Summary:

- Google submitted its Q4’22 earnings on Thursday.

- Google’s advertising revenues actually declined year over year. This is a game changer.

- Advertising market downturn is clearly not over.

400tmax

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) reported poor results for its fourth-quarter last week which fell short of expectations and also indicated that the slowdown in the digital advertising market is not over yet. Google actually saw its advertising revenues decline on a year over year basis in Q4’22 with weakness affecting Google’s core Internet Search business, but also YouTube ads and Google Network. The slowdown is concerning as I expected stronger growth for Google’s top line in Q4’22. Since I was wrong about Google’s growth potential and the state of the advertising market, I am down-grading my recommendation to hold!

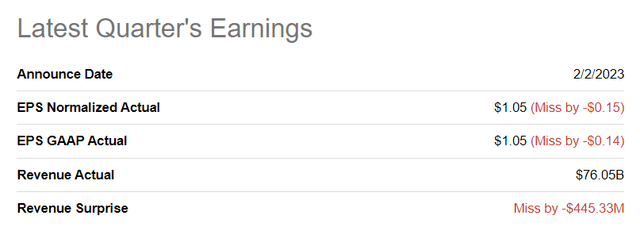

Google misses on both revenue and earnings

Google failed to meet expectations on its top and bottom line for the fourth-quarter last week. Google said it had revenues of $76.05B compared to the street estimate of $76.50B while EPS came in at $1.05, $0.15 per-share below estimates.

Dangerous growth slowdown

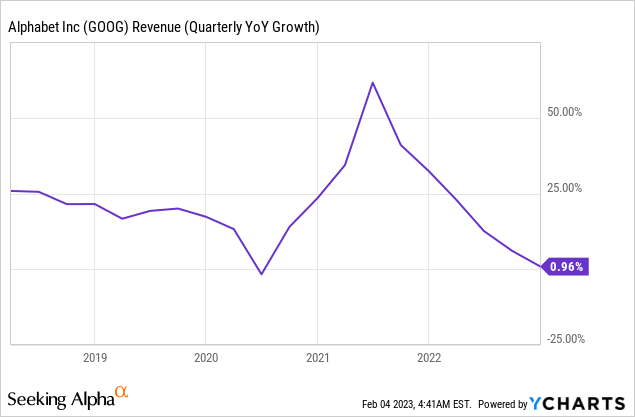

Google’s earnings sheet was much worse than I feared. I expected Google to deliver single digit revenue growth in the fourth-quarter, driven by a strong performance of the Cloud business, but the technology company could not have disappointed more with a revenue growth rate of just 1%.

Unfortunately, Google’s advertising revenue growth even went negative in Q4’22. Google’s advertising revenues — which include Google Search, YouTube ads and Network — skidded 3.6% year over year to $59.1B. Revenues fell chiefly due to weakness in YouTube ad spending where revenues declined 7.8% year over year to just $8.0B and in Google Network which saw a similar percentage decline in segment revenues.

The poor results stem from a cyclical down-turn in the advertising market that is worse than expected. What makes it worse, at least for me, is that Google’s Search-related revenues also decreased which suggests that the advertising market is in worse shape than feared. Google Search is by far Google’s largest business with a revenue share of 56% and this segment saw its revenues decline 1.6% year over year to $42.6B.

|

$millions |

Q4’21 |

Q4’22 |

Y/Y Growth |

Revenue Share (Q4’22) |

|

Google Search & other |

$43,301 |

$42,604 |

-1.61% |

56.02% |

|

YouTube Ads |

$8,633 |

$7,963 |

-7.76% |

10.47% |

|

Google Network |

$9,305 |

$8,475 |

-8.92% |

11.14% |

|

Google Other |

$8,161 |

$8,796 |

7.78% |

11.57% |

|

Google Cloud |

$5,541 |

$7,315 |

32.02% |

9.62% |

|

Other Bets |

$181 |

$226 |

24.86% |

0.30% |

|

Hedging |

$203 |

$669 |

229.56% |

0.88% |

|

Total revenues |

$75,325 |

$76,048 |

0.96% |

100.00% |

(Source: Author)

The Cloud business saved Google from reporting negative consolidated revenue growth for the fourth-quarter, although growth here is also slowing down. The fourth-quarter was the sixth consecutive quarter of revenue deceleration for Google which obviously is a concerning trend.

The larger point I am trying to make here is that Google’s growth is slowing across the board, including the Cloud business which has been a growth engine for Google in the past. In Q4’22, Google Cloud’s revenues increased 32.0% year over year whereas they grew 37.6% in Q3’22. Amazon (AMZN) experienced a similar slowdown in its Cloud segment in Q4’22 as customers spend money less aggressively in a high-inflation world. Still, Google’s Cloud growth saved Google from reporting negative revenue growth for Q4’22, but I believe a negative growth quarter (on a top line basis) is now clearly a possibility in FY 2023.

