Summary:

- Alphabet reported solid second quarter results and especially Google Services as well as Google Cloud contributed to growth.

- While the business is performing great, investors and analysts seem a little concerned about regulatory risks.

- However, the warning signs for a looming recession continue to increase and in such an environment, equities are usually not the best investment.

Kenneth Cheung

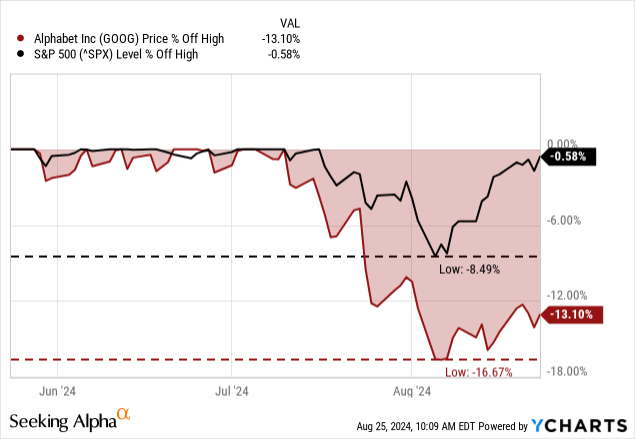

My last article about Google-parent Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) was published on May 22, 2024, and similar to my previous articles, I rated the stock as a “Hold” again. In the meantime, the stock declined about 6% while the S&P 500 (SPY) increased about 6%. In my conclusion, I wrote:

Now, Alphabet falls into the category of stocks that can be bought over the long run and will generate most likely a decent return. But the stock is neither cheap nor a bargain at this point, and therefore I will rate Alphabet with a “Hold” rating once again. But the current stock price is not completely unreasonable, and the company should be able to achieve the necessary growth rates to be fairly valued right now. Nevertheless, investors should have a time-horizon of at least 10 years, as the next few years might get bumpy.

And when looking at the last few weeks, we can see the S&P 500 increasing and reached almost previous all-time highs again while Alphabet is still lagging. The stock managed to move a bit away from the temporary low but could not match the performance of the major indices.

In the following article we are providing three major perspectives: The core business which is still performing solid and will most likely continue to thrive; the regulators and potential fines Google might face and finally the “big picture” and why I think we should be cautious about investments in equities.

Core Business: Solid Performance

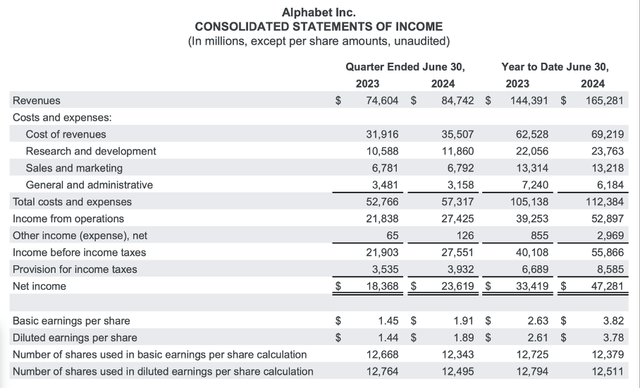

We start by looking at the last quarterly results that Alphabet reported about a month ago on July 23, 2024. For starters, Alphabet did beat revenue as well as earnings per share estimates. And when looking at the results and compare them to the previous year, the top line increased 13.6% year-over-year from $74,604 million in Q2/23 to $84,742 million in Q2/24. Income from operations also increased from $21,838 million in the same quarter last year to $27,425 million this quarter – resulting in 25.6% year-over-year growth. Diluted earnings per share increased from $1.44 in Q2/23 to $1.89 in Q2/24 – a 31.3% year-over-year growth for the bottom line.

Alphabet Q2/24 Earnings Release

While the income statement is looking quite impressive, free cash flow declined from $21,778 million in Q2/23 to $13,454 million in Q2/24 – a decline of 38.2% year-over-year. This stemmed especially from much higher capital expenditures, which almost doubled from $6,888 million in the same quarter last year to $13,186 million this quarter.

Google Services

And when looking at the different business segments, Google Services is still contributing the biggest part of revenue as well as operating income. Total revenue for the segment increased from $66,285 million in Q2/23 to $73,928 million in Q2/24 – resulting in 11.5% year-over-year growth. Operating income for the segment increased even 26.5% year-over-year from $23,454 million in the same quarter last year to $29,674 million this quarter.

