Summary:

- Stock prices and returns are in part influenced by a company’s net cash on the balance sheet and future expected free cash flows.

- Alphabet has a strong net cash position and generates tremendous free cash flow, generating a firm foundation for its share price.

- Dividends are not a driver of a company’s intrinsic value, and a myopic focus on dividends could result in underperformance.

- Since a dividend is capital appreciation that otherwise would have been achieved had the dividend not been paid, we’re indifferent to whether Alphabet eventually pays a dividend.

- However, if or when Alphabet does pay a dividend, the company may become one of the best dividend growth stocks on the market given its strong cash-based sources of intrinsic value.

Ole_CNX

By Brian Nelson, CFA

Stock prices and returns are in part a function of a company’s net cash on the balance sheet and future expected enterprise free cash flows (and changes in them). We call these two items a company’s cash-based sources of intrinsic value. If future expectations of free cash flow increase, the stock price should increase. If future expectations of free cash flow decrease, the stock price should decline. Entities with strong net cash positions on the balance sheet lack meaningful bankruptcy and capital-market dependence risk, meaning that their range of probable fair value outcomes is skewed positively relative to companies with net debt positions, or those that continuously require access to the capital markets.

One company that has a strong net cash position and strong expectations of future free cash flow is Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL). The stock is up more than 45% year-to-date and has more than doubled over the past five years. Though there are risks related to the firm’s bread-and-butter search business, particularly as Microsoft (MSFT) rolls out artificial intelligence in its search engine Bing, search plays a critical role in the everyday lives of consumers, and this isn’t going to change anytime soon. It’d be nearly impossible for any new entrant to unseat Google in the minds of consumers, in our view, and for this, we view Alphabet’s competitive advantages to be extremely strong. That makes its future free cash flow stream quite sustainable.

Alphabet recently reported excellent second-quarter 2023 results. At the end of period, the advertising search giant’s total cash and cash equivalents stood at $118.3 billion, while long-term debt stood at $13.7 billion. This is the type of net cash position that we like a lot in terms of long-term investment ideas. Alphabet’s cash flow from operations increased to $28.7 billion in its second quarter, as capital spending was $6.9 billion, resulting in free cash flow generation during the second quarter of $21.8 billion. Alphabet has what we call strong cash-based sources of intrinsic value. Though ever-changes in future expectations of free cash flow may cause its equity to be more volatile than most, the financial foundation for the equity is among the best on the market today.

Let’s now talk a bit about dividends. Dividends are not a driver behind a company’s intrinsic value. Dividends, which are paid from cash on the balance sheet and generally supported by free cash flow (if they are strong dividends), are often only a symptom of free cash flow (representing a part of free cash flow), and therefore only capture a small part of a company’s intrinsic worth via that portion of its future free cash flow stream. It’s important to note, however, that we’re talking about dividends that are paid out of free cash flow. There are a large number of companies whose dividends are not supported by free cash flow, but rather are supported in part by capital-market activities. What this means is that their free cash flow is not sufficient enough, by itself, to continue to pay the current rate of dividends without support from the capital markets (i.e. new equity and debt issuance). These types of companies are the ones that typically have ultra-high dividend yields, sometimes 8% or more.

But why? Well, an entities’ intrinsic value and share price remains a function of the net cash on the balance sheet and their future expectations of free cash flows, independent of their dividend payments. It’s then not surprising that entities with huge net debt positions that fall short of covering dividends with free cash flow generally have lower-than-usual share prices [low P/Es], and when combined with their elevated dividend payments, it generates a high dividend yield (low stock price, high dividend payment = high dividend yield). Though these high yielders may look attractive at face value, not all yields are created equal, and these types of companies should generally be avoided, with the expectation that high yield is synonymous with high risk, in such a case. Though these types of companies may continue to provide a dividend payout for some time, eventually their financials and market forces catch up with them, and the likelihood that they will have to cut their outsize payout is higher than average. Free cash flow is the key driver behind the sustainability of intrinsic value, not the dividend, which can be financially-engineered (as in being supported by the financing section of the cash flow statement).

