Summary:

- Alphabet Inc.’s stock surged on AI optimism, driven by recent AI developments, including Gemini 2.0 and quantum computing, laying a strong foundation for the “AI agentic” era.

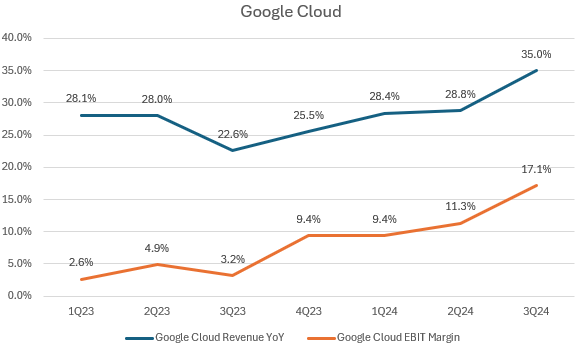

- The rally was further supported by a strong 3Q FY2024 earnings report, with Google Cloud revenue growth and margins showing significant sequential improvement.

- Google Advertising revenue in 3Q exceeded management’s prior outlook for softness in 2H FY2024, with growth showing sequential acceleration.

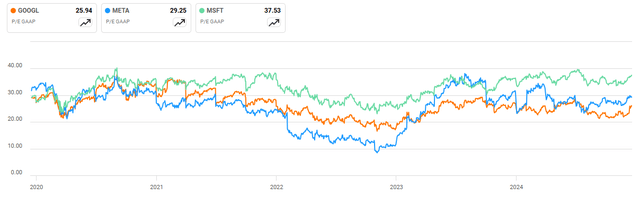

- Despite the recent rally, the P/E multiple is currently 5% lower than its historical average, driven by strong earnings growth that limits valuation expansion.

- I believe GOOGL’s forward revenue consensus is underestimated, with an upside revision likely in the near term, supporting further stock potential.

Just_Super

Stock Breaking All-Time High

Alphabet Inc. (NASDAQ:GOOG, NEOE:GOOG:CA, NASDAQ:GOOGL)’s stock recently hit all-time high after a sharp pullback in this summer. The rally has been largely driven by optimism around its AI investments and also supported by a strong 3Q FY2024 earnings report. GOOGL achieved a sequential growth acceleration in total revenue and strong margin expansion last quarter, fueled by significant growth in Google Cloud Platform (GCP), beating my earlier expectations of softness in growth and margins for the 2H FY2024. In addition, the recent announcements of the Gemini 2.0 AI model and breakthroughs in quantum computing have also justified the expansion in its valuation multiples.

In my previous analysis of 2Q FY2024 earnings, I maintained a buy rating to take advantage of the late-summer pullback, driven by robust AI-related revenue and its relatively low valuation. Since then, the stock has experienced a strong V-shaped recovery, beating the S&P 500 index.

However, the stock triggered a nearly 4% pullback following a broad-based retracement driven by a hawkish Fed on Wednesday, which indicated fewer rate cuts in 2025. This creates an attractive buying opportunity. I believe GOOGL still has room for further upside, supported by a stronger AI growth outlook than the market previously anticipated. The stock’s relatively low valuation is theoretically less sensitive to higher interest rates. Therefore, I’m upgrading it to a “Strong Buy” rating.

Google Cloud Platform Is Growing Stronger Than Ever

The company model

GOOGL is currently in growth acceleration mode, defying the previous soft outlook in 2H FY2024, with total revenue growing 15.1% YoY in 3Q FY2024, up from 13.6% YoY in 2Q FY2024. As shown in the chart, Google Cloud revenue increased by 35% YoY, showing a significant acceleration above its prior growth trend. Additionally, Google Cloud’s operating margin expanded significantly to 17.1% in the last quarter. This implies that its prior AI investments are now monetizing at a faster pace. During the 3Q FY2024 earnings call, CEO Sundar Pichai highlighted that they have lowered the cost of GenAI queries by 90% and doubled the size of the custom Gemini model over the past 18 months, contributing nearly 13.9% numerical increase in operating margin on YoY basis.

