Summary:

- Google’s Q3 earnings beat expectations, but investors were disappointed by the slowdown in cloud growth.

- Despite this, Google remains a strong long-term investment due to its position in AI, search, and YouTube.

- The recent sell-off presents a compelling buying opportunity, and technical analysis suggests the stock could reach new all-time highs.

gremlin

Thesis Summary

Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) reported third-quarter earnings on October 24th, and though the company beat on most metrics, investors were disappointed by the slowdown in cloud growth.

While there is certainly some reason for concern, GOOGL remains in my book, one of the best long-term investments one can make, especially following the latest sell-off.

Google is well-positioned to benefit from secular growth trends in AI, search, and YouTube. Though the company is up against some mighty competition, it remains the best-valued of the Magnificent Seven.

I reiterate the strong buy rating I issued a month ago and would in fact, make the point that GOOGL is even more compelling after the recent sell-off.

Based on TA, GOOGL stock should break above $150 in the coming months.

It Pays To be Bullish

I have been a long-term bull back to May 2021, and the stock has done very well in this time.

GOOGL analyst rating (SA)

There have been some downs, but it has been mostly up. If there’s one thing that I have learned in this time, it’s that dips should be bought. As we can see, GOOGL tends to experience volatility around earnings, but it continues to deliver strong growth.

Back in February, it reported FY 2022 results, with investors disappointed at the slowing growth. However, as I pointed out back then, the AI narrative would help the stock, and that’s what we have seen.

The latest earnings have also been “disappointing”, but once again, I think the market is missing the larger trends at play for 2024 and beyond.

Q3 Earnings

Despite beating on earnings and revenue, GOOGL’s stock is down since it released its Q3 earnings.

