Summary:

- The impact of generative AI on Alphabet’s search business is less than expected, leading to an upgrade in the rating from “hold” to “strong buy”.

- Despite headwinds such as higher overhead costs and greater investment in AI infrastructure, Google remains a strong buy from a fundamental perspective.

- Google’s future is expected to involve both search and AI, with search remaining a significant revenue stream until further AI implementation is required.

- Both on a relative and absolute basis, Google seems to offer the most value for money, grossly underestimating the value of their vast data set when it comes to AI.

Leon Neal/Getty Images News

Investment Thesis

In an era where AI is considered a hot commodity for investors, with Nvidia having traded above $1T, the question is often asked where search incumbents like Alphabet (NASDAQ:GOOG) are headed as large language models (LLMs) become ubiquitous.

Given that Google Search is Alphabet’s bread and butter, representing 57.83% of total revenue in the first quarter, we made a quick assessment of the impact AI would have on their search business. We recognize that we may have overestimated the headwinds, and when we review the current data a few months later, we upgrade our “hold” rating to a “Strong Buy.” While there are still many macroeconomic headwinds for Google, we think we underestimated the rigidity of Alphabet’s business model and moat and expect the company to still perform, even in a recessionary environment.

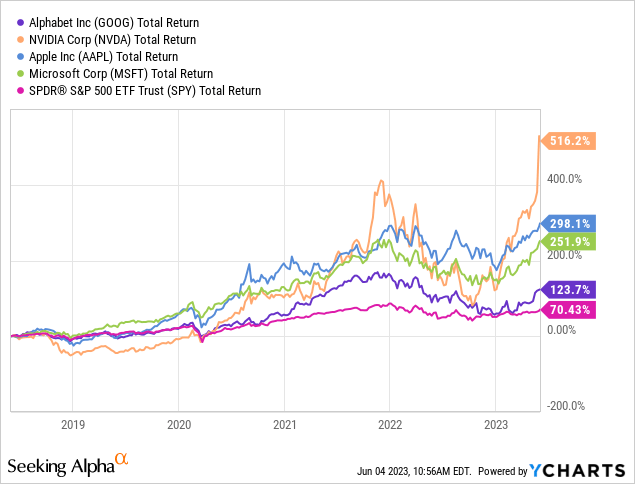

With other large cap & AI companies such as Apple (AAPL), Microsoft (MSFT) and NVIDIA (NVDA) heading for their all-time highs, we think Alphabet could well be the best bang for an investor’s buck. We even go so far as to label Google as the best long-term player currently in the large-cap & AI space in terms of moat, revenue growth, stability, and favorable fundamentals.

From Search to AI

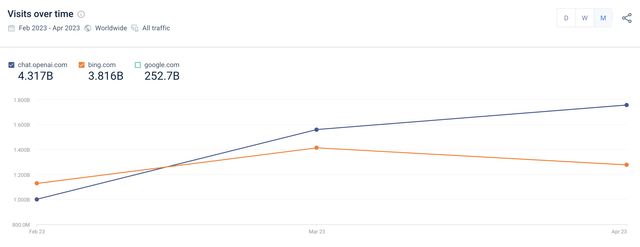

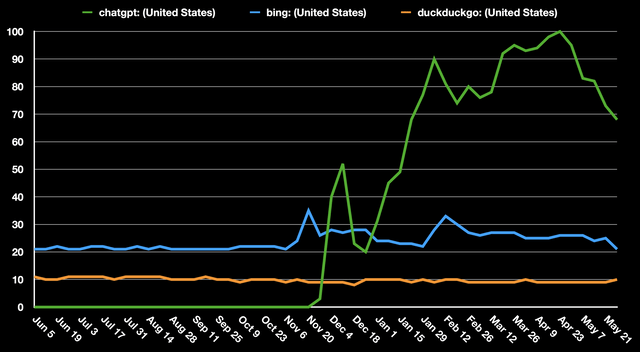

First, perhaps, let’s look at the actual data when it comes to how generative AI is considered headwinds for Alphabet. One of the clearest representations we have arguably at the moment is looking at website traffic data.

