Summary:

- Google faces significant challenges, yet its diverse ecosystem and substantial R&D investments make it a resilient company with developing business opportunities.

- Despite losing some market share, Google Search remains dominant, with growing search volumes and a strong moat.

- YouTube’s vast content library, ad subscription potential, along with Google Cloud’s growth, underscore Google’s robust business segments.

- Google’s forward R&D + EBIT yield of 10.4% and strategic positioning in AI and cloud justify a “Strong Buy” rating.

Justin Sullivan/Getty Images News

Unless you’re somewhat of a complacent investor, you’re probably aware that Google (NASDAQ:GOOGL) is facing several problems:

- A recent antitrust lawsuit threatens to break the company up;

- Investors worry about the extinction or irrelevance of Search due to chatbot/AI technology;

- Google is also not the leader in cloud, far behind AWS and Azure;

- Google is fighting to even be mentioned in the AI race, with Gemini facing some initial issues;

- Despite being nearly the largest social media platform in the world, Google’s YouTube is hardly ever mentioned as such;

- To make a disappointing list longer, Waymo, Google’s robotaxi service, is facing Telsa (TSLA)’s self-driving and data-centric revolution with miniscule scale compared to Tesla.

In short, the company seemingly faces threats to all its businesses. And yet, no company on earth – not Apple (AAPL), Microsoft (MSFT), or Nvidia (NVDA) – will make Google’s $200B in R&D+EBIT in the next twelve months, while also trading on an EV basis at just 10x that: $2T, a forward earnings yield of a whopping 10.4% by my calculation. Equivalent figures for the other five largest companies (Apple, Microsoft, Nvidia, Meta Platforms (META), and Amazon (AMZN)), total $796B in forward cumulative earnings on a cumulative EV of $12.9T, a forward earnings yield of just 6% (my calculations based on Seeking Alpha and income statement figures).

For some reason, doubting Google’s future has always been in reading fodder for the masses, more so than at other companies listed above. To quote the above 2015 article:

Look, if there’s anything that’s true in high-tech business, it’s that rebranding [to Alphabet] can’t fix a product problem. And Google has a huge product problem: It’s a one-trick pony.

You could argue that Google is no one’s Plan A pick to generate safe and high returns into the current and next decade. But I will argue that having market share and potential in several world-wide megatrends is a sign of quality – that Google has become an indestructible five-trick pony worthy of a better premium than market sellers are demanding currently.

Using my own screening analysis, The Five Factor Model: A Screen Of Ultimate Quality For Reasonable Valuation, I will argue that Google should be everyone’s Plan B – that despite not being a leader in many of its businesses, the value set combined is still top-tier. I am going to argue that Google qualifies through the Five Factor Model as worthy of a “Strong Buy”.

Google’s Businesses: Has-been, or Will-Be?

Search

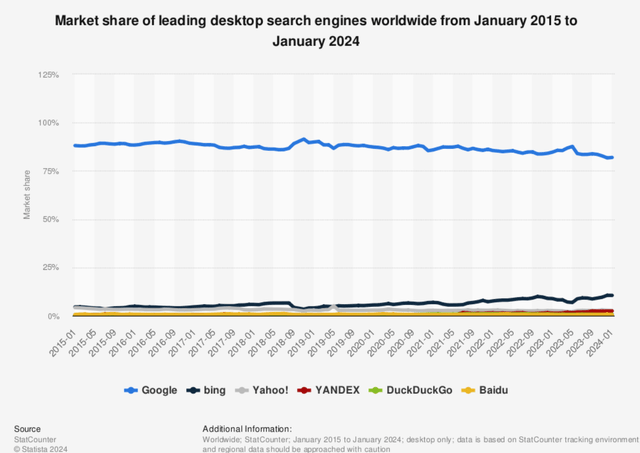

Let’s start with Search, Google’s longstanding cashflow producer. Google Search has been dominant for over two decades, at the forefront of the search engine industry with roughly 90% market share. You can see below that that market share hasn’t changed much.