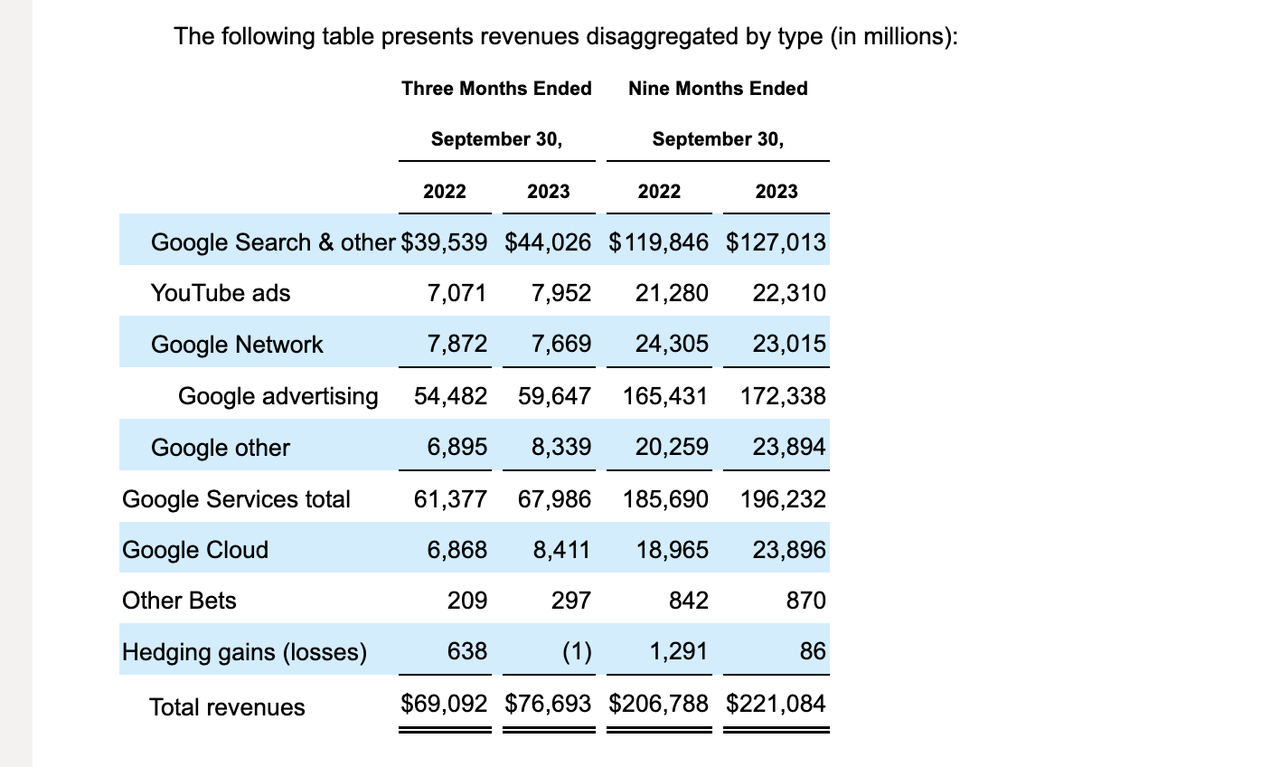

Let’s begin by looking at its segment breakdown:

GOOGL revenues by segment (10Q)

As we can see, Google search grew by over 11% YoY. Meanwhile, YouTube ads grew by around 15%.

The big “disappointment” was Google Cloud, which grew “only” +22%. It seems like investors have become very hard to please this earnings season.

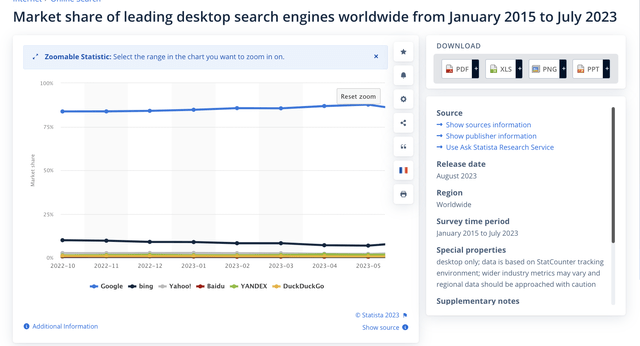

Now, let’s look at the geographic breakdown of revenues.

GOOGL revenues by geography (10Q)

US revenues grow by close to 10 YoY, while revenues in EMEA grow by 16%. Similarly, APAC revenues grew by around 14%.

Personally, I really like the fact that Alphabet can post strong growth in areas outside of the US.

Overall, the results weren’t bad at all. Big moves tend to happen around earnings, and they don’t always make perfect sense. GOOGL has seen nothing but green over the last few months, and a pull-back was due.

However, there have also been some red flags in the latest earnings. Of course, the slowdown in growth is one area that has investors worried.

Another issue is the growing anti-trust cases against Google, which could cost the company some money.

On the other hand, while margins did improve YoY, the 10Q filling noted that R&D costs could increase as a percentage of revenue sin the coming quarters, which makes sense as competition intensifies.

Insights From the Earnings Call

We can get some better insights on some these points from the recent earnings call.

Firstly, on Google Cloud:

“Next, Google Cloud. We see continued growth with Q3 revenue of $8.4 billion, up 22%. Today, more than 60% of the world’s 1,000 largest companies are Google Cloud customers. At Cloud Next, we showcased amazing innovations across our entire portfolio of infrastructure, data and AI, workspace collaboration, and cybersecurity solutions.”

Google continues to be a leader in the space, and most compelling of all, is the fact that it is enabling innovation on its network.

Furthermore, there is an argument to be made that Google cloud has a competitive advantage over much of the market, as mentioned here:

“customers are choosing Google Cloud because we are the only large cloud provider with a unified platform to analyze structured and unstructured data. In Workspace, thousands of companies and more than a million trusted testers have used Duet AI. They are writing and refining content in Gmail and Docs, creating original images from text within slides, organizing data in Sheets and more.”

Moving on to Youtube:

“overall year-on-year growth in revenues was driven by both brand advertising and direct response. But very much to your question, yes, there was a stabilization in spending by advertisers. We’re really pleased about that. We’re particularly pleased about the ongoing performance in the Living Room and on Shorts.”

Youtube continues to expand, thanks to shorts and in “The Living Room”, which refers to the use of YT on smart TVs. YT is fighting to become more than just a video platform, and could stand to eventually take more market share from other video streaming companies.

As mentioned in the earning call, YT is fast becoming the best place for creators, which will ensure its long-term success.

