Summary:

- Google’s latest 6th generation TPUs can boost Cloud revenues and lower costs of training AI models, lifting gross margins and Cloud EBIT growth.

- Gemini 2.0 and AI Mode in Google Search features can recover lost market share and be a tailwind for the Advertising business via improved ads targeting.

- Valuations are at a discount vs historical multiples, even with earnings growth expectations ticking upward regularly.

- Technically relative to the S&P500, buyers are pushing up strongly but are in a zone of strong resistances.

- The quantum computing opportunity could be worth trillions of dollars. Google’s Willow quantum chip just achieved a major milestone in the long road toward commercialization. This growth wildcard is a key monitorable that may not be priced in.

Justin Sullivan

Performance Assessment

It’s been a while since my last update on Alphabet/Google (NASDAQ:GOOGL) (NASDAQ:GOOG). Perhaps a bit too long, so this update is long due. It is good to see that my ‘Neutral/Hold’ stance, expressing a view of performance broadly in-line with the S&P500 (SPY) (SPX) (IVV) (VOO) has been accurate:

Performance since Author’s Last Article on Alphabet (Seeking Alpha, Author’s Last Article on Alphabet)

Thesis

I remember earlier this year, there was a lot of criticism of Google and its CEO Sundar Pichai, as it seemed to fumble and was perceived to “fall behind” in the AI race. It is amazing how quickly things can change since now, the narratives seems strongly in Google’s favor:

- TPUs can boost Cloud revenues and lower costs of training AI models, lifting gross margins

- AI-boosted search features can be beneficial for the advertising business

- Valuations are at a discount with earnings growth expectations ticking upward regularly

- Buyers are pushing strongly but are in a zone of strong resistances

- Willow quantum computing is a massive growth wildcard monitorable that may not be priced in

TPUs can boost Cloud revenues and lower costs of training AI models, lifting gross margins

Google Cloud’s Tensor Processing Units (TPUs) are custom-designed AI chips specifically used to optimize the training and inference of large AI models. Recently, the company released its latest 6th generation TPUs called Trillium, making it available for Google Cloud customers as well.

From a financial impact perspective, this is expected to reduce the costs of training Google’s own AI models as well:

TPU advancements could accelerate the training and inference of Google’s own AI models while improving cost efficiency versus peers.

– BoFA Analyst Justin Post

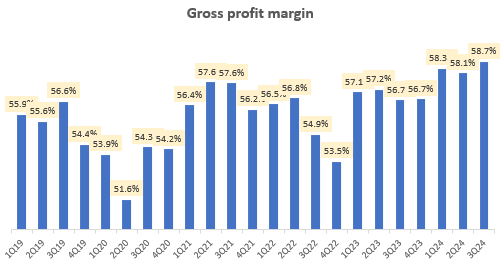

Hence, I believe there can be an incremental gross margin lift in the upcoming quarters:

Gross profit margins (Company Filings, Author’s Analysis)

From the demand side of things, Google’s TPU shipments are growing rapidly and even taking share away from NVIDIA’s GPUs:

shipments of TPUs… are growing at a pace fast enough to take share from NVIDIA for the first time… Google’s Cloud Platform business continues to grow as a share of Google’s revenue while improving profitability. This could indicate that TPU-accelerated instance types or AI products running on TPUs are driving the growth at Google Cloud, especially as accelerator instance types are high-margin products.

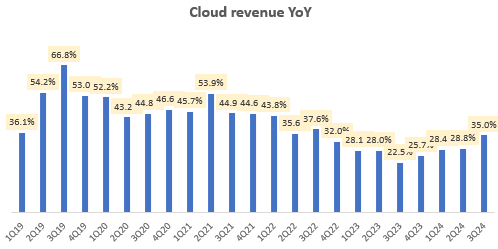

So I think this bodes very well for Google Cloud revenue growth, which has anyway been accelerating in Q3 FY24:

Cloud revenue YoY (Company Filings, Author’s Analysis)

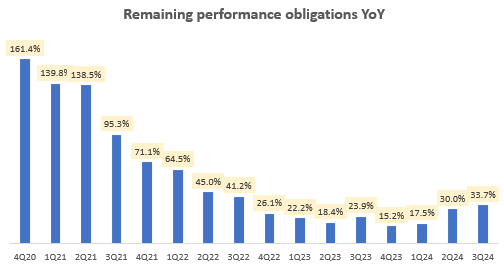

Note worthily, the future revenue outlook also seems to be accelerating as evidenced by an acceleration in remaining performance obligations (an indication of contracted but not yet delivered work, thus representing future revenue potential), which currently stand at $86.8 billion, more than double the amount of TTM Cloud revenues of $40.5 billion:

Remaining performance obligations YoY (Company Filings, Author’s Analysis)

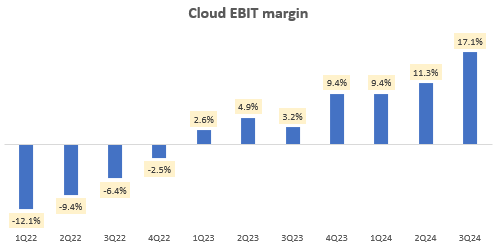

The scalable operating leverage of the Cloud business means this growth can lead to strong EBIT margin expansion in Google Cloud, continuing the trend seen in Q3 FY24:

Cloud EBIT Margin (Company Filings, Author’s Analysis)

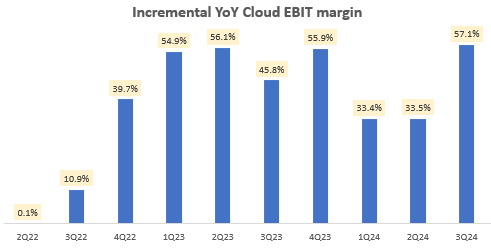

I believe there is a lot more scope to go as the incremental YoY Cloud EBIT margins (which I view as a soft indication of peak margin potential) are at 57%:

Incremental YoY Cloud EBIT Margin (Company Filings, Author’s Analysis)

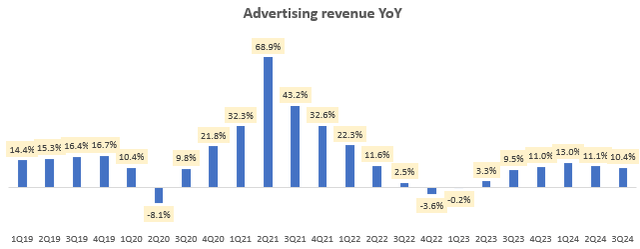

AI-boosted search features can be beneficial for the advertising business

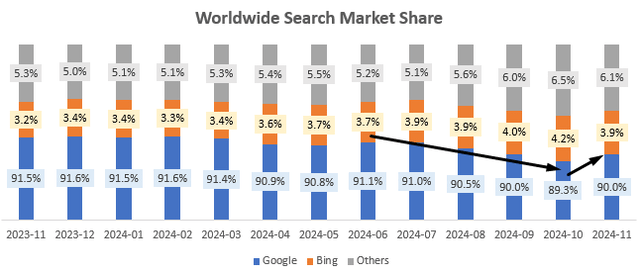

Over the past 2 years since the launch of Open AI’s ChatGPT, there have been existential concerns about Google’s Search business, which makes up almost 56% of the company’s revenues. Improvements to Microsoft’s Bing Search and the rise of alternatives such as Perplexity (which I also use more often than standard Google Search these days) have made investors wonder about the disruption threats it poses to Google Search. Indeed, initial bugs with Google’s Gemini launch earlier this year added to the skepticism of Google’s ability to handle the AI-enabled Search world well.

However, it looks like Google is recovering strongly and proving its mettle with the launch of Gemini 2, that matches OpenAI’s solutions on many features including multimodal inputs such as native image and audio. This is built on Google’s advanced Trillium TPU and initial feedback from developers is positive. Additionally, Google is planning to build on Google Search’s AI summaries to create an AI mode to the Search experience. I believe this may get some users such as me back to using Google Search instead of alternatives such as Perplexity.ai. Management seems very focused on making this work well as former CFO and current Chief Investment Officer Ruth Porat has called AI for Search as the company’s “biggest bet“.