Gemini 2.0 and Quantum Computing Breakthrough

On December 9th, GOOGL announced a groundbreaking achievement in quantum computing, with its new quantum chip, Willow. As highlighted in the introduction video, this chip showcased exceptional performance, completing in under five minutes a calculation that would take today’s fastest supercomputer approximately 10 septillion years. One potential monetization strategy could involve integrating quantum computing capabilities into the Google Cloud Platform, allowing users to access quantum resources for specialized tasks or offering add-ons for enterprise customers.

Shortly after, GOOGL introduced its new AI model, Gemini 2.0, which significantly enhances its ability to handle complex tasks with minimal human input. During the earnings call, the CEO mentioned that more than 25% of new code at Google is now generated by AI. As GOOGL develops AI agents powered by Gemini 2.0, it’s hard to see why investors wouldn’t be excited about the company’s growth outlook, which is expected to transform various industries in the upcoming “AI agentic” era.

Although these achievements were not mentioned during the latest earnings call, I believe they will strengthen GOOGL’s position in the GenAI landscape, particularly against Microsoft’s (MSFT) OpenAI. I also think Google Cloud Platform is well-positioned to maintain a growth trajectory of over 30% YoY and achieve further margin expansion to 20% in the next 12 months. The market has clearly embraced this new AI growth narrative. According to Seeking Alpha, GOOGL’s revenue revisions for FY2025 have remained muted in recent months. I expect more upward revisions in the near term.

What Could Go Wrong for the Stock?

While GOOGL’s cloud business is “on fire”, the majority of its revenue still comes from consumer-focused segments, which tend to be cyclical. Currently, strong consumer spending during the holiday season is supporting its advertising revenue. During the earnings call, management highlighted “broad-based strength across all verticals,” likely driven by election-related ad spending. This could explain why the company has been able to maintain resilient growth in its Google Advertising segment for now. However, I’m not sanguine about the U.S. macro outlook for FY2025, especially considering what the market has priced in, particularly with the Fed signaling higher rates into 2025.

A potential slowdown in advertising spendings, driven by unexpected weaker consumer demand, could significantly impact GOOGL’s overall revenue growth, as the Google Cloud segment currently contributes only 12.5% of total revenue. Nevertheless, the stock’s downside risk could be supported by its relatively attractive valuation, after a potential consolidation.

Valuation Looks Reasonable

Seeking Alpha

Now let’s look at its multiples. GOOGL’s valuation remains relatively cheap compared to other mega-cap stocks, all of which have benefited from elevated capex in GenAI infrastructure, driving their growth trajectories above historical averages. Despite this, GOOGL’s GAAP P/E TTM is approximately 5% lower than its five-year average. Its non-GAAP P/E fwd is at 24.7x, still the lowest among “Magnificent 7” stocks.

Additionally, we can see that its P/E is currently trading at an attractive level relative to its EV/sales. This is largely due to strong growth in Google Cloud revenue, offset by slower growth in advertising revenue, which is affected by its already large market share. However, strong margin expansion has driven earnings growth significantly higher, limiting further expansion in its P/E multiple.

Lastly, I believe that recent breakthroughs, including Gemini 2.0 and advancements in quantum computing, will structurally accelerate long-term revenue growth. We should expect a faster decline in its EV/sales multiple going forward.

Conclusion

In conclusion, GOOGL’s fundamentals have improved significantly since my last rating after the 2Q FY2024 earnings release, which explains the sharp rebound in stock price. The valuation still looks very attractive under the current lofty market backdrop. We clearly see a strong ROI from its elevated capex in AI, including Gemini 2.0 and advancements in quantum computing. Moreover, a sustained trajectory of margin expansion has enhanced the stock’s quality, resulting in a P/E lower than its historical average. With the recent pullback bringing the stock below overbought levels, I’m upgrading GOOGL to a “strong buy” rating to capitalize on this “growth at a reasonable price” opportunity, especially compared to other mega-caps right now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.