“And to your first part, obviously, we see AI as a foundational platform shift and are excited about the opportunities across our business. It starts with Search. And I’ve been pretty pleased with how the user feedback has been on SGE.”

GOOGL has been implementing AI into search through Search Generative Experience (SGE), and the company is pleased with the results so far.

Nothing’s changed

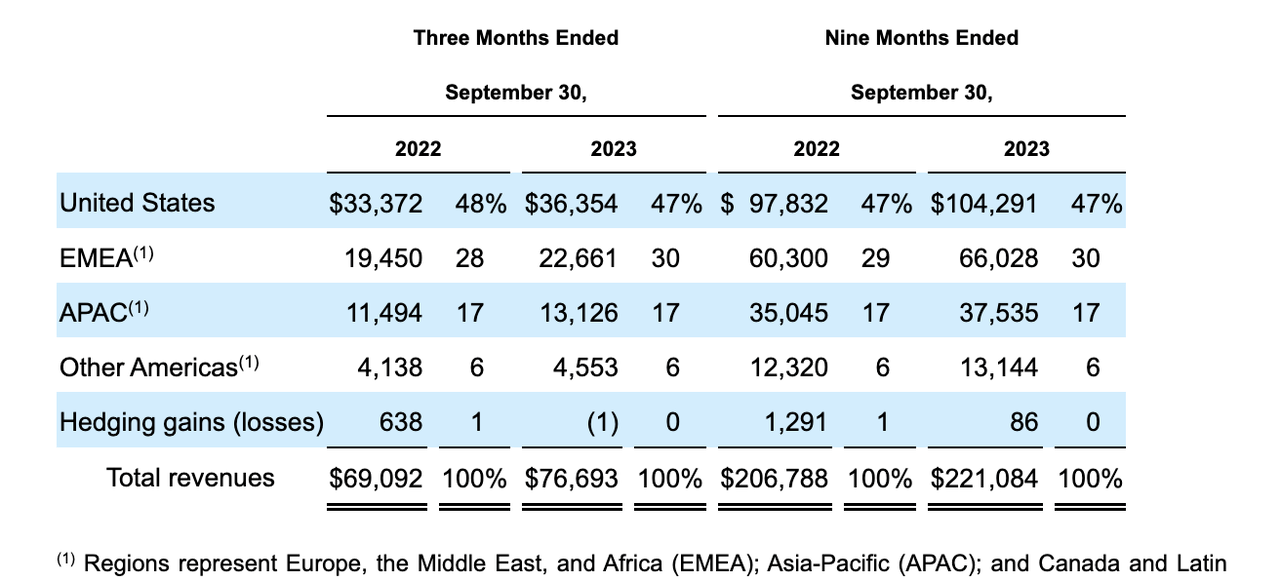

If I could summarize my bullish thesis on GOOGL in one sentence, or better yet, an image, this would be it.

search engine market share (statista)

There is Google, and then there is the rest. Google represents over 80% of desktop searches. That’s not going to change anytime soon, even with ChatGPT.

And yet, it is one of the best-valued mega-caps out there.

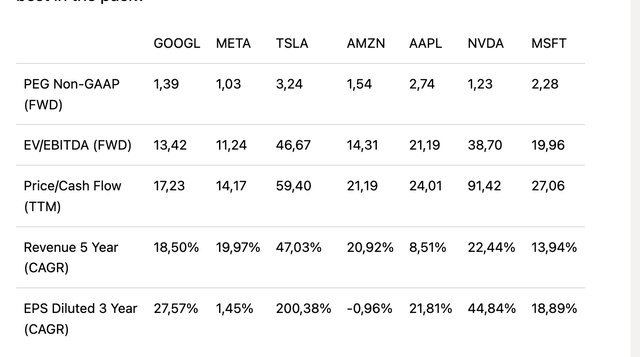

Magnificent 7 valuations (SA)

Compared to the other Magnificent 7, Google is the cheapest with the exception of Meta Platforms (META), which, though also a great company, has experienced significantly less EPS growth and has a worse outlook.