Looking at one of the largest providers of website traffic data, it is notable that OpenAI’s ChatGPT experienced serious growth and huge adoption in the first few months after its launch, but some of that growth seems to be leveling off a bit. The same can be said of Bing, which adopted ChatGPT very quickly and is even now starting to see a decline in monthly visitors growth. If we were to compare this with the number of visits from ChatGPT and Bing, together they would represent only 3.22% of Google’s main site visits.

Even if we were to look at the other side of it, and look at search interest rather than website visits, it is clearly visible that interest in ChatGPT also seems to be fading compared to other search engines such as Bing & ChatGPT, after the initial hype of its launch at the end of last year. This effect may be due to the fact that many users tried the tool for the first time but did not adopt it meaningfully in their day-to-day activities.

Author’s Visuals, Google Trend Data

It may also have to do with the fact that Google first launched Bard in March and released the stable release last month. Don’t get us wrong, though, we still believe that Generative AI will be a major headwind for Google’s legacy/core search business in the near future.

We actually see Google’s transition from search to AI much like Meta and YouTube, who had to change some of their content from long form video to short form video to compete with competitors like TikTok. In that case, Meta in particular experienced significant headwinds from initial adoption, in the same way it had to switch from desktop to mobile in its early days. Similarly, we see Google’s average revenue per user (ARPU) being impacted and gross margins coming under pressure.

Looking back, it may also have been in Alphabet’s interest to delay the launch of its conversational AI, or at least wait until competitors showed up, as some studies have indicated that the cost per AI prompt is much higher than Google’s cost per search. Some studies currently state that the cost per AI search is about 10x the cost of an original search. Not only that, but it could cause Google’s ARPU to go south, as interfaces like ChatGPT may be harder to monetize profitably.

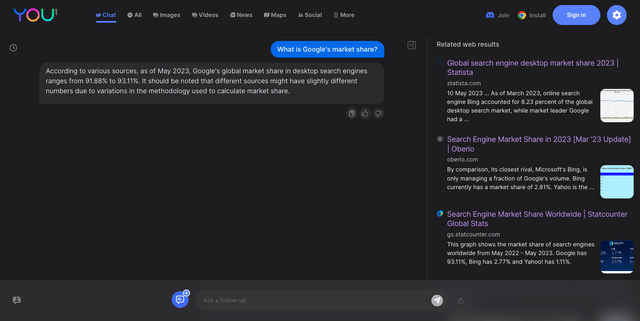

One such service that most people are not familiar with could be the search engine “You,” which could point to where search is headed if AI is fully adopted. It uses a combination of traditional Google search and a Web page directory, as well as an AI chat prompt.

And while Bard has many advantages, it may also be important to point out that it is not yet available in every country. At the time of writing, Bard is not yet available here in Belgium, where we are located, and we can only resort to OpenAI if we have questions/prompts.

Other companies such as Microsoft and Adobe have also already started integrating AI into their own software, such as Microsoft Copilot, potentially eliminating a certain amount of time spent on search and reducing Google’s monetizable base. On the other hand, at the last I/O event, Google unveiled the possibility of using their AI in conjunction with Google sheets and other applications, creating a very smooth integration that could also contribute to their existing moat.

To elaborate on the risks, we still see huge macroeconomic and operational headwinds for Google in 2023. One of the key risks we are still watching is the previously mentioned potential increase in infrastructure costs as it relates to the move from search to AI, and the effect that the increase in infrastructure costs will have on gross margins by the end of the year. Add to that a potential recession, and it could mean trouble ahead for Google, which depends on the strength of advertisers/companies.

