Summary:

- Alphabet’s valuation is reasonable with a PEG ratio under 2x, but key risks include AI competition, regulatory threats, and shifts in search behavior.

- Alphabet’s strong balance sheet supports its investments in cloud and AI, while recent shareholder returns through buybacks and dividends reflect sensible capital management.

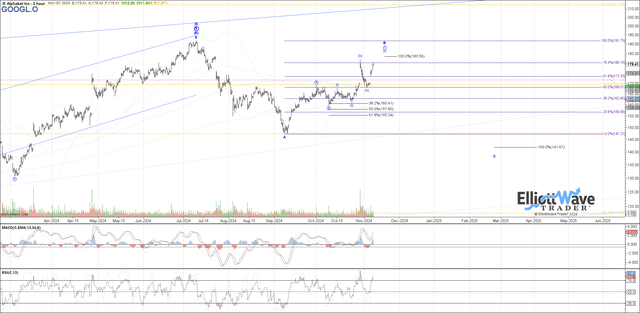

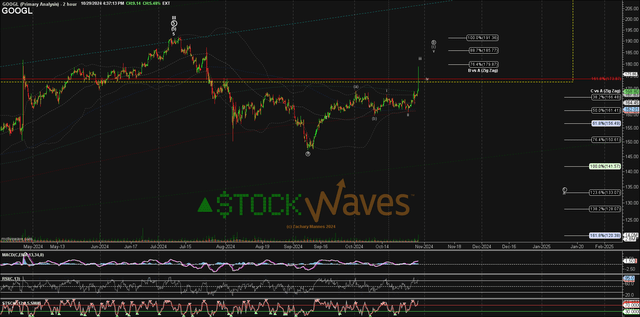

- Market sentiment is a primary driver of Alphabet’s stock price, necessitating the use of Elliott Wave theory and Fibonacci Pinball for dynamic adaptability.

- The current GOOGL chart suggests a potential consolidation period; monitoring micro-movements is crucial to predict the next significant price direction.

Shutter2U

By Levi at Elliott Wave Trader; Produced with Avi Gilburt

No matter the moat this one is believed to possess, there will always be risks and threats to its business model. Let’s take a deep dive into these and then discuss how they may be minimized via innovation and inclusion of the perceived threat. Also, we’ll analyze how sentiment is a primary driver here in what is reflected on the charts. You will likely find this a fascinating study from various aspects. Here we go!

A Deep Dive Into The Fundamentals With Lyn Alden

Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) is currently one of the least well-loved among the ‘Magnificent Seven’ mega-cap U.S. tech stocks.

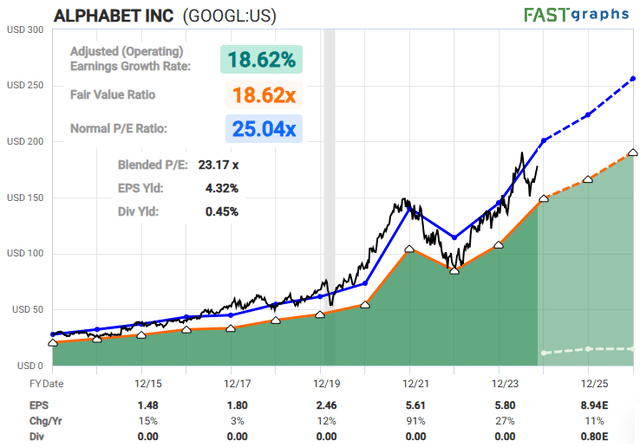

With a price/earnings ratio of about 23x, Alphabet trades at a similar earnings multiple to Coca-Cola (KO) and less than half of the earnings multiple of Costco (COST):

Consensus analyst expectations are for about 12% annualized earnings growth going forward, which, if correct, gives us a price/earnings/growth ratio (PEG ratio) of under 2x. That’s a rather reasonable valuation in my view. From that point, we then have to analyze the risks that could cause the company to fail to achieve that level of growth, which are categorized further down in the risk section.

Company Overview

Alphabet started out its life by redefining how search engines work. Rather than just looking for a bunch of keywords on pages like many other search engines did (which is highly game-able by content writers), Alphabet’s co-founders used a concept called “page rank” to identify better quality signals for websites in order to rank them properly.

Specifically, they would catalog and analyze the vast number of links that websites gave each other, and would rank websites higher if they had 1) a lot of links from other websites pointing to them and 2) links from high-authority websites pointing to them (e.g. Reuters linking to a page is more impactful than a hobby blogger linking to a page). And so, when a user searched for something, Google would look for both relevant content signals such as keywords, but then would also look for these quality/link metrics. By doing so, they dominated the search engine market. And they monetize it by selling ads on those search pages, rather than just showing the organic search results.

They acquired YouTube when it was small, which has grown into the dominant and ubiquitous video-hosting social media website, and gives them more ad surface to work with.