Statista (Statista)

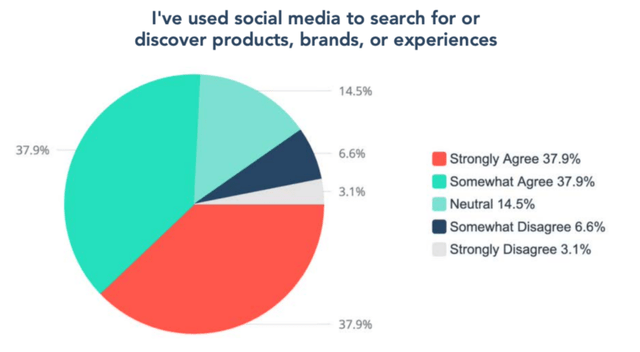

Only, it has. If you factor in searches on Instagram, Facebook, YouTube, TikTok, Amazon, and other search outlets not traditionally counted in the search engine industry, the market share appears to be materially less. According to Forbes, Google Search is in third place for 18-24 year-olds looking for a search platform, behind both Instagram and TikTok. And according to Tint, 76% of those surveyed had used various social media to look for “products, brands, or experiences”.

Youth Using Social Media For Search (Tint)

It’s hard to know exactly how much searching now happens on social media platforms because those figures aren’t disclosed. But it’s likely Google is losing its market share.

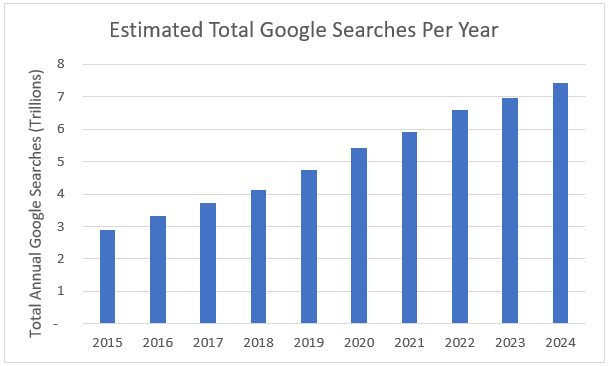

However, Google Search is still expanding wonderfully, meaning the whole pie is growing. After finding the total internet users per year, I matched it with Google Search’s desktop market share, and the 3-4 search per day rate per person, increasing gradually from 3/person/day to 4/person/day over the time period 2015-2024. I multiplied by 365 to calculate annual figures for total Google searches per year, worldwide. In words: the total number of internet users, multiplied by Google’s market share, multiplied by an estimated annual search volume per person, produced the following figures.

Total Google Searches Per Year, Worldwide (Author’s Analysis)

Estimates for the input data can vary depending on your source, since Google doesn’t disclose some of this information directly. But the trend is clearly still on track.

This 3–4 searches per day per person pencils out to nearly 15 million searches a second, around the world. Consider the sort of market maker Google is to facilitate 15 million unique searches for information to so many people looking for truly anything – every second. And all it costs is a little scroll downwards, below the top layer of ads.

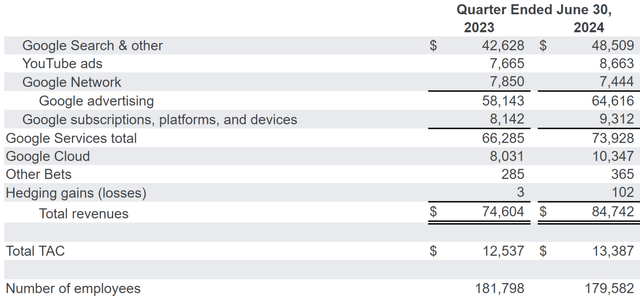

This value offering to users translates well financially, into 14% year-over-year revenue growth in Google Search advertising revenue growth, despite market share going in part to social media search engines.

