Summary:

- Alphabet is reporting great third quarter results and the company is growing its top and bottom line with a high pace again.

- While Google Cloud continues to grow with a healthy pace, YouTube also managed to return to double-digit growth again.

- When calculating an intrinsic value, we can make the case that Alphabet is undervalued, but I would remain to the sidelines.

Alena Kravchenko

In my last two articles, I was clearly wrong about Alphabet Inc. (NASDAQ:GOOG). I was rather cautious in both cases, but the stock continued to climb higher and higher. In my last article published at the end of June 2023, I wrote that Alphabet is not hyped at this point – in contrast to some other businesses associated with AI – but not cheap either. Since the last article was published, the stock not only outperformed the S&P 500 (SPY) but gained about 11% in value.

I must admit I was too cautious in October 2022 when I rated Alphabet as a “Buy” but did not purchase shares for myself. When the stock was trading around $90, it probably was a good investment. At this point in time however, I remain cautious – not only because of Alphabet as a company but also my expectations about the market in general. Let’s take a look.

Is Alphabet Expensive?

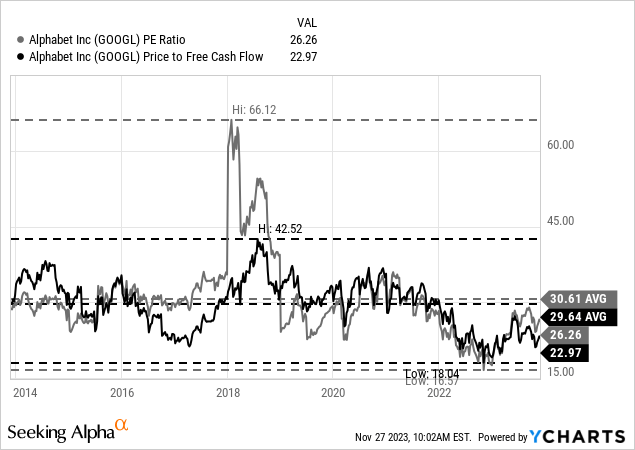

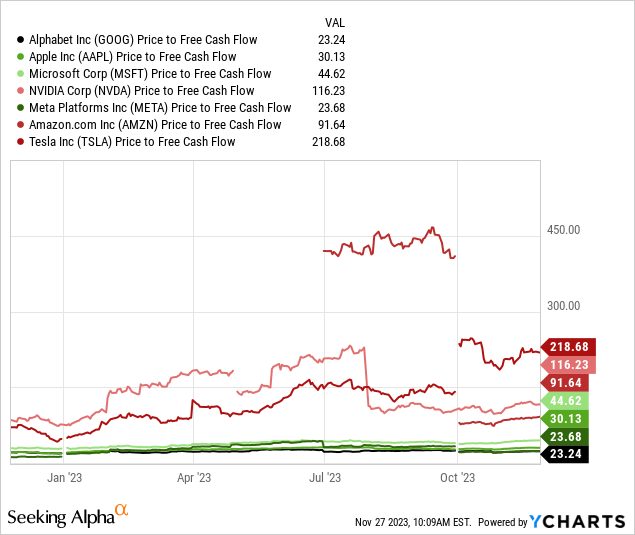

But despite all the caution that might be appropriate, we must admit that Alphabet is one of the cheaper big tech companies when looking at simple valuation metrics. At the time of writing, Alphabet is trading for 23 times free cash flow, which is clearly below the 10-year average of 29.64.

On an absolute basis, a valuation multiple of 23 is neither telling us that a stock is cheap nor that it is extremely expensive. For solid businesses growing with a stable rate, a valuation multiple around 20 can be seen as acceptable and the stock is often fairly valued.

And when comparing Alphabet for example to the group of the “Magnificent Seven” – also including Amazon.com (AMZN), Apple Inc. (AAPL) , Meta Platforms (META), Microsoft Corporation (MSFT), NIVIDA Corporation (NVDA) and Tesla Inc. (TSLA)– it is the stock trading for the lowest valuation multiples. Of course, such comparison are always a bit tricky as the P/FCF does not take into account growth rates – and Apple is growing at a different rate than NVIDIA (at least at the moment).

But at least among this group of high-quality businesses – and aside from Tesla where I always have my doubts how sustainable the business is and what kind of a moat the company actually has – we are certainly talking about great businesses.

Quarterly Results

But as I have mentioned already, to determine if a stock is cheap or not, we can’t just look at valuation multiples, we also must take into account if the business can grow – and at what rate the business can grow. And similar to other companies among the “Magnificent Seven” Alphabet can also grow with a higher pace again.

