Summary:

- The Google stock has stayed relatively resilient despite the start of a high-profile anti-trust lawsuit brought on by the DoJ against its Search advertising business.

- A verdict against Google would result in a costly remediation process, and potentially impact the future cash flows underpinning its valuation prospects.

- However, we think said risks are still remote. Instead, we’re more concerned about recent findings disclosed on trial, which raises questions over the durability of Google’s advertising moat.

zodebala

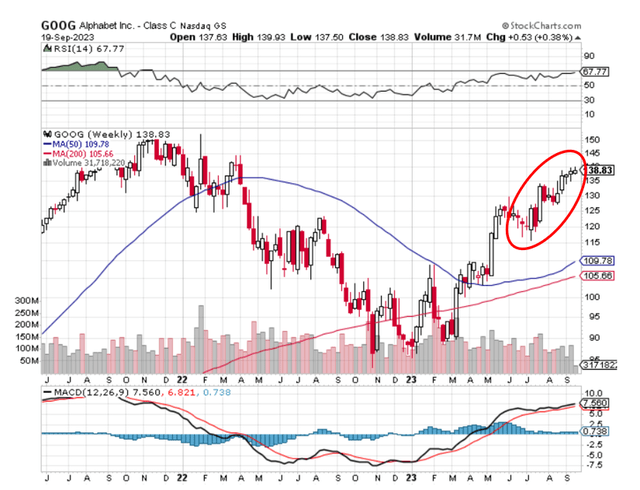

In our recent coverage of the Google stock (NASDAQ:GOOG)(NASDAQ:GOOGL), we had highlighted the company’s Q2 outperformance, as well as emerging AI-driven TAM expansion for its core advertising and cloud businesses as potential factors for fueling further upsides. However, recent headwinds over Google’s high-profile anti-trust fight against U.S. regulators unveils signs of emerging weakness to its advertising moat. Meanwhile, direct monetization of impending AI opportunities have also yet to prevail as an accretive growth factor for the company. The concoction of challenges is likely to overshadow the role of Google’s recent fundamental outperformance in the near-term, and stir some weakness to the stock’s performance. This is in line with slowing momentum to the stock’s rally this year in recent weeks.

The Google stock has been showing stronger dips and weaker buys in recent weeks (stockcharts.com)

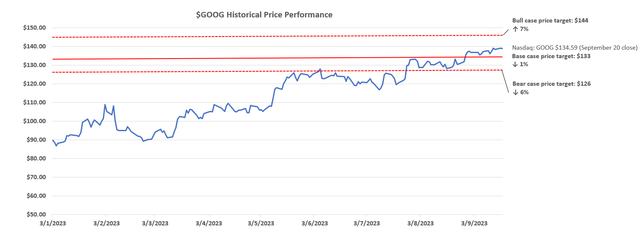

While Google’s current valuation at 5.5x estimated sales, following the stock’s 56% rally this year, still trails some of its peers’ in the Magnificent Seven, we believe recent findings disclosed from its anti-trust trial implies some idiosyncratic risks to underlying business fundamentals. As a result, we are recommending against the stock at current levels in anticipation of impending volatility in the near-term.

The Anti-Trust Suit is Uncovering Weakness to Google’s Advertising Moat

Regulatory agencies under the Biden administration have been tightening anti-trust scrutiny over big tech companies in recent months. And Google’s sprawling advertising unit has been no stranger to relevant allegations. However, recent disclosures and findings from the ongoing suit brought on by the Department of Justice are, in our opinion, sowing skepticism over the durability of Google’s moat, which has been fortified in tandem with the rise of digital advertising’s dominance.

Specifically, the Google vs. DoJ anti-trust trial began last week. The DoJ alleges that Google’s practice of ad revenue sharing with big tech companies in exchange for making Google Search the default search engine in “browsers and mobile devices” has breached anti-trust laws. The lawsuit claims that such arrangements have essentially blocked out “rival search engines such as DuckDuckGo or Microsoft’s Bing (MSFT) from gaining the volume of data they need to improve their products and challenge Google”. Meanwhile, Google has argued that such revenue sharing arrangements are akin to brands making deals with grocery stores for “prime shelf space”.

With Google’s core search advertising business being the bread and butter of its valuation – the unit is what has been bankrolling everything else from cloud to streaming to AI – any changes to relevant operations could be adverse to the stock’s prospects. Admittedly, even if Google’s revenue sharing practice is found in breach of anti-trust regulations after the 10-week trial, ensuing remediation is unlikely to eradicate its 90%+ market leadership in online search queries overnight (it’s just like how Bing’s integration of ChatGPT – a transformative phenomenon – has yet to overtake Google Search’s lead).

