24 with around $32 billion in advertising revenue, $29 billion in subscription revenue, and $61.5 billion in total revenue. You can nitpick these numbers, but those are our estimates based on results YTD and historical growth rates.

From there, we’re expecting advertising revenue growth in the ~12% range for the next several years. This is a mature, saturated market, and aiming higher seems aggressive. 12% is where the segment has been at for some time, so we’ll project it out at that level.

From there, we expect monetization to improve substantially. We don’t have a breakdown of YouTube TV vs. YouTube Premium subscribers, so for the sake of argument we’re assuming that all subscribers are premium. This may appear to be a crude estimate, but YouTube TV subs probably aren’t a large portion of overall subs, and even if they are, gross margins most likely put the value of the sub in the mid-teens anyway.

From here, we anticipate growth towards around 12% of the current user base (2.5 billion users) paying for a premium subscription, along with some light price hikes over the coming years. If you back out the numbers, right now, we’re at about 7% of the user base with a subscription, perhaps a bit lower.

Finally, we’re predicting 14% YoY average total cost growth to support this new premium product through 2027. If you plug these numbers in, you arrive at almost $110 billion in total YouTube revenue by 2027, with an improved margin profile that boosts operating income to roughly $50 billion.

Again, you can argue with the rates of growth we’ve used here, but we think our estimates, in each silo, seem reasonable.

The Valuation Picture

Here’s why this growth matters.

Over the last twelve months, Netflix (NFLX), the leading premium paid video service globally, did roughly $37 billion in revenue and $7 billion in net income. Consequently, the company has been valued by the market at roughly 8.6x revenue and 42x net income.

Our estimates above put YouTube’s 2027 revenue at $109 billion, with operating income at ~$50 billion that same year. If we apply Netflix’s multiples to these figures, we’d get somewhere between $937 billion and $2.1 trillion.

Given that GOOG’s entire market cap as of now is around this figure, $2.1 trillion for YouTube alone seems quite extended, even in 2027.

Additionally, in large companies like this, profitable segments are often valued at lower premiums due to an investor’s inability to “access” earnings on a per-segment basis.

Thus, if we apply GOOG’s current 6.4x sales multiple and 25x profit multiple to YouTube in 2027, we get a figure somewhere between $704 billion and $1.25 trillion.

Realistically, we’ll ascribe YouTube’s value a bit more conservatively, opting for a 6x sales multiple and a 18x operating income multiple in 2027. With that, we’re looking at a value of roughly $650 billion to $900 billion.

Currently, if you value YouTube based on GOOG’s overarching multiple, the segment is worth about $370 billion. Thus, on an incredibly conservative basis, we think this segment could grow to around $775 billion (a midpoint of our previous multiples) by 2027, which would add $400 billion in value.

Given GOOG’s current valuation of around $2.15 Trillion, YouTube’s growth could boost GOOG’s value by 20% or more over the coming years.

Taken together, we think YouTube’s organic growth could boost GOOG’s share price, in addition to GOOG’s auxiliary growth in other segments.

Bottom line – we’re bullish.

Risks

There are some risks that come with investing in GOOG. On the YouTube front, we may have overestimated the speed at which YouTube Premium will acquire new paid subscribers. If the company doesn’t acquire paid subs at the rate we’ve predicted, then YouTube may not be worth the multiple we’ve applied.

Additionally, YouTube may not have the pricing power to boost prices from here, which would dent our model.

Finally, YouTube costs could increase faster than modeled as management spends up to build out better recommendation algorithms and content delivery networks. This would result in less cash dropping to the bottom line and a reduced multiple from investors.

More broadly, GOOG is under intense scrutiny from global regulators, which presents significant break-up risk to shareholders.

Additionally, GOOG is trading above most historical multiples, which means that the company’s valuation could mean-revert lower if market sentiment were to worsen.

Summary

Overall, though, we’re bullish on YouTube as a segment within GOOG, in addition to the company’s other businesses that have been performing well.

Increased monetization and growth should lead to improved margins and a higher multiple looking a few years down the road.

While there are some risks, we think owning GOOG is one of the safer ways to deploy capital in today’s market.

Thus, our ‘Buy’ rating.

Cheers!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.