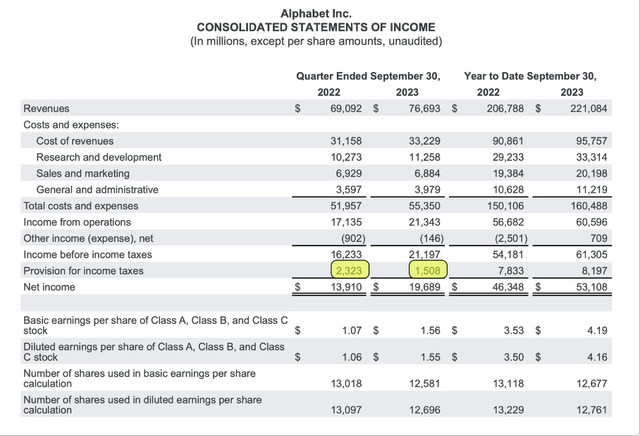

In the third quarter, revenue increased from $69,092 million in Q3/22 to $76,693 million in Q3/23 – resulting in 11.0% YoY growth (by the way, growth in constant currency was also 11%). And while Alphabet reported the highest top line growth in the last five quarters, an operating income growth rate this high wasn’t reported in the last seven quarters. Compared to $17,135 million in the same quarter last year, operating income was $21,343 million this quarter – resulting in 24.6% year-over-year growth. And finally, diluted earnings per share increased 46.2% YoY from $1.06 in Q3/22 to $1.55 in Q3/23.

Alphabet Q3/23 Earnings Release

And finally, free cash flow was $22,601 million this quarter compared to $16,077 million in the same quarter last year – resulting in 40.6% YoY growth. But we should be a bit cautious about the bottom line (and free cash flow). As management pointed out, Alphabet profited from an IRS change:

This reflects an effective tax rate of 7% in the third quarter from an IRS change related to the use of foreign tax credits, which had an outsized impact on the third quarter rate because the change resulted in a catch-up for prior periods.

(…)

As a reminder, our cash balance and free cash flow in the second and third quarters benefited from the deferral of certain tax payments to the fourth quarter of 2023.“

Saving Costs

In the past, Alphabet was often criticized for spending too much and focusing too less on expenses. But it seems like Alphabet is continuing to cut costs and becoming more efficient. During the last earnings call, management stated:

We have a number of workstreams in place. First, we are maintaining a slower pace of headcount growth, reflecting product prioritization and reallocation of talent to support our most important growth opportunities. Second, we remain focused on optimizing our real estate footprint, including how and where we work to reduce our expense growth. As you can see from our earnings release, we incurred $207 million in accelerated rent and depreciation in the third quarter related to these actions.

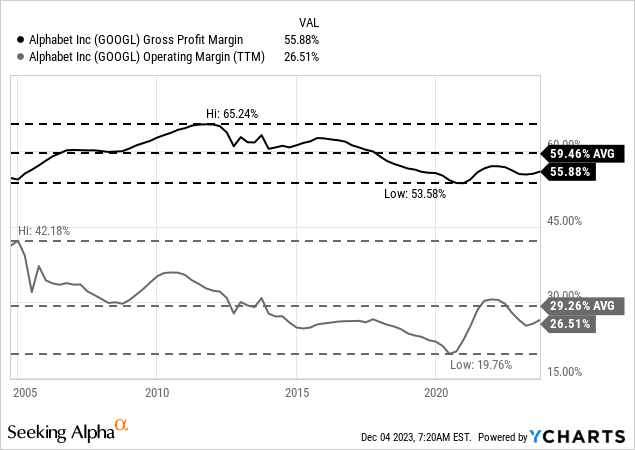

As a result, operating margin increased from 25% in the same quarter last year to 28% this quarter and the number of employees declined from 186,779 in the same quarter last year to 182,381 this quarter. Operating margin increased from 25% in the same quarter last year to 28% this quarter.

However, when looking at the long-term picture the gross margin and operating margin were rather declining in the last ten years.

Segment Results

Aside from “Google Network” (which is including revenues generated on Google Network properties participating in AdMob, AdSense and Google Ad Manager) all other segments reported higher sales. The biggest part of revenue is still stemming from “Google Search & Other” which generated $44,026 million in revenue (11.3% year-over-year growth). Let’s look at two segments in more detail – YouTube and Google Cloud.

YouTube

We start with YouTube, which was struggling a bit in the last few quarters. In the first quarter of 2023, revenue from YouTube ads was still declining year-over-year and while revenue was already growing in Q2/23, growth is accelerating. This quarter, Alphabet generated $7,952 million in revenue from this segment – resulting in 12.5% year-over-year growth.

And aside from generating revenue by ads, YouTube is also generating revenue by subscriptions. However, Alphabet doesn’t disclose these numbers. We only know that “Google Other” which is including subscription revenues from YouTube Premium and YouTube TV reported strong growth rates – from $6,895 million in Q3/22 to $8,339 million in Q3/23 resulting in 20.9% YoY growth and CBO Philipp Schindler mentioned during the earnings call that strong YouTube subscriptions drove revenue growth for this segment.