From a commercial impact perspective, I think this can improve targeting and overall ads performance, making a case for growth acceleration in the company’s Advertising segment (76.4% of overall revenues):

Advertising revenue YoY (Company Filings, Author’s Analysis)

A key indicator to watch for to evaluate the success of Search’s AI mode is Google Search’s market share:

Worldwide Search Market Share (StatCounter, Author’s Analysis)

Indeed, it is pleasing to note that after 5 months of losing share to Microsoft’s (MSFT) Bing and others, Google Search started to regain share in Nov’24

Valuations are at a discount with earnings growth expectations ticking upward regularly

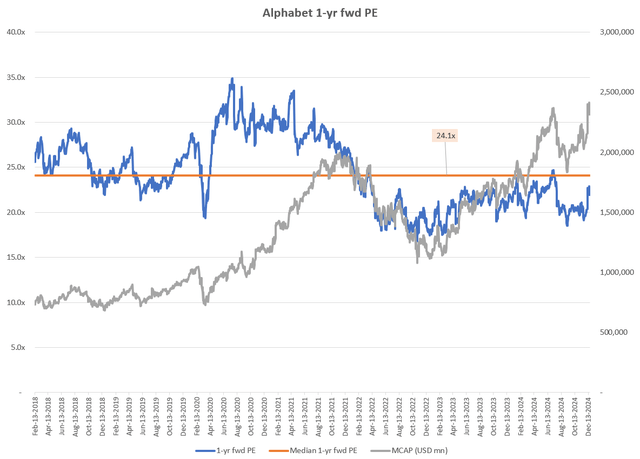

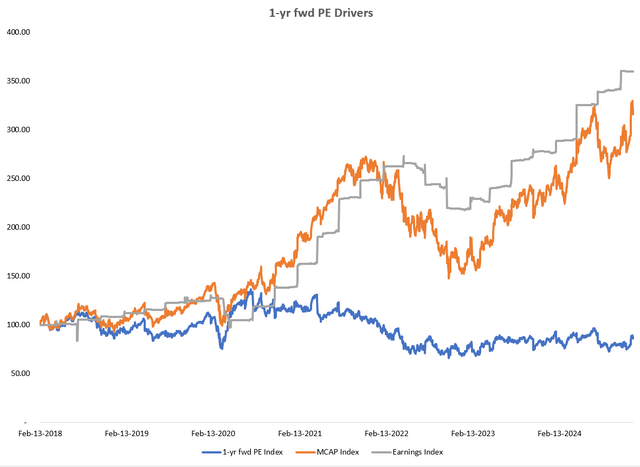

Alphabet 1-yr fwd PE (Capital IQ, Author’s Analysis)

Alphabet stock is trading at a 1-yr fwd PE of 22.3x, which is at a 7.6% discount to the longer term median of 24.1x. Looking at the 1-yr fwd PE drivers, the fact the earnings expectations keep growing (grey line in chart below), whilst valuation multiples remain steady (blue line in chart below) is a good sign as it means the company is not becoming too expensive even though the fundamental drivers of the stock are growing:

1-yr fwd PE Drivers (Capital IQ, Author’s Analysis)

Buyers are pushing strongly but are in a zone of strong resistance

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

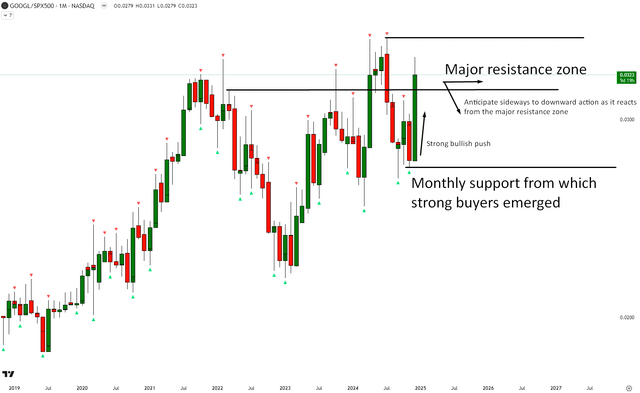

Relative Read of GOOGL vs SPX500

GOOGL vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

GOOGL/SPX500 shows a strong push by the buyers into a major monthly resistance zone. According to my technical read, I think we can see some sideways to downward price action ahead. This is not helpful for bullish, outperformance views on the stock.

Willow quantum computing is a massive growth wildcard monitorable that may not be priced in

Here’s the layman’s concept of quantum computing:

Unlike traditional computing, quantum computing enables for vast amounts of parallel computation, enabled by the ability of sub-atomic particles to be in superposition, which means being in multiple states at once. For example, whereas traditional bits in computers can only have a value of either a 0 or 1 at any particular time, quantum bits called qubits can represent both 0 and 1 at the same time.

Now what matters for us investors:

According to McKinsey, the exponentially vast parallel computational capabilities of quantum computing technology can create value worth trillions of dollars within the next decade. Naturally this is a huge opportunity available to whoever manages to figure out the technology and make it commercially viable.