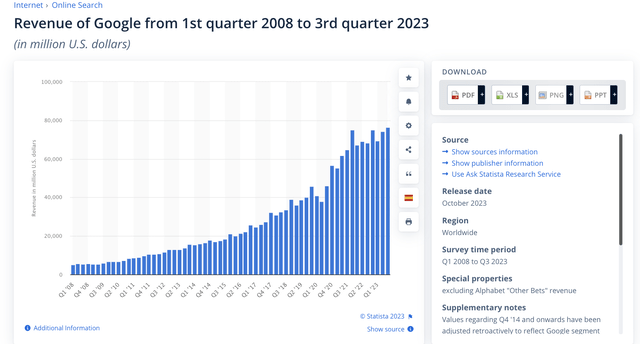

Looking at GOOGL’s performance over the last few quarters, the company’s growth has actually been accelerating.

GOOGL Revenues (Statista)

Q3 has been in line with the company’s expectations and guidance.

My Two Cents

Though some investors are concerned about the competitive landscape, especially as it relates to Cloud and AI, I believe Alphabet will no doubt be one of the largest beneficiaries of AI technology.

Even if the company does use some market share, by implementing AI into its set of tools, Google can deliver significantly more value to its customers. Google already uses AI for many of its largest apps, like Maps and YT, and it is working to implement more AI tools into its Cloud:

“Google Cloud has built AI into countless solutions that our customers can customize for their unique needs, such as DocAI for document processing, Contact Center AI for call center operations, Vertex Vision AI for video and image analysis, Translation Hub for translation in 100+ languages at scale, and many other examples.”

Source: Google

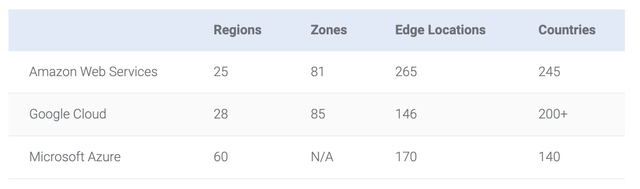

Granted, Cloud remains a competitive space, but again, I believe there is still plenty of advantages Google Cloud has over many of its competitors, and this is namely the fact that it has such a robust ecosystem behind it.

For example, Google’s cloud is second only to AWS in terms of reach.

Cloud comparison (Kinsta.com)

On top of that, a recent study found Google’s cloud VM’s have three times the throughput of AWS and Azure.

GOOGL offers a very competitive product, and I still think it will remain a dominant player int he cloud market.

I believe the market’s overreaction to the cloud slowdown is short-sighted and will likely be short-lived.