And while Mark Zuckerberg reported during the last earnings call that Reels is now a net neutral to Meta Platform’s overall revenue (see my last article for more information), it seems like YouTube Shorts is still struggling. CEO Sundar Pichai commented:

We continue to work on closing the monetization gap here. Shorts now average over 70 billion daily views and are watched by over 2 billion signed-in users every month. At Made on YouTube in September, we announced new tools that make it easier to create engaging content.

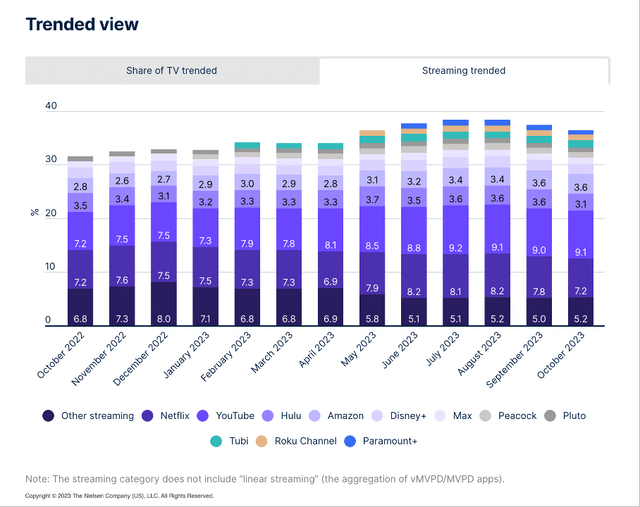

But overall, it seems like YouTube is progressing well. NFL Sunday Ticket is now live (with a multi-view feature to stream up to four games on a single screen) and according to Nielsen YouTube continues to be the number one overall streaming destination with 150 million plus people watching YouTube on CTV screens every month in the United States. And when looking at the latest numbers from Nielsen (October 2023), streaming combined already has a market share of 36.6% and increased its market share from 31.6% one year earlier. And among the different streaming services, YouTube is certainly one of the winners increasing its market share from 7.2% in October 2022 to 9.1% in October 2023.

And management has high hopes that AI will make YouTube even better:

AI will do wonders for creation and storytelling. From Dreamscreen and YouTube Create, which Sundar talked about, to features that audit up content in multiple languages, flip and trim existing assets, remix and clip videos, and more, we’re just getting started.

Google Cloud

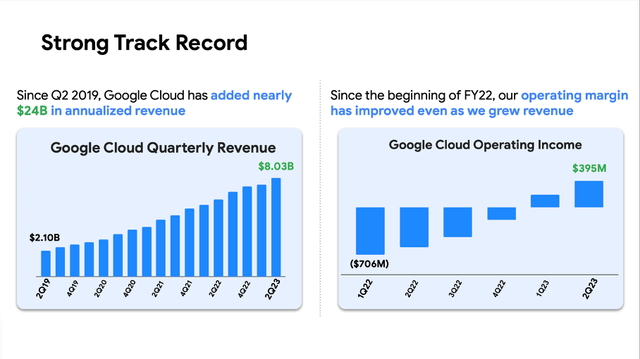

A second segment growing with a high pace and with high hopes on AI leading to even higher growth is Google Cloud. Revenue from Google Cloud increased from $6,868 million in the same quarter last year to $8,411 million this quarter – resulting in 22.5% year-over-year growth. And Google Cloud was also profitable for the second quarter in a row – compared to an operating loss of $440 million in the same quarter last year, Google Cloud generated an operating income of $266 million this quarter.

Google Goldman Sachs 090723 Investor Presentation

With more than 60% of the world’s 1,000 largest companies already being Google Cloud customers, I think Google Cloud can grow hand in hand with these businesses. And as I have written in my last article about Alibaba (BABA), I see rather high switching costs for cloud services:

I am certainly not a cloud expert, but I would assume that migrating all your data from one cloud provider to another is a difficult task – especially for businesses with huge amounts of data and many different applications. This is generating high switching costs for the existing customers and leading to consistent revenue streams(…)

Overall, I assume that Google Cloud can continue to grow with a similar pace as in the last few years for quite some time (of course, growth might slow down during a recession).

Keeping Its Dominant Position

I already mentioned above that YouTube is gaining market shares in the United States. And Alphabet is also keeping the dominant position it already has in other markets. When looking at the different operating systems, Android continues to be the dominating operating system (especially when only looking at mobile). And Chrome is also continuing to be the leading browser around the world.

