Summary:

- Google faces regulatory challenges across both sides of the Atlantic, which are unlikely to disappear soon.

- The rising competition and excessive capital expenditure on AI could undermine the company’s growth.

- Google remains a SELL for us, especially at the current market price.

Dan Kitwood/Getty Images News

In September, we said that Google’s (NASDAQ:GOOGL)(NASDAQ:GOOG) downside is more significant than ever. Although its shares have slightly risen in value since that time thanks to the release of a positive earnings report for Q3, major challenges continue to mount. The regulatory environment is unlikely to significantly improve, the competition is rising, the capital expenditures on AI continue to increase, and the stock is overvalued to this day. Therefore, we still believe that Google is a SELL at this point.

Major Risks Persist

Google had a good performance in Q3. Its revenues were up 14.9% Y/Y to $88.27 billion and exceeded expectations by $2.05 billion. The bottom-line performance was also decent as the GAAP EPS of $2.12 was above expectations by $0.27. Although those are solid numbers, major risks persist and could undermine Google’s growth story in the foreseeable future.

The biggest downside of Google right now is that it faces a plethora of regulatory challenges that can have a negative monetary impact on the company itself. Two months ago, Google lost an antitrust fight against the European Commission and needs to pay $2.7 billion in fines. The company has also recently stopped showing political ads in the European Union to comply with new regulations, which could result in lower revenues from Europe in the future.

More importantly, there are calls to widen the European Digital Markets Act probe of Google, which could lead to fines of up to 10% of the company’s global annual turnover or result in the breaking of the business into smaller parts. Earlier this year, Google was already designated as a gatekeeper under the Digital Markets Act and has been on the European watchdog list ever since. Considering that Google lost a fight against the European Commission in September, while another Big Tech company, Apple (AAPL) is about to face an EU-fine over App Store rules, the harsher regulatory environment in Europe could undermine the business’s growth in the future.

Things are also not looking optimistic back at home. Recently, it was reported that Google’s deal to invest in an AI startup Anthropic could be unwound by the Department of Justice, which aims to force Google to spin off its Chrome browser. A separation of Chrome could put ~15% of the company’s search revenue at risk. Considering that earlier this year, Vice President-elect JD Vance called for the breakup of Google, investors might be wrong in thinking that the Department of Justice will fully drop off all the cases against the company under the Trump administration.

The macro environment could also change for the worse soon and stop Google’s aggressive rise. If the Trump administration implements the promised tariffs against Chinese goods, then they could undermine global growth. Under such a scenario, advertising spending could be indirectly affected as advertisers would be required to optimize their budgets to better adapt to the new economic reality.

The rising competition is another major challenge that Google now faces. After decades of dominance, the company’s leadership position in the search market is under threat of disruption. Microsoft (MSFT) in the latest conference call said that the growth of its Bing search engine has outpaced the search market as the company has been implementing its Copilot AI tool into its search products lately. The creator of ChatGPT OpenAI also looks to create its web browser and integrate its chatbot into it, which could also undermine Google’s leadership position in the search business.

Finally, as Google faces such major risks, some of which could be considered existential, the company is nevertheless engaged in a spending spree to gain an advantage in the ongoing generative AI revolution. In 2023, its CapEx was $32.25 billion. In the first three quarters of 2024, the company’s CapEx already exceeded $38 billion, and another $13 billion is expected to be spent in Q4. The issue is that there’s a risk that the AI payoff won’t be seen anytime soon, while the company will nevertheless spend billions on AI infrastructure in a tough environment.

The Real Value Of Google

We believe that all the risks described above will make it harder to justify Google’s current valuation. In September, our valuation model showed that Google’s intrinsic value is $138.54 per share. This is already above the current market price. Since Google’s Q3 numbers came in after we published our latest article, we decided to update our valuation model.