Free cash flow provides protection

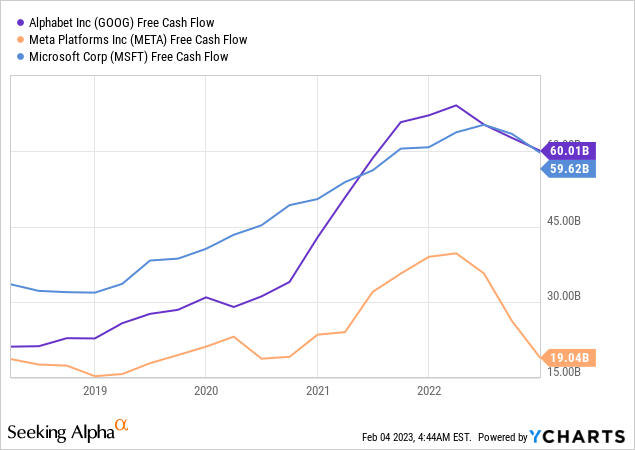

Although the advertising down-turn is getting more severe and investors are rightfully worried about Google’s growth momentum, the technology company is still running a very profitable advertising business model. Google generated $16.0B in free cash flow in the fourth-quarter which calculates to a free cash flow margin of 21.1%.

Although the free cash flow margin skidded from 24.6% year over year, Google’s free cash flow strength must be seen in the context of a weakening digital advertising market. While Google’s advertising performance was not great, the company clearly remains a free cash flow powerhouse that limits the stock down-side risks.

|

$millions |

Q4’21 |

Q1’22 |

Q2’22 |

Q3’22 |

Q4’22 |

|

Revenues |

$75,325 |

$68,011 |

$69,685 |

$69,092 |

$76,048 |

|

Net cash provided by operating activities |

$24,934 |

$25,106 |

$19,422 |

$23,353 |

$23,614 |

|

Less: purchases of property and equipment |

($6,383) |

($9,786) |

($6,828) |

($7,276) |

($7,595) |

|

Free cash flow |

$18,551 |

$15,320 |

$12,594 |

$16,077 |

$16,019 |

|

Free cash flow margin |

24.6% |

22.5% |

18.1% |

23.3% |

21.1% |

(Source: Author)

Google also generated $60B in LTM free cash flow which equates to an FCF-margin of 21.2%. While Google likely has not seen the bottom in the ad market yet, the pure size of Google’s free cash flow provides a basic level of protection for the stock. Google’s free cash flow also compares favorably against the free cash flows of other large technology companies including Meta Platforms (META) and Microsoft (MSFT).

Google’s valuation

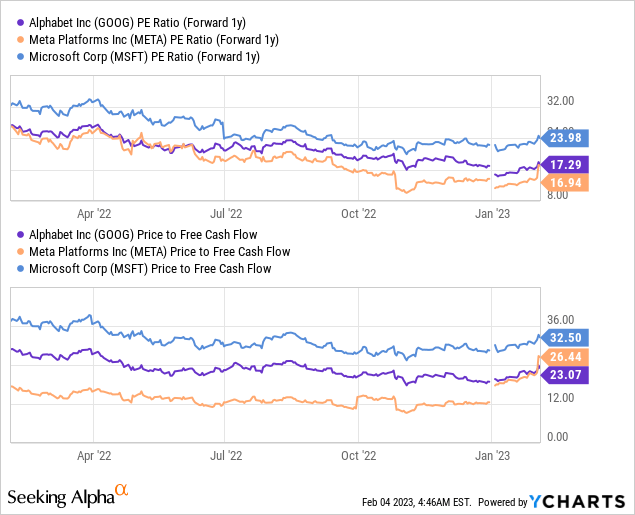

Google has resilient free cash flow, but the advertising market still hasn’t bottomed yet which may lead to more short term correction potential for Google’s shares. Compared against other technology stocks with material free cash flow, Google still maintains a favorable valuation.

Google’s shares trade at a forward P/E ratio of 17.3 X and are therefore cheaper than Microsoft’s shares (P/E ratio of 24.0 X) and only slightly more expensive than Meta Platforms’ shares (P/E ratio of 16.9 X).

Regarding free cash flow, shares of Google are also competitively priced: Google has a P/FCF ratio of 23.1 X, the lowest of the three, despite Google earnings the largest amount of free cash flow.

Risks with Google

The biggest commercial risk for Google is that the advertising downturn gets even worse and that, especially the core Search business, could post stronger revenue declines in the coming quarters. Due to Google’s large reliance on Search-driven advertising revenues, a slowdown in Search could actually push Google’s top line growth into negative territory in FY 2023. A further slowdown of the Cloud business would also likely be considered a headwind for the stock.

Final thoughts

Google experienced a dramatic slowdown of its core advertising business in the fourth quarter that I did not foresee. I also expected Google to produce stronger revenue growth in Q4’22 about which I was clearly wrong. The breadth of Google’s revenue decline is a warning signal for investors and strongly indicates that the digital advertising market is set for a continual consolidation in FY 2023. While I generally view Google’s free cash flow as resilient, I am more cautious now (which is also why I am changing my recommendation to hold) that Google is seeing negative revenue growth in its most important segments!

Disclosure: I/we have a beneficial long position in the shares of GOOG, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.