On the positive side, however, Google is mostly dealing with larger companies compared to Meta, which tends to focus more on smaller companies that can have more impact in the event of a “hard landing.” These headwinds may also be partially offset by Google’s cost-cutting efforts, after laying off 6% of its workforce earlier this year. This will reportedly save Google between $2.5BN and $3BN annually.

The Trend Is Still Alive

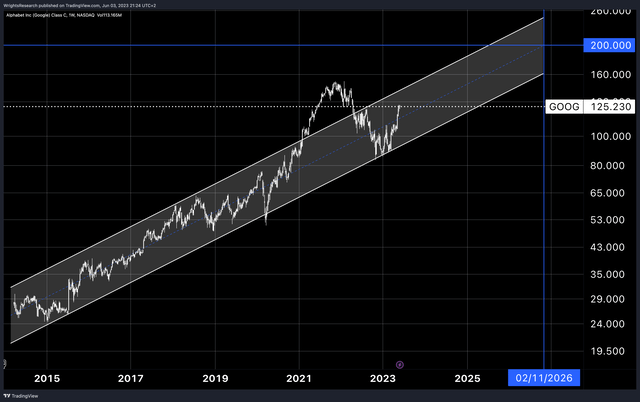

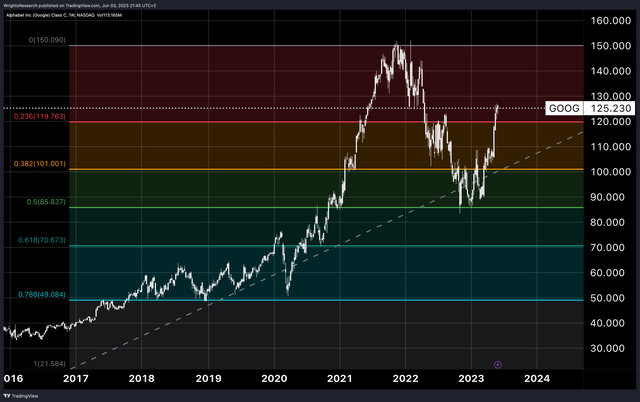

Interestingly, despite the fact that other large cap tech focusing on AI has currently reached all-time highs, Google is still far from recovery with about 17% from all-time highs.

Looking at the long-term trend for Alphabet and putting it on a logarithmic scale, the stock is still trading within the long-term channel, although it peaked out of the channel in 2021 when monetary conditions were arguably too accommodative. Especially since Alphabet depends on virtually every type of business across the economy for advertising, it is very sensitive to macroeconomic shocks. Nevertheless, it still appears to be on its way to all-time highs at $152, and perhaps our long-term goal of $200 in 2026.

Wright’s Research, TradingView

From a long-term Fibonacci retracement perspective, Google also appears to be easily breaking through resistance levels in recent weeks, having previously found tremendous support at the $85-90 level. We wouldn’t rule out a retracement to the $100 support level, either, as the recent pop in recent weeks could fade away if recession fears resurface. After all, the yield curve is still inverted, the Fed is still fighting inflation, and interest rates have arguably not shown the full extent of its effect due to the lags in monetary policy.

Wright’s Research, TradingView

Data Is Currency

Before we get into our price target and where we see Alphabet’s growth going, let’s say a word about research and development. While Google’s operating income has remained relatively flat over the past 2 years, it is perhaps important to point out why this is unlikely to remain so in the future.

