Summary:

- Google successfully used quantum error correction in practice, opening the door to large quantum computers with vast capabilities.

- The team used a surface code to improve qubit error rates and demonstrated that quantum error correction works in practice.

- Forward-looking investors should keep track of Google’s progress with respect to their roadmap in the years ahead.

bpawesome/iStock via Getty Images

Introduction

Quantum error correction (“QEC”) has been discussed in theory for many years but in February Google-parent Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) announced they successfully used it in practice. My thesis is that Google’s work with quantum error correction opens the door to making large quantum computers with vast capabilities.

Google has many positives per my May article, but quantum computing deserves special mention as it isn’t yet showing up significantly in earnings.

The February QEC Announcement

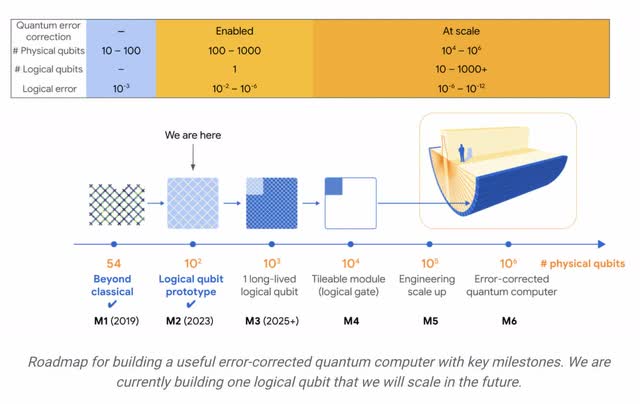

A February Google Research Quantum AI Team blog post by Engineering VP Hartmut Neven and Quantum Hardware Director Julian Kelly shows a path forward. Google’s 3rd generation Sycamore processor has quantum bit (“qubit”) error rates in a range of 1 in 10,000 to 1 in 100 and Google needs to improve this to a range of 1 in 10^9 to 1 in 10^6. The roadmap shows we went beyond classical computers in 2019, and we’re at an error rate of 1 in 100 now:

Google Quantum Computing Roadmap (Google Research Quantum AI Team blog post)

Prior to QEC, each physical qubit on the processor acted as a unit of computation. Many good physical qubits are traded for one excellent logic qubit with QEC but this only works if the additional errors from the added physical qubits are low; until the experiment behind the February announcement, the physical error rates had been too high.

The team uses a particular error-correcting code called a surface code and they’ve gone from 17 to 49 physical qubits. The concept of QEC surface codes is explained by talking about classical bits as opposed to qubits. Suppose Bob sends a bit that reads “1” to Alice. If it has an error and flips to “0” then the message is lost. As such, Bob could send “111” instead such that if one of the bits flips because of an error then Alice could still take a majority vote. This repetition of information, “111” instead of “1” increases the size of the code. In terms of coins, I like to think of this as sending 3 pennies that show heads instead of 1 penny that shows heads. The team explains that two additional constraints must be satisfied beyond checking for individual qubit errors:

First, the surface code must be able to correct not just bit flips, taking a qubit from |0⟩ to |1⟩, but also phase flips. This error is unique to quantum states and transforms a qubit in a superposition state, for example from “|0⟩ + |1⟩” to “|0⟩ – |1⟩”. Second, checking the qubits’ states would destroy their superpositions, so one needs a way of detecting errors without measuring the states directly. To address these constraints, we arrange two types of qubits on a checkerboard. “Data” qubits on the vertices make up the logical qubit, while “measure” qubits at the center of each square are used for so-called “stabilizer measurements.” These measurements tell us whether the qubits are all the same, as desired, or different, signaling that an error occurred, without actually revealing the value of the individual data qubits.

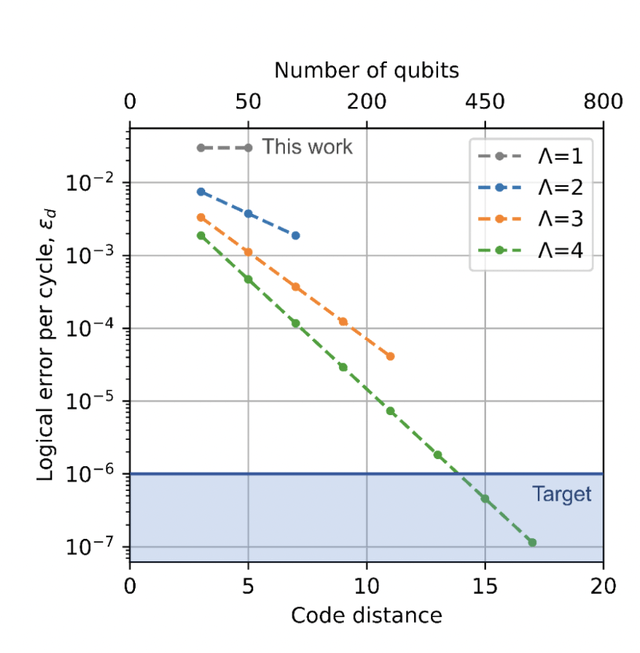

The team’s blog post shows the work from the February announcement relative to what needs to happen in the future:

Google Quantum Computing Targets (Google Research Quantum AI Team blog post)

Google’s full publication on this work is published in Nature where they said their efforts have demonstrated a critical step:

In this work we report a 72-qubit superconducting device supporting a 49-qubit distance-5 (d = 5) surface code that narrowly outperforms its average subset 17-qubit distance-3 surface code, demonstrating a critical step towards scalable quantum error correction.