Instead, we are more concerned over recent findings disclosed from the trial, which suggest increasing risks of structural market share loss to rivals. Despite its resilient market leadership, Google Search has not been immune to the shake-up across the digital advertising industry over the past two years, spanning inherent macroeconomic sensitivity, shifting competitive dynamics, and policy changes. Much of the stock’s valuation premium to the broader internet sector has been primarily driven by market’s interpretation of Google’s cash prospects ensuing from its unmatched 92% share of search ads, and 39% share of global digital ads. Any weakness to these numbers would risk exposing the stock to downsides, and we are afraid the unfolding of such a scenario is already underway.

Google and Meta Platforms (META) has long been mainstays in the digital advertising industry. When the latter had briefly succumbed to Apple’s (AAPL) privacy policy changes implemented in 2021, Google Search stepped up as a key beneficiary of ad dollars previously attributable to social media advertising formats. The combination of a tight ad spend environment at the time due to emerging macroeconomic uncertainties (e.g. inflation, rate hikes, etc.) had also incentivized advertisers to allocate resources to where engagement and conversions were strongest – i.e. Google Search. This was likely a meaningful driver for resilience in Search ad sales through the first half of 2022, when the ad spending environment headed for a cyclical downturn.

But Meta has made a strong comeback since. The social media giant has been actively honing its internal AI expertise to rid its core advertising business’ dependence on external data sources going forward. And the multi-year remediation strategy announced during the worst of its Apple signal loss era has only gained further momentum with the recent surge of interest in generative AI. This shift in competitive dynamics is likely to be a negative for Google Search ads, as its Performance Max offering directly rivals Meta’s AI-driven Advantage+. Meta has also been making significant improvements to campaign performance on the Advantage+ format, with more than half of its users identifying competitive cost-per-action (“CPA”) and return on ad spend (“ROAS”) as key positives over Google.

Unfortunately, the increasingly structural risks of market share loss for Google Search ads don’t end there. Amazon’s (AMZN) increasing grip on retail advertising formats, bolstered by its first-party data advantage, also risks displacing ad dollars previously attributable to Google Search. This is corroborated by recent commentary from Google’s senior advertising executives during the anti-trust trial, which confirms the company is “losing share to other new entrants including TikTok and Amazon”.

Specifically, Amazon’s prominence in digital advertising also emerged around the same time when Meta’s influence was upended by Apple signal loss. Its expanding share in retail advertising formats is effectively disrupting Google’s leadership in the space. Retail ads represent more than a third of Google Search ads, and is currently its “biggest category of advertising”. Yet Amazon’s market share gains are expanding at an accelerating pace that is “twice the rate” of Google’s, effectively owning a bigger piece of the retail advertising pie. And that’s no surprise – merchants are incentivized to advertise on e-commerce platforms, as it helps target conversion from customers already looking to spend money. It is also in line with Google’s increasing focus on honing its shopping strategy in recent years in an aim to better capture retail ad dollars. This ranges from the direct integration of Shopping with Search ads, to increased reliance on digital content creators via “Perspectives”, and AI-enabled virtual try-ons to drive conversion.

Retail ad demand has also been relatively resilient compared to the broader digital advertising industry in the latest cyclical downturn. Yet much of the corner’s success continues to be driven by Amazon, highlighting risks of emerging cracks to Google’s advertising moat:

Retail media advertising will increase from $31 billion this year to $42 billion in 2023. The bulk of it comes from Amazon’s product search but all other large retailers are now developing advertising sales through keyword search or display ads on their apps and websites. Retail media is mostly fuelled by consumer brands reallocating below-the-line, trade-marketing budgets from in-store towards digital retail networks, as a greater percentage of retail sales comes from e-commerce.

Source: Magna Advertising Forecast, U.S. Fall Update (September 2022)

