Summary:

- Google presented its Q1 results, leaving investors ambivalent.

- Google has been one of the worst-performing big tech names in the last year, but this should change.

- The company is cheap, while also having some of the best growth prospects in the tech sector.

Sakorn Sukkasemsakorn/iStock via Getty Images

Thesis Summary

Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) presented its Q1 results yesterday, and investors seemed to be somewhat pleased. The stock popped 4% pre-market, though it now looks set to open in the red.

The company continues to grow revenues steadily, has achieved profitability in Cloud, and is also seen as a strong beneficiary of the AI revolution.

Despite the recent tech overcrowding, Google is a tech company that offers investors an attractive valuation, a strong moat and a long growth runway.

Earnings Overview

Looking at the YoY comparison, the results don’t actually look too great:

Google Q1 overview (Earnings Release)

We got a 3% increase in revenues, a 5% decline in the operating margin and lower EPS. With that said, these results have to be put into context.

This quarter included $2.8 billion in charges associated with the workforce and office space reduction. These are costs associated with severance packages and penalties for exiting a lease agreement prematurely. In other words, short-term pain, long-term gain.

We also must understand that this is a difficult comparison, since Q1 2022 was a high-growth quarter.

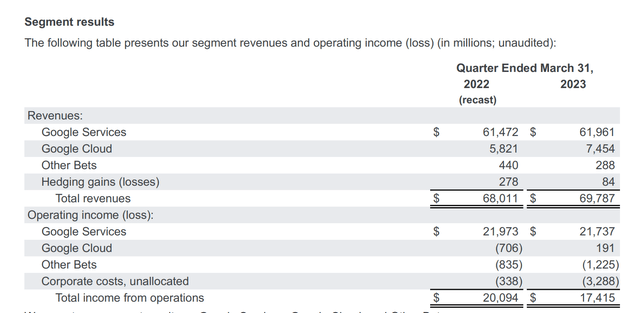

Let’s move on to the segment breakdown:

Google segment breakdown (Earnings Release)

Google services were almost flat, and it’s also with nothing since it is not shown here that YouTube revenues, which are included in this segment, have fallen YoY and sequentially.

The good news here is Google Cloud, which grew at a much faster pace and also achieved positive operating income for the first time.

Granted, Google has experienced some headwinds, and the stock has fallen out of favor with investors, who see more potential in other tech names like Microsoft Corporation (MSFT). However, for those willing to play the long game, Google stock offers great value at this price.

Insights From The Earnings Call

During the earnings call, the Google team covered everything from AI and Google Cloud to YouTube and Search.

First off, on the latest AI developments:

In March, we introduced our experimental conversational AI service called Bard. We have since added our PaLM model to make it even more powerful and Bard can now help people with programming and software development tasks, including code generation, lots more to come. For developers, we have released our PaLM API alongside our new MakerSuite tool. It provides a simple way to access our large language models and begin building new generative AI applications quickly.

Source: Earnings call, CEO Sundar Pichai.

Bard was already presented to the world, with some hitches. Since then, the company has added its Pathway Language Model (PaLM) which allows for further scalability.

Ruth Porat, Chief Financial Officer, then talked about the balance of profitability and growth:

We are very pleased with the Q1 results. And as both Sundar and I noted, we are intensely focused on all elements of the cost space and the long-term path to attractive profitability. At the same time, I think at the core of your question, and what we were trying to convey, is that we will continue to invest to support long-term growth, in particular, given the opportunities we see delivering AI capabilities to our customers.

Source: Earnings call.

The tech space, in general, is following an effort to reduce costs. However, Google still has a lot of growth ambitions, and balancing these out will be key as we move forward.

One important area of growth is YouTube:

YouTube Shorts continues to see strong momentum with Creators. Last year, the number of channels that uploaded to Shorts daily grew over 80%. Those posting weekly on Shorts, saw the majority of new channel subscribers coming from their Shorts post. The living room remained our fastest-growing screen in 2022 in terms of watch time, and we are seeing growth and momentum internationally.

Source: Earnings call.

Shorts are growing at a fast click, but monetization is another story. While we did not get concrete figures, they said this is progressing nicely. It’s encouraging to know that people are using YouTube more in the living room, as the company tries to expand into content areas like sports and entertainment. Overall, YouTube continues to attract the best talent thanks to its favorable revenue share.