Google’s Earnings Report (Google)

ChatGPT came out in late 2022 and despite reaching over 200 million users, worldwide Google searches continue to grow. This is strong evidence, and my first point, that Search’s dominance continues.

Google Chrome default pages continue to be www.google.com, which remains Google’s main avenue for maintaining its lead in Search. There are almost 4 billion users on Android, Alphabet’s proprietary smartphone software platform. That user base grew 8.3% in the last 12 months, and they are exposed to Google Search through Chrome, Google’s Android browser.

This mechanism of offering the widely used Android software for smartphone makers, and then funneling new Android users into the Google ecosystem is one of Google’s strongest claims to a moat, with the late Charlie Munger describing it in candid language:

Google has a huge new moat. In fact I’ve probably never seen such a wide moat.

Moreover, this is a moat that grows stronger over time: other traditional search engines are unlikely to get the capital required to buy enough compute for better search engine results than Google already has, while social media searches don’t typically want to provide URLs that transport users off their platforms (despite it being a growing market for search in certain contexts). Google has been properly challenged by various other notable CEOs such as Steve Ballmer of Microsoft, via its acquisition of Bing, and Jeff Bezos of Amazon, who famously said:

Treat Google like a mountain. You can climb the mountain, but you can’t move it.

On a final note, I personally believe that judgement is something most humans will never want to outsource to AI. If milk is about to spoil, I want to read a variety of sources, I want to hear several human opinions (for example, via Reddit (RDDT)), I want to read something substantial from a few food safety websites, and then I want to come to my own decision about it after looking at it from several sides, all using Google Search as the portal for those sources of information. What I don’t want is an AI giving me a blanket and irrefutable answer, especially when some of these AI models have been shown to have certain coded restrictions, political leanings, censorship, and other inhibitions.

While I can expect simple answers will come from perhaps more convenient AI sources – like Meta AI, which is embedded in Facebook Messenger now simply as one of your friends you can chat with – I believe that Google Search will remain the first place on the internet from which to jump. As such, the moat is still sound.

YouTube

I consider YouTube to be one of the most, if not the most, important libraries on the internet. Content uploads, dating back to almost 20 years ago, represent a record of human history spanning everything:

- Logs of nightly news hours posted from hundreds of TV channels, even stretching back to news from the 1950s and earlier;

- Histories of different civilizations;

- Interviews and discussions about almost literally everything;

- Product reviews;

- Courses in biology or any other subject;

- DIY projects;

- Relationship help;

- Workout routines.

The topics are endless, and thus so is the value proposition to users seeking any sort of content. I personally use YouTube enough to justify paying for YouTube Premium. I calculated that if I was 100 hours of YouTube a year (16 minutes a day), and every two to four minutes there are 10–15 seconds of ads, I am saving myself an extra 4-12 hours of advertisements throughout the year. For $100 USD, that is worth it, not just for the time savings, but the frustration savings.

By the numbers, YouTube Premium “subscriptions, platforms and devices” is the best breakdown Google offers with regard to subscriptions. That category grew 14.4% annually, “primarily” via subscriptions, according to the earnings transcript. This indicates others are finding the same value I am receiving, getting rid of ads for uninterrupted access to the best video library.

YouTube ads are also brimming with potential. Just as we’ve seen Meta Platforms (META) use GPU processing power to connect the right content with the right viewers like never before, surprising analyst estimates by growing revenues 22% in the last 12 months, investors should expect to eventually see similar developments at YouTube with Google’s GPU compute, estimated to be over $100B (previous spend, and estimated forward spend). Further, investors should also expect that AI content will begin to be a driver of viewership and thus, advertising revenue, over the long haul. AI video creation is already here in various forms and from multiple providers, including Meta and Alibaba (BABA), the latter of which just released over 100 new open-source AI models.

While AI-generated content has huge potential to replicate other successful forms of content or imagine new forms of content tailored to each unique user, there are also risks associated with content not made by humans. As such, YouTube will be labeling each AI-generated video on its platform.