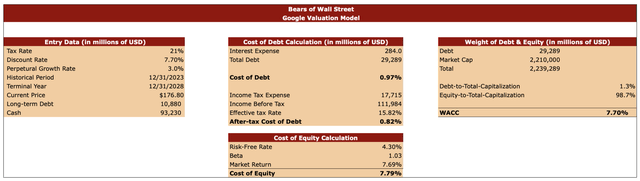

Before going into the forecast, we added the entry data, which will help us figure out Google’s real worth. We retained the tax rate of 21% in the model since it’s the current corporate tax rate in the United States. The perpetual growth rate remains at 3%, which is close to the historical GDP and inflation data. We’re updating our valuation model when Google is trading at $176.80 per share and the long-term debt and cash data is taken from the latest earnings report.

The discount rate in this model is 7.70%. We figured it out by calculating Google’s after-tax cost of debt and cost of equity. For calculating the after-tax cost of debt, we used primarily Google’s TTM data. For calculating the cost of equity, we used a risk-free rate of 4.30%, a beta of 1.03, and a market return rate of 7.69%. We then weighted the debt and equity to arrive at the discount rate.

Google’s valuation model (Bears of Wall Street)

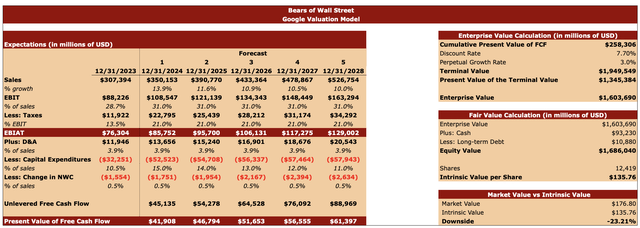

In the forecast table below, we assume that Google will be growing at a stable double-digit growth rate. The forecast for the next two years is the same as the current expectations, after which we expect a gradual normalization of the growth rate. The EBIT as a percentage of sales in the model is 31% in all years. This is the same as in the previous model and also close to the recent historical performance.

Both revenues and earnings might be slightly high in the model due to the potential disruption of the company’s business model due to the reasons described earlier in this article. However, a tax rate that’s slightly higher in comparison to Google’s historical rate balances things out. The assumptions for the depreciation & amortization and change in net working capital haven’t changed much in comparison to the previous model. At the same time, CapEx assumptions have been increased due to the higher spending on AI. This has been highlighted earlier in this article.

This model shows that Google’s enterprise value is $1.6 trillion, while the equity value is $1.69 trillion. At the same time, Google’s intrinsic value under our assumptions is $135.76 per share, below the market price by 23.21%.

Google’s valuation model (Bears of Wall Street)

Our price target has been lowered in this model in comparison to the previous model mostly because of the expected increase in capital expenditures, which has been highlighted in the latest earnings call. Considering the regulatory and other risks described earlier, the downside could be even more significant. That is why Google remains a SELL for us.

Risks To Our Bearish Thesis

There’s a possibility that our bearish thesis won’t materialize, and Google would be able to avoid a worst-case scenario. The company is still the biggest name in the search business by a wide margin and considering that the ad spending on search is expected to accelerate in the upcoming years, the competition is unlikely to dethrone Google from its leadership spot in the foreseeable future.

There’s also a possibility that while the Department of Justice won’t fully abandon its cases against Google, a softer approach could be taken against the company, which won’t lead to a drastic scenario. While Vice President-elect JD Vance called for the breakup of Google, he did so before the elections and the position could be different right now.

Final Thoughts

Although Google’s situation is not dire and it has some growth opportunities, major risks persist and can negatively affect its performance in the future. Due to its size and scale, the regulatory challenges are unlikely to disappear across both sides of the Atlantic anytime soon. Also, the potential implementation of harsher tariffs by the incoming Trump administration could affect growth and have a direct impact on the digital advertising market since it could prompt the cut of advertising budgets by businesses to adapt to a more protectionist environment. Finally, an aggressive CapEx might not be worth it in the end. That is why Google remains a SELL for us, especially at the current market price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.