Summary:

- Alphabet Inc.’s, a.k.a. Google, market leadership in cloud infrastructure, AI, and cybersecurity supports a ‘Buy’ rating with a fair value of $218 per share.

- Waymo’s $5.6 billion equity funding and partnerships with Uber highlight the strong adoption and maturity of self-driving technology.

- Alphabet’s investment in Anthropic and the integration of Claude 3.5 Sonnet into Google Cloud enhances AI capabilities and cybersecurity features.

- Despite potential margin pressure from AI investments, Alphabet’s projected 14% revenue growth and strong cloud business justify the “Buy” rating.

krblokhin

I discussed why Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) a.k.a. Google is unlikely to be disrupted by AI-powered search engines, including SearchGPT in my “Buy” thesis published in September 2024. I favor Alphabet’s market leadership in their cloud infrastructure powered by data analytics, AI, and cybersecurity. Alphabet delivered a strong Q3 result, led by 35% revenue growth in its cloud business. I reiterate a “Buy” rating with a fair value of $218 per share.

Waymo Equity Funding

In October, Waymo, Alphabet’s subsidiary, raised $5.6 billion through a private equity placement. Waymo has been valued at about $50 billion in the past. Waymo has been partnering with Uber Technologies, Inc. (UBER) with a plan to launch self-driving cab services through Uber’s app in Atlanta and Austin, Texas, in early 2025.

Over the past few months, Waymo has expanded its services in cities like Los Angeles and San Francisco. Additionally, Waymo plans to add Hyundai Motor Company (OTCPK:HYMTF) IONIQ 5 BEVs to its fleets. Waymo disclosed that there is an average of 100,000 paid weekly trips, representing a tenfold increase compared to 2023, which demonstrates strong adoption and improved maturity of self-driving technology.

Cloud Partnership with Anthropic

Alphabet invested $2 billion in Anthropic, the AI startup founded by ex-OpenAI executives in 2023. In October 2024, Alphabet announced the general availability of the upgraded Claude 3.5 Sonnet for US customers on Vertex AI model Garden. Vertex AI simplifies the process of deploying and managing models like the upgraded Claude 3.5 Sonnet.

I believe Google Cloud has successfully integrated cybersecurity, AI, and data analytics into their infrastructure structure. Key benefits could include:

- Alphabet has embedded their AI capabilities in their cloud infrastructure, supporting models from Google as well as partners like Anthropic, Cohere, AI21 Labs, and Runway. The variety of AI models enables enterprise customers to choose suitable AI models to deploy their AI workloads.

- It is important to integrate AI into cloud cybersecurity platforms and I believe Google Cloud Platform offers some of the best cybersecurity features, providing comprehensive solutions to manage, detect and respond to vulnerabilities and potential cyberattacks.

- As discussed in my previous article, Alphabet possesses advanced data analytics technology, providing data insights to their cloud customers. The strong data analytics capabilities could enhance Alphabet’s competitive advantages in the public cloud market.

Q3 and Outlook

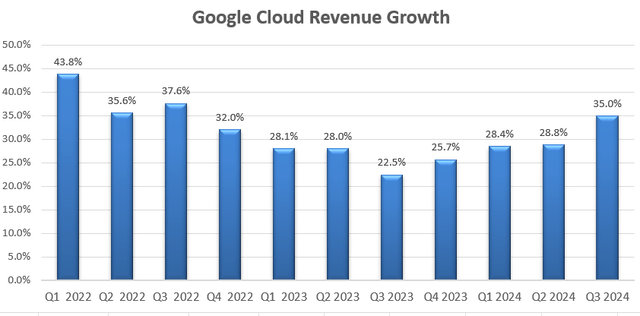

Alphabet released its Q3 result on October 29th after the market close, delivering 16% constant revenue growth with 35% growth in its cloud business, as shown in the chart below.

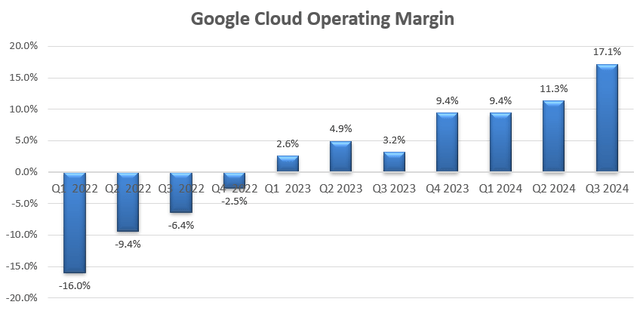

My key takeaway from the quarter is the accelerated growth in the Google Cloud platform, which demonstrated strong industry adoptions of generative AI solutions and core GCP products including data analytics, security, database and third-party software. As discussed in my previous article, Google Cloud business has a very high operating leverage. Primary investments in cloud infrastructure were completed in the early years, and any incremental sale growth in the cloud platform is unlikely to require a proportional increase in operating expenses.

As shown in the chart below, the Google Cloud business has consistently improved its operating margin, reaching 17.1% in the current quarter.

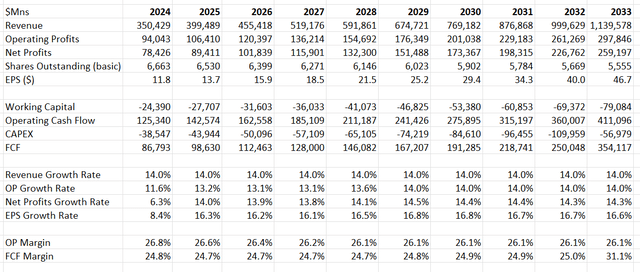

For normalized revenue growth, my projections are as follows:

- Google Search: I continue to project their search business will grow by 12% annually, driven by 10% market growth and 2% additional growth from AI-powered search engines. As discussed in my previous article, I don’t think AI-powered search engines will pose any significant risks to Alphabet because of Alphabet’s unique vertical integration across marketers, end-users and digital ads bidding platforms.

- Google Cloud: I forecast the segment will grow by 25%, maintaining the growth momentum. Alphabet, Microsoft Corporation (MSFT) and Amazon.com, Inc. (AMZN) continue to dominate the public cloud infrastructure market.

- Subscription and Services: This segment has shown stable growth, with Alphabet expanding services over recent years. I anticipate the segment will grow by 10%, aligned with their historical trend.

As such, I calculate Alphabet will grow its revenue by 14% in the near future. As the company invests heavily in their AI technology and capital expenditures, Alphabet is more likely to face some margin pressure in the coming years. I calculate their operating margin will gradually decline to 26.1% by F28, stabilizing thereafter once this investment phase concludes. I adjusted the WACC to 11% assuming: a risk-free rate of 3.6%; beta of 1.1; cost of debt of 5%; equity risk premium of 6%; equity of $283 billion; debt of $13 billion; tax rate of 17%. With these parameters, I summarize the discounted cash flow, or DCF, model as follows:

Discounting all the future FCF, the fair value is calculated to be $218 per share, as per my estimate.

Key Risk

In October 2024, the UK antitrust officials indicated that they were probing whether Alphabet’s investment in Anthropic could pose a threat to competition. Alphabet argues that the company does not have veto rights over Anthropic’s strategic decisions, as Alphabet does not have any board seats or voting rights at Anthropic. The probe outcome remains unknown at this point.

Conclusion

I believe Alphabet is well positioned in the AI-powered search and cloud infrastructure market. With holistic services spanning cloud, AI, cybersecurity and data analytics, Alphabet remains relevant in the new AI era. I reiterate a “Buy” rating with a fair value of $218 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.