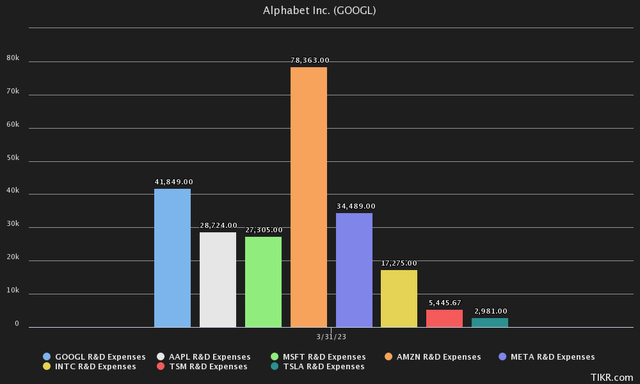

For example, we see few analysts talking about the fact that Google is currently one of the largest companies when it comes to R&D spending. In fact, they spend more money on R&D than Apple, Microsoft Meta (META) and Intel (INTC). The only company currently spending more on R&D is Amazon (AMZN). However, what most analysts don’t tell you about R&D is its nature and how it is accounted for. Most R&D in technology companies consists of engineers’ salaries and, according to the Financial Accounting Standards Board, is expensed directly as it is incurred.

What we’re trying to imply here is the fact that this $41.85BN of R&D may undermine Alphabet’s real profitability in the short term, because the growth that comes from this R&D, for example, in the field of AI, may take some time before it shows up in the income statement as revenue, because R&D is recorded as a cost when it is incurred.

To put $41.85BN worth of R&D into context, that is more than the GDP of some small countries like Iceland, which had a GDP of $25.77BN. It is also far more than NASA’s annual budget of $32.35BN.

So while Google is currently spending a lot of money on R&D and investing more in AI projects, we think this will pay off tremendously in the future, with EBITDA growth still following their previous baseline. Overall, we think Google has a huge data advantage over virtually all other competitors in this AI race. Imagine Google’s ability to train neural networks on their datasets. From every search ever performed to every email ever sent through Gmail, all the data sent through Android devices and every piece of video uploaded to YouTube or data stored in the cloud. The data set is just incredibly large and diverse, from text to photo and video, and could generate huge cash flows from these assets in a future where data is currency.

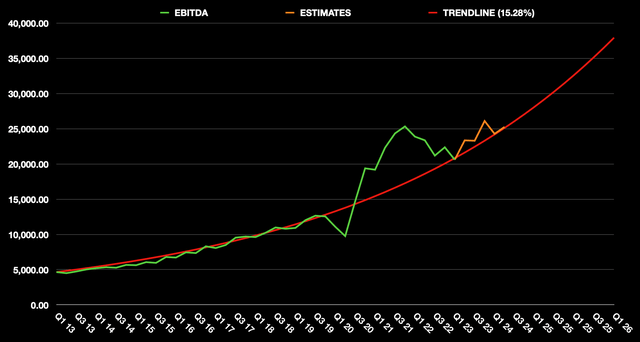

What we haven’t talked much about is Google’s previous trend line when it comes to EBITDA growth. Between Q1 2013 and Q4 2019, Google followed an incredibly stable baseline, with growth of about 15.28%. After that, however, the trend line was hugely distorted by macroeconomic events.

Author’s Visuals, SEC Data, Bloomberg Estimates

For example, in 2021, with an overly accommodative monetary policy, it deviated sharply upward from this trend line, but recently returned to it. So we smoothed the data and looked at what the estimates indicate for the coming quarters.

Indeed, they indicate that Google is still on track to follow this trend line. However, we would not be surprised if Google briefly drops below this trend line in the next few quarters but continues to follow it for at least the next few years. To reach our price target of $200, or a market cap of 2.54T, Alphabet would need to generate $141.07BN in EBITDA annually at a market multiple of 18x EV/EBITDA for information services. On a quarterly basis, this would mean 35.27 billion in EBITDA. According to our trend line, Google should be able to reach this point sometime in Q4, 2026. This is also in line with other analysts’ estimates of reaching this EBITDA by FY2026. If the company could reach our $200 price target by then, that would represent a nice above-average market return with a CAGR of 12.42%.

