Summary:

- Alphabet is significantly undervalued, with strong Q3 results and a robust balance sheet, making it the best deal in big tech.

- The Trump Administration’s return is expected to ease antitrust pressures, fostering a favorable environment for GOOGL’s growth and innovation.

- Despite risks like ChatGPT and potential antitrust issues, GOOGL’s revenue and profitability metrics remain strong, indicating a resilient business moat.

- GOOGL’s aggressive share buybacks and strategic investments in A.I. and growth areas are poised to drive long-term shareholder value.

Boy Wirat

I didn’t want to write an article about Alphabet (NASDAQ:GOOGL)(GOOG) until after the Presidential election was over, even though Q3 earnings had been reported. I believe that the outcome of the 2024 election is more important for the long-term viability of Alphabet (GOOGL) and other big tech companies than the results from Q3. I normally never discuss politics, but certain factors from a changing administration are extremely bullish for big-tech, specifically the ones that the FTC launched inquiries into. GOOGL delivered a double beat in Q3, which was led by its operating income increasing 34% while its operating margin expanded to 32%. I think that GOOGL is the most undervalued company in the Magnificent Seven, and there are many tailwinds that can cause higher shares. While the A.I. boom has made popular tech companies reach triple-digit returns during 2024, I think we will see GOOGL outpace the market in 2025.

Following up on my previous article about Google

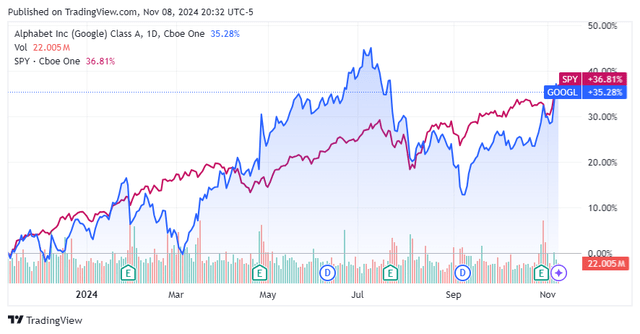

Shares of GOOGL have experienced an interesting ride since my last article was published on July 1st (can be read here). Shares of GOOGL were trading for $183.03, fell to around the $150 level, and climbed back to $178.35. Ultimately, shares of GOOGL are still down -2.56%, while the S&P 500 has climbed 9.59% over this period. I had discussed why I felt shares of GOOGL would continue appreciating after Q2 earnings. I am following up with a new article as I feel the future for GOOGL is stronger than ever as many things have changed. The Fed is cutting rates, a new Administration has been elected, and the macroeconomic environment is setting up well for continued growth. I believe that GOOGL will make new all-time highs in 2025 and continue much higher.

Risks to investing in Google

While I am very bullish on GOOGL going forward, and some risks look like they will be taken off the table, there are still several factors to consider. ChatGPT could cannibalize search and lead to less advertising dollars being spent on Google Ads. We could see growth decelerate in Google Cloud, and its competitors expand the percentage of the cloud market they represent. Lawsuits and potential antitrust cases may not go away under a new administration, and there is always a risk that GOOGL will break up. YouTube could also face declining user engagement, and the subscription business could deteriorate over time. These are several risk factors to consider before allocating capital toward GOOGL.

Google’s Q3 results indicated continued strength and that their moat isn’t being impacted

Many investors that I have talked with have indicated that ChatGPT will cannibalize search, which will impact GOOGL’s bottom line. There have been segments on the financial news networks about this as well. I believe GOOGL remains undervalued because of a narrative focused on future revenue being impacted by ChatGPT and even internal products such as Google Gemini. ChatGPT has been live for more than a year, and I do not see anything in GOOGL’s numbers that indicates their revenue is being impacted. In Q3, GOOGL generated $84.74 billion in revenue, which beat consensus estimates by $445.49 million, and delivered $1.89 in EPS, which came in $0.05 ahead of estimates. GOOGL’s revenue increased by 15% YoY to $88.27 billion and operated at a 32% margin, driving in $28.52 billion in operating income. On a pure profit basis, GOOGL delivered $26.30 billion in net income, which was a 29.8% profit margin. There were 13 weeks during Q3, and GOOGL produced $6.79 billion in revenue and $2.02 billion in net income per week. It’s hard for me to agree with a bear case for GOOGL when it’s generating more than $2 billion in profits every 7 days.