…content created by YouTube’s generative AI products and features will be clearly labeled as altered or synthetic.

With a log of videos spanning decades, comments sections, likes, saved videos, and videos demonstrating various other signs of positive and negative reactions from users, YouTube has an immense series of datasets on which GPUs can train AI models, meaning the quality, variety and impact of AI-generated content on YouTube could be comparable, or superior, to human-generated content – enhancing YouTube viewers’ experience and driving revenue growth.

Google Cloud

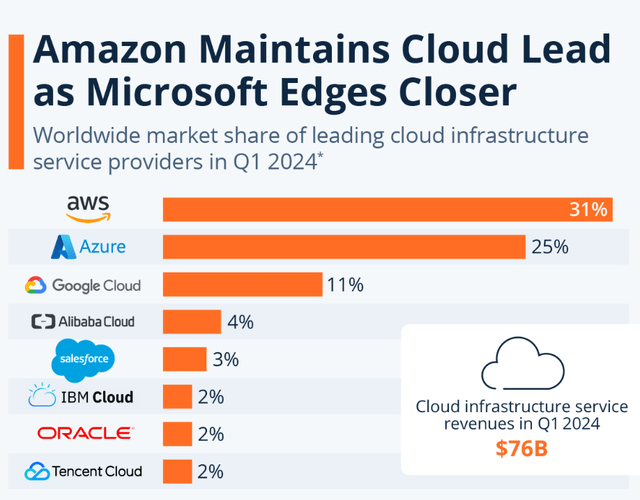

Despite being far behind Amazon’s AWS, and Microsoft’s Azure in terms of market share, Google Cloud continues to work wonders for Alphabet’s bottom line, delivering $10.35B in quarterly revenue compared to last year’s quarter, and growing at 29%.

Cloud Market Share Breakdown (Statista)

This is notable growth because Amazon Web Services grew its revenue by 19% over the comparable period, and Google Cloud kept pace with Microsoft Azure at 29%, meaning Google Cloud is taking market share from AWS.

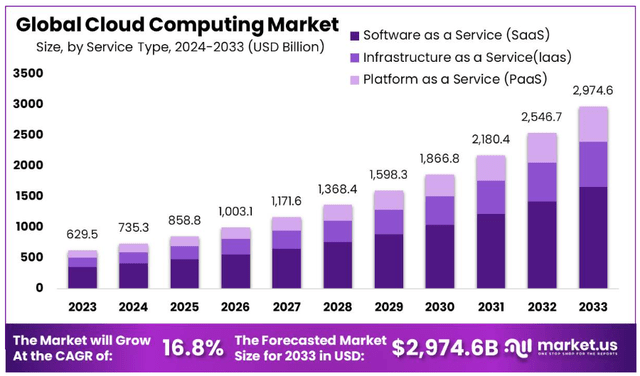

Cloud TAM (Market.us)

Being successful with a growing market share in a huge and growing tangible addressable market is a great spot to be in for Google. Expected TAM growth is estimated in the 16-17% CAGR range.

Google Cloud is not seen as first-rate for general businesses, who are primed for Microsoft’s Azure cloud platform by already working in Windows. Online businesses with relationships with Amazon are also geared towards Amazon Web Services. For Google, it’s Google’s Android ecosystem and user base that will likely continue to funnel Android users into Google’s ecosystem, including photo and video storage via Google Cloud.

Google Gemini

Google’s AI ventures are among the oldest in the tech industry, with roots in corrective spelling dating back to 2001, Google Translate released in 2006, and TPUs for AI development released in 2016. Released in 2023, Google Gemini has faced a few hiccups in development, with early versions demonstrating political leanings, hallucinations and factually incorrect answers. Investors focused on these issues, crushing the stock price at the time.