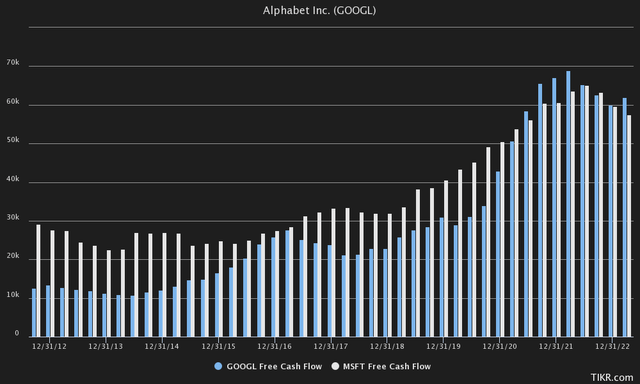

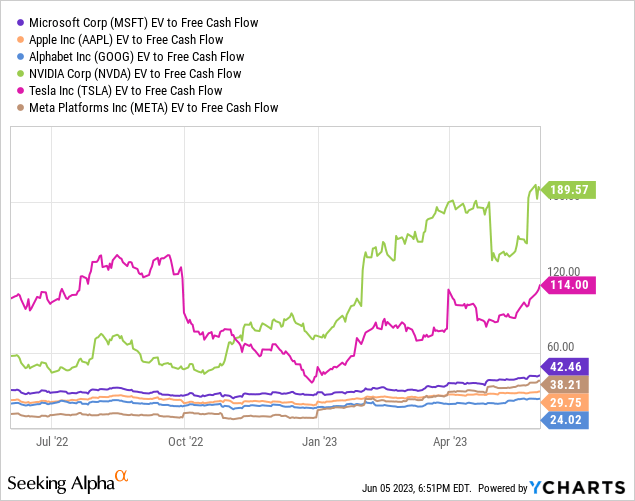

Even from an EV/FCF basis, looking at both enterprise value that takes into account excess cash/debt in the company and actual cash coming into the company, Google remains the cheapest of all the large-caps. As a sidenote, we did not include Amazon because it currently has a negative EV/FCF.

If we line up free cash flow, for example, Alphabet has a very similar free cash flow profile compared to Microsoft. Over the last few quarters, on a TTM basis, they have basically generated almost identical free cash flows. Yet, Microsoft’s market cap is about $900BN higher than Google’s. If Alphabet were trading at the same FCF multiple as Microsoft, it would have already been extremely close to our $200 price target, indicating the undervaluation Google is currently in compared to other tech companies with large market caps.

The Bottom Line

After reviewing recent data and taking into account the headwinds Google is currently facing, we have changed our rating from “Hold” to “Strong Buy” due to the less-than-expected impact of Generative AI. As it stands, Google is still supreme when it comes to search dominance and continues to prove its ability to maintain its dominant market share.

While we believe there will still be significant headwinds to Google’s gross margins in the coming quarters due to higher overhead costs and greater investment in AI infrastructure and R&D, we believe the company is still considered a strong buy from a fundamental perspective, both on a relative and absolute basis. Putting macroeconomic disruptions aside, we also believe that Google is again following its previous trend line of EBITDA growth and will likely continue to reap the benefits of AI and the advantage they have with their incredibly extensive dataset.

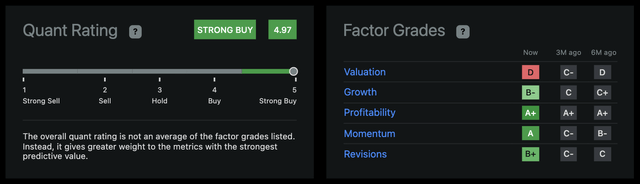

We also fully agree with Seeking Alpha’s Quant Rating, which also gives Alphabet a 4.97/5 and cite growth, profitability, and momentum as reasons for rating it a strong buy.

In short, we think Google’s future is both Search and AI, not Search or AI. We expect Search to remain part of Google’s main revenue streams for some time to come, until further AI implementation is forced upon them. And perhaps these future developments in AI could indeed bring the Alpha back into Alphabet’s stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.