Summary:

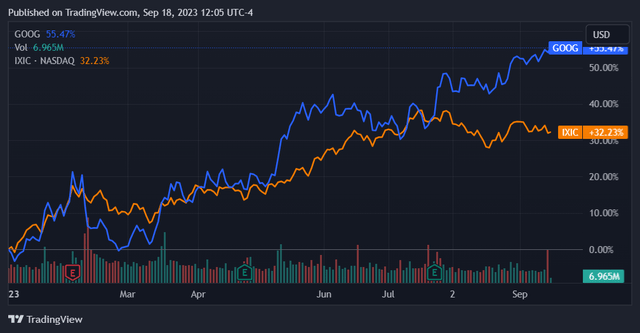

- Google stock has bounced back from a difficult start to the year, overcoming the media cycle and AI concerns. It’s now trading 23% above the NASDAQ Composite’s return YTD.

- Since the narrative has now shifted, and Google is properly considered a real player in AI, investors should take note of new drivers for the stock: Cloud and AI growth.

- Google is performing well across both of these areas, with robust cloud segment performance as well as a slate of new artificial intelligence products.

- Additionally, Google’s valuation relative to its history, as well as its peers, indicates that shares are still worth buying at present.

NicolasMcComber/iStock Unreleased via Getty Images

Overview

Google stock (NASDAQ:GOOG, NASDAQ:GOOGL) has had a distinct trajectory this year. While initially performing in line, or even below, the NASDAQ Composite, Google stock has since reclaimed momentum and has now returned a solid 23% beyond the index year-to-date.

Seeking Alpha

In my view, this price trajectory has been due to the shifting narrative and news cycle around the stock. Namely, Google shares were pummeled early in the year due to investor concerns around it being a laggard in artificial intelligence. The high-profile announcement of Microsoft’s (MSFT) newly AI-enabled Bing search engine also played into this.

Ultimately Bing did not materialize as a credible threat to Google’s business. Additionally, a revamped public relations campaign by the firm made it evident that Google is far from a laggard when it comes to AI. Indeed, it is very much a leader in this nascent space. As investors parsed this information and reoriented their perspectives, Google shares have followed suit. It also didn’t hurt to see two consecutive beats against consensus earnings expectations.

Now that the dust has settled, it is possible that Google shares could now be fairly priced. Furthermore, the artificial intelligence situation also continues to evolve, albeit without producing material shifts in the company’s financials. This has been the case market-wide. The question is now what will drive the stock going forward.

Given where things stand, I am inclined to believe that the primary factors will be a mixture of the company’s cloud results as well as its progress on artificial intelligence. Cloud is Google’s primary growth engine in terms of percentage growth, and AI is slated to be the next one. In this article I wanted to review how things are coming along across these areas while also contextualizing Google’s valuation.

Cloud Momentum

Google Cloud has come into its own over the last two quarters. First entering operating profitability in Q1 ’23, it subsequently doubled its operating income contribution in Q2. Year/year revenue growth remained particularly robust at 28% for both quarters. Operating margins nearly doubled as well.

|

Google Cloud |

Q1 ’23 |

Q2 ’23 |

|

Revenue $M |

7,454 |

8,031 |

|

Y/Y % R. Growth |

28.1% |

28% |

|

Q2 Q/Q Growth |

7.74% |

|

|

Op. Income $M |

191 |

395 |

|

Q2 Q/Q Growth |

106.8% |

|

|

Op Margin |

2.6% |

4.9% |

Data Source: Seeking Alpha, Author’s Calculations

These results are excellent and indicate that the company’s Cloud division has genuinely turned the corner into becoming a profit driver for Google. We will now see this segment maturing. Operating margins should continue to increase for the foreseeable future, ultimately approaching a similar level to that of other cloud services business. Considering that Google Cloud’s closest competitor, Amazon’s (AMZN) AWS, posts cloud margins in between 23-29%, we have a long way to go. If revenue growth can remain remotely close to these levels as margins expand, that will be very good for Google’s earnings. This is a robustly bullish fundamental indicator for the stock.

Artificial Intelligence Developments

As to artificial intelligence, things are much more uncertain here. While I have previously outlined why Google is a particularly serious player in the realm of AI, I’ll reiterate here that it hasn’t yet received a windfall from its technology capabilities in this regard. Indeed, no publicly traded company appears to have as of yet. It is also quite possible – probable, even – that artificial intelligence will yield more in the way of incremental improvements to cost structure and margins rather than wholesale benefits to either the top or bottom line. I’m inclined to think that things will go this way. This means that investors should eye incremental improvements across these metrics rather than expecting some kind of significant shift. The benefits should percolate across the income statement as digital economies of scale from AI materialize.