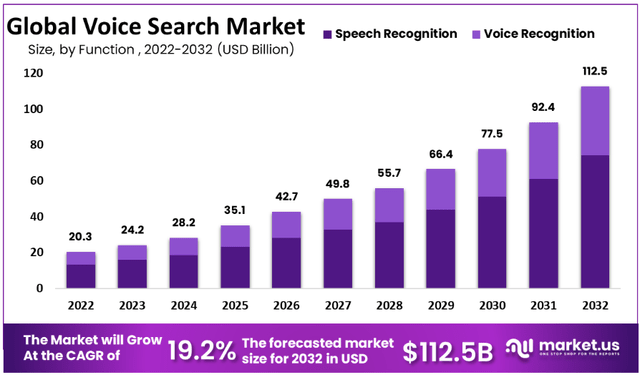

Perhaps investors have forgotten that since Google owns a smartphone platform, the ability includes Gemini in the daily use of Google’s 4 billion smartphone platform users is relatively straightforward with such a captive audience. Through voice search, as an app, or as a character avatar or photo-realistic human face on screen, Gemini is rife with opportunities for monetization such as advertising, subscriptions, and potentially other revenue generators.

Voice search in particular is a budding sub-industry, with an expected quadrupling by 2032 – a CAGR of approaching 20%.

Voice Search Market Growth (Market.us)

The Five Factor Model

Now that I’ve reviewed Google’s largest business lines, I’m now going to run Google through my Five Factor Model. I documented this test in-depth in my recent article The Five Factor Model: A Screen Of Ultimate Quality For Reasonable Valuation. I won’t describe it in detail here.

1) The Company Is Important

Google is definitely important. As the dominant search engine, a key figure in cloud, a unique social media platform found on YouTube, a dominant position in Android, and a potential leader in AI in various ways, Google touches the lives of billions, with people interacting with various parts of its ecosystem multiple times throughout the day. To replace all of Google’s businesses in one shot would be impossible, and there is immense value offered to the world through its ecosystem.

2) The Company is Founder-run, or the Founders are on the Board

Google sports nearly 10.4% insider ownership, largely represented by its founders Larry Page and Sergey Brin, who both remain on the Board of Directors and execute different roles within Google. CEO Sundar Pichai has over $150 million invested in Google, representing up to 10% of his net worth. Sundar Pichai has become known for desiring to slim-down Google, towards its “scrappy” roots, while also expanding its AI and compute capabilities. According to Pichai, the company’s AI infrastructure and generative AI products have:

…already generated billions in revenues and are being used by more than 2 million developers.

Pichai, Brin and Page are inspired management, who hold huge personal stakes in the company.

3) Gross Margins are Over 60%

Google’s gross margins hover around 58% in recent years, and the company has produced as high as 62.44% in the past. Its gross margins are relatively stable, and I believe with growth in various higher-margin areas such as subscriptions, ads, and potentially AI, it can continue to push gross margins up over the long term. I give Google a light pass on high gross margins.

4) Reasonable Exception to 15% Revenue Growth Over the Next 3 Years, with Similar Historic Growth

Unfortunately, Google doesn’t pass this hurdle if you believe analysts estimates. Current forward revenue growth rates are in the range of 11-13% annually. I disagree with such a pessimistic range, given the opportunities as AI is monetized over the coming years and the long tailwinds of internet and phone access expansion across the world. Further, efficiencies found in Search, YouTube ad allocations, AI content driving viewership and Gemini monetization are all opportunities for revenue beats and raises for years to come.

In this regard, while I believe that 15% is somewhat out of reach in the short term, I can see 13-14% revenue growth as an acceptable and likely outcome in the coming three years. I give Google another light pass on this front, being not too far behind the 15% revenue growth standard I prefer in the model.

5) Valuation – 4% Earnings Yield: (Fwd R&D+EBIT)/EV

Google invested $47B (annualized) last quarter in R&D, and produced $110B (annualized) in the same quarter in EBIT. These figures are expected to grow 25-30% over the next twelve months, to the combined $200B level.