Google has been working on Quantum Computing since 2012. And recently, it launched a quantum chip called Willow that was capable of handling some very complex calculations in a span of five minutes. This is a very big deal as the world’s most powerful supercomputers need 10 septillion years of time to perform the same calculations. This is a pioneering development as it solved a problem of reducing errors whilst computational scale grows:

It [Willow] reduces errors exponentially as it scales up its qubits, a feat that no previous system has come close to accomplishing. Willow doesn’t just add more qubits — it makes them more reliable, an essential ingredient if quantum computers are ever going to tackle real-world problems.

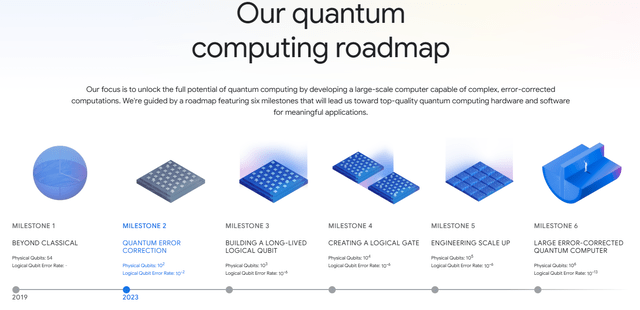

Such a development makes Google progress closer to Milestone 3 in the overall commercialization of quantum computing roadmap:

Google’s Quantum AI Roadmap (Google Quantum AI)

As the first system below threshold, this is the most convincing prototype for a scalable logical qubit built to date.

– Founder and Lead of Google’s Quantum AI – Hartmut Neven

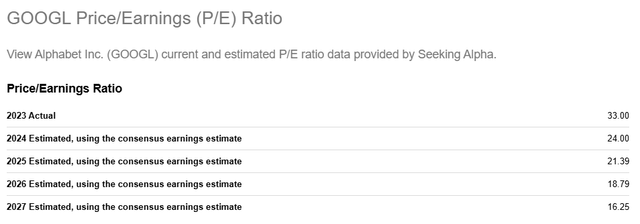

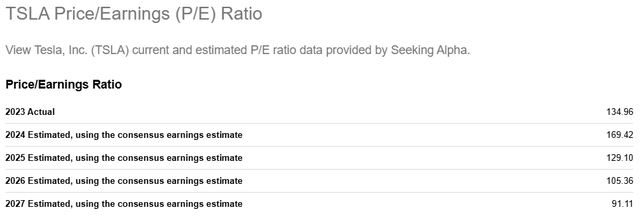

Overall, I believe this represents a meaningful growth optionality for Google similar to Tesla’s (TSLA) multi-trillion dollar opportunities in FSD and Optimus humanoid robots. The difference is that I think investors are not pricing in the potential here for Google anywhere close to the same extent as Tesla, as evidenced by the longer term fwd PE valuation comparisons:

Google fwd PE Ratios (Seeking Alpha) TSLA fwd PE Ratios (Seeking Alpha)

I will continue tracking Willow developments to monitor this longer term upside risk for GOOGL stock.

Takeaway & Positioning

From being at the brunt of a lot of criticism for falling back in the AI opportunities race in H1 2024, Alphabet/Google seems to be making a strong comeback, proving to the world its mettle. I have a bullish outlook fundamentally as I expect the company’s latest 6th generation TPU to boost Cloud revenues and profitability, and also improve overall gross margins by reducing the company’s internal costs of training new AI models.

I also expect the Gemini 2.0 and AI mode in Google Search to recover lost market share to competitors such as Microsoft Bing and ChatGPT and provide a revenue tailwind for the Advertising business via better ads targeting and effectiveness.

GOOGL stock seems attractively priced at a 7.6% discount vs its longer term median 1-yr fwd PE multiple, whilst the company’s EPS expectations continue to grow. And a milestone progress toward commercialization of the trillion-dollar quantum computing opportunity makes it look like the stock’s longer term growth potential may not be priced in, especially if one compares it to other stocks such as Tesla on the verge of unlocking trillion-dollar markets (autonomous driving and humanoid robots).

The only thing however that prevents me from declaring the stock a ‘Buy’ is a misaligned read on the relative technicals vs the S&P500; there is bullish momentum, but the ratio prices are at a major area of resistance.

Hence, I rate the stock a ‘Neutral/Hold’ for now, but I am itching to get in when the technicals turn more favorable as well.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to more than a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.