For Alphabet, will paying a dividend increase or decrease its intrinsic value? Well, for starters, net cash is a source of cash-based intrinsic value. It helps to drive a company’s fair value and share price. The action of paying a dividend, itself, is a reduction to cash on the balance sheet, meaning that over time, the payment of the dividend then represents capital appreciation that otherwise would have been achieved had the firm not paid a dividend. After all, the stock price is reduced by the amount of the dividend on the ex-dividend date, and capital appreciation is therefore reduced. Said another way, the dividend just shifts the components of total return; it does not add or detract from it. If you’re interested in learning more about this dynamic, please read about the free dividends fallacy here. Since that cash that was distributed from the balance sheet for the dividend would have instead accumulated on the balance sheet had the company not paid a dividend, investors should generally be indifferent to a company paying a dividend–or having the company store that cash on the balance sheet.

Warren Buffett of Berkshire Hathaway (BRK.A) (BRK.B) is probably one of the best teachers of the discounted cash flow model, albeit indirectly. Berkshire Hathaway has only paid one dividend in its history, and Buffett often quips that he must have been in the bathroom when that happened. Investors can generally sell some of their stock to receive proceeds to fund their retirement, making a focus on total return the primary consideration. What good, after all, is a dividend yield of 10%, if the stock price falls 15%, resulting in 5% of wealth destruction. It’s far more important to identify companies that have strong free cash flow generation (and expectations for free cash flow generation to increase) to drive total return than to find companies that are increasing their payouts, which in some cases may not even be supported by free cash flow. Sometimes, these dividend liabilities could come back to haunt the firm, as investors come to rely on them more and more, bloating their balance sheets with more and more debt.

|

Company Name ($ in millions) |

Symbol | 2022 Total Debt | 2022 Total Cash | Net Debt | 2022 Free Cash Flow | 2022 Dividends | 2022 Free Cash Flow after Dividends |

| 3M CO | MMM | 15,939 | 3,893 | 12,046 | 3,842 | 3,369 | 473 |

| INTL BUSINESS MACHINES CORP | IBM | 50,949 | 8,841 | 42,108 | 9,089 | 5,948 | 3,141 |

| WALGREENS BOOTS ALLIANCE, INC. | WBA | 11,674 | 2,472 | 9,202 | 2,165 | 1,659 | 506 |

| STANLEY BLACK & DECKER, INC. | SWK | 7,456 | 396 | 7,060 | -1,990 | 466 | -2,456 |

| LEGGETT & PLATT, INC | LEG | 2,084 | 317 | 1,767 | 341 | 229 | 112 |

| Note: Total debt does not include operating lease obligations | |||||||

Source: State Street Global Advisors; Fundamental data retrieved from individual company filings.

This is why many dividend payers that have increased their dividends over time tend to have large net debt positions on the balance sheet. Having paid out a large percentage of their free cash flows as dividends for years and years, pursuing strategic initiatives of the acquisitive variety often means they must lean on their balance sheets (and debt tends to pile up). A look at a few Dividend Aristocrats that are near the top of the S&P High Yield Dividend Aristocrats Index is informative. 3M (MMM) holds a considerable amount of net debt, and its free cash flow coverage of its payout is less than ideal. IBM has better free-cash-flow coverage of its dividend, but its net debt position is huge. Walgreens’ (WBA) free cash flow coverage of its payout isn’t terrible, but the company suffers from a large net debt position, too. Stanley Black & Decker (SWK) is burning through cash and has a net debt position and can probably be considered the worst out of the bunch. Leggett & Platt (LEG) holds a net debt position, too.