On an EV basis, Google sits at $1.99T, meanings it’s forward earnings yield by this metric is 10.4%. In other words, if Google cut all R&D and paid it and it’s EBIT out as a massive dividend, the forward yield would be around 10% on an ongoing basis, pre-tax, and adjusting for Google’s world-leading $72B net cash position on its balance sheet. On forward earnings yield, I give Google a full pass.

Risks

Despite various business lines presenting compelling opportunities, Google does face challenges on all fronts. I will highlight what I see as the main risks below.

Search becomes obsolete – ChatGPT, other chatbots, and social media search engines’ popularities are growing and may continue to become places where people prefer to search for various things. Google Search could face its “Big Tobacco” moment when cigarette volumes began to decline. Regardless, I believe habit, use cases, increased smartphone adoption (with Android), and the general tailwind of more work and ecommerce conducted online will continue driving total Google searches over the coming years, even if market share is lost to newer formats of searching online.

AI training on YouTube data – this could produce new “AI social media”, a pure, AI-only medium that learns from the best of YouTube and other platforms. In this case, AI would replicate, augment and perfect content for viewers to consume. This could draw viewership away from YouTube. However, training AI on external data is already becoming a legal quagmire, which could be a mitigating factor to this risk.

Google Cloud’s growth slows – this is perhaps the biggest risk in my view in the medium term, which could have an effect on Google’s valuation and earnings potential. While the industry is expected to grow very healthily into the next decade, compute is expensive, and allocating it towards AI will likely mean allocating it away from cloud. This could raise costs for clients, which would slow adoption. It will depend on which industry (AI or cloud) the large technology companies deem more profitable. However, if Nvidia continues its innovation schedule, compute could remain affordable enough compute for both industries to grow as well as they have. There is also some research demonstrating that cloud is still a high priority among industry leaders.

A Note On Next Quarter

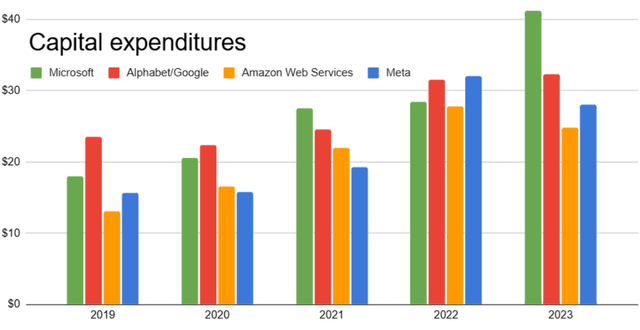

Google reports Q3 earnings on October 22, 2024. Investors can expect further capex (and R&D) investments, “with the largest component for servers followed by data centers”, at or above $12B this coming quarter, which has been the trend throughout the year, as well as in the last few years. Google is also investing a further $5B in Waymo, a figure “consistent with recent annual investment levels”.

Geekwire

Investors can expect that until the investments in these “Other Bets” opportunities, and it’s server and data center build-out are concluded, GAAP earnings will reflect these costs, while adjusted earnings will not, to an extent. If the capital expenditure and R&D cycle ever stops, investors should expect larger earnings jumps as income to free cashflow conversion rates improve.

Conclusion

I have reviewed Google’s various businesses, and shown that they do lead in certain ways, and that each maintains a strong or leading position in its own industry. Further, each segment has a growing Tangible Addressable Market, and all businesses are high margin. Notable opportunities include YouTube ads and subscriptions, Google Gemini, Voice Search, and even potentially charging for Android.

Through the lens of my Five Factor Model, Google comes a little shy on revenue growth and gross margin, but it excels in importance, management, and especially, forward earnings yield.

Google offers undeniable quality, and opportunity, for shareholders prioritizing those items, and further, such quality and opportunity comes at an incredible 10.4% forward R&D + EBIT yield (a 10x earnings ratio), using my specific forward metrics. As such, I am assigning a Strong Buy to Google.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, META, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.