@GoogleQuantumAI summarized the February announcement on Twitter by saying we are now past the break-even point for the first time. The team went to a larger array of data qubits and the error rate came down. The team showed that quantum error correction doesn’t only work in theory; it now works in practice as well!

Quantum Computing Approaches

In addition to keeping track of the quantum computing progress being made by Google, forward-looking investors should be aware of the effort being put forward by other companies. Google’s road to scalable quantum computing with the current quantum error correction could take many years and it is possible other companies might get to practical quantum computing solutions in a shorter time period. Google and IBM (IBM) are making progress with the superconducting quantum computers where machines are cooled down to nearly absolute zero in order to avoid breaking coherence. Honeywell (HON) is working on an Ion Trap Quantum Computer.

Photonic quantum computers can operate at room temperature and they are working on this approach in China such that they’re computing on laser light beams instead of electrons. They’re also working on the photonic quantum approach in Canada per the Quantum Supremacy book by Michio Kaku:

More recently, a Canadian start-up called Xanadu has introduced its photonic quantum computer, which has a distinct edge. It is based on a tiny chip (not a tabletopful of optical hardware) that manipulates infrared laser light through a microscopic maze of beam splitters. Unlike the Chinese design, the Xanadu chip is programmable and its computer is available on the internet. However, it only has eight qubits, and still requires some superconducting freezers. But, as Zachary Vernon of Xanadu says, “For a long time, photonics was considered an underdog in the quantum computing race…. With these results… it’s becoming clear that photonics is not an underdog, but in fact one of the leading contenders.”

[Quantum Supremacy Kindle Book Location: 1,436]

PsiQuantum is partnering with GlobalFoundries (GFS) on silicon photonic computers. Microsoft (MSFT) is using topological processors for their quantum computer efforts. A Canadian company named D-Wave is working on quantum annealing.

Implications For Investors

Airlines have been good for humanity but they have been terrible for investors as a whole. An August 2022 article in the Financial Times from Oxford physicist Nikita Gourianov casts doubt on how much quantum computing can benefit humanity. University of Texas at Austin physicist Scott Aaronson is more optimistic and he addresses the Financial Times article in his blog:

As for applications, my position has always been that if there were zero applications, it would still be at least as scientifically important to try to build QCs as it was to build the LHC, LIGO, or the James Webb telescope. If there are real applications, such as simulating chemical dynamics, or certifiable randomness – and there very well might be – then those are icing on the cake.

We have to be wary of hyperbole in headlines when quantum computing breakthroughs are announced. Physicist Scott Aaronson said on his blog that Google’s Sycamore did not create a wormhole as some have claimed:

Let’s start with the wormhole thing. I can’t really improve over how I put it in Dennis Overbye’s NYT piece: “The most important thing I’d want New York Times readers to understand is this,” Scott Aaronson, a quantum computing expert at the University of Texas in Austin, wrote in an email. “If this experiment has brought a wormhole into actual physical existence, then a strong case could be made that you, too, bring a wormhole into actual physical existence every time you sketch one with pen and paper.”

Valuation

Looking at the 2Q23 10-Q and the 2022 annual report, Google Services has trailing twelve month (“TTM”) operating income of $88,169 million or $45,191 million + $86,572 million – $43,594 million and this comes from TTM revenue of $257,461 million or $128,246 million + $253,528 million – $124,313 million. I think it’s reasonable to value Google Services at 18 to 20x TTM operating income and this comes to $1,585 to $1,765 billion when rounded to the nearest $5 billion.

Google Cloud finally saw operating income turn positive in 1Q23 and in 2Q23 it had operating income of $395 million on revenue of $8,031 for a revenue run rate of $32,124 million. I think Google Cloud will always lag AWS with respect to operating margin but I’m optimistic Google Cloud can get to 15 to 20% which implies a hypothetical operating income run rate of $4,819 to $6,425 million. Putting a valuation of 18 to 20x on this gives us a range of $87 to $129 billion.

In my last article I valued Other Bets at $0 but I’m more optimistic now given the potential for efforts with quantum computing. As such, I now value this segment at $25 to $50 billion.

Here is my sum of the parts valuation:

$1,585 to $1,765 billion Google Services

$87 to $129 billion Google Cloud

$25 to $50 billion Other Bets

—————————–

$1,697 to $1,944 billion Total

Per the 2Q23 10-Q, there are 5,933 million A shares plus 875 million B shares for a sub total of 6,808 million GOOGL shares. This component of the market cap comes to $903.6 billion based on the July 31st share price of $132.72. There are also 5,801 million C shares which bring the GOOG component of market cap to $772.2 billion based on the July 31st share price of $133.11. Summing up, the total market cap is $1,675.8 billion.

The enterprise value is far below the market cap seeing as cash and equivalents are significantly more than debt.

Seeing as the market cap is below my valuation range, I think the stock is a buy for long-term investors.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, GOOGL, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.