Their next big win was to dominate the portals to which people interact with the internet and applications. Alphabet’s Chrome browser is the world’s most popular computer browser for accessing the internet, and Alphabet’s Android operating system is the world’s most popular smartphone operating system. This helped them entrench their search engine into peoples’ lives, and gave them a near-duopoly along with Apple when it comes to mobile app stores.

With their large datacenter scale, they then entered the cloud computing market. Since they already needed massive datacenters to host their own stuff, they benefit from significant economies of scale by building some additional datacenters and hosting other companies’ and consumers’ computing needs in them. On that front, their main competitors are Amazon (AMZN) and Microsoft (MSFT).

Lately, they’ve gotten into AI, which is very processing-intensive, and thus can benefit from their massive scale. Their AI offering, Gemini, has secondary market share after ChatGPT, although it’s a distant second at the moment.

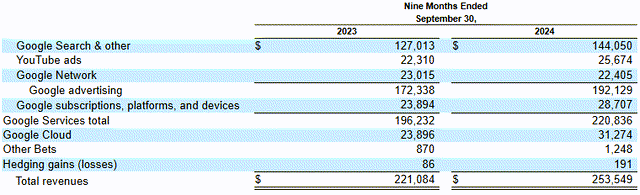

Overall, the company is undergoing a rotation and diversification of its revenue sources. Its search engine business is still its leading business, but is not growing as fast as other areas like service revenue or cloud revenue, and so we’re seeing a gradual transformation of the company in that sense.

For some areas, their business lines give them powerful synergies or economic moats. For example, Alphabet’s cloud offering is not as big as Amazon’s or Microsoft, but an important advantage that they have is that unlike those two companies, they are dominant in mobile operating systems, and thus their cloud services specifically for mobile applications tend to punch above their weight, thanks to partnerships with Samsung and other companies.

Balance Sheet

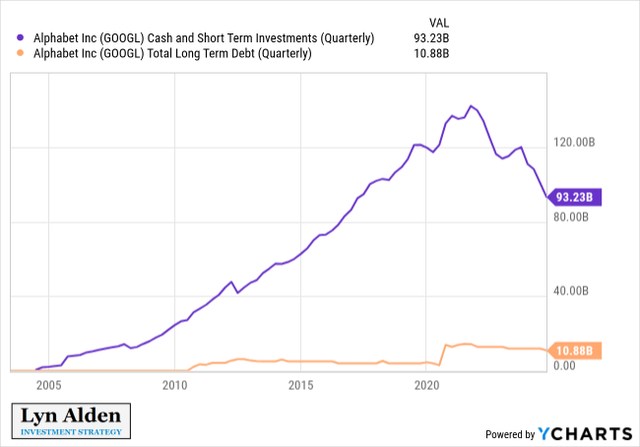

Alphabet has one of the strongest balance sheets in the world, with far more cash-equivalents than debt:

However, in recent years, they have been upping their capex for rapid datacenter scaling and GPU purchases to compete in the cloud and AI space. I think that’s a good thing because it puts the cash to better use, but it also presents some risk because investors have to monitor the return on investment that this type of capex is achieving.

The tremendous cash flow generation potential of Alphabet has recently also been turned toward shareholder returns. Starting in 2019, the share count began decreasing due to net buybacks. Here in 2024, Alphabet initiated a regular dividend. So instead of more and more cash accumulating on the balance sheet, more is going back to either 1) increasing the ownership stake of each share or 2) paying cash to owners of each share which they can choose to reinvest into more shares or not.

Overall, I think this is a sensible balance sheet policy. It’s important for them to hold a large cash hoard because that gives them a lot of optionality, but only up to a certain point where it becomes dilutive, and thus at those very lofty levels it’s better to give some of it back to shareholders as excess capital (unless they want to do what MicroStrategy does and buy bitcoin with it and thus outperform everyone).

Key Risks

Since Alphabet has been very focused on the search business, any threat to that search business is a key threat to the company.

One of the early threats was the rise of social media and the relative downfall of individual websites and blogs. Alphabet benefits when people search for websites, or when websites put ads on themselves. But if people spend more time on large super-sites like Instagram or Twitter/X in a walled garden type of environment, then it kind of takes market share away from the whole search/website environment around the margins.

Another long-term threat has been antitrust risks. Their market share in several areas has become so dominant that they’re always facing the risk of regulatory crack-down in multiple jurisdictions. This became more tangible this summer, when Alphabet lost a key antitrust case. The court found that Alphabet’s payments to companies like Apple (AAPL) and Samsung (OTCPK:SSNLF) to be their default search provider locked out competition. Alphabet intends to appeal the decision, and it’s still not clear what the outcome will be. It’s possible that Alphabet might have to break off parts of its business so that the search business and the “portals” business (Chrome, Google Play app store, Android, etc.) are not under the same roof. But there are also a lot more benign outcomes. And in general, I expect some of the more benign outcomes as a base case while acknowledging “non-benign” outcomes as an upside risk. And notably, due to the election outcome, we’ll be seeing a shift at the Department of Justice, which could affect cases like this.