Google Cloud

And aside from Google Services, it was especially Google Cloud contributing to growth. Revenue for the segment increased 28.8% year-over-year to $10,347 million and Alphabet also made huge steps towards getting its cloud business more profitable. Compared to an operating income of only $395 million in the same quarter last year, it generated $1,172 million in operating income this quarter – resulting in 197% year-over-year growth and an operating margin of 11.3% (vs. an operating margin of only 4.9% in the same quarter last year).

Other Bets: Waymo

Aside from these two major business segments, which are generating most of the company’s revenue and the entire operating income, Alphabet is reporting a third business segment called “Other Bets” that I did not mention so often in my previous articles. In the earnings release, “Other Bets” is described as the following:

Other Bets is a combination of multiple operating segments that are not individually material. Revenues from Other Bets are generated primarily from the sale of healthcare-related services and internet services.

The most promising among these other bets is probably Waymo right now. We don’t know exactly how big the stake of Alphabet in Waymo is, but according to the company’s last 10-Q, Alphabet committed to fund up to $5.0 billion for the ongoing operations of Waymo.

So far, the “Other Bets” segment – including Waymo – is not profitable and generating only a small part of revenue. In Q2/24, revenue was $365 million, which was an increase of 28.0% year-over-year, but the segment still reported an operating loss of $1,134 million (which is bigger than the operating loss in the same quarter last year – $813 million).

But aside from not being profitable yet, Waymo seems to be progressing quite well in the recent past. According to a recent blog post, Waymo had more than 150,000 people sign up for the waiting list and riders can now explore a total of 79 square miles of LA County. And Waymo also recently disclosed that it is now giving more than 100,000 paid rides every week in its three markets – Los Angeles, San Francisco and Phoenix. This is double the volume Waymo reported a few months ago in May 2024.

Risks

Although the business is performing well and Alphabet is obviously one of the least shorted stocks in the S&P 500 (showing confidence about the business and stock among investors), we should not assume that Alphabet is without any risk and without doubt a great investment.

Alphabet (especially Google) is constantly facing regulatory scrutiny and especially the European Union fined Google several times. But to be honest, as long as Alphabet only had to pay fines it was not a problem. Even when these fines were billions of dollars, Alphabet is generating enough free cash flow to pay some fines now and then without the business really being affected in a negative way.

However, it seems like the recent antitrust suit Google lost at the beginning of August is seen like a bigger risk by some analysts and investors. An U.S. District Court found Google violated Section 2 of the Sherman Act “by maintaining its monopoly in two product markets in the United States—general search services and general text advertising—through its exclusive distribution agreements.” Alphabet allegedly used expensive agreements in order to maintain its position as the number one search engine in the world, and Alphabet spent huge amounts for making that possible.

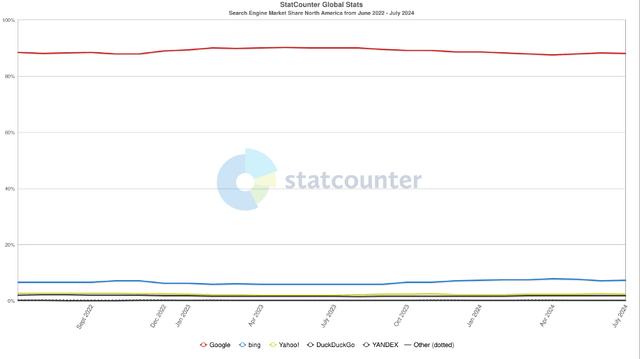

We must see what the coming months will bring and if the court decision has any effects on Google’s business and ability to generate revenue. But right now, the market share of Google remains at extremely high levels, and I don’t think there is much chance for competitors gaining market share from Google. Similar to Bing, which was also not really able to take market share from Google despite its collaboration with OpenAI and including ChatGPT.

The Big Picture

Alphabet is also part of the big picture – the U.S. stock market and the U.S. economy – and I see dark clouds on the horizon. And especially for the next few years, this should also play a role in any investment decision. As I have argued in several articles, I expect a recession in the United States in the near future and in my opinion, we see all the typical signs usually occurring before a recession.

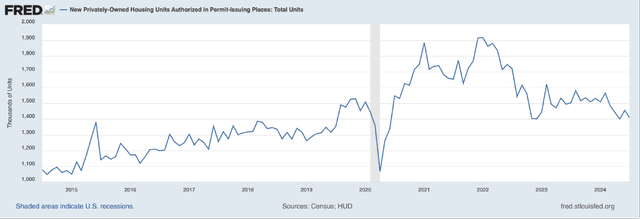

In the following sections I will present a few data points that should make us very cautious right now. We start by looking at the housing permits in the United States and although Alphabet doesn’t have to do much with the housing market, the housing permits are an early warning indicator for the entire economy as the number always declined steeply before and during a recession. And in 2022, the number started to decline and while in 2023 the number of permits rather stagnated it seems like the number is continuing to decline now.