Fundamental Considerations

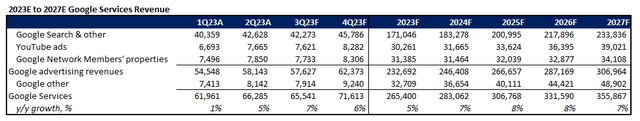

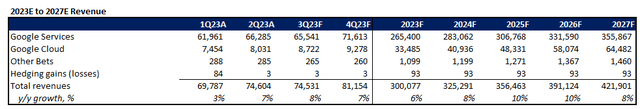

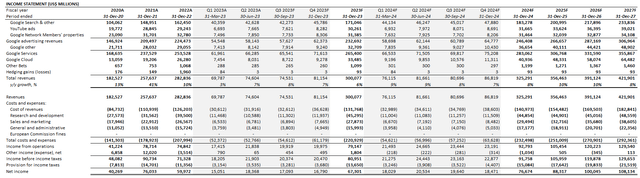

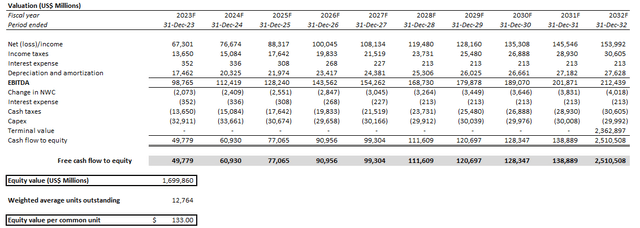

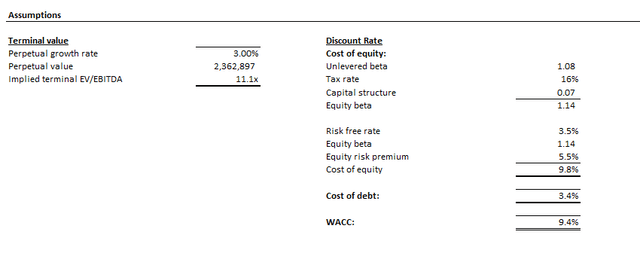

In light of the foregoing analysis on recent details unveiled on the extent of an ongoing adverse shift in competitive dynamics for Google’s advertising business, we have revised our base case growth estimates. With incremental consideration of overhanging anti-trust headwinds, our forecast has downward adjusted the five-year CAGR for Search ad revenue from 11% to 7%. We expect YouTube ad and non-ad revenues to be the emerging driver of Google Services growth over the longer-term. However, sales generated from YouTube are expected to remain a nominal mix of total Services revenue in comparison to Search ads.

Taken together with anticipated strength in Google Cloud opportunities (+14% five-year CAGR – discussed here), as well as nominal contributions from Other Bets and hedging gains (losses), total revenue is expected to expand at a 7% five-year CAGR.

On profitability, we expect gross profit margins to stay relatively stable in the mid-50% range exiting 2023. Despite anticipation for elevated AI investments in the near-term, and weaker operating leverage in Search ads due to the adverse shift in competitive dynamics, Google’s scale advantage and its recently implemented cost-savings initiatives are expected to be primary compensatory factors. We also expect continued Google Cloud share gains to help drive expansion for the segment’s margin profile over time.

Google_-_Forecasted_Financial_Information.pdf

Valuation Considerations

Despite still being a cash cow, fueled by a high-margin business model, and incremental contributions from Google Cloud’s expanding profitability and recently implemented cost-savings initiatives, the stock’s valuation has continued to trail some of its megacap peers with a similar growth profile. Especially in recent weeks, we have been observing stronger dips and weaker climbs in the stock. This is likely reflective of exhausting market sentiment on the stock, as the anti-trust trial continues to highlight findings disruptive to Google’s growth (though the trial itself is unlikely to unleash material damage for a while).

Our base case price target of $133 is based on a discounted cash flow analysis, and applies a 9.8% discount rate and 3% perpetual growth rate. The WACC is computed in line with Google’s capital structure and risk profile, while the terminal value assumes perpetual cash flow growth in line with the pace of economic expansion without incremental investments into new developments.

Final Thoughts

Key sentiment drivers for the stock today remains on the fact that Google still holds unmatched leadership in the high-margin advertising business, with emerging strength in the provision of public cloud computing services buoyed by AI tailwinds. The company also boasts one of the strongest balance sheets, with a resilient check-book to better navigate through evolving industry dynamics.

But recent findings disclosed in the ongoing anti-trust trial suggests its growth is at risk of stabilizing in the mid-single digits. This compares to key rival Microsoft, which has continuously defied the law of large numbers through TAM-expanding innovations to sustain double-digit growth. While Google shows prospects of achieving the same by pulling the AI lever and driving accretive growth to its core advertising business, relevant efforts have not been materializing as fast as expected, nor has it been much of a differentiating factor for the company (e.g. PMax directly rivals Meta’s Advantage+, Bard directly rivals OpenAI’s ChatGPT and Microsoft’s Bing Chat, etc.).

In the event that the DoJ requires Google to remedy its anti-competitive actions previously undertaken to bolster its leadership in search ads, the company risks facing further weakness to its longer-term growth prospects. While Google Cloud has been emerging as a promising stream of growth and profitability in recent quarters, its contributions remain materially distant from the scale of Search ads, and is unlikely to be a sustainable driver of valuation upsides in the near-term. Taken together, we expect volatility to the stock as market sentiment stays conservative in response to developments related to Google’s anti-trust trial over the next several weeks. Relevant uncertainties are likely to be exacerbated by ongoing macroeconomic challenges that remain a prominent influence on company fundamentals and broader market performance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!