Finally, the newest threat to Alphabet’s search business is the rise of AI. If we want to know something, rather than search for the relevant website to tell us about it, we can now ask ChatGPT. That can indirectly eat into Alphabet’s market share by changing how we search for information. In response, Alphabet has gotten into the AI business itself, incorporates AI into Google searches, and has had to spend a lot of capex money on this.

One thing that, I think, is important to realize is that not all searches are equal in terms of add revenue. Some types of searches inherently have more value to advertisers and thus to the advertiser platform. If I search for “plumber near me”, then it’s pretty clear I want to find a plumber and spend money on plumbing services, and so plumbers are going to compete to get my attention. But if I want to know “what’s the difference between Sci-Fi and Fantasy?” then whether I type that into Google or ChatGPT I’ll get an AI answer that helps explain the difference, and it’s not nearly as monetizable. So if Google loses market share to people searching for various less-monetizable information, then that’s not really a big issue.

And AI in general “expands the pie” for what’s possible. So for example we can ask AI to summarize something for us, or create something for us, which wasn’t possible with search engines. Since Alphabet is getting into the AI business, it expands the areas in which it can provide value. And so in that sense, new entrants like ChatGPT are a challenge, but also the technology itself is harnessed by Alphabet and thus multiple entities can grow larger at the same time.

That’s not to say that AI isn’t a threat to Alphabet’s search business, but rather it’s to say that not all searches are equal and that the pie is growing, and thus it may take more time for AI to eat into Alphabet’s search revenue than bears think, which by extension gives Alphabet more time to expand its cloud and AI businesses.

How We Use Fundamentals

To follow is a brief excerpt from findings provided by Avi Gilburt regarding how we use fundamentals in our methodology:

“Remember that market sentiment is the primary driver when we are dealing with investment products wherein mass sentiment is evident. However, this is not an absolute perspective. Rather, it is based upon a continuum of sentiment.

You see, while the SPY is an example of an investment product that presents us with the ultimate in mass sentiment, a microcap biotechnology company may be on the opposite end of that continuum of sentiment. Within the example of the microcap, sentiment can be a factor, but the fundamentals of the company are going to be the primary driver of this stock. And, all products run somewhere within that continuum. The greater the mass sentiment being evident within the buying and selling of that product, the greater probability that sentiment will be the driver of price. And the reverse is true.” – Avi Gilburt

What this means is that fundamentals, while important and highly useful in our analysis, will not likely lead the price of stock on the chart, particularly in such a widely traded and held issue such as GOOGL. So then, we must use the study of sentiment to round out the entire picture.

How do we do this? Markets are not linear. So, tools that measure such will not fully capture the nuances of human behavior. We need a dynamically adaptable utility. Enter Elliott Wave theory. But, this must be correctly applied and reduce the subjectivity inherent in human analysts. Add on the overlay of Fibonacci Pinball. Now we have the necessary implements for the battlefield. Let’s see how to apply the theory in real life with GOOGL.

Sentiment Speaks On The GOOGL Chart

The first point that will stand out to you is that it is quite possible the GOOGL chart has seen an important high for now and that it is entering a prolonged consolidation period.

For the moment, we would lean toward neutral on this with a slight bearish slant. There could be one more surge in price here to the 183-184 level. Then, should the chart show a micro 5 waves down, it would actually signal probabilities of a sharp move down to the 140 area next.

If price only forms a corrective move lower from the next high and then takes out the 184 region, it would suggest that the all-time highs near 192 may actually be tested next instead. Therefore, you likely understand the neutral stance for now until the micro-machination resolves itself and gives us clarity as to the next larger move.

Do You Have A System In Place?

Those who have experience forged by time in the markets will tell you that it’s imperative to have a system of sorts in place. You need to be able to define how much you are willing to risk vs. how much gain is likely. Those who survive across the decades in the greatest game on earth will also inform you that the preservation of capital is paramount.

While there are multiple manners of doing this, we have found Fibonacci Pinball to be a tool of immense utility for traders and investors alike.

Conclusion

There are many ways to analyze and track stocks and the market they form. Some are more consistent than others. For us, this method has proved the most reliable and keeps us on the right side of the trade much more often than not. Nothing is perfect in this world, but for those looking to open their eyes to a new universe of trading and investing, why not consider studying this further? It may just be one of the most illuminating projects you undertake.

(Housekeeping Matters)

If you would like notifications as to when our new articles are published, please hit the button at the bottom of the page to “Follow” us.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

STOCK WAVES: Where fundamental analysis meets technical analysis for highest-probability investment opportunities! Get leading Elliott Wave analysis from our team, along with fundamental insights and macro analysis from top author Lyn Alden Schwartzer.

“Stockwaves is my bread and butter, and that’s only catching maybe 10% of the charts they throw out! I had 7-10x+ trades with SW last year, and dozens more that were “slackers” (LOL) with “only” 3-4-5x returns. Amazing!” (Nicole)

Click here for a FREE TRIAL.