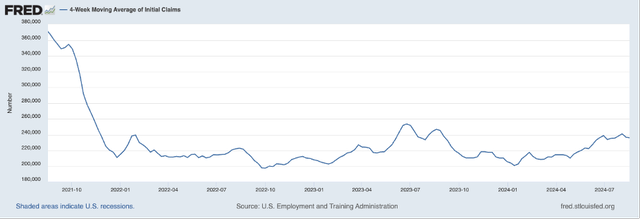

Additionally, the number of initial claims for unemployment is constantly increasing since early 2024. I often mentioned that this not the best metric to use, but we should also not ignore the numbers as unemployment is usually rising before a recession.

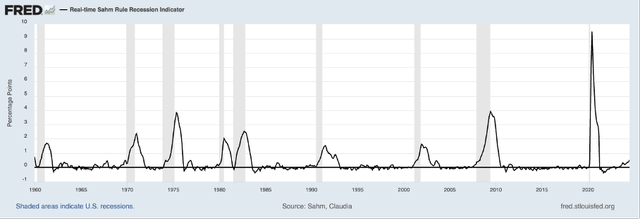

And as long as we are talking about unemployment, another very precise recession indicator is the Sahm Rule Recession Indicator. Simply put, a recession is looming when the unemployment rate is increasing by more than 50 basis points. At least since 1960, this indicator has predicted every recession and – what is even more important – there were no false signals (we can argue if November 1976 is a false signal with the metric reaching exactly 0.5).

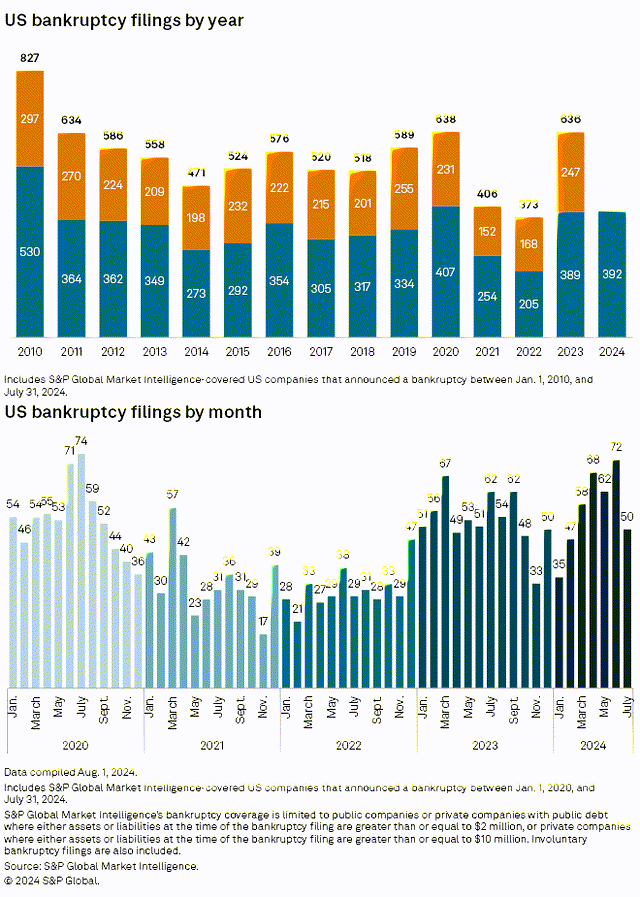

We can also point out that bankruptcies are increasing. And even when July 2024 numbers improved a little bit, I see no reason to be optimistic at this point. The year to data numbers are at a similar level as in 2020 or 2010 (years associated with recessions in the United States).

And in case of a recession, advertising is usually declining. When looking at the numbers in the last 20 years in the United States, we see a double-digit decline during the Great Financial Crisis, and it took several years before the advertising reached pre-crisis levels again. Statista is also presenting a few more numbers from the past 100 years, and we see several declines of 10% to 20% during crises. We can assume a similar decline in the next potential recession, and Alphabet (especially Google) will be affected by this as well.