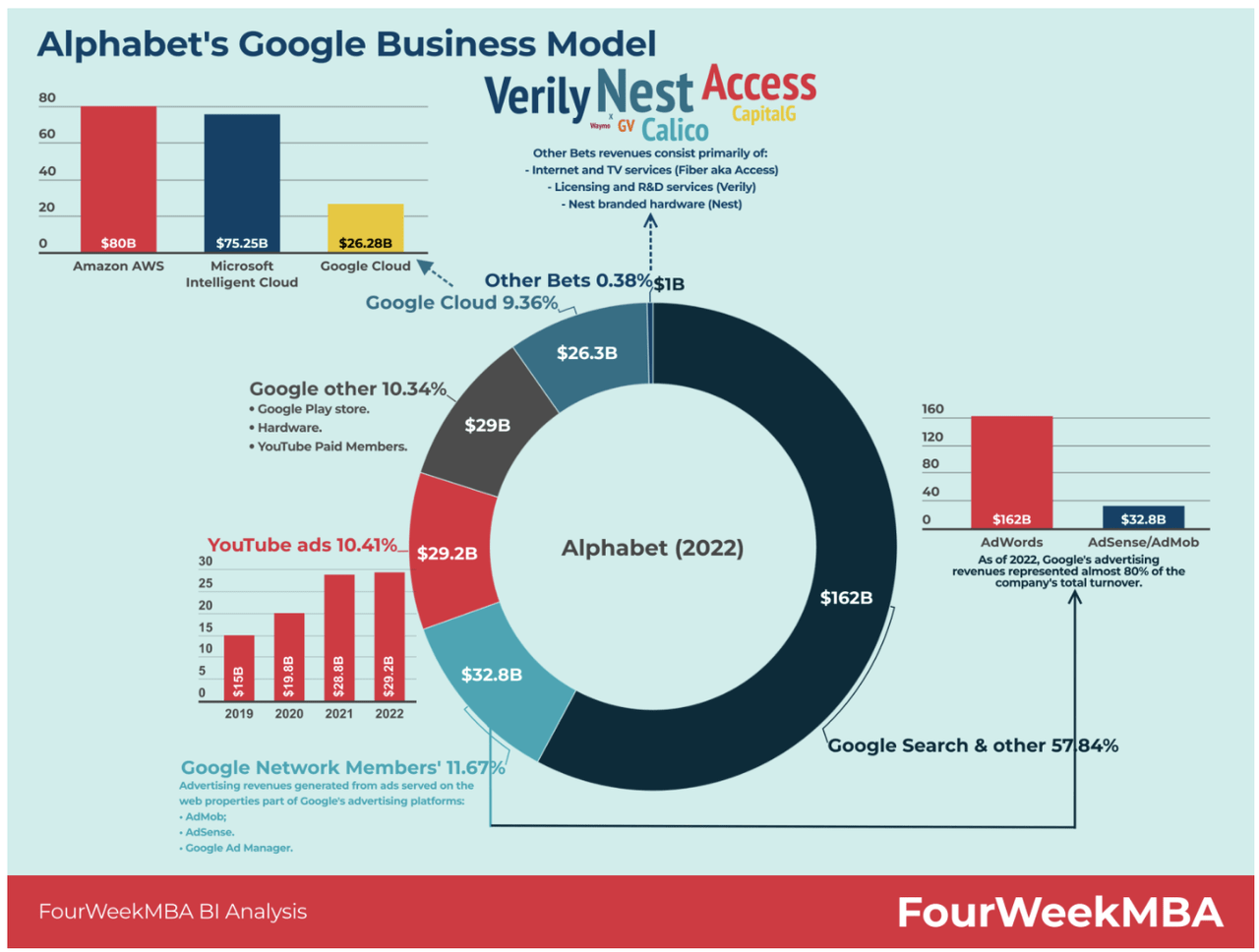

And, as I pointed out in my last article, Google has a very robust array of revenue sources, which is why I am not concerned about the “slowdown” in cloud.

Alphabet revenues (fourweekMBA)

Future Outlook

Overall, the only thing that has changed here is the share price, which makes it an even more compelling buy.

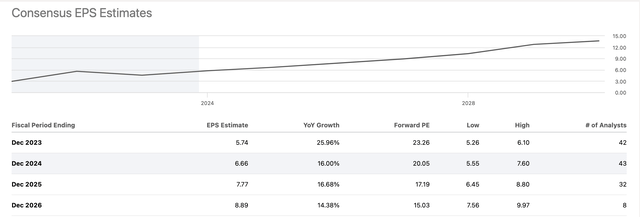

EPS estimates (SA)

Looking ahead, EPS is projected to keep growing at double digits.

GOOGL’s growth prospects and TAM continue to be substantial.

Cloud is a segment that is projected to grow at a CAGR of 17.9%, and GOOGL is still set to capture this opportunity.

Search continues to be strong. In fact, GOOGL gained market share over Bing, according to this report.

And global ad spend is projected to top $1 trillion in 2024.

Furthermore, Google continues to make inroads in AI, and I am especially excited about the prospects of its TPUs, which are already being used by startups like Anthropic.

The biggest challenge for GOOGL will be regulation, with anti-trust cases against the company mounting.

The Market Is Missing The Point

There is a great opportunity with GOOGL, that the market is ignoring. While the company is rewarding competitors like Microsoft (MSFT) I believe they are wrong. As I pointed out above, Bing has actually lost market share despite ChatGPT.

GOOGL stands to benefit from AI as much as any of these other companies. AI can improve the outlook on most of its businesses, and the company could even profit more directly if it ever managed to broadly commercialize its TPUs, something which I touched on here.

With a forward PEG of 1.47, this remains the most undervalued big tech name.

On top of that, this is probably the best company to own in the event of a recession, thanks to its global footprint, diversified revenues and fortress balance sheet.