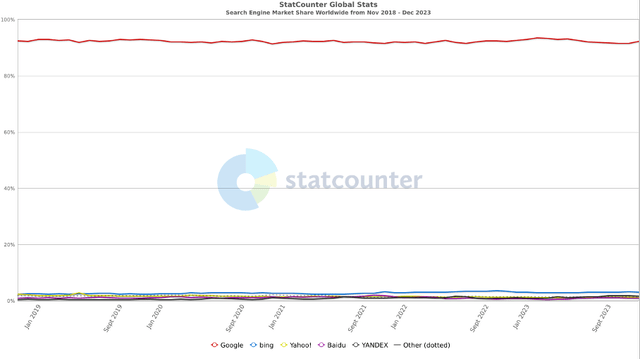

And while I don’t want to downplay the importance of these two, the most important metric for Alphabet is the market share Google has in the search market. In the last few months, almost everybody was looking at Bing and if Microsoft could gain market shares but so far, Google is not only continuing to hold its leading position, but no other search engine is able to gain even slightly and take market shares from Google.

At this point we should not just look at other search engines, but also look at ChatGPT and OpenAI as both might draw traffic from Google and people are not switching from one searching engine to another but rather to ChatGPT. However, the numbers are not supporting that theory. In May 2023, ChatGPT (chat.openai.com) had about 1.8 billion visits and according to SimilarWeb, the site has about 1.7 billion monthly visits right now – hence, ChatGPT is stagnating. In comparison, Bard had about 143 million visits in May 2023 and increased to 266 million visits right now. By the way, Google (google.com) is generating about 80 to 90 billion visits a month.

And I don’t know if the chaos OpenAI generated in the last few weeks by firing and reinstating Sam Altman within only a few days will be advantageous for Alphabet and Bard. But Alphabet will most likely be one of the profiteers of the “Generative AI” market growing with a high pace. Bloomberg is expecting generative AI to become a $1.3 trillion market by 2032 resulting in a growth rate around 40% annually. In the article, Bloomberg is writing:

Moreover, rising demand for generative AI products could add about $280 billion of new software revenue, driven by specialized assistants, new infrastructure products, and copilots that accelerate coding. Companies like Amazon WebServices, Microsoft, Google and Nvidia could be the biggest beneficiaries, as enterprises shift more workloads to the public cloud.

Intrinsic Value Calculation

I already mentioned above that Alphabet seems to be among the cheapest stocks in the list of the Magnificent Seven that drove index performance in the last few quarters. When trying to calculate an intrinsic value for the stock by using a discount cash flow calculation, the picture is similar.

As basis for such a calculation we often use the free cash flow of the last four quarters (in Alphabet’s case $77.62 billion). When calculating with 12,696 million outstanding shares and a 10% discount rate, Alphabet must grow its free cash flow between 5% and 6% from now till perpetuity to be fairly valued. And no matter whether we are looking at past growth rates (in the last ten years, earnings per share grew with a CAGR of 18.90%) or expected growth rates (according to analysts, earnings per share are expected to grow with a CAGR of 17% until fiscal 2029) it seems like Alphabet should be able to match mid-single digit growth rates easily and is therefore probably undervalued. Additionally, we should consider the fact that Alphabet decreased the number of outstanding shares about 3.1% over the last twelve months and the company still has $120 billion in cash and marketable securities – this seems almost to be enough to achieve the necessary mid-single digit growth.

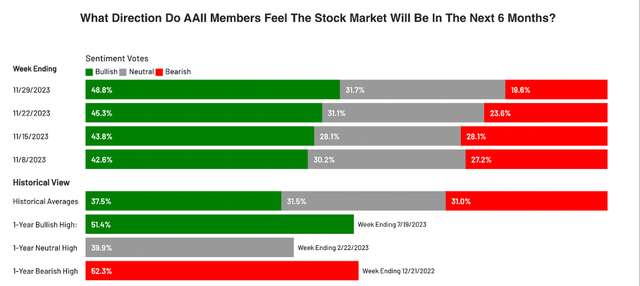

Red Flag: Everyone Being Bullish

And especially everyone being bullish is making me very cautious. Not only the CNN Fear and Greed index is showing a very bullish sentiment, when looking at the AII sentiment survey only a small fraction of investors is bearish at this point.

AAII Investor Sentiment Survey

And we know that sentiment is usually a contrarian indicator. When everyone is being bullish, we should be very cautious. This does not mean I will short Alphabet – certainly not – but I would be cautious at this point. Over the long run, I see higher stock prices for Alphabet and in 10 or 20 years from now chances are very high that Alphabet will be worth much more. But I don’t think the best time to buy is now. When looking at the chart we can also see the forming of a potential double top.

Conclusion

I don’t want to make the case that Alphabet is overvalued or that investing in Alphabet might be a mistake. I am just cautious at this point when it comes to equities, and this is including great businesses like Alphabet and Google with a wide economic moat around the business. Of course, being cautious always faces the risk of missing out. But at this point Alphabet is not trading for such a low price that all the risks I see are already reflected by the stock price and therefore I will stick to my “Hold” rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.