That being said, we can review Google’s product development pipeline for artificial intelligence. Before diving into specific products, I want to note two important corporate structure changes that Google made in Q2 of this year. Firstly, the company merged its Google Brain division with that of DeepMind, its deep learning division based near London. Secondly, the Founder and CEO of DeepMind – Demis Hassabis – is now in charge of this entire new division. I think this is a sound decision and a positive indicator for Google’s AI efforts going forward.

Executive talent, particularly in highly technical fields such as artificial intelligence, can make or break companies or their operating segments. Technical executives with credible experience in AI are also a particularly scarce resource at the moment. Hassabis is a valuable executive for Google to have on board. He founded DeepMind and has continued to lead it since its acquisition by Google, overseeing an impressive slate of AI achievements from DeepMind. I expect this realignment should bolster further innovation for Google.

Google announced new AI products at two major events this year. The first of these – Google I/O – was in May. The Google I/O Conference detailed products that were on the whole more product integrations rather than stand-alone offerings. It came at an opportune time and helped shift the narrative around the stock into more favorable territory. Announcements included autofill for Gmail, 3D path maps in Google Maps, automated photo editing, and two new large language models called PaLM 2 and Gemini. As mentioned, these products appeared more iterative and engineering-oriented in nature.

The second event worth paying attention to – Google Cloud Next – was more recent and concluded at the end of August. It also included products that are significantly more customer-oriented and commercializable, offerings that now put Google toe-to-toe against Microsoft and Amazon. Two new cloud products that were announced are Cloud TPU v5e and A3 GA. Cloud TPU is a cloud-delivered ‘tensor processing unit’. This is a cloud service of an ASIC (application-specific integrated circuit) designed to be particularly efficient for AI workloads. A3 is a cloud service of an AI-optimized supercomputer that leverages NVIDIA A100 GPU’s.

The next product worth mentioning is called Vertex AI. While Vertex has technically been in operation for six months, it is now becoming more generally available to enterprise customers. Vertex provides API’s (standardized protocols for data transfer between computers) for accessing a large library of LLM’s. This is similar to AWS’ offerings in that it provides more of an infrastructure layer for accessing LLM’s, each of which is tailored to certain types of processing. This is a good product to offer because it should allow Google to capture the economics of AI in a broad swath as it gets utilized across various businesses; it is a very ‘generalized’ product.

The final new product worth mentioning is Duet AI. This is Google’s version of Microsoft’s Copilot. It is an AI integration that is fitted into the entirety of Google’s Workspace products (such as Google Docs) as well as Google Cloud, where it helps programmers write code.

All in all, I think it’s clear that Google is on its front foot when it comes to AI. It is now competing directly with Amazon as well as Microsoft in terms of providing AI capabilities across different types of end users. Whether you’re working with a spreadsheet, a document, or a codebase, Google now has something on offer.

Valuation

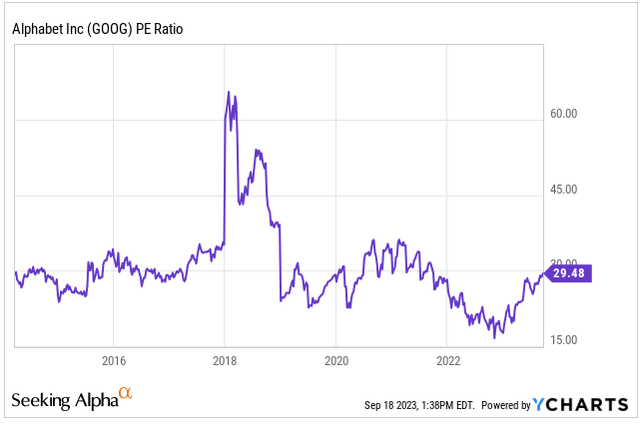

We can now look at Google’s valuation to see how the market is pricing all of this. The first thing to note is that Google’s P/E ratio is not expensive by historical norms. While not particularly cheap due to recent appreciation, it is still hovering a bit below where it was as recently as 2021. This indicates that shares aren’t overpriced, at minimum.

YCharts

The other thing to note is that Google is still trading at a discounted multiple as compared to its cloud computing/artificial intelligence peers. This holds up on both a GAAP and a non-GAAP basis. Since GAAP provides a more sensible comparison across different firms, however, we should focus on that metric in particular. Google’s GAAP P/E of 29.10 is cheaper than Microsoft’s and far cheaper than Amazon’s on a trailing twelve month basis. Its forward GAAP P/E of 24.58 provides a more significant discount as compared to Microsoft and what is still a significant discount against Amazon. On a relative value basis, Google still looks cheap.

Seeking Alpha

Conclusion

I am optimistic for Google as well as its stock. Considering the increasing profitability and ongoing growth in Google Cloud, as well as recent progress in AI product development, I think the near-term looks bright. Additionally, Google shares are not particularly expensive on a historical basis and are trading at a material discount as compared to its two closest peers. I’m calling it a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.