Lastly, Pichai was asked about his thoughts regarding the increased competition from Microsoft as they try to gain more of the Search market.

It’s important to remember, as far as I can remember, we have always been in a competitive environment for these deals. And while I can’t comment on the specifics of any of our partnership agreements, what has served us well is always, first of all, building the best product possible, focused on giving value to users.

Source: Earnings call.

A straightforward yet insightful answer. People seem to forget that Google has had competition in the Search space since its inception. They forget, perhaps, because Google has done so well to dominate this market. It’s still very early to assume that Microsoft or other competitors can put a big dent in Google’s market share.

Still Dirt Cheap

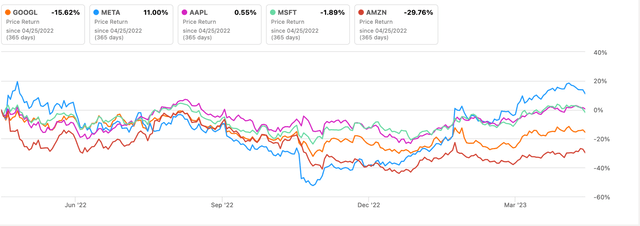

Google continues to be, in my book, one of the best positioned tech stocks, and it has become more attractive vis-à-vis its peers in the last few months, as investors seem to be favoring its competitors.

Within the big tech space, Google and Amazon.com, Inc. (AMZN) have been the laggards over the last 12 months.

Big tech performance 12 months (SA)

Furthermore, If we look at any of the classic valuation metrics, Google is much cheaper than the rest of the big tech companies. Below, we have valuation metrics for Google, Meta Platforms, Inc. (META), Apple Inc. (AAPL), Microsoft, and Amazon.

|

GOOGL |

META |

AAPL |

MSFT |

AMZN |

|

|

PEG Non-GAAP (FWD) |

1,22 |

1,49 |

2,66 |

2,58 |

2,60 |

|

Price/Sales (TTM) |

4,80 |

4,78 |

6,80 |

10,08 |

2,03 |

|

Price to Book (TTM) |

5,21 |

4,32 |

45,74 |

11,20 |

7,19 |

|

Price/Cash Flow (TTM) |

14,44 |

10,55 |

23,73 |

24,30 |

22,51 |

Google is the cheapest in fwd PEG and is only beat on Price/cash flow and Price/Book by Meta Platforms.

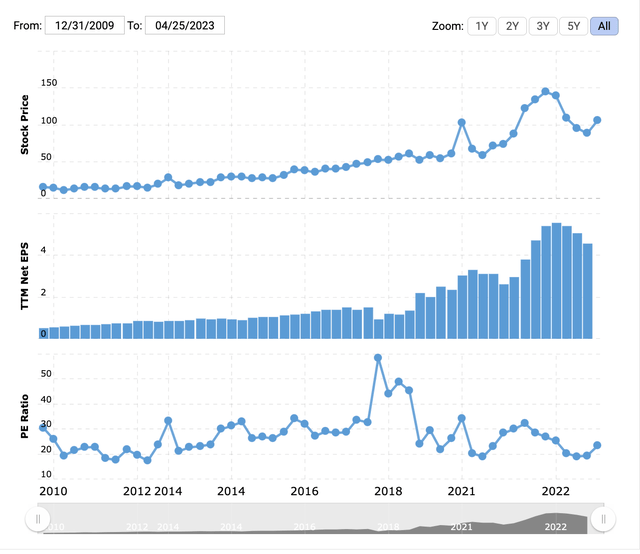

Finally, if we look at Google’s historical P/E, we are also well below the average:

Google Price, EPS and PE (macrotrends)

This seems really counterintuitive when we think about all the hype in AI. Google is well positioned to benefit from this, has initiated cost-cutting initiatives, and still has a strong moat.

Takeaway

The current Google earnings have neither convinced nor dissuaded investors. Google stock is down for now, but at $102, Google is dirt cheap here. This is a company with a long runway to keep growing that is executing well on all cylinders. Competitors will have to do a lot more to prove they can actually move the mountain that is Google.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This is just one of many exciting and fairly priced tech stocks you can buy right now!

Join The Pragmatic Investor to stay ahead of the latest news and trends in the tech space and you will receive:

– Access to our Portfolio, which features “value tech stocks”.

– Deep dive reports on tech stocks.

– Regular news updates

Technology is changing the future, don’t just watch it, be a part of it!