That’s another premium the market is failing to account for.

Technical Analysis

I already covered in my last piece on GOOGL how the company is attractively valued, so today, I am going to be looking at this stock’s technical outlook.

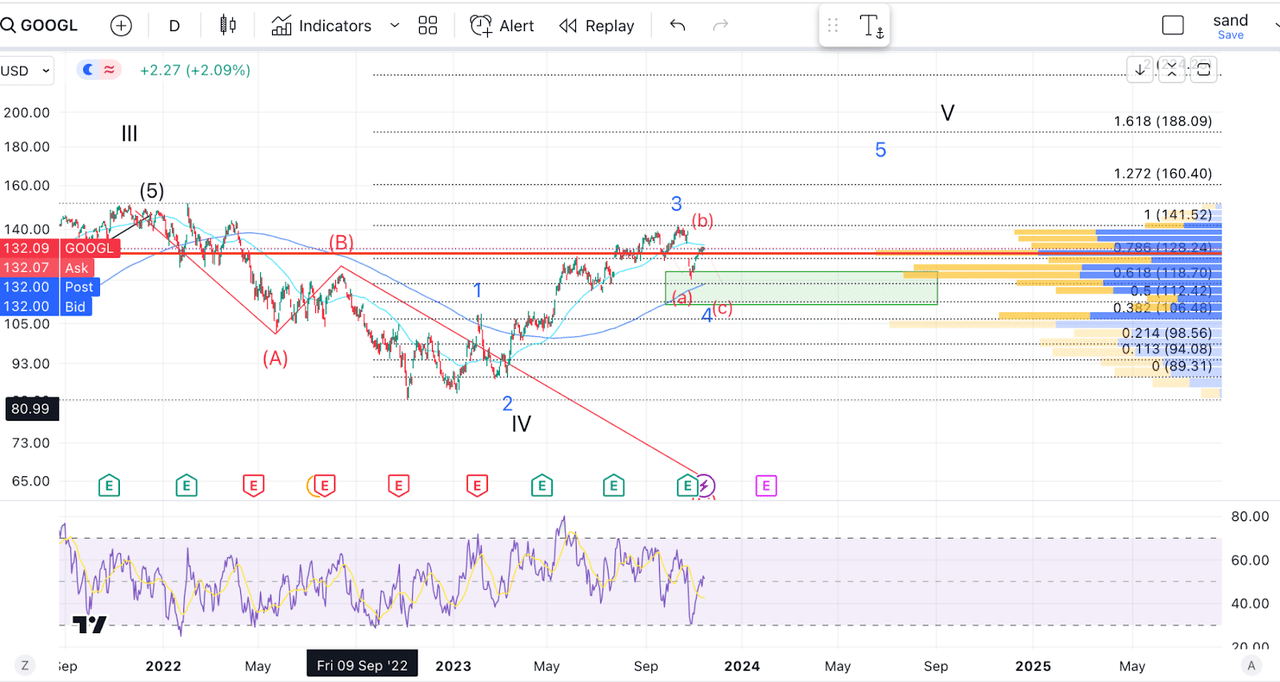

GOOGL TA (Author’s work)

Looking at the chart, I believe we are forming a five-wave impulse that will take us to new ATHs.

Within that impulse, we may now have entered a wave 4. which could still need one last leg down. Notice how the 200 day MA coincides with the 38.2% retracement of the wave 3 rally, just above $118. In my opinion, this would be an ideal spot for GOOGL to find a bottom.

Following this, we should begin one final leg up in wave 5, which should take us to at least $150.

Takeaway

All in all, I see nothing bearish about the recent earnings and believe the current sell-off in the stock is a great opportunity to go long. We may see lower in the coming weeks, but there is no guarantee. What I am more certain of is that GOOGL will eventually break to new ATHs.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This stock is part of my End Of The World Portfolio.

A portfolio of highly diversified, secure and reliable companies that will do well in ANY environment.

Join the Pragmatic Investor today to get full access to the portfolio and more.

– Weekly Macro newsletter

– Access to the End of The World and YOLO portfolios

– Trade Ideas

– Weekly Video