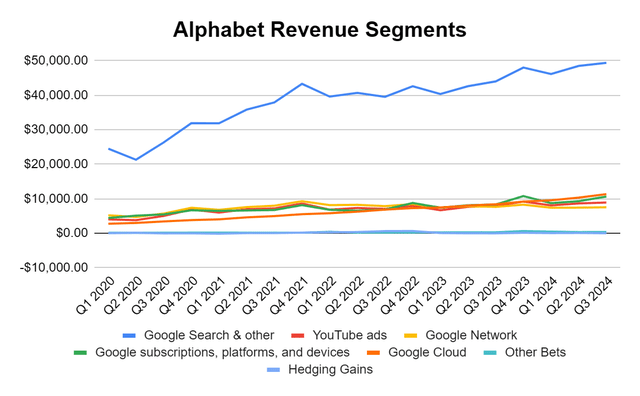

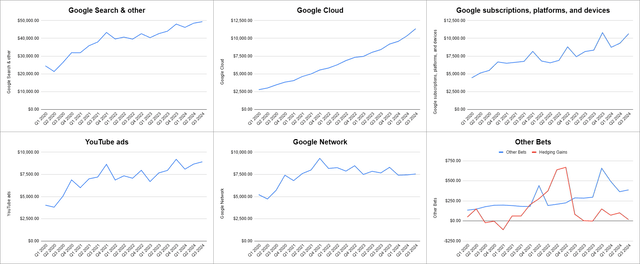

When I dive into the individual metrics that drive revenue, it looks like GOOGL’s moat is still there. Google Search is the main metric that was supposed to be impacted by individuals utilizing ChatGPT and Google Gemini over Google Search. That still hasn’t happened, as Google Search & others generated $49.39 billion in revenue during Q3. This was a 12.17% YoY increase and an increase of 1.81% QoQ. Advertising on YouTube continues to grow, as it reached $8.92 billion of revenue in Q3. The Advertising growth rate on YouTube grew 12.19% YoY and 2.98% QoQ. Subscriptions, platforms, and devices experienced larger growth rates of 27.79% YoY and 14.43% QoQ, as this segment generated $10.66 billion of revenue throughout Q3. Google Cloud increased its standing in the cloud services world as it added more than $1 billion of revenue, growing by 9.72% QoQ and 30.64% YoY. For a company that is supposed to be on the decline, its business metrics are very strong. GOOGL increased its revenue by $3.53 billion QoQ and $11.58 billion YoY. This is more revenue than companies in the S&P 500 generate in a year, and these are GOOGL’s growth metrics.

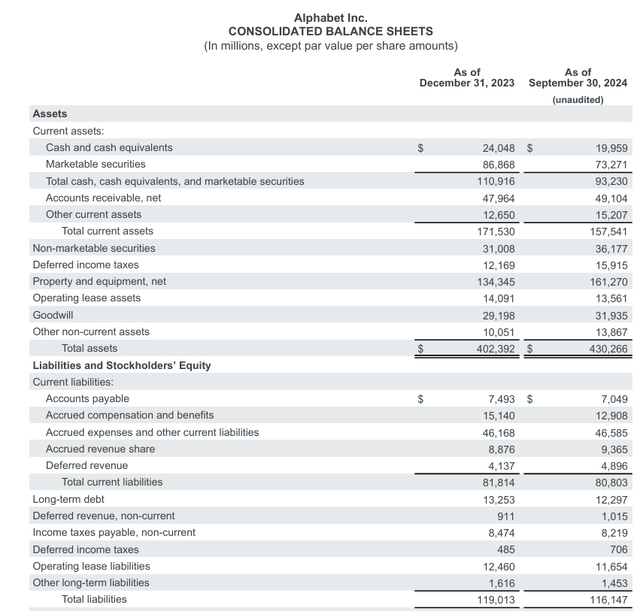

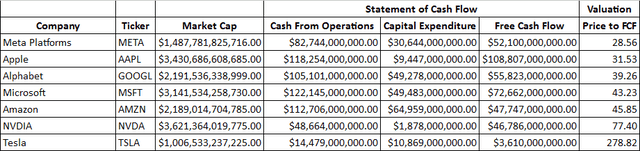

In addition to GOOGL’s moat not being impacted and its profitability increasing, GOOGL’s balance sheet continues to be a treasure trove of assets, with $314.12 billion in total equity on the books. GOOGL has $92.23 billion in cash and marketable securities on hand, with an additional $36.18 billion in non-marketable securities. GOOGL has $12.3 billion in long-term debt and more than 3x the number of assets than its liabilities. Over the TTM, GOOGL has generated $105.10 billion in cash from operations and allocated $49.28 billion toward CapEx, which places its free cash flow at $55.82 billion. This is after increasing their CapEx allocation by $17.03 billion (52.8%) YoY. GOOGL continues to prove that they can allocate any amount of capital toward CapEx and organic growth, and it will drive increased profitability. GOOGL is able to do this without tapping the debt markets and still generated more than $2 billion in pure profit per week in Q3. I think the bears are incorrect and that GOOGL will continue to find ways to expand their business despite ChatGPT emerging from out of nowhere.