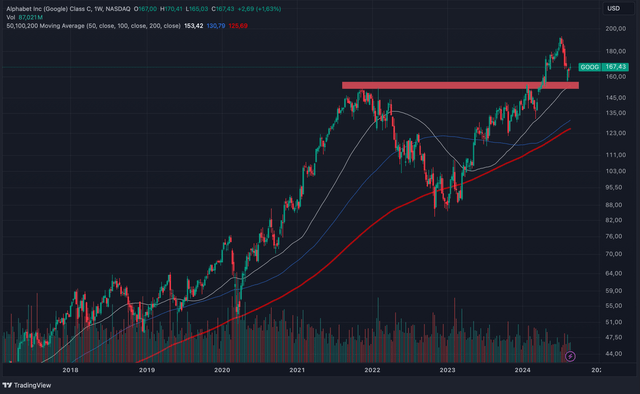

And in my opinion, it does help that Alphabet seems to be well-supported from a technical point of view, and that we should be rather bullish at this point when looking at the chart. Alphabet broke above its previous all-time high, and then we saw a pullback to the breakout levels and might now continue to move higher.

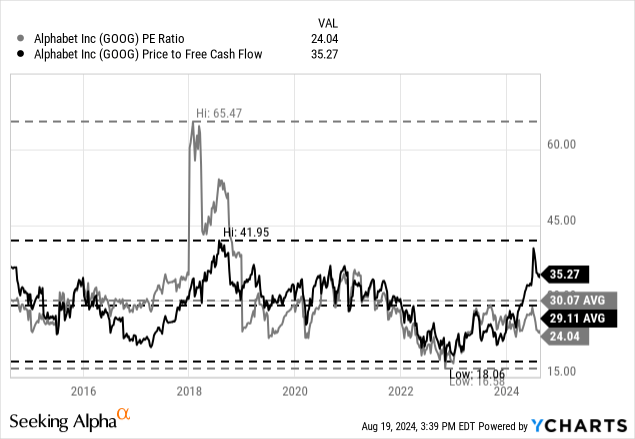

On the other hand, Alphabet is trading for rather high valuation multiples. At the time of writing, Alphabet is trading for 24 times earnings, which can be seen as reasonable (and is also below the 10-year average of 30.07). However, the stock is also trading for 35 times free cash flow, and this is not only above the 10-year average of 29.11, but is also a rather high valuation multiple for almost any business.

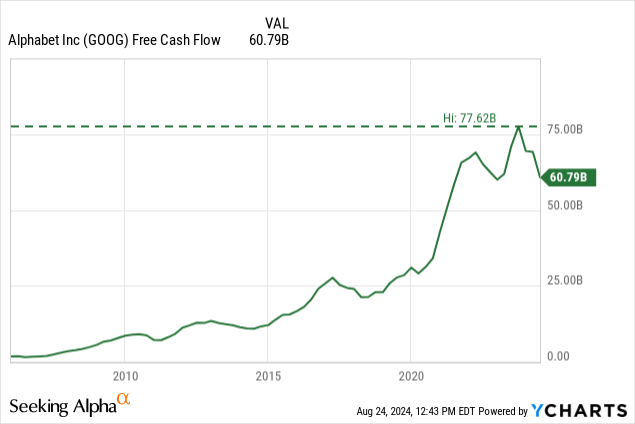

We can also calculate an intrinsic value by using a discount cash flow calculation. As always, we are calculating with a 10% discount rate (as this is the annual return on investment we like to achieve at least) and with the last reported number of outstanding shares (12,495 million). And we can also use the free cash flow of the last four quarters as basis. The free cash flow declined a bit from its previous all-time high of $78 billion in the last few quarters, but considering difficult times ahead it is also never a good idea to use the highest free cash flow a business ever reported.

In order to be fairly valued right now, Alphabet has to grow almost 15% for the next ten years followed by 4% growth till perpetuity. When considering that Alphabet grew earnings per share with a CAGR of 19.79% in the last ten years and revenue with a CAGR of 17.78% in the same timeframe, it is reasonable to argue for 15% annual growth in the next ten years. However, we should not ignore that growth rates will slow down over time and especially for major businesses (and Alphabet clearly belongs in that category) it is getting more difficult over time to grow with a high pace. Additionally, we should not ignore that risk of a recession in the coming years making 15% annual growth rather unlikely.

In the past, I often calculated with 6% growth till perpetuity (and I still think it is possible to justify these higher terminal growth rate for high-quality business). Nevertheless, it seems also reasonable to be a little more cautious and follow the recommendations of the CFI (and others) and use a lower terminal growth rate. And as Alphabet is certainly a high-quality business with a wide economic moat, I think 4% terminal growth rates are reasonable and in-line with the CFI recommendation (but probably above GDP growth).

Conclusion

Alphabet remains a great business, but the stock is not cheap, and the regulatory risk combined with the looming recession should make us cautious. I remain on the sidelines.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.