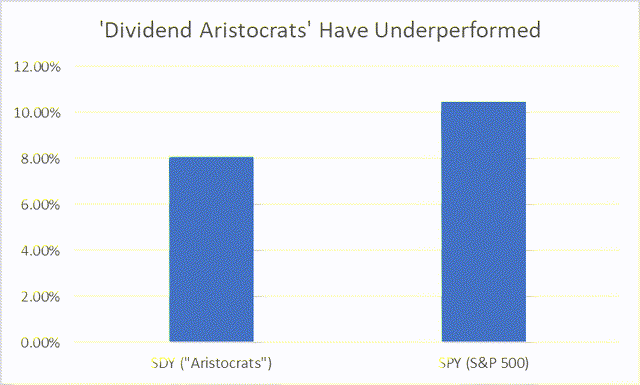

Return after Taxes on Distributions and Sale of Fund Shares (10-year) (State Street)

The point is not to say that dividend growth paying stocks aren’t good or don’t fit well in certain portfolios. Many dividend growth stocks have excellent total return potential. The point is that the dividend, itself, is not a driver of total return, and a myopic focus on the dividend could result in underperformance. The past 10 years have been good for dividend growth investors, but they haven’t been better than an investor that was just invested in the S&P 500 (SPY). Dividend growth stocks have compounded at a pace that has been about 2 percentage points per-annum less than that of the S&P 500. Things look worse when dividend growth stocks are compared to a more targeted area of the stock market such as that of big cap tech and large cap growth, which have been among the best areas to consider investing, at least over the past 10 years.

Now, back to Alphabet. We know that the dividend is a cash payment from the balance sheet that reduces cash on the books that otherwise would be there. This means that the payment of a dividend is but capital appreciation that otherwise would have been achieved had the dividend not been paid. Again, the stock price is reduced by the amount of the dividend on the ex-dividend date, much like cash distributions reduce intrinsic value by reducing the net cash on the balance sheet. It’s probably no surprise that we like companies with huge net cash positions then, because net cash not only bolsters intrinsic value but it also generates an asymmetric risk/reward scenario as bankruptcy risk and capital-market dependence risk becomes negligible. Net cash on the balance sheet is also a huge source of option value during recessions when valuable assets can be purchased on the cheap.

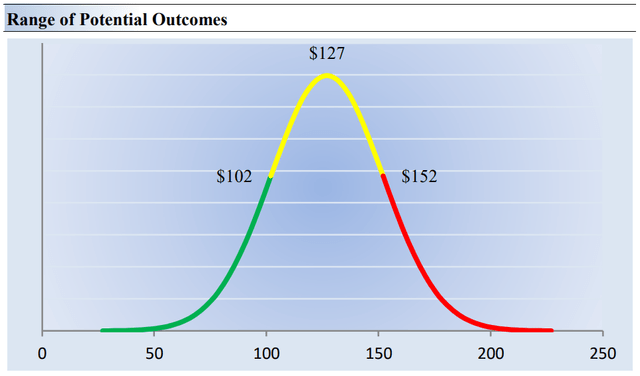

On the basis of our discounted cash-flow model, we estimate Alphabet’s fair value at about $127 per share at this time. Every company, however, has a range of probable fair value outcomes that’s created by the uncertainty of key valuation drivers such as future revenue or earnings that roll into future expectations of free cash flow. After all, if investors knew the future with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values. There’d be no need for price discovery, as we’d know precisely what the company would be worth. Because the future is unpredictable to varying degrees, however, this is why a margin of safety or the fair value range we assign to each stock is a critical part of our process. In the graph that follows, we show this probable range of fair values for Alphabet. For optimistic investors, we point to the high end of the fair value estimate range ($152) as a reasonable valuation for shares, implying considerable upside potential.

The high end of our fair value estimate range is $152 for Alphabet. (Valuentum)

All things considered, for us, we’re indifferent if or when Alphabet eventually pays a dividend. In some ways, we prefer that it doesn’t, but we’d be remiss if we didn’t mention that we’re also huge fans of net-cash-rich, free-cash-flow generating powerhouses Apple (AAPL) and Microsoft (MSFT) that do pay out strong free-cash-flow backed dividends. As with these two examples, if or when Alphabet does initiate a payout, its cash-based sources of intrinsic value suggest it may become one of the best long-term dividend growth stocks the market has yet seen. We wouldn’t hesitate at all to add it to the Dividend Growth Newsletter portfolio if it ever were to initiate a payout–not only because it would then meet the dividend criteria for inclusion, but also because its total return potential would continue to be supported by its tremendous cash-based sources of intrinsic value.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SPY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article and any links within are for informational and educational purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice. Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.