The Trump Administration should be very bullish for shares of Google

Skadden, Arps, Slate, Meagher & Flom LLP and Affiliates wrote a publication on June 18th, 2021 (can be read here) that the appointment of Lina Khan would likely signal that the Biden Administration would be more aggressive in antitrust enforcement. After the FTC’s first meeting under Lina Khan, which was held in public for the first time in decades, POLITICO reported that the threshold for FTC’s staff to launch probes into antitrust suspicions had been significantly lowered. Previously, the FTC required an antitrust attorney to receive a full approval by the commission to begin an investigation. Now, under their new leadership, only one commissioner’s approval will be needed to start the subpoena process. As time went on, the House Judiciary Committee received letters that outlined more than 350 demands for information to Twitter within the first 3 months that Elon Musk took over. Jim Jordan ended up subpoenaing Lina Khan for harassing Twitter, and a House report indicated that Lina Khan weaponized the agency against Elon Musk. Per the FTC’s website the FTC issued orders to GOOGL, Amazon (AMZN), Microsoft (MSFT), Anthropic, and OpenAI, requiring them to provide information into their investments and partnerships involving generative A.I. and cloud service providers. Fortune reported that the probe focused on roughly $19 billion in investments and transactions that created alliances between the largest cloud companies.

The election is over, and President Trump will be headed back to the White House with Republicans taking control of the Senate and potentially retaining control of the House as well. Some of Silicon Valley’s most prominent figures have rallied behind President Trump and have become instrumental throughout his campaign, including Elon Musk, David Sacks, Chamath Palihapitiya, and Joe Lonsdale. David Sachs and Chamath Palihapitiya have discussed on the All In Podcast that it would be devastating for America’s A.I. innovation if companies such as GOOGL were broken up by the FTC. I believe that Lina Khan will be one of the first people let go by the Trump Administration, especially with Elon Musk having President Trump’s ear. Elon knows that if GOOGL or AMZN are broken up, it will set a precedent and potentially impact Tesla’s (TSLA) future. I don’t believe that big-tech will get a free ride and that a Trump Administration would still scrutinize and possibly not allow further acquisitions by big-tech, but I also believe that the antitrust inquisitions will disappear. This administration has many leaders from the tech industry involved, and President Trump plans to unravel President Biden’s safeguards. The only way that the United States advances A.I. quicker than our adversaries will be for the largest companies in A.I. to have a clear path for A.I. development, and that won’t occur by breaking up AMZN, GOOGL, or MSFT. I think that 2025 could be very bullish for GOOGL as there is a likely scenario that they won’t have to fight the FTC and can focus on innovation without worrying about triggering investigations into potential antitrust actions.

Google still looks very undervalued and could be the best deal in big-tech

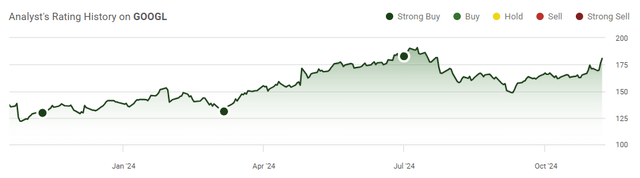

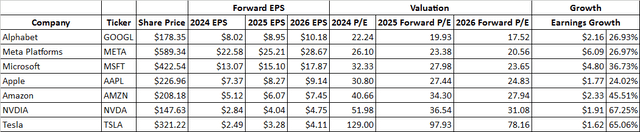

Based on the forward earnings estimates, GOOGL looks extremely undervalued. GOOGL is expected to generate $8.02 in EPS for their 2024 fiscal year, which is projected to increase by 26.93% over the next 2 years to $10.18. GOOGL is trading at 22.24 times 2024 earnings and 17.52 times 2026 earnings. These are the lowest valuations in the Magnificent Seven, and GOOGL is trading at almost half the average 2026 forward P/E of 31.96. Apple (AAPL) is trading at 30.80 times 2024 earnings and 24.83 times 2026 earrings, with 24.02% EPS growth on the horizon. Investors can get more growth at a better valuation by investing in GOOGLE rather than AAPL at these levels.

Steven Fiorillo, Seeking Alpha

GOOGL is also buying back shares hand over fist, which should help increase its EPS over time. In Q3, GOOGL repurchased $15.3 billion worth of shares while paying $2.5 billion in dividends. GOOGL has returned almost $70 billion to shareholders over the TTM. On the earnings call, management indicated that they would be balancing investments in A.I. and other growth areas so they could continue to fund buybacks and dividends. Currently, GOOGL is allocating the 3rd largest amount toward CapEx in the Magnificent Seven. At some point, they will be able to scale back their investments and increase profitability even further. After allocating $49.28 billion toward Capex over the TTM, they are still trading at 39.26 times FCF. Over the next several years, GOOGL will be able to allocate more capital to its buyback program, which, I believe, will create more value for long-term shareholders.

Steven Fiorillo, Seeking Alpha

Conclusion

I think there are many reasons to be bullish on GOOGL going forward. GOOGL is trading at less than 18 times 2026 earnings, and its quarterly revenue is still growing by 4.16% QoQ and 15.09% YoY. In Q3, GOOGL generated over $6.78 billion of revenue and $2.02 billion of net income per week. The moat isn’t shrinking, and GOOGL’s revenue segments continue to grow. When I look out to 2025 and beyond, I think that GOOGL is in a fantastic position as the Trump Administration is likely to remove Lina Khan, which should create a stronger operating environment for Big Tech. I will be looking to increase my position in GOOGL as shares look to be the most undervalued in the Magnificent Seven.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, META, AAPL, NVDA, AMZN, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.